Download PDF (377 kb)

Download Chart Data (49 kb)

Summary

2022 consumer payment behavior remains consistent with early pandemic

At the onset of the pandemic in 2020, US consumers dramatically changed how they purchased goods and services, favoring credit cards by a significant margin and increasing their use of online payments. With the country emerging from the pandemic and economic conditions characterized by high inflation, we were interested to see if this trend would continue.1

Analyzing the 2022 survey data that informs the Diary of Consumer Payment Choice, we found that 2020’s shift away from cash and toward credit card payments has continued. Consumers continued to reach for credit cards at a higher rate in 2022. Their use of on-line payments also remained elevated as compared to pre-pandemic payment habits. By contrast, consumer use of debit cards and cash held steady at 2020 levels.

Although consumers are making fewer cash payments when compared to pre-pandemic, both on-person and store-of-value cash holdings remained above pre-pandemic levels in 2022, signifying 1) consumers’ demand for cash remains and 2) there may be a long-term impact from the onset of the pandemic on consumer cash holdings.2

The key Diary findings are:

- The share of payments made using cash declined slightly from 2020 and 2021 to 18 percent of all payments, driven by an increase in non-cash payments and not a decrease in cash payments.3

- The share of in-person purchases and person-to-person (P2P) payments remained steady since 2020 at 81 percent.4

- On-person cash holdings increased by $5 from 2021, averaging $73.

- Average store-of-value holdings remained elevated compared to pre-pandemic holdings and increased slightly to $418.

The consistency across these cash data points since start of the pandemic revealed what may be a new normal level of cash payments and holdings.

Acknowledgements

This paper would not have been possible without the support and contributions of the following individuals. From the Atlanta Fed: David Altig, Antar Diallo, Kevin Foster, Claire Greene, Marcin Hitczenko, Brent Meyer, and Oz Shy. From the Boston Fed: Ruth Cohen and Joanna Stavins. From the San Francisco Fed: John Brady, Simon Kwan, and Sandra Rolnicki. From Federal Reserve Financial Services: Alexander Bau, Haley Gibson, Ben Gold, Steve Son, and Kathleen Young.

Trends in Payment

Consumers increased credit card use as cash use remained consistent

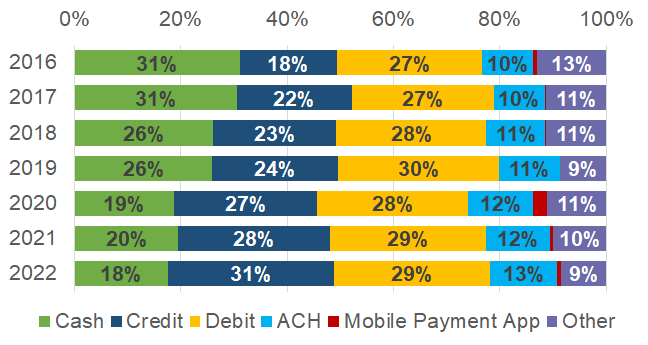

Through the 2022 survey, we found that some of the major payment trends that started early in Covid-19 public health emergency have continued into the pandemic’s later stages.5 Notably, consumers have continued to use credit cards more often and credit cards were the most used payment method in 2022. By contrast, consumers use of debit cards and cash in 2022 remained consistent with 2020 levels. This is a significant change from the pre-pandemic period when consumers made a greater share of payments with both cash and debit card. This shift toward credit card use is correlated with shifts in consumer preferences, which will be discussed in more detail later in this paper. Cash use remained the third most popular payment choice and accounted for 18 percent of all payments in 2022. Another key takeaway from 2022 payment trends was the leveling-off of mobile app payments. Although consumers rapidly shifted toward online and remote payments in 2020, the average number of mobile app payments has not increased since that time, indicating that consumer use of mobile payment apps may have reached a peak earlier in the pandemic (Figure 1).6,7

Figure 1

Share of payment instrument use for all payments

Although cash use remained lower than pre-pandemic levels, the consistent number of cash payments in the past two years following a steep decline between 2019 and 2020 suggests there may be a current floor to cash use. During the pandemic, opportunities to use alternatives to cash increased dramatically.8 These conditions greatly affected consumer use of cash as opportunities to pay online reached an all-time high Nonetheless, cash accounted for 20 percent of all consumer payments in 2020. This enduring demand indicates that there are consumers who needed or wanted to use cash throughout the pandemic. If these consumers did not shift away from using cash amidst the conditions of the early pandemic, it is less likely that they will shift their payment behavior in the future; barring another major event occurring. Consumer payment preferences tend to be sticky, so the stabilization of cash payments since 2020 suggests an underlying and consistent level of demand for cash.9

Factors Affecting Consumer Cash Payments

The following factors, which are expanded upon in the sections below, affected consumer cash use early in the pandemic and remained present in 2022:

- Consumers continued to make more purchases online than they did before the pandemic. This shift away from in-person payments has resulted in fewer opportunities to use cash.

- Fewer consumers reported that they preferred cash when making in-person payments.

- The number of in-person payments at retailers where consumers make most payments returned to pre-pandemic levels; however, cash payments at these retailers did not.

- The change in consumer shopping habits resulted in fewer payments of less than $25 compared to 2019. Historically, cash has been used more often for such payments.

Share of online purchases remained elevated compared to pre-pandemic

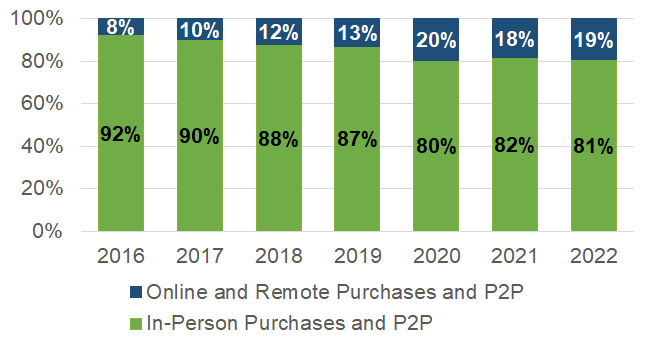

In 2022, consumers continued to make a greater share of purchases remotely when compared to before the pandemic in 2019. Consistent with 2020 and 2021, consumers made approximately one of every five purchases and person-to-person (P2P) payments remotely or online. Prior to the pandemic, in 2019, consumers made 13% of payments remotely (Figure 2). With consumers making more online payments, opportunities to pay with cash decreased beginning in 2020 and remained below 2019 levels in 2022. However, as the share of payments in-person stabilized since 2020, opportunities to make cash payments remained steady in 2022.

Figure 2

Percent of purchases and P2P payments made in-person versus online or remote

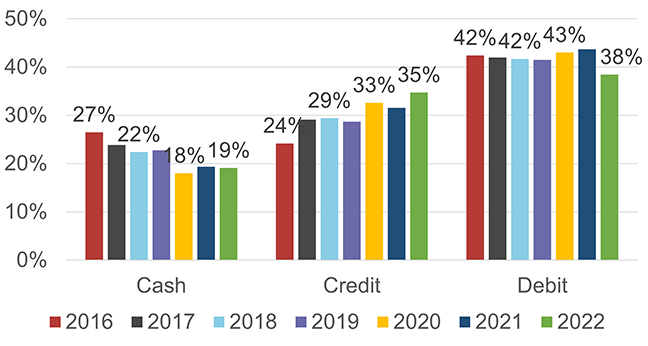

Increased card preference since 2020 reduced the probability of cash use

Like the stabilization of the share of in-person purchases and P2P payments, the share of people preferring cash for in-person payments in 2022 remained stable but below pre-pandemic levels (Figure 3). Since 2016, consumers preference for cash has declined while their preference for credit cards has increased. Consumers prefer credit cards because of the perceived convenience, lower rates of cash acceptance, and the ease of record keeping as compared to cash. According to the 2022 survey, over 90 percent of respondents agreed that credit and debit cards are usually accepted for making payments while only 82 percent said that cash was accepted. The largest gap revealed by the survey concerned cash and record keeping. Only 18 percent of survey respondents felt that cash was a good record of payment. By comparison, 50 percent of respondents cited credit and debit cards for their ease of record keeping.

Figure 3

Stated payment preference for in-person payments

While there are characteristics of cards that consumers prefer over those of cash, consumers previously identified cash as the least costly payment instrument.10 While there are less up-front costs to get or use cash, studies on the cost of using cash as compared to cards suggest that the cost of using credit cards is decreasing as consumers receive cashback rewards.11 Of the 82 percent of consumers that indicated they have at least one credit card in 2022, approximately 92 percent indicated that the credit card gives rewards. Such rewards may play an additional role in the shift toward credit cards specifically, as compared to debit cards or cash.

The shift away from cash and towards credit cards that started at the beginning of the pandemic appears durable. It is based on consumers evaluation of the relative convenience, acceptability, and cost associated with different payment instruments.

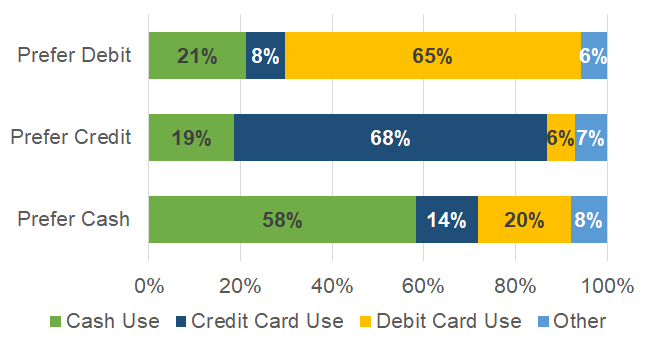

Despite this shift in preference towards credit cards and decreased preference for cash and debit cards compared to the pre-pandemic period, a fundamental level of demand for cash for in-person payments remained. Even for those that preferred credit and debit cards in 2022, cash continued to be the second-most used instrument and accounted for approximately 20 percent of in-person purchases made by consumers who prefer cards (Figure 4). This suggests that cash remains an important back-up payment instrument for instances when cards are not available or when cash is more convenient to use, such as with for payments under $25, which will be discussed in more detail later in this paper.

Figure 4

Share of in-person payments by payment preference

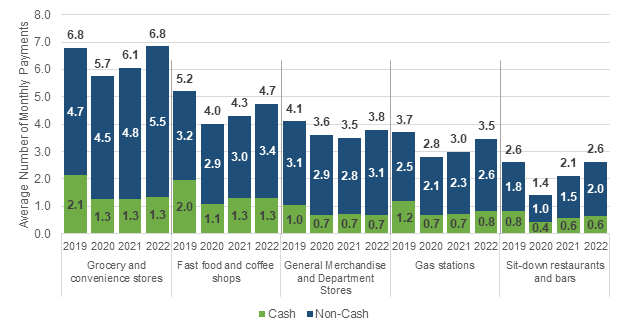

In-person payments increase as cash remained stable at select merchants

Overall in 2022 and in line with the trend that started in 2020, consumers made fewer in-person payments. However, at certain merchant locations, the opposite was true and consumers increased their in-person payments as compared to 2020.12 These merchants included grocery and convenience stores, restaurants, gas stations and general merchandise stores (Figure 5).

Figure 5

Average number of monthly cash and non-cash payments by merchant type

The increase in in-person payments at these locations did not, however, result in an increase in consumers use of cash. Instead, consumers used credit cards more frequently. The shift away from cash use at these locations since 2020 suggests the pandemic provided the conditions for many consumers to change their payment behavior. While substitution away from cash took place during the beginning of the pandemic at these merchant locations, the number of cash payments has not decreased since the start of the pandemic.

Small-value cash payments increased slightly from 2021

Historically, cash has been the most used payment instrument for small-value payments, so an increased number of small-value payments usually corresponds with increased cash use.13,14 In 2022, the number of small-value payments remained below pre-pandemic levels, however, there was a stabilization in the number of these small-value payments since 2020 and cash was the most used instrument for payments under $25 (Figure 6). Compared to other payment instruments, the average value of cash payments in 2022 remained below that of credit and debit card payments. Consumers made large value purchases with credit cards, averaging about $95 per transaction, while they made smaller value purchases with cash, averaging $39 per transaction.

Figure 6

Average number of in-person payments per month under $25

Cash Use by Demographics

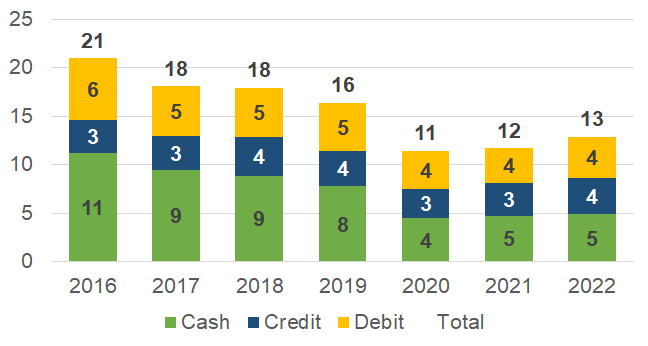

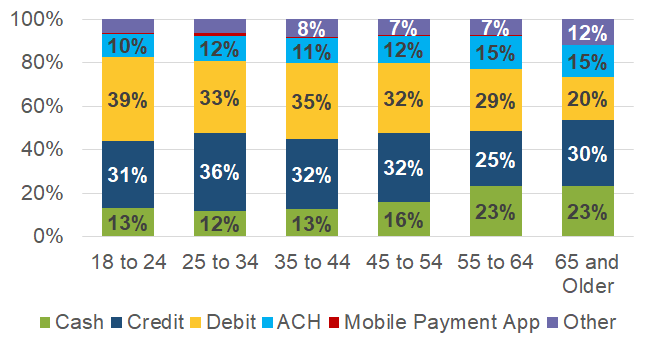

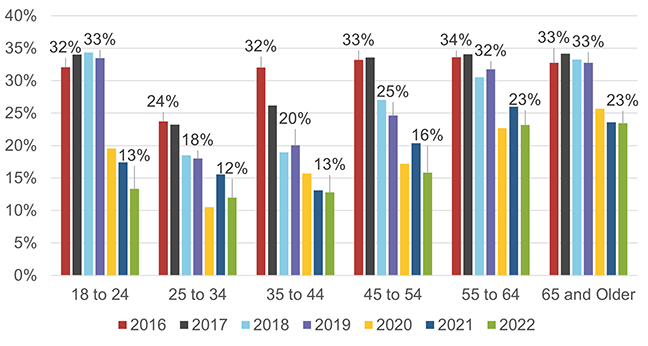

Cash use remained below pre-pandemic levels for all age groups

Since the start of the pandemic, consumers’ cash use has become more strongly correlated with age. Older consumers are more likely to use cash than younger consumers, who are more likely to use debit cards (Figure 7).15 This was not the case prior to the pandemic when individuals aged 18 to 24 used cash at a similar rate as those 55 and older (Figure 8). The impact of the pandemic on 18- to 24-year-olds’ cash use was the largest of any age cohort; these consumers’ cash use fell 20 percentage points between 2019 and 2022. Over the same period, 35- to-44-year-olds and 45- to-54-year-olds decreased their share of cash use by seven and 11 percentage points, respectively.

Figure 7

Share of payment instrument use by age

Figure 8

Shares of cash use by age group

The difference in cash use by age cohort is not directly correlated with differences in shopping behavior, as the share of payments made at different merchant types did not differ significantly between groups. However, consumers aged 35 and over made a greater share of their payments at grocery stores, department stores, and utilities than 18-to 24-year-olds. 18- to 24-year-olds made a greater share of payments at fast food places, public transportation locations, and at school and colleges (Figures not shown). Regardless of age, the share of cash use has declined while the share of credit and debit card use has increased since the start of the pandemic.

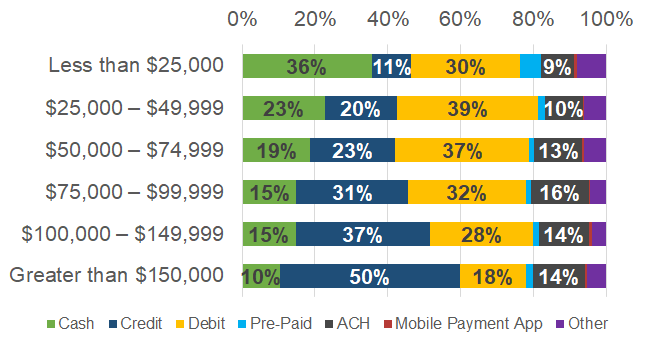

Cash was the most used payment for the lowest income households

There are also significant differences in how consumers from lower income and higher income households make payments. These trends, which pre-date the pandemic, continued to hold in 2022 (Figure 9). On average, those in households making less than $25,000 per year used cash at a rate over three times greater (36 percent) than those from households making more than $150,000 (10 percent). The opposite is true with the share of credit card use: those in households making more than $150,000 used credit cards at a rate four times greater (50 percent) than those in households making less than $25,000 (12 percent). While the pandemic accelerated the shift away from cash for all household income groups, cash remained an important payment instrument for lower income households.

Figure 9

Share of payment instrument use by household income

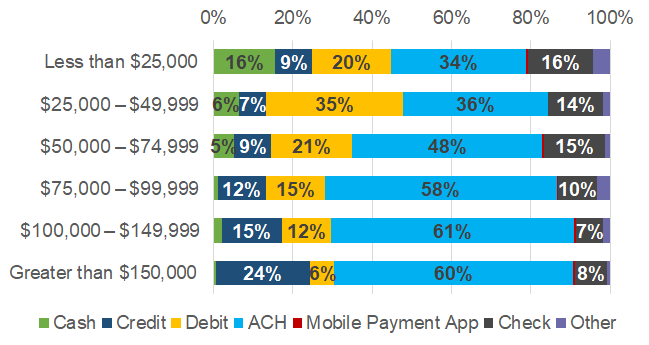

The importance of cash for individuals in lower income households becomes even more pronounced when examining payment instrument use for bill payments (Figure 10). People living in households making less than $25,000, used cash for approximately 16 percent of all bill payments, the same share as checks. Cash use for consumers making less than $25,000 a year exceeded the combined cash use for all other household income groups making more than $75,000 (Figure 9). This highlights that the access and use of the full suite of payment choices is not always available to all members of the U.S. population.

Figure 10

Share of payment use for bill payments by household income

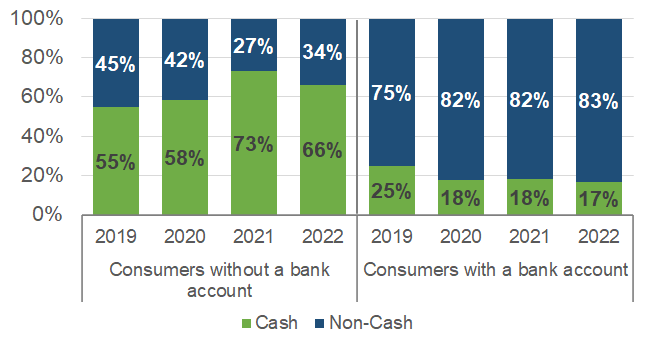

Cash is crucial for consumers who do not use traditional banking services

There is a strong relationship between cash use and being unbanked. In turn, those who are unbanked tend to live in low-income households. More than 90 percent of the unbanked population live in households making less than $75,000.16 Approximately 24 percent of people living in households making less than $25,000 are unbanked. This lack of access to traditional banking limits the available payment options for these individuals and results in a higher share of cash use when compared to those who use traditional banking services.

One key difference between consumers that have a bank account and those who do not has been divergent trends in the share of cash use since the pandemic began (Figure 11). In 2019, consumers that have a bank account used cash for approximately 25 percent of their payments, which decreased to 17 percent in 2022. By comparison, consumers that do not have bank accounts increased their share of cash use since 2019; they made 66 percent of all payments with cash in 2022. These diverging trends illustrate how cash remains a vital payment method for specific groups of consumers. While cash use decreased for those that use banking services, the consistency in the share of cash use for unbanked consumers supports the notion that cash is sticky for wide portions of the population, not only those that do not have access to bank accounts or from lower income households.

Figure 11

Cash use by banking status

Trends in Cash Holdings

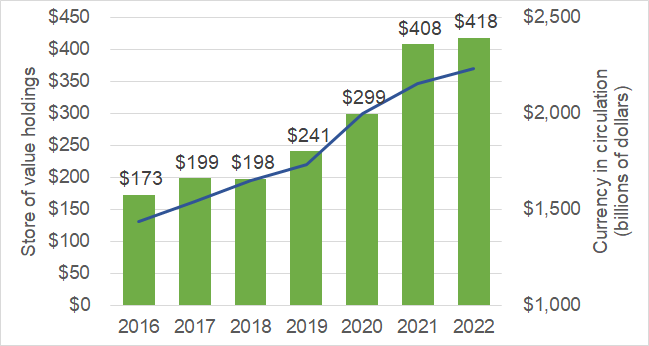

While the average number of cash payments remained below pre-pandemic levels, aggregate demand for cash continued to increase. As of October 2022, the value of currency in circulation passed $2.23 trillion, a 28 percent increase compared to February 2020,17 but with slower growth since 2021.18,19 The Diary studies since 2020 show a significant factor for this increased demand is consumer cash holdings, both on-person (cash in one’s pocket, purse, or wallet) and store-of-value holdings (cash held in one’s home, car, or elsewhere). Both measures remained elevated compared to pre-pandemic levels and emphasized that demand for cash increases during times of uncertainty.

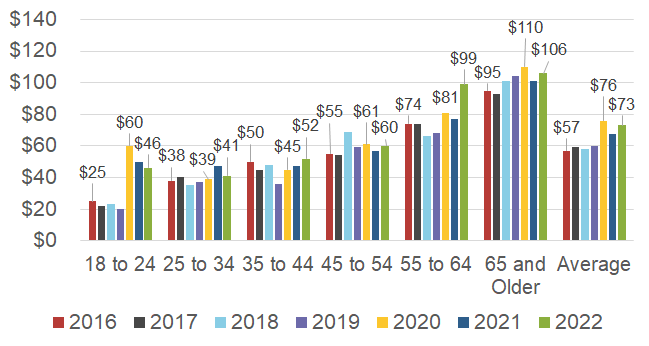

Average on-person holdings remain elevated compared to pre-pandemic

Compared to 2019, people were still holding on to more cash in 2022. On average, each consumer held approximately $73 in cash and used this cash for purchases (Figure 12). This increase in holdings was observed across all age groups, although the extent of the increase varied. The age group with the greatest increase in both the amount and proportion of cash holdings was 18-to-24-year-olds. Despite the increase in cash holdings, those aged 18-to-24 reduced their cash use by 20 percentage points bringing them closer in line with adults aged 25 to 54. Whether these increased cash holdings by 18-to-24-year-olds will result in greater cash use in the future remains uncertain.

Figure 12

Average daily holdings by age

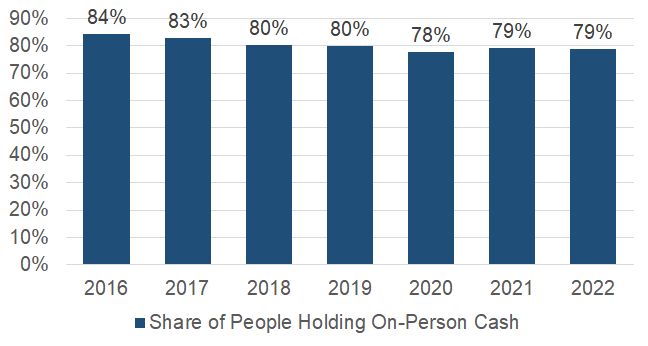

While the value of on-person holdings has fluctuated since 2020, the share of consumers that held cash during the 2022 survey period remained steady at 79 percent (Figure 13).20 Between 2016 and 2018, the share of people holding cash was decreasing annually. However, since 2018 that trend has remained within a two percentage-point range. The significant level of adults who routinely hold cash combined with elevated holdings since the pandemic indicate that cash remains in demand, even if some individuals hold cash only for contingency purposes and as a backup payment option.

Figure 13

Share of adults holding on-person cash at least one day

Store-of-value cash holdings increased and remain elevated

Just as with on-person holdings, consumers also maintained elevated store-of-value cash holdings in 2022. This suggests that consumers continued to hold a significant amount of cash that may be unlikely to be used for daily purchases. This may be due in part to lingering uncertainty surrounding the pandemic or a shift in holdings behavior because of the pandemic (Figure 14).21 Although store-of-value holdings increased year-over-year, the rate of increase between 2021 to 2022 slowed and grew at a similar rate to holdings between 2016 and 2019. This slower growth of holdings took place as the growth of the value of currency in circulation also slowed, returning to pre-pandemic growth rates.

Figure 14

Average store of value holdings

Most consumers expected to continue using cash

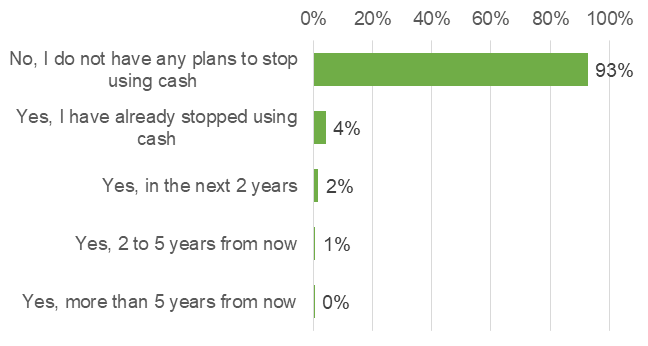

To attain a better understanding of how consumers think about their future cash use, Diary participants in 2022 were asked whether they expected to stop using cash in the future and, if so, when they expected this change to occur (Figure 15). The survey results showed 93 percent of consumers have no plans to stop using cash. Of the remaining participants, four percent have stopped using cash all together, while approximately three percent expect that they will stop using cash within the next five years. In addition, when asked if a completely cashless society would be problematic, only 30 percent of consumers answered ‘no’ while the remainder of consumers believed it would be problematic or were uncertain if it would be problematic.

Figure 15

Do you currently have any plans to stop using cash in future?

These results showed most consumers expect to demand cash in the future. Insight into consumer expectations also helps explain why so many people report carrying cash during the Diary, despite decreased cash use and underscores why cash remains the third most popular payment instrument. The characteristics of cash that make it valuable to consumers include its instant settlement between individuals and retailers without the need for a third party, and its availability and wide acceptance during times of uncertainty. These characteristics are not expected to change in the future, and unless a new payment option replicates these characteristics, some level of cash demand is likely to continue.

Conclusion

The consistency of many data points between 2020 and 2022 shown in this year’s Diary suggest that consumer payment behavior is stabilizing in the latter part of the pandemic. Recent trends also suggest that the shift away from cash and towards credit cards that started at the beginning of the pandemic has become a persistent trend. At the same time, the increased popularity of credit cards has not decreased the demand for cash. Demand remained stable at the current level. Finally, the 2022 Diary underscores the continued attractiveness of cash as a payment instrument as well as a store of value in times of uncertainty and stress.

An especially important takeaway from the 2022 Diary results is that most consumers do not expect to stop using cash in the near future. In addition, approximately one in five consumers reported cash as their preferred payment instrument for in-person purchases, indicating a persistent demand for cash for in-person payments despite online payments remaining elevated compared to pre-pandemic. While some consumers may choose to stop using cash at some point in the future, the underlying cash demand suggested by these results emphasize the importance of continued investment across the various participants of the supply chain to ensure cash access for those consumers who need or prefer to use it.

Appendix

About the Diary of Consumer Payment Choice

The Federal Reserve has conducted the Diary annually since 2016 to better understand consumer payment habits. Respondents to this nationally representative survey of U.S. consumers report all payments they make during an assigned three-day period in October. By tracking consumer payment transactions and preferences annually during the month of October, Federal Reserve Financial Services compares cash with other payment instruments, such as debit and credit cards, checks, and electronic options. Diary participants also report the amount of cash on hand after each survey day, cash stored elsewhere, and cash deposits or withdrawals. The Diary data is then analyzed, including the impact of age and income on an individual’s payment behavior and preferences. This detail of the stock and flow of cash at an individual level provides insight into how consumers use cash.

Developed by the Federal Reserve Bank of Boston’s Consumer Payment Research Center (CPRC) and currently managed by the Research Department at the Federal Reserve Bank of Atlanta, the Diary collects data about shopping and payments behavior from a unique, nationally representative survey of consumers administered by the University of Southern California (USC) Dornsife Center for Economic and Social Research. USC’s Understanding America Study panel of households comprises approximately 9,000 respondents from across the United States, 4,453 of which completed the 2022 Diary.

To ensure a nationally representative sample, responses are weighted to match national population estimates based on the Census Bureau’s Current Population Survey. The Diary is administered throughout the month of October, which was selected to minimize seasonality effects in consumer spending patterns. Participants were each assigned a three-day period within the month, with some individuals assigned a starting date in late September and others assigned to finish in early November. For a more detailed description of the Diary of Consumer Payment Choice, see Angrisani, Foster, and Hitczenko (2017b); Angrisani, Foster, and Hitczenko (2018); Greene, Schuh, and Stavins (2018); Greene and Schuh (2017); Greene, O’Brien, and Schuh (2017); and Schuh (2017).

About Federal Reserve Financial Services

Federal Reserve Financial Services is an integrated organization within the Federal Reserve that is responsible for managing critical payment and securities services that foster the accessibility, integrity and efficiency of the U.S. economy. Through its relationships with about 10,000 financial institutions nationwide, the Federal Reserve provides equitable access to a system that facilitates more than $5 trillion payments each day. Federal Reserve Financial Services, delivered via a secure FedLine® network, include FedCash® Services, FedACH® Services, Check Services, Fedwire® Funds and Securities Services, the National Settlement Service and more. The Federal Reserve also collaborates broadly with payments stakeholders on improvement initiatives (Off-site), to advance the end-to-end speed, security, efficiency of domestic and cross-border payments. This collaboration led to and has informed development of the upcoming FedNow℠ Service, an instant payments infrastructure launching in 2023 that will become part of the FRFS product offering.

About FedCash® Services

As the nation’s central bank, the Federal Reserve ensures that cash is available when and where it is needed, including in times of crisis and business disruption, by providing FedCash Services to depository institutions and, through them, to the general public. In fulfilling this role, the Federal Reserve’s primary responsibility is to maintain public confidence in the integrity and availability of U.S. currency.

FedCash Services provides strategic leadership for this key function by formulating and implementing service level policies, operational guidance, and technology strategies for U.S. currency and coin services provided by Federal Reserve Banks nationally and internationally. In addition to guiding policies and procedures, FedCash Services establishes budget guidance, provides national direction for Federal Reserve currency and coin distribution and inventory management, and supports business continuity planning at the supply chain level. It also conducts market research and works with financial institutions and retailers to analyze trends in cash usage.

The Diary studies provide vital insights into how consumer payments may be changing from one year to the next. Federal Reserve Financial Services uses these insights to understand consumer cash use and anticipate its ongoing role in the payments landscape. This ensures FedCash Services are fulfilling the mission of meeting demand in times of normalcy and stress, maintaining the public’s confidence in U.S. currency, and providing ready access to cash. Understanding the evolving role of cash in the economy is critical to fulfilling that mission.

References

Angrisani, Marco, Kevin Foster, and Marcin Hitczenko. 2017b. “The 2012 Diary of Consumer Payment Choice: Technical Appendix.” Federal Reserve Bank of Boston Research Data Reports No. 17-5.

Angrisani, Marco, Kevin Foster, and Marcin Hitczenko. 2018. “The 2015 and 2016 Diaries of Consumer Payment Choice: Technical Appendix” Federal Reserve Bank of Boston Research Data Reports No. 18-2.

Coyle, Kelsey, Laura Kim, and Shaun O’Brien. 2021. “2021 Findings from the Diary of Consumer Payment Choice.” Cash Product Office, Federal Reserve System, May.

Coyle, Kelsey, Laura Kim. and Shaun O’Brien. 2021. “Consumer Payments and the COVID-19 Pandemic: The Second Supplement to the 2020 Findings from the Diary of Consumer Payment Choice.” Cash Product Office, Federal Reserve System, July.

Cubides, Emily, and Shaun O’Brien. 2022. “2022 Findings from the Diary of Consumer Payment Choice.” FedCash Services, Federal Reserve System, May.

Foster, Kevin and Claire Greene. 2021. “Consumer Behavior in a Health Crisis: What Happened with Cash?” Policy Hub, 1, pp.17-39.

Greene, Claire, and Scott D. Schuh. 2017. “The 2016 Diary of Consumer Payment Choice.” Federal Reserve Bank of Boston Research Data Reports No. 17-7.

Greene, Claire, Shaun O’Brien, and Scott Schuh. 2017. “U.S. Consumer Cash Use, 2012–2015: An Introduction to the Diary of Consumer Payment Choice.” Federal Reserve Bank of Boston Research Data Reports No. 17-6.

Greene, Claire, Scott D. Schuh, and Joanna Stavins. 2018. “The 2012 Diary of Consumer Payment Choice: Summary Results.” Federal Reserve Bank of Boston Research Data Reports No. 18-1.

Judson, R., 2017. “The Death of Cash? Not So Fast: Demand for US Currency at Home and Abroad, 1990-2016.” In International Cash Conference 2017–War on Cash: Is there a Future for Cash? (No. 162910). Deutsche Bundesbank.

Kim, Laura, Raynil Kumar, and Shaun O’Brien. 2020. “2020 Findings from the Diary of Consumer Payment Choice.” Cash Product Office, Federal Reserve System, July.

O’Brien, Shaun. 2021. “Consumer Payments and the COVID-19 Pandemic: Findings from the April 2021 Supplemental Survey.” Cash Product Office, Federal Reserve System, September.

Schuh, Scott. 2017. “Measuring Consumer Expenditures with Payment Diaries.” Federal Reserve Bank of Boston Research Department Working Papers No. 17-2.

Schuh, Scott, Oz Shy, and Joanna Stavins. “Who Gains and Who Loses from Credit Card Payments? Theory and Calibrations.” Federal Reserve Bank of Boston Research Department Public Policy Discussion Papers No. 10-3.

Shy, O. and Stavins, J., 2022. “Who Is Paying All These Fees? An Empirical Analysis of Bank Account and Credit Card Fees.” Federal Reserve Bank of Boston Research Department Working Papers No. 22-18.

The financial services logo and “FedCash” are registered service marks of the Federal Reserve Banks. A list of marks related to financial services products that are offered to financial institutions by the Federal Reserve Banks is available at www.FRBservices.org.

Footnotes

1. Interest rates rose due to inflation at approximately eight percent in October 2022.

2. On-person holdings refer to cash held in one’s pocket or wallet to be used for purchases, while store-of-value holdings refer to cash held in one’s home not for immediate use on purchases.

3. This decrease in the share of cash use was partly due to the increased number of reported payments after a reminder prompt was added to the second and third day of the Diary asking participants if they forgot to report any payments the previous day. This addition to the instrument was based on findings from interviews in 2022 which demonstrated that consumers were forgetting to report some of their payments. To make the Diary instrument more robust and capture these forgotten payments, questions were added to prompt consumers to enter any of their forgotten payments from the previous days. This additional reminder prompt resulted in an increase of approximately four monthly payments between 2021 to 2022.

4. Purchases and P2P payments exclude bill payments such as rent, utilities, and credit card bills.

5. The coronavirus national emergency was first declared in March 2020 and declared as officially ended on May 11, 2023.

6. The category ‘other’ includes payments made with pre-paid, checks, mobile payment apps, money orders.

7. In 2022, the Diary survey instrument was modified to include a forgotten payments screen to allow participants to log possibly forgotten payments from the prior Diary day.

8. The shift to other cash options was driven by pandemic conditions such as social distancing, work from home accommodations, uncertainty in how the virus spread, and shelter-in-place orders.

9. The current floor to cash is conditional on the current state of payment technology and adoption rate. In addition, this floor does not account for another major or extreme event occurring.

10. See Table 14 from the 2020 Survey of Consumer Payment Choice

11. See Shy and Stavins (2021) and Schuh, Shy, and Stavins (2010)

12. Additional payments reported by participants in the reminder section of the Diary were included in the analysis. The most significant changes in the number of total payments reported when payments from the reminder section were included was an increase of 0.4 payments grocery and convenience stores and 0.3 payments at gas stations.

13. Small-value payments are payments under $25.

14. The only exception to cash being the most used payment instrument for small-value payments was 2020, when consumers reported to make equal numbers of debit and cash in-person payments.

15. The only exception was in 2020. Consumers made an equal number of debit and cash small-value payments.

16. Includes individuals who report not have either a checking account or a savings account. Within this year’s Diary study, approximately 5.7 percent of the sample were unbanked, a share slightly higher than the most recent FDIC study of the U.S. unbanked population.

17. The growth in CIC in 2020 exceeded that in pre-pandemic as heightened financial or political uncertainty can prompt investors, businesses, and households to move rapidly toward cash which drives rapid growth in currency.

18. Currency in Circulation (CURRCIR) | FRED | St. Louis Fed (stlouisfed.org)

19. Based on estimates by Judson (2017), approximately half of the value of currency in circulation is held overseas. The increase in cash demand starting in March 2020 was due to increased payments to financial institutions in the domestic market based on Federal Reserve payment and receipt data.

20. Participants were carrying cash at least one day if they reported holding cash in their pocket, purse, or wallet if a non-zero amount of cash was reported at the beginning or end of any assigned diary-day.

21. 2021 store of value holdings were revised up to $408 from $347. This was due to a change in methodology in which the top 0.1 percent of store of value holdings are no longer truncated. The change in FedCash services methodology was due to a decreased in the number of outlier observations that significantly shifted the average value of holdings.