Financial conditions indexes summarize a broad range of financial indicators with the goal of measuring how financial markets affect economic activity. Evidence from event studies with high-frequency data supports the view that monetary policy is a key driver of financial conditions. The effects are evident, not only around monetary policy announcements but also, indirectly, around macroeconomic data releases. The impact of inflation surprises on financial conditions has strengthened over the past year, likely due to the perceived implications for the future course of monetary policy.

Investors, analysts, forecasters, and policymakers have a keen interest in understanding how monetary policy and conditions in financial markets affect economic activity. One way to go about this issue empirically is to compare the current level of the central bank’s policy rate and a hypothetical neutral interest rate. If the policy rate is above its neutral level, this indicates that monetary policy is stepping on the brakes of the economy. According to most estimates, this is currently the case for the U.S. economy.

But focusing only on the short-term policy rate does not account for the broader financial conditions. After all, the effects of monetary policy on the economy also depend on long-term interest rates, corporate bond yields and lending rates, stock prices, exchange rates, and other asset prices. These factors, and not the policy rate alone, help determine financial market effects on economic activity.

This Economic Letter analyzes financial conditions indexes (FCIs) to better understand recent financial developments and their underlying drivers. We first explain how some popular FCIs are constructed and use them to document how financial conditions have changed over the course of the ongoing monetary policy cycle. Then, we provide new evidence on the drivers of financial conditions, using event studies of monetary policy announcements and inflation data releases. Our analysis shows that monetary policy has significant direct effects on financial conditions, as evident from the response to monetary policy surprises. In addition, monetary policy also has indirect effects: Macroeconomic news affects financial conditions in part by shifting perceptions about the likely course of future policy. Financial market participants appear to be especially attuned to recent inflation data releases, which has led to unusually strong responses in financial conditions.

Recent changes in financial conditions

A wide range of financial indicators affect economic activity, mainly by influencing the behavior of households and firms. For example, financial markets create some headwinds for economic activity when interest rates—including long-term bond yields, lending, and mortgage rates—are high, when the stock market is doing poorly, and when the dollar is strong. As a result of these restrictive, or tight, financial conditions, overall demand for goods and services and macroeconomic activity tend to slow.

FCIs summarize various financial indicators in a single number, with the goal of measuring how current market conditions affect economic activity. Typically, FCIs are simply weighted averages of several financial indicators. For example, the Chicago Fed’s National FCI is a weighted average of 105 different measures of financial activity in money, debt, and equity markets and the banking system. Similarly, an FCI from Bloomberg averages eight indicators from money, bond, and equity markets. Goldman Sachs produces its FCI using a dynamic macroeconomic model to determine the relative weights of five underlying indicators: a policy rate, a long-term riskless bond yield, a corporate credit spread, a measure of equity valuations, and a trade-weighted exchange rate.

The Federal Reserve Board of Governors recently launched the Financial Conditions Impulse on Growth (FCI-G) index, developed by Ajello et al. (2023), to estimate how changes in financial indicators will affect the growth rate of output. The index weights its seven financial indicators based on how they affect output growth in the large-scale general equilibrium model used at the Board of Governors for forecasting and policy analysis, known as FRB/US. Unlike most other FCIs, the FCI-G considers past financial market changes instead of only current market conditions. This difference and the focus on output growth set it apart from other FCIs.

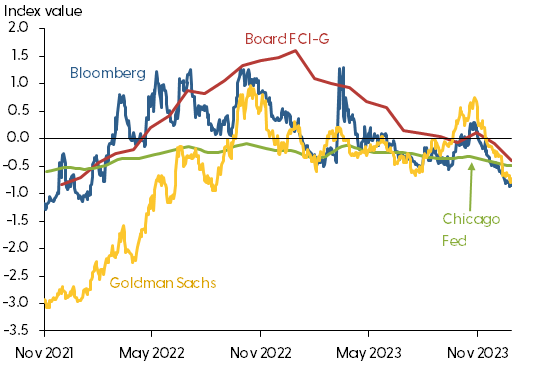

Figure 1 shows these four FCIs over the period from November 2021 to December 2023, with positive values corresponding to tighter financial conditions and negative values reflecting looser conditions. A value of zero corresponds to the average value of each index over a specific historical period, which is not necessarily a level that is “neutral” for economic activity. Financial conditions started to tighten before the first rate hike by the Federal Open Market Committee (FOMC) in March 2022, and continued tightening during the period of substantial policy rate hikes over most of 2022. Over the period since late 2022, financial markets exhibited some volatility at times, but on net they have become quite a bit more accommodative, despite the FOMC raising its policy rate more than 2 percentage points.

Figure 1

Financial conditions indexes over time

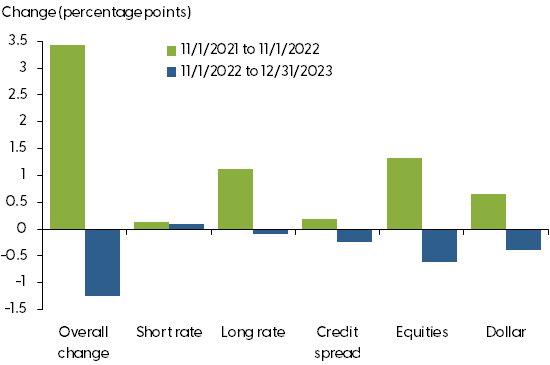

Monetary policy can affect all the components of FCIs. For example, Figure 2 shows the overall change and contributions of five different components in the Goldman Sachs FCI for two different periods. During the financial tightening from November 2021 to November 2022 (green bars), the substantial increase in the federal funds rate made only a small contribution. According to the Goldman Sachs model and consistent with empirical research, this is because short-term rates are not as relevant for economic activity. Instead, financial conditions tightened mainly because of higher long-term interest rates, lower stock prices, and a stronger dollar. As financial conditions eased from November 2022 to December 2023 (blue bars), about one-third of the earlier tightening in this FCI was reversed due to higher stock prices, a weaker dollar, and narrower credit spreads.

Figure 2

Contributions to Goldman Sachs FCI

The effects of monetary policy surprises

These developments illustrate that the relationship between monetary policy and financial conditions is complex. Correlations between time series, for example between the policy rate and an FCI, are not particularly useful for understanding this relationship because they do not reveal causal effects. By contrast, high-frequency event studies of FOMC announcements can provide estimates of the effects of monetary policy on economic variables. Here we follow a similar methodology as in Bauer and Swanson (2023) and measure the surprise component of monetary policy actions using 30-minute changes in various market interest rates around the time of the announcements. Then we estimate the effects on financial conditions using event-study regressions, relating monetary policy surprises to changes in FCIs on the day of the announcement and subsequent days.

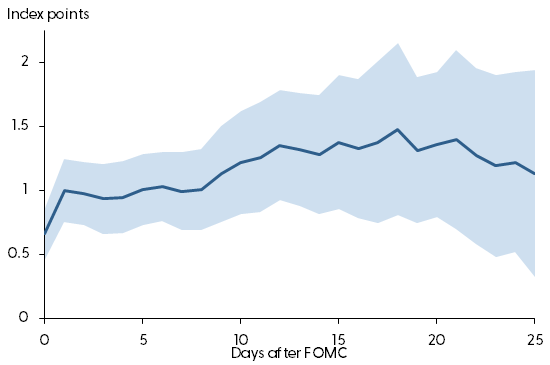

Figure 3 shows the estimated responses of the Goldman Sachs FCI to monetary policy surprises. A surprise monetary tightening leads to significant and persistent tightening in financial conditions. The size of the impact is moderately large: a policy surprise of 0.1 percentage point leads to an increase in the FCI by about 0.07 index points on the day of the announcement and further increases over the following two weeks.

Figure 3

Response of Goldman Sachs FCI to surprise tightening

Source: Goldman Sachs, Bauer and Swanson (2023), and authors’ calculations.

What mechanisms can explain these effects? It is well established that monetary policy can affect long-term risk-free interest rates (Bauer and Swanson 2023), which are an important component of every FCI. In addition, monetary policy can also affect the risk appetite of investors, which is a crucial driver of all risky asset prices and hence of financial conditions more broadly (Bauer, Bernanke, and Milstein 2023).

The evidence in Figure 3 supporting the effects of monetary policy on financial conditions is consistent with the tightening of FCIs over the course of 2022 in the face of monetary tightening. Our results are also consistent with related analysis by Sack and Swanson (2023) using the FCI-G. However, during other episodes, it is less clear how changes in financial conditions may have been related to monetary policy—for example, during the tightening of financial conditions in fall 2023.

Market sensitivity to inflation data

Macroeconomic data releases contain valuable information about the economic outlook; they therefore tend to affect monetary policy expectations, interest rates, and financial conditions more broadly. But the nature and strength of these effects depends on perceptions about monetary policy. Bauer, Pflueger, and Sunderam (2023) show that macroeconomic news can cause a stronger financial market response when professional forecasters expect the Fed to be very responsive to economic conditions. They also find that the Fed has recently been perceived to be very responsive to the inflation outlook.

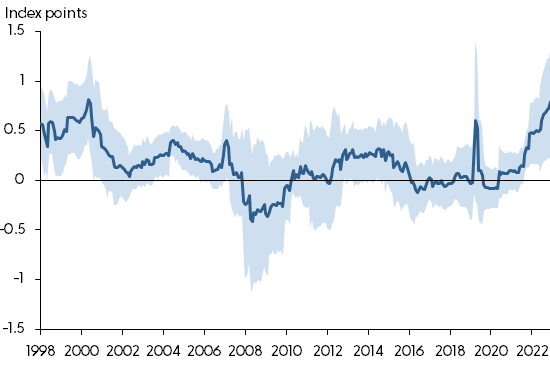

Are inflation data releases currently having larger effects on financial markets than usual? Event-study evidence using FCIs can also shed light on this question. Figure 4 shows the time-varying effects of core consumer price index (CPI) inflation surprises on the Goldman Sachs FCI. For inflation surprises, we use the differences between released data and Bloomberg consensus expectations. The results show that the sensitivity of financial conditions to core inflation surprises is currently at its highest level in over two decades.

Figure 4

Response of Goldman Sachs FCI to inflation surprises

Source: Goldman Sachs, Bloomberg, Bureau of Labor Statistics, and authors’ calculation.

Macroeconomic data, particularly inflation news, have increasingly taken center stage for financial markets, likely due to their importance for the monetary policy outlook. This can explain some of the developments in FCIs. For example, strong data on real activity and persistently high inflation data in fall 2023 had fed a narrative that interest rates might need to remain “higher for longer,” which in turn caused more restrictive financial conditions.

Conclusion

Changes in financial conditions garnered much public attention over the past year, in part because they sometimes seemed disconnected from the evolution of the Fed’s policy rate. However, our event-study analysis in this Letter confirms that monetary policy plays a crucial role for financial conditions, both through direct effects from policy announcements and indirect effects from macroeconomic news via perceptions about the likely future policy response. While the complexity of financial markets makes it difficult to pinpoint the exact determinants of observed changes in FCIs, monetary policy and macroeconomic data are clearly two important and interrelated drivers of financial market conditions.

References

Ajello, Andrea, Michele Cavallo, Giovanni Favara, William Peterman, John Schindler, and Nitish Sinha. 2023. “A New Index to Measure U.S. Financial Conditions.” FEDS Notes, Federal Reserve Board of Governors, June 30.

Bauer, Michael, Ben Bernanke, and Eric Milstein. 2023. “Risk Appetite and the Risk-Taking Channel of Monetary Policy.” Journal of Economic Perspectives 37(1), pp. 77–100.

Bauer, Michael, Carolin Pflueger, and Adi Sunderam. 2023. “Perceptions about Monetary Policy.” FRB San Francisco Working Paper 2023-31.

Bauer, Michael, and Eric Swanson. 2023. “A Reassessment of Monetary Policy Surprises and High-Frequency Identification.” NBER Macroeconomics Annual 37, pp. 87–155.

Daly, Mary C. 2023. “Monetary Policy: Progress Is Not Victory.” Speech at the Economic Club of New York, October 5.

Sack, Brian, and Eric Swanson. 2023. “The Impact of Federal Reserve Policy on the Fed’s Financial Conditions Index.” Brookings Institution, Commentary, October 18.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org