Green bonds are a creative response to the challenge of financing environmental protection efforts. They pay interest like normal bonds, but must dedicate funds raised to projects like environmental cleanup and climate change mitigation. The combination of return, environmental impact, and tax incentives make green bonds attractive to environmentally conscious investors. While the global green bond market has grown at a rapid pace, China has quickly emerged as the largest issuer of green bonds.

Worldwide, the costs associated with environmental protection and climate change mitigation are estimated to be in the trillions of dollars. New and innovative financing methods are required to provide the necessary investment capital and green bonds provide one possible solution.

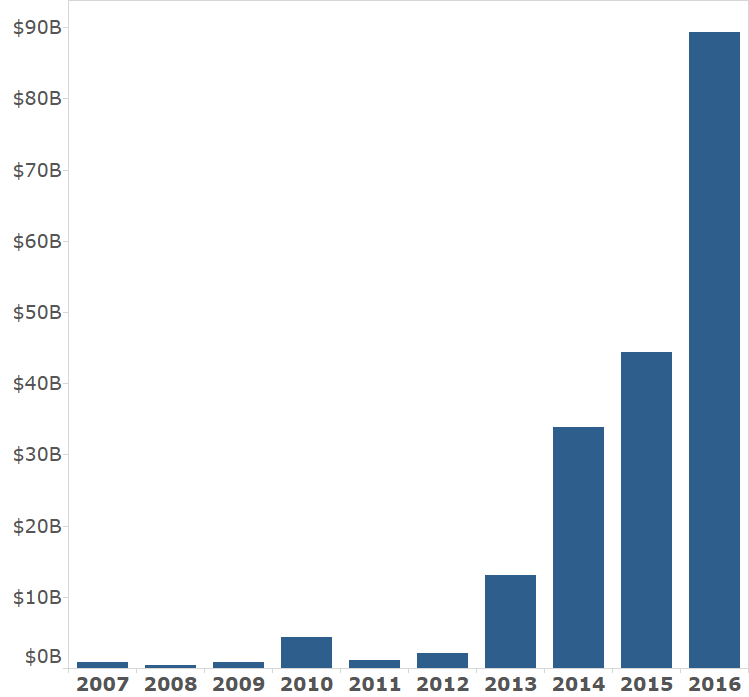

The first green bonds were issued in 2007 by multilateral development banks, including the World Bank and the European Investment Bank. National and municipal government borrowers then began to enter the market in large numbers. In 2013, the market expanded to include corporate issuers. As Figure 1 shows, the global green bond market has expanded quickly, particularly over the past three years.

In 2014, a group of financial institutions came together to promulgate the Green Bond Principles, a series of voluntary recommendations for the structuring of green bonds and verification procedures to ensure that funds are used for their intended purpose. Green bonds received a significant boost in 2015 when, following the Paris Climate Agreement, a major group of global investors pledged to support green bonds as a way to support global environmental goals.

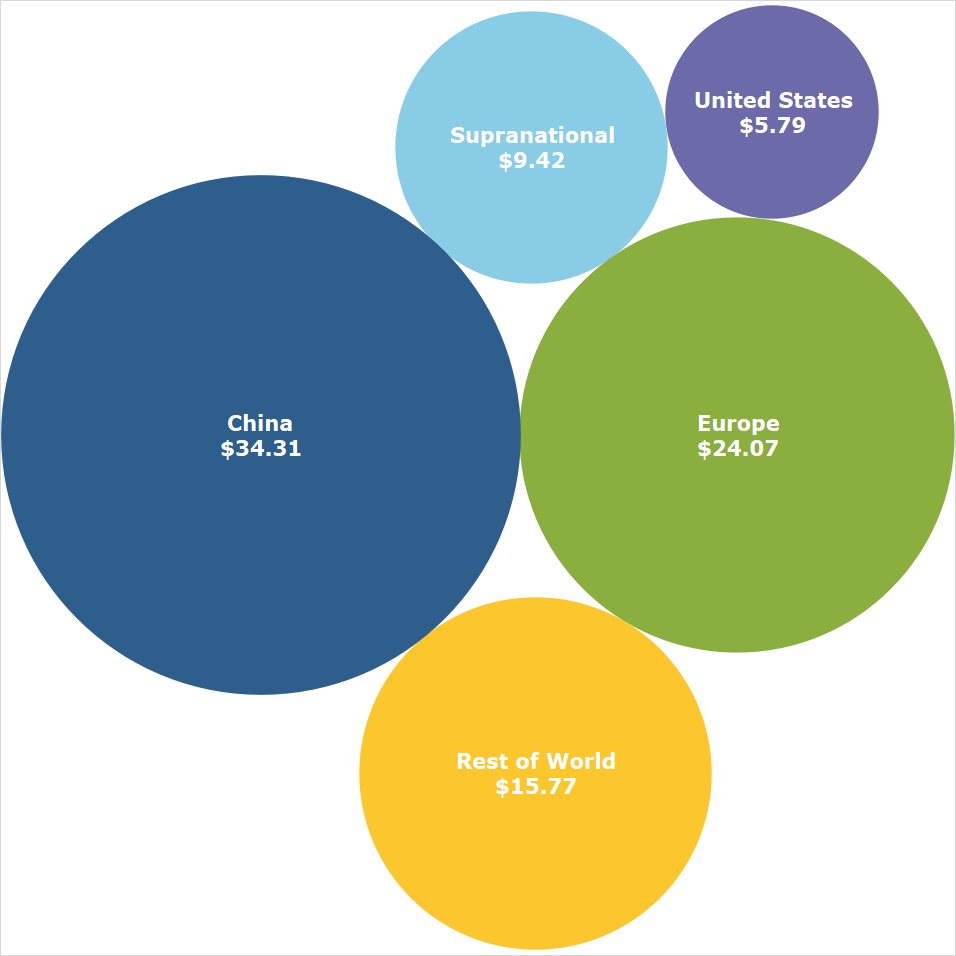

Even more rapid than the growth of the global market has been the expansion of the Chinese green bond market. The Chinese green bond market did not even exist before 2015. The first issue of a green bond by a Chinese company was by wind power company Goldwind for $300 million in July of that year. The bond was five times oversubscribed, a testament to demand for these products. By 2016, the Chinese green bond market had grown to be the largest in the world. China accounted for nearly three-quarters of the increase in global green bonds between 2015 and 2016. Figure 2 highlights the outsized role China has come to play in the global green bond market.

China’s interest in green bonds stems from its extensive environmental challenges. The People’s Bank of China (PBoC) estimates the country will need hundreds of billions of dollars a year to fund environmental and climate change projects, mostly from private capital. Proceeds from green bonds in China go into a variety of projects, including renewable energy, mass transit, pollution reduction and climate change mitigation.

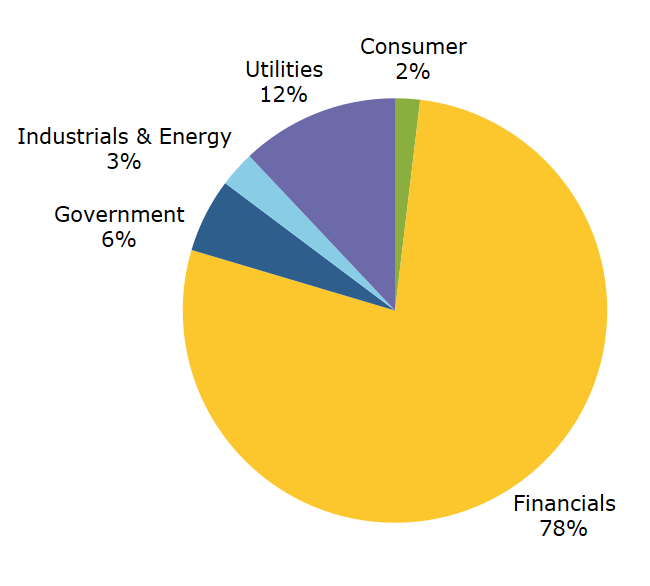

Financial institutions in China are a major part of the growth. The Agricultural Bank of China was the first Chinese bank to issue a green bond in October 2015. Since then a range of financial institutions, primarily commercial banks, have issued green bonds. Banks raise money from investors via the bonds and then make loans to borrowers for environmental projects. Figure 3 demonstrates the extent to which financial corporations have been responsible for the extraordinary growth of the Chinese market.

Although China has an outsized role in the green bond market, there are some disagreements as to how large the market is. This is because China has not fully adopted international standards for green bonds. In late 2015 and early 2016, the PBoC and the National Development and Reform Commission (NDRC) released standards for green bond issuance that, among other differences with international guidelines, allow larger portions of funds to be used for non-environmental purposes. China also allows the proceeds of green bonds to fund projects that are omitted from the global standards, like clean coal and large hydropower projects, which have an environmental impact but are generally more controversial. Around one-third of Chinese green bonds issued in 2016 did not align with international guidelines, according to one estimate. These differences may be minimized going forward as the PBoC recently announced that it would take steps to reduce inconsistencies with international standards.

The global green bond industry is expected to continue growing at a rapid pace, with Chinese issuers among those at the forefront. In August 2016, seven Chinese government ministries jointly issued the Guidelines for Establishing the Green Financial System, which included provisions to bolster the green bond market. This March, the China Securities Regulatory Commission (CSRC) announced a new initiative to accelerate the approval process for new green bonds and encourage more private investment in the industry.

Despite their rapid growth, green bonds will only be able to supply a portion of the financing necessary to address global environmental challenges. Nonetheless, they are an important component of a larger effort to find new and creative ways to finance environmental protection.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.