Andrew Foerster, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 13, 2023.

- The economy remains resilient in the face of substantial monetary policy tightening and related changes in broad financial conditions.

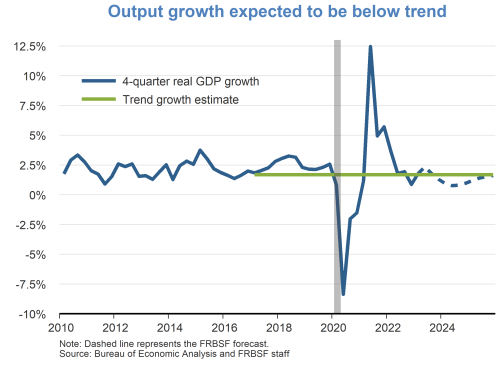

- The economy grew at a 2.0% annual rate in the first quarter of 2023, slightly above our estimate of trend. Given tighter financial conditions, however, we expect growth to be modest for 2023 and 2024 overall before returning close to potential in 2025.

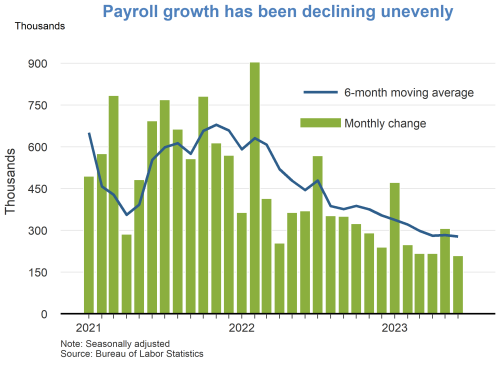

- The labor market has cooled somewhat but remains tight. Payroll employment grew by 209,000 jobs in June. Job growth has generally been trending down since late 2021 but substantially exceeds the pace needed to keep up with normal labor force growth. The unemployment rate in June ticked lower to 3.6%.

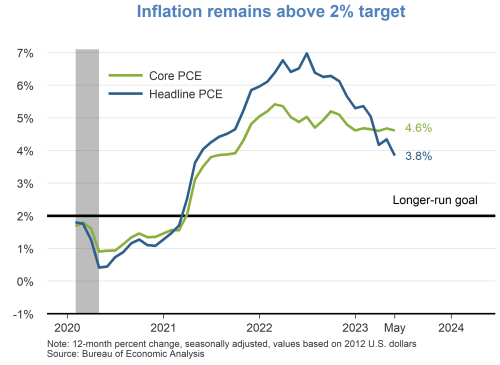

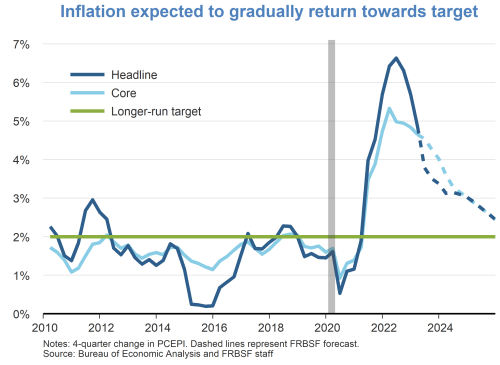

- Inflation has fallen but remains well above the Federal Open Market Committee’s (FOMC’s) 2% longer-run goal. On a 12-month basis, headline personal consumption expenditures (PCE) inflation decelerated from around 7% in June 2022 to 3.8% in May 2023. The May rate was the lowest since the first half of 2021. The 12-month rate for core PCE inflation, which removes volatile food and energy prices, has declined less substantially; it was at 4.6% in May and has changed little this year. Recently released data show a sharp drop in the Consumer Price Index (CPI) measure of inflation in June, raising the possibility of further declines in headline and core PCE in coming months.

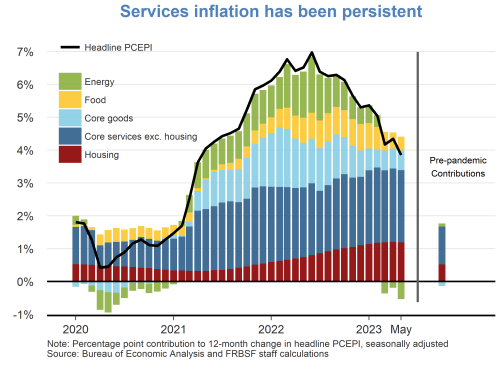

- The decline in 12-month headline PCE inflation over the past year can be attributed to both lower energy prices and a shrinking contribution from goods inflation. The contribution from housing inflation remains high. But since slowing house price growth and moderating market rents affect inflation data with a lag, the contribution from housing inflation is expected to diminish in coming quarters. Inflation in core services excluding housing has been a persistent driver of elevated inflation. The contribution from this segment may take more time to decelerate as the economy cools further.

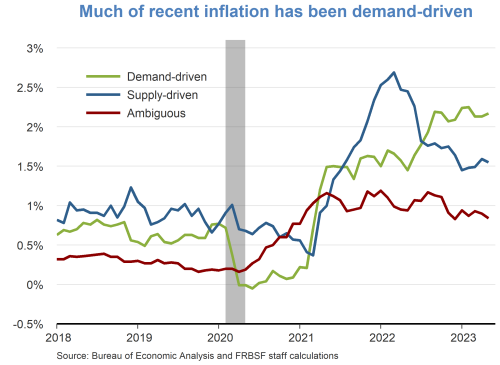

- A substantial portion of core PCE inflation has been driven by demand rather than supply. In the immediate rebound from the pandemic recession, supply chains were impaired, pushing up supply-driven inflation, in which prices increased but quantities declined. As supply chains have recovered, supply-driven inflation has receded but remains well above pre-pandemic levels. In contrast, demand-driven inflation has continued to grow in recent quarters, despite tighter monetary policy. A robust labor market and elevated levels of household savings from prior fiscal stimulus has supported strong demand and pushed prices higher. Demand-driven inflation continues to far exceed pre-pandemic levels.

- Inflation is expected to slowly decline towards the FOMC’s 2% longer-run goal. Cooling demand and the recovery of supply chains will help bring inflation down over time.

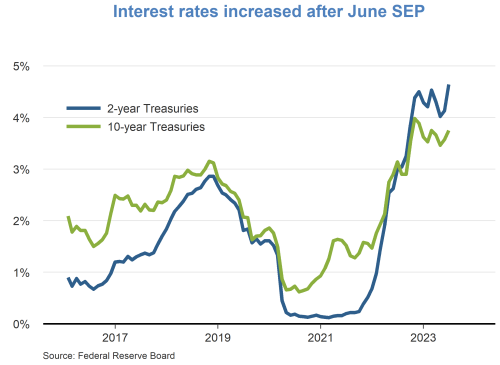

- Following the conclusion of its latest meeting on June 14, 2023, the FOMC announced its decision to leave the target range for the federal funds rate unchanged at 5 to 5¼%. The median projection in the June Summary of Economic Projections (SEP) was for the federal funds rate to be 5.6% at the end of 2023, 0.5 percentage point higher than was projected in the March 2023 SEP.

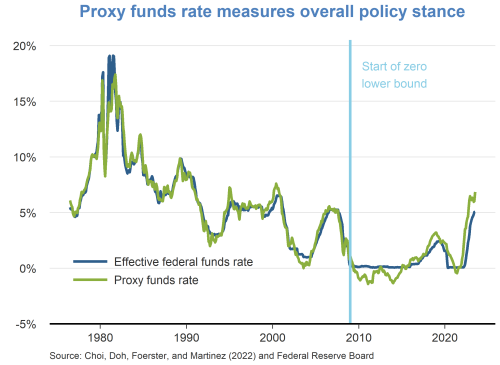

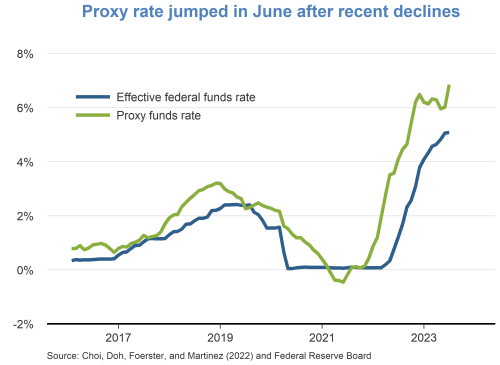

- The proxy federal funds rate gauges the overall stance of U.S. monetary policy, including Fed balance sheet actions and forward guidance. This indicator uses a set of 12 financial variables, including Treasury rates, mortgage rates, and corporate borrowing rates. It maps these financial variables into an effective level for the federal funds rate that can be compared with the actual funds rate. Current financial market conditions map to a proxy federal funds rate of about 6.9%, well above the actual funds rate. Indeed, the proxy federal funds rate has exceeded the actual federal funds rate since late 2021.

- Between late 2022 and May 2023, the proxy federal funds rate declined slightly on net, indicating a slight easing in the overall stance of monetary policy. This pattern is a natural by-product of the market’s anticipation that the end of the tightening cycle is approaching. As the expected end of the tightening cycle draws near, the proxy rate has less scope to increase further due to forward guidance, leading to a leveling-off effect. Moreover, the market’s anticipation of future cuts in the actual federal funds rate may lead to some easing of overall financial market tightness.

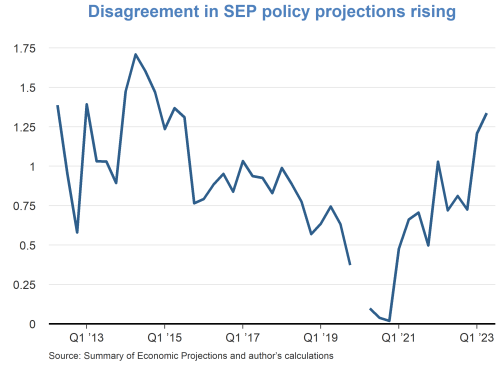

- The proxy rate’s late-cycle behavior can also be influenced by the disparity of views among policymakers about how future monetary policy will unfold. An index measuring disagreement among SEP participants about the projected path of the federal funds rate shows an increasing trend since early 2021. This pattern is not surprising as the funds rate approaches its terminal level, and it suggests that markets have less precise forward guidance about the future path of monetary policy.

- The proxy federal funds rate showed a marked increase in June 2023, despite the pause in funds rate increases announced following that month’s FOMC meeting. The FOMC’s expectation of further funds rate increases in 2023 and its indication that policy will remain restrictive in 2024 contributed to increased interest rates for Treasury bonds and a higher proxy rate.

Charts produced by Zinnia Martinez.

About the Author

Andrew Foerster is a senior research advisor in the Economic Research Department at the Federal Reserve Bank of San Francisco. Learn more about Andrew Foerster

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.