Mary C. Daly, senior vice president and associate director of research at the Federal Reserve Bank of San Francisco, states her views on the current economy and the outlook.

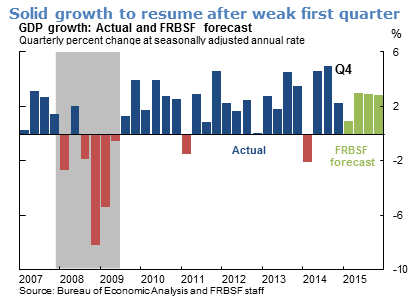

- Real GDP grew at a solid 2.4% pace in the four quarters of 2014, supported by low interest rates and strong consumer spending. In contrast, data for the first quarter of this year have generally come in weaker than expected. However, much of the weakness can be traced back to severe winter weather in the Midwest and East Coast that snarled transportation networks, idled construction sites, and kept shoppers at home.

- With winter behind us, we expect above-trend growth to resume in the second quarter and continue for the rest of 2015. Accommodative monetary policy along with ongoing improvements in credit market conditions, asset values, and household incomes related to the strong labor market all are expected to help sustain this solid growth.

- We project the pace of growth to gradually slow over time and settle near our long-run trend estimate of about 2% toward the end of 2016. This path is consistent with expected increases in interest rates, the fading boost of lower gasoline prices to household spending, and the increasing drag of the dollar appreciation on U.S. exports and on sectors exposed to import competition.

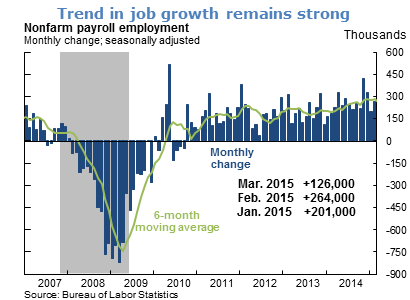

- The addition of only 126,000 jobs to the labor market in March was a disappointment. However, averaged over the past six months, trend job growth remains quite strong. And importantly, the March numbers, including downward revisions for payroll job growth in January and February, bring the labor market readings into better alignment with the pace of GDP growth.

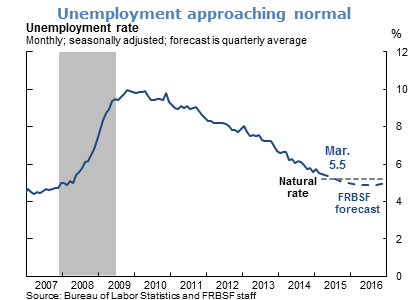

- As solid growth in GDP resumes in coming quarters, we expect monthly job gains to pick back up and the unemployment rate to continue its gradual decline. We project the unemployment rate will dip below our estimate of the natural rate around the middle of this year and remain there for the duration of our forecast horizon.

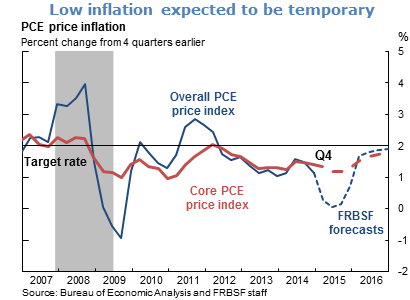

- Inflation remains low and well below the Federal Open Market Committee’s 2% target. We expect inflation to fall further in coming months as the effects of lower energy prices and the stronger dollar show through to final goods prices. As these temporary factors abate, we expect inflation to gradually rise, moving back towards the target.

- The expectation that inflation will gradually return to 2% is based on several factors, including higher inflation readings from alternative series such as the trimmed-mean compared with the overall or core personal consumption expenditures series. The stability of long-run inflation expectations among businesses and households and the historical link between diminishing labor market slack and inflation reinforce this projection.

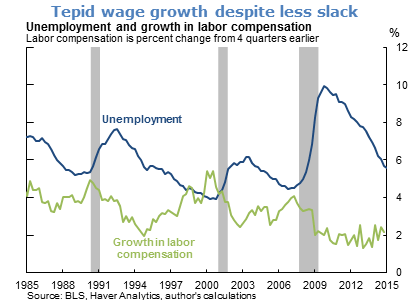

- A lagging factor in the recovery has been growth in labor compensation, which remains tepid despite the considerable drop in unemployment. The question is: Is this typical or troubling? In other words, is it normal for wage growth to lag the decline in unemployment, or does this lag indicate that some fundamental relationship in the labor market has been broken?

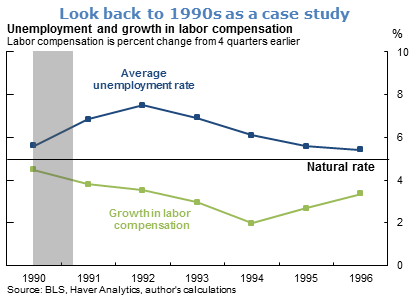

- One way to answer this question is to look at what happened in the 1990 recession and recovery. When the recession hit, the unemployment rate rose and growth in labor compensation slowed, although less than one might expect or than simple models predicted. As the recovery ensued and unemployment came down, wage growth continued to slow. Only when unemployment neared its normal level or natural rate did growth in compensation begin to pick up.

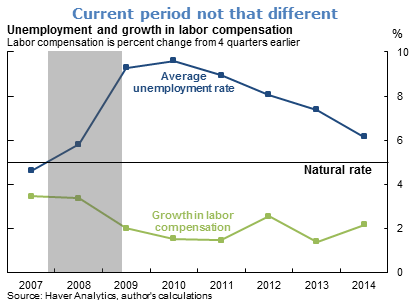

- The current period does not look that different from the 1990s. In 2008 and 2009, the unemployment rate shot up and wage growth slowed slightly. As unemployment declined, labor compensation growth slowed further and then began to oscillate around a tepid 2%.

- Looking ahead, with unemployment approaching our estimate of its natural rate, we expect compensation growth to accelerate this year and next. We already see signs of this in the data. The March labor market report showed a surprising pickup in average hourly earnings of total private employees.

- A number of major corporations have announced they will increase their minimum wages and make comparable pay increases for other hourly workers. These are expected to kick in sometime this year, providing an additional boost to wage growth.

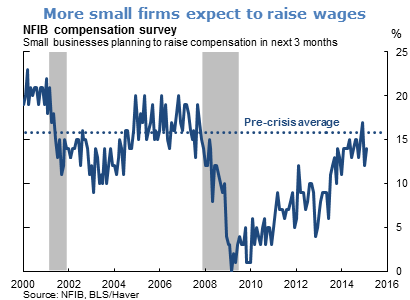

- Small businesses also plan to increase wages in coming months. Surveys from the National Federation of Independent Business show the share of small businesses planning to raise compensation in the next three months has risen and is quite close to its pre-crisis average.

- An especially clear signal that compensation growth is picking up comes from the improving job market for new college graduates, following years of poor prospects. According to the National Association of Colleges and Employers 2015 Job Outlook Survey, about two-thirds of employers plan to raise starting salaries, and over half plan to offer signing bonuses.

- Combined, these data point to a pickup in compensation growth over the next year and suggest that the typical cyclical relationship between unemployment and wage growth remains alive and well.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.