Testing Time for Emerging Market Resilience

Nearly five years ago, economists identified several emerging economies overly reliant on foreign financing and susceptible to global outflows when anticipated monetary policy tightening precipitated the “taper tantrum.” As global financial conditions further tighten this year, emerging market risks seem to be on the rise again, as countries like Turkey experience steep currency depreciation and capital outflows. Of course, not all emerging market economies are affected equally. Indonesia, for example, saw its economic performance strengthen considerably over the past several years, with the International Monetary Fund (IMF) and ratings agencies sanguine about its fundamentals, even though recent emerging market volatility will put the country’s economic resilience and policies to the test.

Sensitive to Outflows despite Improvements

As of this writing, Indonesia’s economy looks remarkably better than it did five years ago. GDP growth remains relatively strong on the back of a global economic recovery and mild inflation. Importantly, its external position has strengthened. The current account deficit narrowed to 1.7 percent of GDP in 2017, nearly half the level in 2013. Foreign exchange reserves grew by more than 28 percent over this period and amounted to roughly eight months of import coverage as of the first quarter of 2018. Short-term external debt fell as a percentage of reserves from 46 percent to 42 percent from 2013 through the first quarter of 2018.

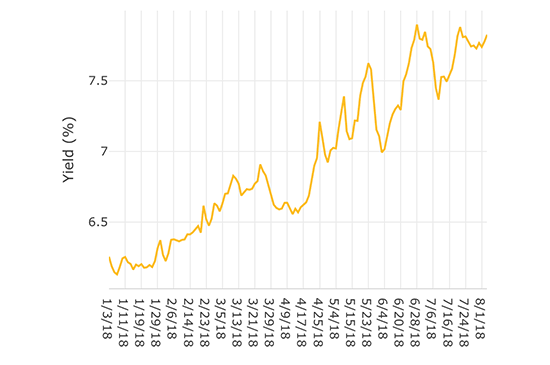

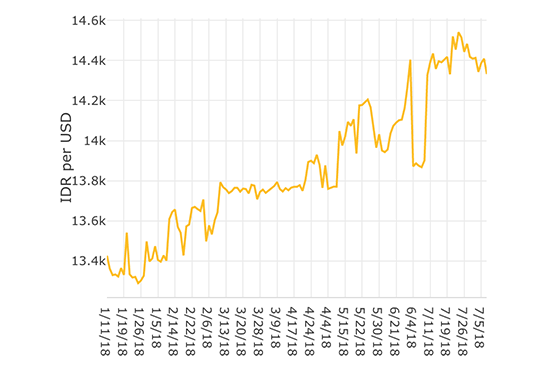

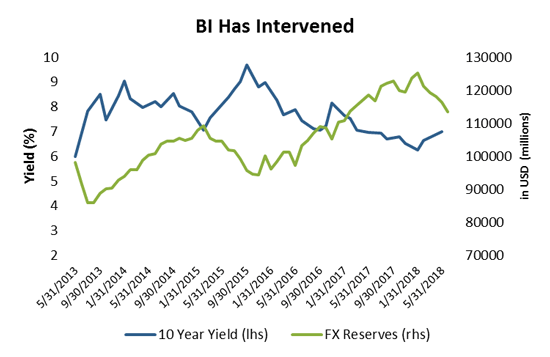

Like many other emerging economies, Indonesia experienced capital outflows earlier this year as global interest rates have risen. Foreign investors sold more than $3 billion of Indonesian stocks and fixed income assets in April, with an estimated $1.1 billion in sovereign bonds. The yield on the 10-year government bond approached 8 percent in the summer of 2018, and the Jakarta Stock Exchange has fallen more than ten percent since late February. Moreover, the rupiah weakened by more than 6 percent in the first seven months of 2018.

Rupiah Depreciation

External Vulnerabilities Put Resilience to the Test

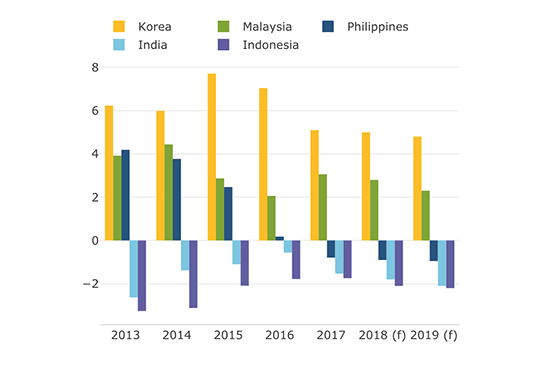

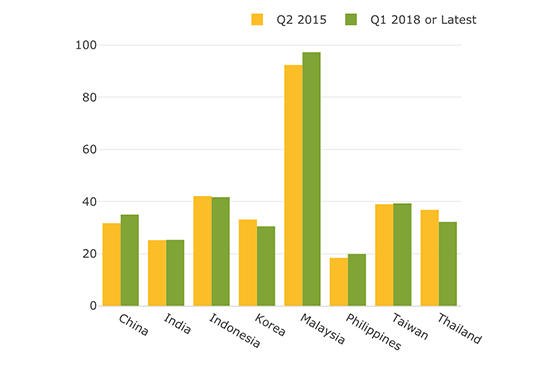

Changing global financial conditions have been difficult for emerging markets generally. The level of stress felt by Indonesia has been moderate so far, but despite aforementioned improvements in external positions, short-term external debt remains relatively high compared to its Asian peers (save for Malaysia), and the country still runs persistent current account deficits.

Foreign ownership of Indonesian sovereign debt securities was roughly 60 percent at the end of 2017. Large foreign ownership of local currency government debt typically makes an economy more susceptible to outflows when investor sentiment shifts. In the case of Indonesia, as foreign investment retreats, the rupiah experienced downward pressure from foreign investors selling local currency debt for dollars. A weaker rupiah makes it more expensive to service foreign currency denominated debt and increases borrowing costs for all borrowers. This is a challenge that most EM countries have had to cope with repeatedly in past episodes of EM capital outflows.

Short Term External Debt (% of Reserves)

Not Alone in Search of a Solution

Over the years, policymakers have used a combination of macroprudential, capital flow management, and monetary policy tools to curb outflows. Since 2013, Indonesia has taken steps to ease foreign investment restrictions to attract more stable foreign fund inflows. And as noted in a previous blog post, BI and the Financial Services Authority required borrowers that had increased foreign debt during laxer credit cycles to hedge their exposure. More recently, the two regulators coordinated actions to remove a collateral requirement for certain structured products, making it cheaper to hedge.

In 2018, the central bank decided to intervene in the foreign exchange market to support the rupiah. In doing so, Indonesia reduced its reserves by more than $10 billion (or roughly 8.2 percent) in the first six months of the year with the new BI governor revealing that the central bank had purchased $3.5 billion of government debt in that time. BI has also raised the policy rate multiple times in recent months, and may consider an easing of macroprudential measures, such as reducing loan-to-value ratio requirements in the real estate sector, to offset rate hikes and stimulate growth if needed.

In its most recent Article IV Consultation mission completed in February 2018, the IMF highlighted Indonesia’s susceptibility to outflows, but opined that its external debt was at sustainable levels. Moreover, two of the three major ratings agencies have issued ratings upgrades in the past eight months, with Fitch upgrading from BBB- to BBB in December 2017, and Moody’s to Baa2 as recent as April 2018. The upgrades cited Indonesia’s policy framework that promotes macro stability as well as its ability to withstand external shocks. As recently as June 2018, S&P affirmed its BBB- rating even after it had experienced much of the volatility.

Still, recent market developments show that certain economic metrics–current account deficits, foreign ownership of domestic bonds, and short-term external debt to reserves—continue to be important drivers of cross-border capital flows and investor sentiment, and test the resilience of emerging markets.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.