Daniel Wilson, research advisor at the Federal Reserve Bank of San Francisco, states his views on the current economy and the outlook.

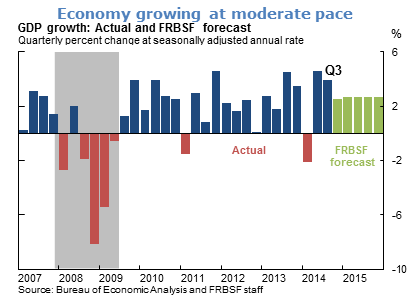

- Real GDP growth was quite strong over the past two quarters, averaging around 4%. Some of that growth was driven by factors that are likely to be temporary, such as boosts in inventory investment and federal defense spending. As these temporary factors dissipate, we expect growth to ease somewhat in the fourth quarter. Taking into account recent strength in retail sales and other consumer spending data, we expect GDP growth in the fourth quarter to be about 2.5%.

- We appear on track to continue growing at a moderate pace—between 2½ and 3%—over the next two years. Tailwinds underlying this growth include rising incomes, strong household balance sheets, low interest rates, and falling gasoline prices. Headwinds include the recent strengthening of the dollar and weak foreign economic growth.

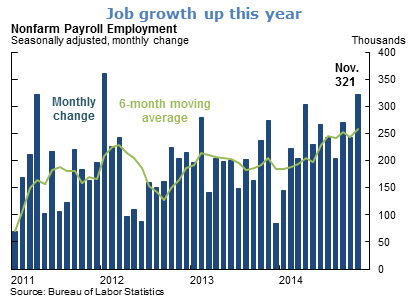

- We’ve seen solid growth in total employment this year. November had a net gain of 321,000 jobs, and the employment data for September and October were revised upward. The six-month moving average of employment gains is now over 250,000.

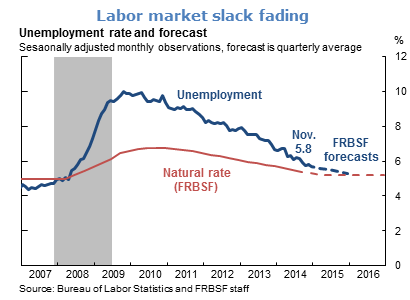

- The unemployment rate held steady in November at 5.8%. However, with modestly above-trend GDP growth, we expect it to continue its gradual decline toward our estimate of the natural rate of unemployment, that is, the rate consistent with the labor market being back to normal. This gap between the actual unemployment rate and the natural rate is one measure of labor market slack. We expect this unemployment gap to fade over the next year.

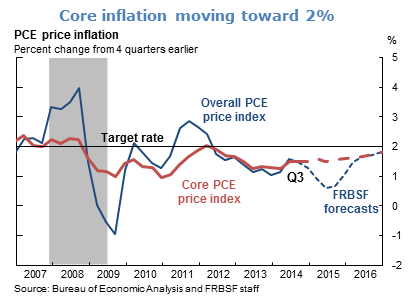

- As the labor market continues to improve and wage and salary pressures rise, we expect core inflation excluding volatile food and energy prices to continue rising toward 2%. Headline inflation, on the other hand, has moderated in recent months, a trend we expect to continue through the middle of next year. This downward movement is driven mainly by the ongoing declines in oil prices. However, we expect oil prices to stabilize by mid-2015, after which we expect headline inflation to start rising toward the Federal Open Market Committee’s 2% target.

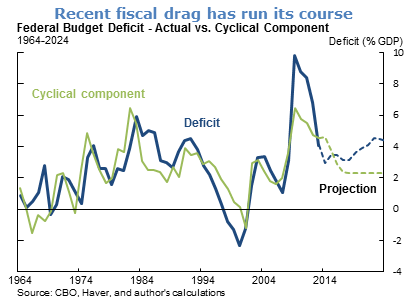

- An important headwind to U.S. economic growth during the recovery has been contractionary fiscal policy by federal, state, and local governments. The federal aspect of this tightening is captured by the federal budget deficit, measured as total federal government spending less total federal tax revenues. That deficit as a share of GDP fell from nearly 10% in fiscal year 2009 to a projected 2.5% in fiscal year 2014. A falling deficit generally is a headwind for economic growth because either government spending is falling as a share of the economy, tax revenue is rising, or both.

- This decline in the deficit was the result of both cyclical and structural factors. Our measure of the cyclical component of the deficit, which is a statistical estimate capturing how the deficit tends to move together with the business cycle—can only account for about 2 percentage points of the 7.5% decline in the deficit from 2009 to 2014. The remainder of the decline was due to various factors, including the gradual fade-out of the spending increases and temporary tax cuts enacted by the American Recovery and Reinvestment Act of 2009, the budget cuts made in the Budget Control Act of 2011, and an atypically strong recovery in tax revenues over the past three years.

- Looking forward, the decline in the deficit, and any corresponding drag on the economy, appears to have largely run its course. The federal budget deficit is projected to increase slightly over the next 10 years, assuming the continuation of current budget policies. This projection of an increase is driven by structural factors related to the aging of the population, especially the powerful underlying trends of rising federal health care and Social Security spending.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.