Women experience large and persistent declines in earnings after having children, which in part reflects fewer hours worked while children are young. Recent studies of large policy-induced changes in mothers’ work experience in the 1990s quantify the impact of avoiding lengthy work interruptions after childbirth. The analysis shows that mothers who return to work a year sooner after childbirth earn 5-6% higher wages 10 to 20 years later. Thus, policies that encourage mothers’ return to work can lead to large improvements in their lifetime earnings.

Growing evidence shows that motherhood leads to large and persistent declines in women’s employment, and that this accounts for an increasing share of the wage gap between men and women workers (Cortés and Pan, forthcoming). Yet although extensive research documents this “child penalty,” the causes remain uncertain. One explanation focuses on the initial interruption in work after childbirth, such as from limited parental leave (see, for example, Daly et al. 2018), which reduces work experience and can lead to permanently lower wages. Another explanation centers on the ongoing challenges faced by mothers, including the lack of flexible work schedules, which can limit job opportunities. Assessing the importance of each of these explanations in the data is crucial for designing public policy to address these earnings gaps.

This Letter discusses recent research by Kuka and Shenhav (2023), who estimate the impact of initial work interruptions on mothers’ employment and earnings over many subsequent years. The study looks at the effects of a specific policy change—the 1993 expansion of the Earned Income Tax Credit (EITC)—that substantially increased work incentives for low-income mothers with young children. The authors compare the labor market outcomes of single mothers who differ only in the timing of their childbirth relative to 1993, which determined the size of EITC benefit they would receive from working soon after childbirth. They find that the 1993 increase in post-childbirth work incentives had important long-run effects on labor market outcomes for mothers. Specifically, while the increase had no effect on a mother’s likelihood of being employed in the future, it raised the earnings of working mothers 4.2% in 10-20 years after the initial return to work. This significant increase in earnings was likely the result of greater work experience, which increased by 0.62 to 0.91 years in response to the work-incentive boost.

The results suggest that policies to reduce the length of mothers’ work interruptions can have substantial long-run benefits in the labor market. Specifically, these estimates imply that shortening potential non-employment spells by one year would be expected to raise future wages between 4.6 and 6.8%. This has important implications for the design of policies around parental employment, including paid parental leave, childcare subsidies for workers, and work-based tax credits.

Estimating the long-run benefits of mothers’ work experience

One substantial challenge when estimating the impact of work interruptions on mothers’ careers is that labor participation choices are not random. In particular, women who have longer spells out of the workforce after having a child may face different situations than other women. For instance, they may be less career-oriented, experience worse health, or be paired with higher-earning partners. Thus, the difference in labor market outcomes between mothers with shorter and longer work interruptions after childbirth is unlikely to represent the causal effect of work experience.

An ideal setting to test for this would randomly assign some mothers a large bonus if they start working within six months after childbirth, and no bonus to other “baseline” mothers for comparison. Researchers could then compare the labor market outcomes between these groups over several decades. The difference in career outcomes would be informative about the effect of work incentives on mothers’ employment and how reducing work interruptions affects earnings. However, such a scenario would be difficult, if not infeasible, to implement.

Using EITC expansion as a change in mothers’ work incentives

Fortunately, as discussed in Kuka and Shenhav (2023), the large expansion of the EITC in 1993 provides a unique “natural experiment” that provides an unexpected bonus for mothers similar to the ideal test setting. The EITC is a refundable tax credit that raises the income of low- and moderate-income households in the United States. The size of the credit varies nonlinearly with household income and increases with the number of children in the household. Single mothers make up the largest group of taxpayers who are eligible for the credit: Kuka and Shenhav estimate that 97% of single mothers are eligible based on prechildbirth earnings.

The 1993 EITC expansion provided a large boost to the income of eligible households, particularly single female heads of households. The expansion raised the maximum credit from $2,381 to $3,300 (in 2016 dollars) and increased benefits at every level of eligible earnings. These benefits represented an additional 8% of household income for the lowest-income recipients, roughly equivalent to an additional month’s wages. Previous research shows that the 1993 reform substantially increased low-income mothers’ employment, particularly among single mothers (see, for example, Meyer and Rosenbaum 2001).

To capture benefits similar to the randomized bonus described above, Kuka and Shenhav (2023) compare single mothers who, because the EITC expanded shortly before they had a child, had a greater incentive to work soon after childbirth to other single mothers who had a child a few years before the expansion. Similar to the first group in the ideal setting, the “early-incentive” group in this setting had a large incentive to work in the first few years after childbirth and thus were likely to have fewer work interruptions. The second group of mothers is like the ideal setting’s baseline group for comparison: they had the same general incentives as the first group but did not have an additional incentive to work soon after childbirth.

To address the possible differences between mothers with early incentives to work and baseline mothers, the authors account for details related to past work experience and other policies. These include a mother’s demographic characteristics and prechildbirth labor market outcomes, the generosity of state-level safety net policies, local economic conditions, and labor market outcomes among mothers ineligible for the EITC.

The study relies on administrative earnings data from the Social Security Administration from 1978 to 2015, linked to data from the Census Bureau’s Current Population Survey Annual Social and Economic Supplements (CPS ASEC) from 1991 to 2016. Employment is defined as having any earnings in the current calendar year, and total earnings are measured as the sum of wages and self-employment earnings. The main sample consists of women who had a first child between 1988 and 1996.

Impact of incentives on mothers’ work outcomes

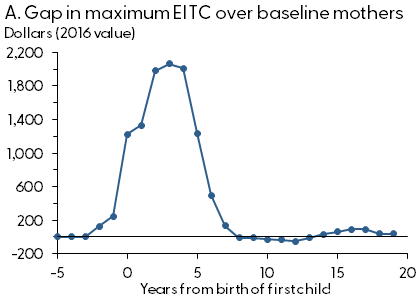

Panel A of Figure 1 shows the difference in work incentives between the two groups in dollar amounts, based on 2016 values. This is equivalent to the size of the “bonus” in the ideal setting and is computed as the difference in the average maximum EITC available to early-incentive and baseline mothers in each year around their first childbirth. It shows that early-incentive mothers are eligible for a higher maximum credit than baseline mothers for at least the first five years after a first birth. The gap in work incentives ranges from $500 to $2,000 in each of the first five years after a first birth. The difference in incentives is temporary, however, which is reflected by the gap fading to zero in the long run.

Figure 1

Additional work incentives for early-incentive mothers and impact on labor market outcomes

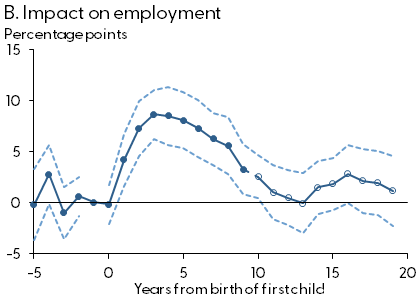

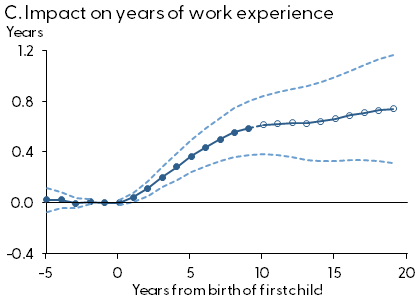

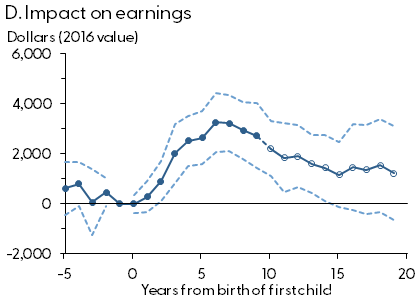

Notes: Panel A shows the difference in the maximum Earned Income Tax Credit benefits in each year since first birth between mothers who received 1993 EITC benefits in year of first childbirth versus mothers in the baseline group who received EITC benefits 3-6 years after childbirth. Panels B, C, and D present the estimated effects for early-incentive mothers relative to the baseline in each year from first childbirth on being employed, years of experience, and earnings; open dots are long-term effects (10-20 years). Dashed lines represent 95% confidence bands around average effects.

Source: Calculations in Kuka and Shenhav (2023) based on Social Security Administration and Current Population Survey data.

The main results in panels B through D show the differences in a given labor market outcome, such as earnings, between the two groups in the years after the birth of a child. These differences capture the full labor market responses of early-incentive mothers as they move throughout their careers. The effects are normalized to zero in the year before childbirth, so each marker reflects the difference between the early-incentive and baseline groups relative to that year. The panels also provide important insights about behavior before childbirth and how similar the groups are before the availability of additional EITC incentives. Dashed lines show 95% confidence bands for each estimate, which reflect their statistical precision.

Panel B shows the effects on employment. As expected, there is no difference between the groups before childbirth, which suggests that the two groups make for a reliable experimental comparison. However, employment for early-incentive mothers is 5 percentage points higher in the first five years after childbirth, compared with the average among baseline mothers of 63.1%. The difference in employment between the two groups closes over 5-10 years and is statistically insignificant thereafter. Thus, the gap in employment is temporary, similar to the gap in work incentives.

Panel C presents the cumulative effect of changes in employment on mothers’ work experience. Similar to the strong impact on employment, the impact on work experience grows substantially over the first 10 years after childbirth. Between 10 and 20 years after childbirth, early-incentive mothers have 0.62 additional years of work experience, which corresponds to a 5.7% increase relative to their baseline work experience. Using survey data on hours of work, Kuka and Shenhav (2023) show that total hours of experience also increase. Those results suggest that early-incentive mothers have 0.91 additional years of full-time, full-year experience in the long run.

Panel D shows that early-incentive mothers have higher earnings in every year after childbirth. Viewed in isolation, this increase in earnings could be explained either by a higher likelihood of being employed, holding annual wages constant, or by higher wages, holding employment constant. However, the increase in earnings persists long after the employment effect has dropped to zero (panel B), which points to a long-lasting increase in mothers’ wages. In the long run, mothers who receive early incentives earn $1,393 more per year 10-20 years after childbirth. This amounts to a 4.2% increase relative to average earnings among workers. In a complementary analysis, the authors show that these effects on long-run earnings reflect improvements throughout the income distribution.

In total, early-incentive mothers earn at least an additional $37,000 over the first 20 years after childbirth. Roughly 40% of these additional earnings accrue 10-20 years after childbirth, suggesting that estimates that do not incorporate these long-lasting effects would vastly underestimate the potential growth of mothers’ income.

Taken together, these results show that mothers who receive early incentives to return to work have greater work experience and earn more at every stage of their careers. But what drives higher earnings? Kuka and Shenhav show that higher earnings are concentrated among women who also work for more years, which suggests that the reduction in work interruptions may play a substantial role. In contrast, there is little support in the data for alternative explanations, such as changes in fertility, marriage, hours of work, skill depreciation, or occupation. If the effects on earnings are entirely explained by more years of experience, this would imply that a year of additional work experience provides a benefit of between 4.6 and 6.8% in annual earnings, based on the 4.2% increase in wages and 0.62 to 0.91 increase in years of experience reported in this study.

Conclusion

This Letter describes recent research measuring the effects of reducing work interruptions after childbirth on women’s labor market outcomes using administrative earnings data. Results show that mothers who begin working sooner after a first birth gain additional work experience and earn higher wages in the long run. These results suggest that policies supporting maternal employment by helping mothers avoid lengthy work interruptions can lead to higher earnings that accumulate over the life cycle. By boosting taxable earnings, such policies may have long-term fiscal benefits as well.

Na’ama Shenhav

Senior Economist, Economic Research Department, Federal Reserve Bank of San Francisco

References

Cortés, Patricia, and Jessica Pan. Forthcoming. “Children and the Remaining Gender Gaps in the Labor Market.” Forthcoming in Journal of Economic Literature.

Daly, Mary C., and Joseph H. Pedtke, Nicolas Petrosky-Nadeau, and Annemarie Schweinert. 2018. “Why Aren’t U.S. Workers Working?” FRBSF Economic Letter 2018-24 (November 13).

Kuka, Elira, and Na’ama Shenhav. 2023. “Long-Run Effects of Incentivizing Work After Childbirth.” FRB San Francisco Working Paper 2023-27.

Meyer, Bruce D., and Dan T. Rosenbaum. 2001. “Welfare, the Earned Income Tax Credit, and the Labor Supply of Single Mothers.” Quarterly Journal of Economics 116(3), pp. 1,063–1,114.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org