Reuven Glick, group vice president at the Federal Reserve Bank of San Francisco, provides his views on current economic developments and the outlook.

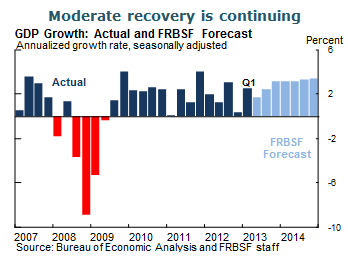

- We expect the economic recovery to continue at a moderate pace this year and next, despite ongoing federal deficit reductions. We project growth of 2½% in 2013 and 3¼% in 2014.

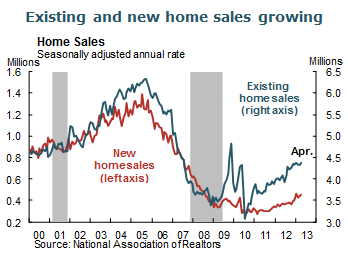

- The housing sector continues to improve. Sales of new and existing homes rose, and private construction increased in April, offsetting continued weakness in public-sector building. House prices surged in April and are up by more than 12% over the past 12 months according to the CoreLogic index.

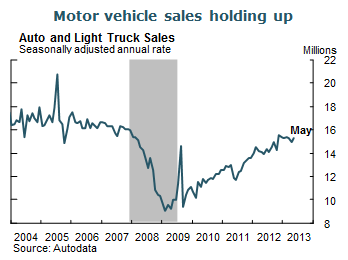

- Vehicle sales are holding their own. In April, weaker car sales raised concerns about the durability of the sales recovery. But May’s rebound to a 15.3 million annual sales rate allayed those concerns.

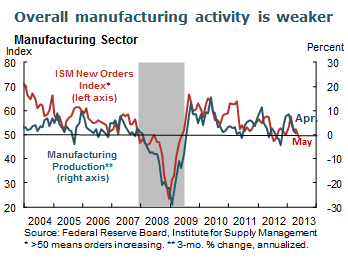

- Overall manufacturing activity has displayed some weakness. Manufacturing output declined in April for the second month in a row, and the Institute for Supply Management (ISM) manufacturing orders index for May contracted for the first time since November 2012. However, the ISM nonmanufacturing index rose in May, suggesting that the services sector is resisting any slowing in the economy.

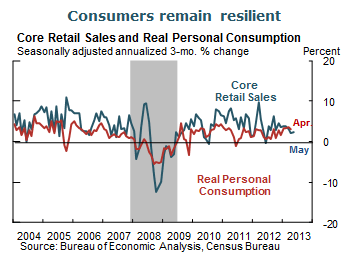

- Consumer spending has been very resilient despite the drag of higher taxes that began in January and the federal sequester imposed in March. The three-month average for core retail sales—which excludes spending on gas, cars, and building materials—fell in April but rose in May. Moreover, real consumption expenditures—which include spending on all goods and services adjusted for inflation—rose in April. Consumer spending was partly dampened by lower utility costs in April compared with March, when weather was unseasonably cold in some parts of the country.

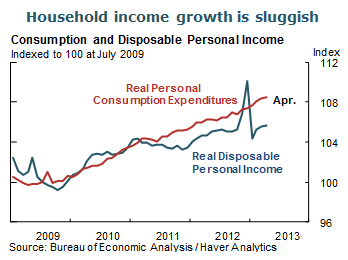

- The strength of consumer spending has been somewhat surprising given the very sluggish growth in personal disposable income since the recovery began. Personal income spiked briefly at the end of 2012 as businesses accelerated payouts of bonuses and dividends to avoid anticipated tax increases. Since then, though, income growth has returned to its earlier subpar pace. In the four years since the recovery began, income has grown by less than 2% per year.

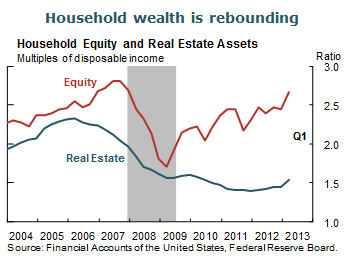

- Consumer spending has been driven largely by rising household wealth. Since the depths of the recession, the value of equity assets owned by households has risen strongly, consistent with the rising stock market. More recently, housing asset values started to climb along with increasing home prices.

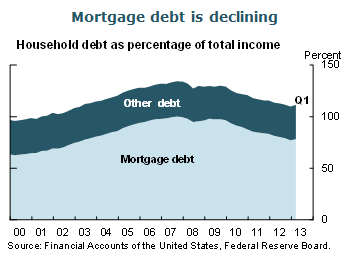

- Households also have improved their balance sheets by reducing their debt. Household debt built up steeply starting in 1999, primarily through mortgages. Since the housing bubble burst, consumer debt has declined significantly. With less cash devoted to debt repayment, households have freed up funds for other uses, including consumption.

- Wealth effect calculations imply that the $3 trillion increase in wealth in the first quarter of 2013 boosted spending by about $90 billion. These calculations assume that a $1 increase in household wealth raises spending by around three cents.

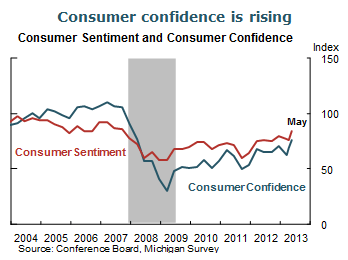

- Consumer sentiment continues to improve. Both the Conference Board and the Thomson Reuters/University of Michigan surveys of consumer confidence reached post-recovery highs in May, providing further evidence that households are more optimistic about economic conditions.

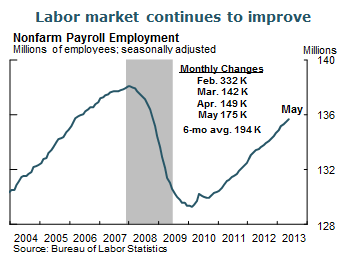

- Job status is a key factor in consumer spending power. Employers added 175,000 new jobs in May, primarily in the services sector. Over the past six months, employers have added an average of 194,000 jobs per month. The federal government, on the other hand, lost 14,000 jobs in May, with most of the losses likely a direct result of the sequester.

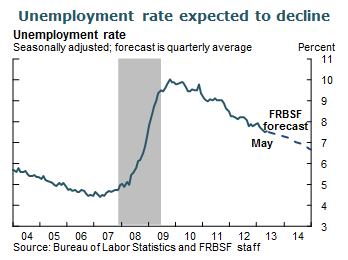

- The unemployment rate edged up one-tenth to 7.6%, as more people entered the labor force. The unemployment rate has declined fairly steadily over the past three years. Even with the May increase, the rate is one-half point lower than in August 2012, just before the Federal Reserve began its latest round of large-scale asset purchases. We continue to expect that output growth will not push the unemployment rate below the Federal Open Market Committee’s 6½% threshold for raising the federal funds rate until sometime in the middle of 2015.

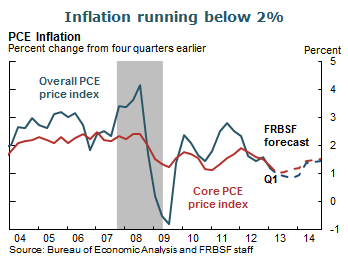

- Recent inflation numbers generally have come in on the low side, and the April personal consumption expenditures price index was no exception. Core inflation, excluding food and energy prices, was up 1.1% in April over the past 12 months, while headline prices were up 0.7%. We continue to project that inflation will rise gradually towards the Fed’s 2% target.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.