Banks tightened the criteria used to approve loans over the past year. Analysis shows that their tighter lending standards can be partially explained by economic conditions that reduce demand for loans and increase their potential risk, such as policy rate increases and a slowing economy. The unexplained part may reflect a restrained credit supply, specifically related to banks being less willing or able to take on risk. What are the potential economic consequences? Past credit supply shocks have had significant long-lasting effects on unemployment but less impact on inflation.

The first half of 2023 was characterized by credit market turbulence, including the collapse of Silicon Valley Bank, Signature Bank, and others. The increased uncertainty in the banking sector that followed these closures led many banks to tighten their credit standards, becoming stricter about the conditions under which they were willing to lend. According to the Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS), lending standards in 2023 tightened to a degree only seen during the Global Financial Crisis and the COVID-19 pandemic. This leads to questions about the possible effects on the overall economy, particularly whether tighter standards resulted from an unexpected drop in the credit supply or other economic factors, such as higher interest rates or a slowing of the economy.

In this Economic Letter, I analyze supply and demand factors in credit market conditions and their impact on bank lending standards, like Lown and Morgan (2006) and others. A measure based on reports from bank loan officers shows that credit conditions began tightening in mid-2022, well before the bank closures. Since early 2023, about half of the tightening in lending standards has been due to changes in the credit supply specific to the banking sector, such as banks reevaluating their willingness to take on risk, and the remainder in response to other economic conditions. My analysis also estimates that unexpected changes to credit supply conditions—including the March 2023 bank closures—can account for 0.4 percentage point of unemployment by the end of 2023, meaning that unemployment in that quarter would have been 3.3% without the credit supply shock. My estimates suggest that the effects related to these credit supply shocks will be persistent, lasting through 2026. The contribution of these shocks to inflation is likely to be more subdued, pushing core personal consumption expenditures (PCE) inflation down by less than a 0.1 percentage point through 2026.

Bank lending standards and the economy

Bank lending to businesses depends on two key components: the loan interest rate and the lending standards that businesses need to meet to qualify for a loan. When banks are more willing to take on risk, they impose minimal lending standards; by contrast, when banks prefer to take on less risk, they scrutinize borrowers more and impose stricter conditions. The interest rate on loans responds to both credit supply and credit demand conditions. By contrast, lending standards are more directly related to the willingness or ability of banks to tolerate risk. Thus, they can be used as a proxy for credit supply conditions.

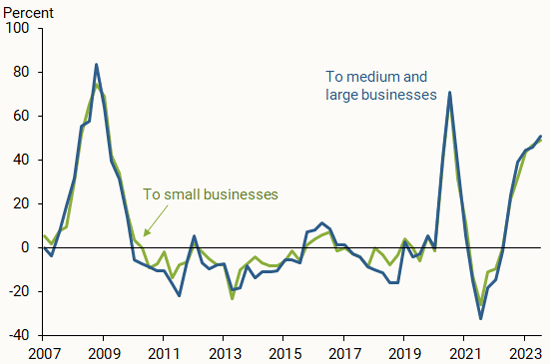

Using SLOOS data, I measure commercial and industrial bank lending conditions as the percentage of responding banks that report tighter lending standards minus the percentage that report easing of lending standards. The resulting measure can range from –100, meaning that all banks are easing standards, to 100, meaning that all banks are tightening standards. A positive (negative) number means that it is harder (easier) for firms to get credit. This method has been used by Lown and Morgan (2006) and other studies to measure credit supply conditions. Figure 1 shows the evolution of this measure from 2007 through 2023 for lending to medium and large businesses (blue line) and to small businesses (green line).

Figure 1

Tightening in commercial and industrial lending standards

The figure shows that lending standards tightened in 2023 to a degree seen only during the Global Financial Crisis in 2008 and the onset of the COVID-19 pandemic in 2020. It also clearly shows that lending standards began tightening in the second half of 2022, well before the bank collapses in early 2023. Finally, the tightening in 2023 lending standards was very similar for all businesses regardless of their size. Therefore, I use the measure for medium and large firms as representative for the economy.

I use this measure in statistical analysis to estimate how credit conditions interact with the rest of the economy, particularly to understand their impact on unemployment and inflation. To measure unemployment, I focus on the unemployment gap, calculated as the difference between the measured unemployment rate and the Congressional Budget Office measure of the potential unemployment rate, and I use the core personal consumption expenditures (PCE) price index to measure inflation.

My approach builds on the work of Lown and Morgan (2006), combining this measure of credit conditions with other measures of financial conditions. These include the effective federal funds rate, the 10-year Treasury constant maturity yield, the 30-year fixed mortgage rate spread relative to the 10-year Treasury yield, the BAA corporate bonds yield spread relative to 10-year Treasury bonds, and bank loans. Finally, to reflect forces that have recently been important in shaping the economy and inflation—namely supply chain pressures and significant changes in energy prices—I also include the West Texas Intermediate spot oil price, and the Federal Reserve Bank of New York’s Global Supply Chain Pressures Index. The analysis uses data from 1998 through the second quarter of 2023.

My statistical model considers interactions between the different variables within the same quarter and over time. The SLOOS lending standards measure is observed early in the quarter and corresponds to bank responses from the previous quarter. Shocks to this measure are thus identified as changes in lending standards that do not respond to other variables within the same quarter. That is, tightening of standards can respond to this identified shock in the same quarter, and to other types of shocks from previous quarters.

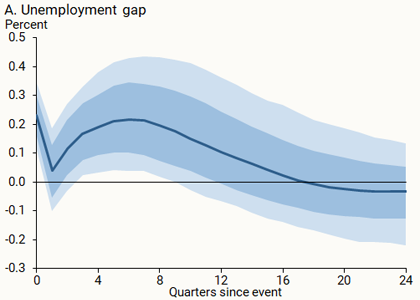

Figure 2 shows how much a 10 percentage point tightening in lending standards affects the unemployment gap and inflation. The horizontal axis shows the number of quarters since the shock took place. The vertical axis shows the increase in percentage points for each variable relative to the absence of tighter lending standards, with zero meaning no change in outcomes. The solid blue line is the median estimate, and the shaded areas represent the 70% (darker) and 90% (lighter) probability ranges of possible estimates.

Figure 2

Response of unemployment and inflation to a 10 percentage point tightening of lending standards

Note: Shading represents 70% (darker) and 90% (lighter) probability estimates around median estimate.

Source: Senior Loan Officer Opinion Survey on Bank Lending Practices and author’s calculations.

Overall, the tightening in lending standards induces a persistent increase in the unemployment gap and a small drop in inflation. The impact on unemployment is expected: tighter lending standards imply that firms cannot invest as much, reducing demand for credit in the economy. With weaker demand, firms will hire fewer workers and lay off some of their workforce, leading to higher unemployment.

The impact on inflation is more nuanced. On the one hand, a weaker demand for credit eases price inflation. On the other hand, as documented in Gilchrist and Zakrajsek (2012), tighter lending standards are also associated with higher interest rates, which increase operational costs for firms. Firms will pass some of those higher costs to their customers, leading to price inflation. Model estimates suggest the demand effect is more likely to prevail, and inflation falls slightly on net in response to tighter lending standards.

What led to tight lending standards in 2023?

Was the 2023 tightening in lending standards a pure credit supply shock, or was it a natural response of banks to evolving economic conditions? To address this question, I compare actual data at each point in time with the model’s predictions for that time to extract each component’s response to past shocks. I use the results to determine how much of the actual response of each component is due to shocks of different sources—for example, how much of the changing lending standards comes from responses to supply chain shocks or credit supply shocks.

The analysis suggests that credit supply shocks account for about 23 percentage points of the tighter lending standards in the first half of 2023. The remaining 22 percentage points of the tightening is associated with the response of lending standards to changes in economic conditions due to supply chain pressures and other factors originating outside the credit market.

The measure also shows that lending standards started to tighten before 2023, as early as the second quarter of 2022, as shown in Figure 1. This suggests that inflationary pressures and monetary policy tightening in previous quarters played a role in banking conditions more generally. Therefore, tighter credit standards may be related to the bank collapses in that they shared similar root causes in recent economic and financial conditions. However, credit supply factors in the first half of 2023 that could be associated with bank closures explain only part of the overall tightening of lending standards. Furthermore, my model estimates that the impact of the credit supply shock on tighter lending standards will be relatively short lived, dissipating by the end of 2024.

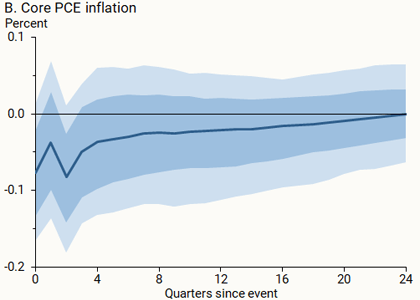

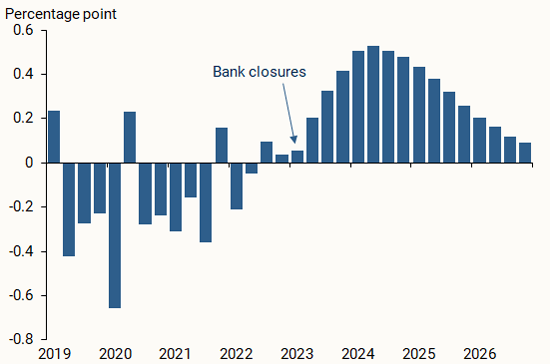

I next use this methodology to estimate how much credit supply shocks contributed to unemployment and inflation in the recent past and how much they are expected to contribute through 2026. To do this, I combine the estimated size of the shocks with the estimated responses of the economy to those shocks. The bars in Figure 3 show the median estimated contribution to unemployment.

Figure 3

Contribution of credit supply shocks to unemployment

The estimated contribution for the last quarter of 2023 is 0.4 percentage point, which means that unemployment would have been 3.3% without the credit supply shock, rather than the 3.7% reported in the data. My analysis shows that, even though the tightening of lending standards is not expected to last long, the effects on unemployment are estimated to persist through 2026. For inflation, the contribution of the credit supply shock is more subdued but more persistent, pulling inflation down by less than 0.1 percentage point through the entire projection into 2026. A persistent increase in corporate bond yield spreads implied by the credit supply shock may explain why the effects on the rest of the economy last so long.

This analysis has several limitations, including the possibility that underlying economic relations changed with the COVID-19 pandemic. Related to this, the model is proportional, implying that a shock of twice the size would have effects that are also twice the reported size. However, the unusually large shocks in this analysis could trigger more than proportional economic responses—for example, if cascading bank failures induced snowball effects in the economy due to an increasingly fragile banking system. Finally, using different measures to proxy for financial and monetary policy conditions could result in different estimates, although my tests using different data yielded similar results to those reported here.

Conclusion

In the first half of 2023, lending standards tightened substantially. This Letter finds that only about half of the tightening resulted from a credit supply shock that would have caused a slowdown in economic activity, while the remainder corresponds to banks’ normal response to overall economic conditions. While a tightening of lending standards is not expected to persist for very long, this analysis suggests it could add half a percentage point to unemployment through 2024 and push down inflation by a small amount.

References

Lown, Cara, and Donald P. Morgan. 2006. “The Credit Cycle and the Business Cycle: New Findings Using the Loan Officer Opinion Survey.” Journal of Money Credit and Banking 38(6).

Simon Gilchrist and Egon Zakrajsek. 2012. “Credit Spreads and Business Cycle Fluctuations.” American Economic Review 102(4, June), pp. 1,692–1,720.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org