Daniel Wilson, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of December 2, 2021.

- After a slowdown in output growth that coincided with the summer surge of the Delta variant of COVID-19, the U.S. economic recovery appears to have picked up steam this fall.

- In particular, real GDP growth slowed from above 6% at an annual rate in the first half of 2021 to about 2% in the third quarter, likely due to a combination of the Delta-driven surge, supply bottlenecks, and waning fiscal transfers. However, GDP growth is expected to rebound strongly in the fourth quarter as at least one of those factors—the Delta surge—has faded. Over time, we expect a gradual deceleration of growth toward our estimate of long-run growth of 1.7%.

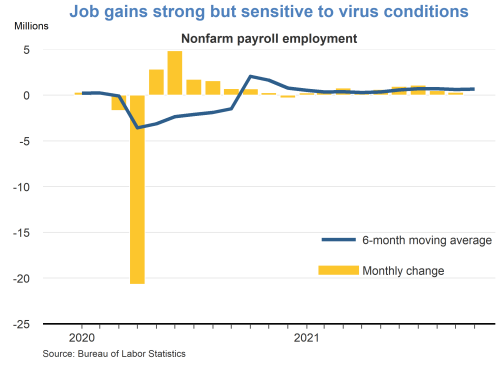

- Employment growth has followed a similar trajectory this year and, like GDP growth, it continues to be highly dependent on virus conditions. In particular, net gains in payroll employment were rather lackluster in August and September, at the height of the Delta surge, but were much stronger in October. Nonetheless, the level of employment is about 4.2 million jobs below its pre-pandemic level, suggesting that the economy still has far to go to reach maximum employment.

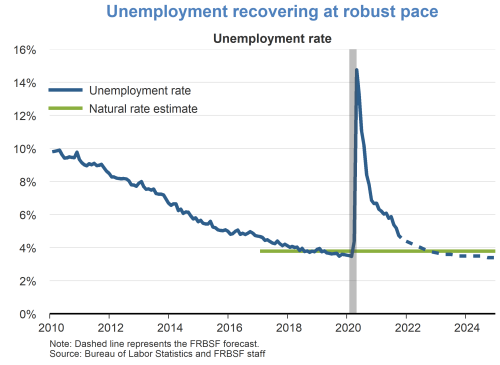

- Correspondingly, the unemployment rate has fallen rapidly. We expect unemployment to continue to fall but decline more slowly as it gets closer to the estimated natural rate of around 3.8%. We also expect an increase going forward in the labor force participation rate, which is a positive sign of labor market recovery, but this will somewhat dampen how fast the unemployment rate declines.

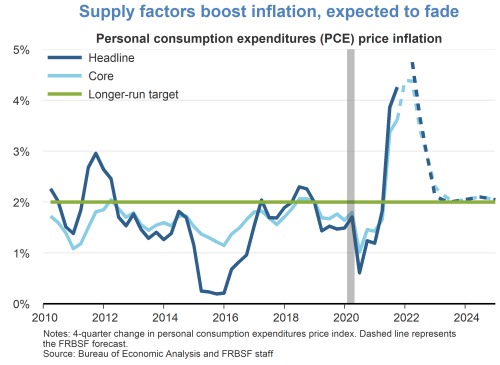

- Substantial supply chain issues, combined with the unusually high demand for goods relative to services, have pushed up inflation in recent months. We expect these pressures to ease by the second half of 2022 as supply chain issues get resolved and demand for goods softens as consumers shift some spending to in-person services. Of course, both the easing of supply bottlenecks and the shifting of spending back to in-person services are highly dependent on improvements in global virus conditions, which continue to be uncertain. We also expect some softening in goods demand by some households as they exhaust higher levels of savings accumulated partly due to income support through federal fiscal transfers, which have waned.

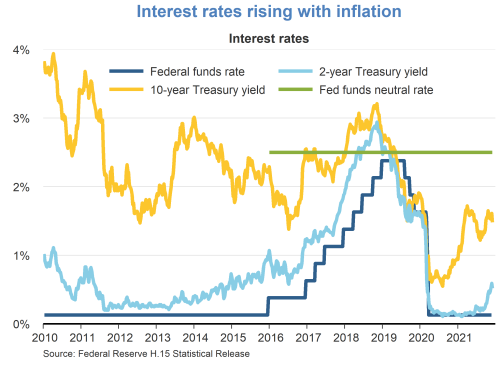

- Recent increases in inflation and associated expectations by market participants of future monetary policy tightening have contributed to rising nominal interest rates.

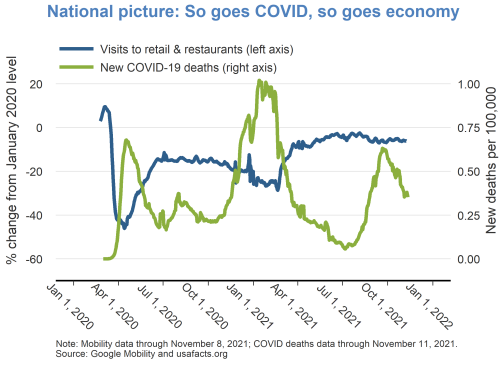

- Economic activity in the United States has been highly dependent on COVID-19 conditions throughout the pandemic. Indeed, since early in the pandemic, the FOMC statement has noted that “the path of the economy continues to depend on the course of the virus.”

- However, it is difficult to infer the virus’s effect on economic activity by looking at national data alone because there are many other non-COVID factors, including fiscal policy and global factors, that also affect the national economy at the same time.

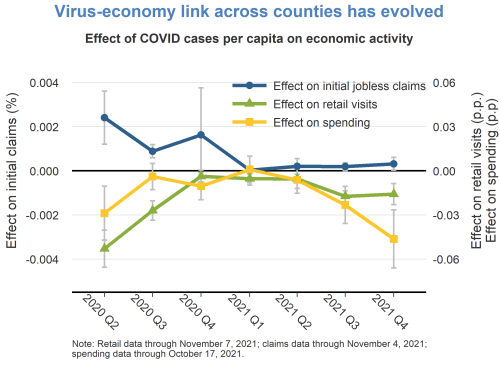

- Hence, here we take a deeper dive by analyzing the link between COVID conditions and economic activity using county-level data. Specifically, we estimate the effect of local virus conditions—namely recent COVID-19 cases per capita—on measures of local economic activity (see research). We look at three measures of economic activity available at the county level, namely initial jobless claims, retail and restaurant visits (from Google Mobility Reports), and credit card spending.

- The data reveals that the effect of local virus conditions on local economic activity has changed over time in important ways. Local economies and local virus conditions were strongly linked early in the pandemic. For instance, in the second quarter of 2020, initial jobless claims were significantly higher, while credit card spending and retail and restaurant visits were significantly lower in counties with high recent COVID-19 cases per capita. These linkages declined to some extent in the winter of 2020-2021, but they have strengthened more recently.

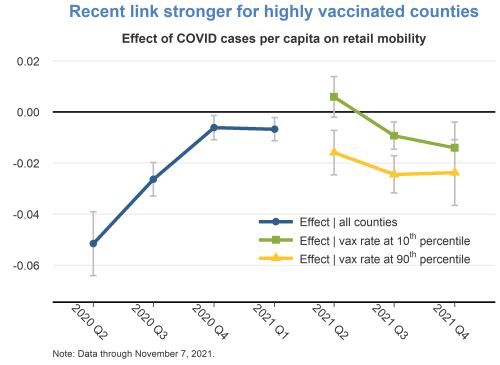

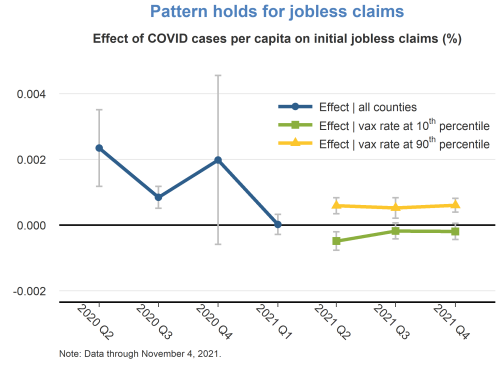

- This analysis permits examination about whether the recent linkages differed between less vaccinated and highly vaccinated counties. We find that the sensitivity of local economic activity to local virus conditions is actually strongest in highly vaccinated counties. The relatively higher sensitivity in highly vaccinated counties may reflect that households in highly vaccinated counties tend to be particularly averse to virus risks.

- Going forward, it will be important to monitor these linkages. For instance, the strong link between virus conditions and economic activity in recent months suggests that the economy is likely to remain highly dependent on COVID-19 conditions for some time to come.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.