Sylvain Leduc, executive vice president and director of research at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of September 7, 2023.

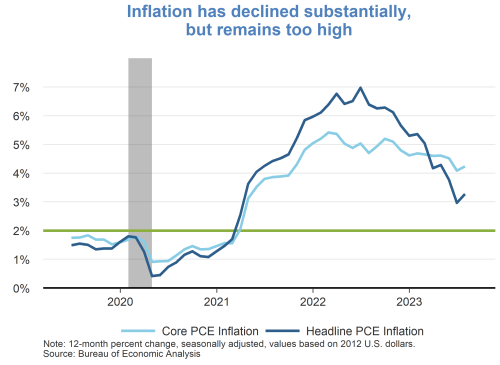

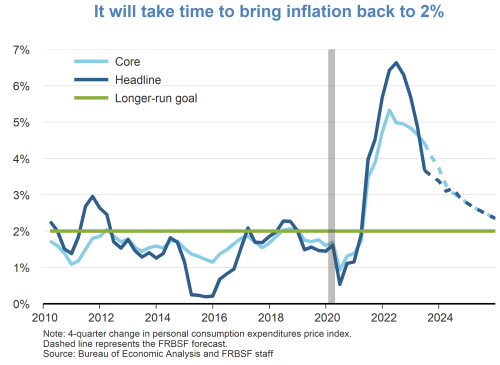

- Over the past year, substantial progress has been made in bringing inflation down. The 12-month headline personal consumption expenditures (PCE) inflation rate in July was 3.3%, down from a peak of 7% in June 2022. Core PCE inflation, which removes volatile food and energy components, also declined during this period, albeit more modestly. The 12-month core PCE inflation in July remained particularly elevated at 4.2%.

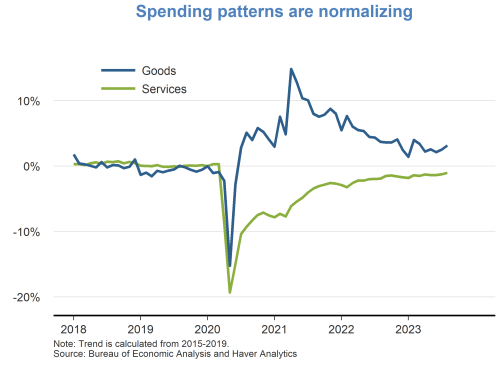

- Consumer spending patterns in the aftermath of the pandemic continue to normalize. Real spending on goods, which surged as COVID-19 spread, has moderated substantially and is now roughly back to its pre-pandemic trend. Real spending on services has continued to recover following a steep drop during the early stages of the pandemic.

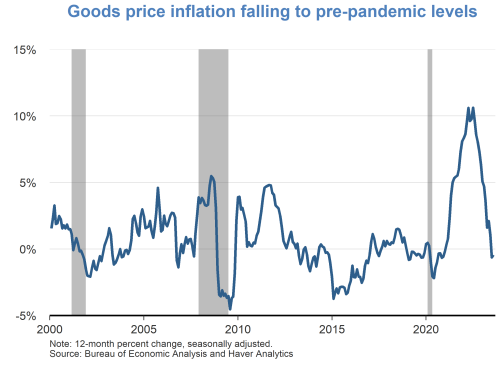

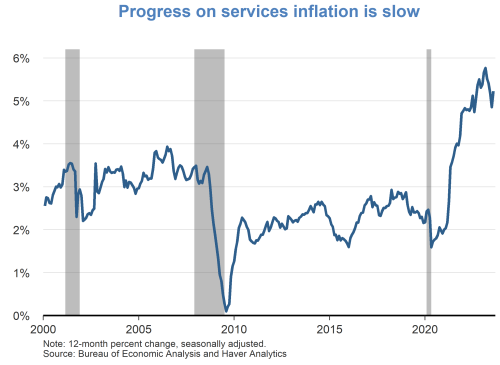

- The decline in goods consumption together with improvements in global supply chains have contributed to a pronounced decline in goods price inflation since the middle of 2022. In contrast, the progress in lowering services inflation has remained subdued, with little change in the rate over the past two years.

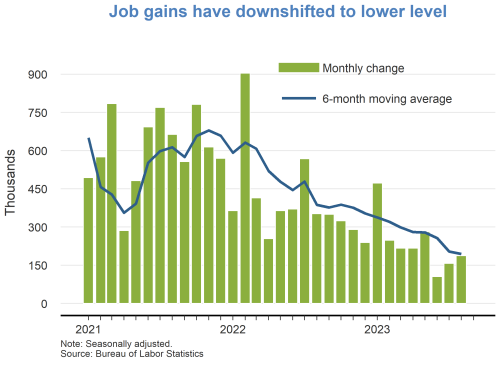

- High services inflation partly reflects resilient consumer spending, supported by strong labor markets overall. The 6-month moving average of monthly job gains continued to moderate last month, and the job gains for June and July were revised down. However, businesses still added 187,000 new jobs in August, roughly twice as much as needed to keep up with labor force growth. Still, the unemployment rate increased a bit to 3.8%, while the rates of job openings and quits continued to moderate.

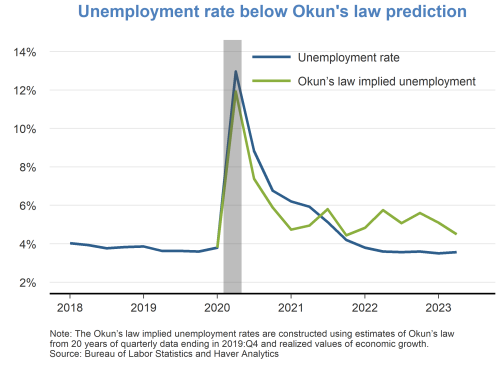

- Over the past year, the unemployment rate has remained lower than we had expected. One tool to gauge movements in the unemployment rate is Okun’s law, a relationship which links movements in the unemployment rate to changes in economic activity. Estimates of this relationship over the past 20 years using the average of the 4-quarter growth rates of real GDP and real GDI as the measure of economic activity indicate that unemployment over the past year has been notably lower than the rate predicted by Okun’s law.

- One possible reason for the unexpectedly low unemployment rate is the idea that because of hiring challenges faced in the past, firms were reluctant to lay off workers, a practice referred to as “labor hoarding.” Indeed, during the early stages of the recovery from the pandemic recession, the unemployment rate was higher than predicted by Okun’s law, suggesting that firms faced difficulties in hiring workers that were needed during that period.

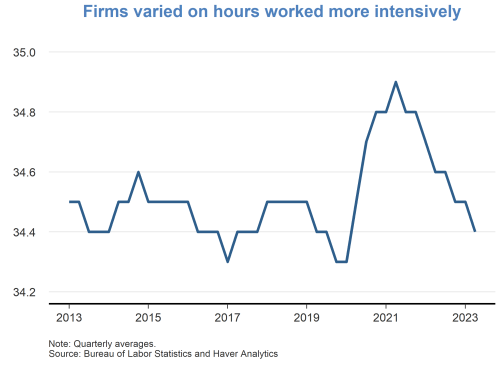

- To cope with these hiring difficulties in the early stages of the recovery, firms initially increased the hours of currently employed workers. And over the past year, firms have now reduced workers’ hours rather than lay off staff.

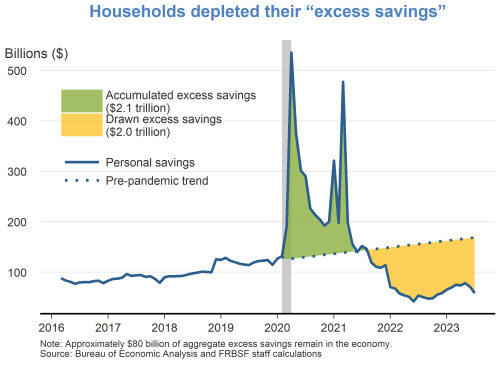

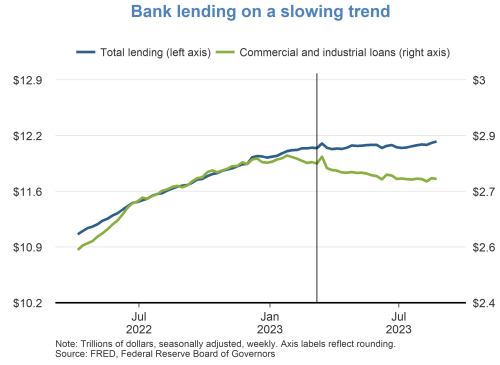

- Still, we expect the unemployment rate to rise gradually to 4.2% by the end of 2024 as consumer spending slows in response to tighter monetary policy, the excess savings accumulated during the pandemic depletes, and firms’ access to credit diminishes. Total bank lending has slowed since the start of the year, while banks have made fewer commercial and industrial loans. We expect this trend to continue as banks remain attentive to risk since the banking turmoil in March.

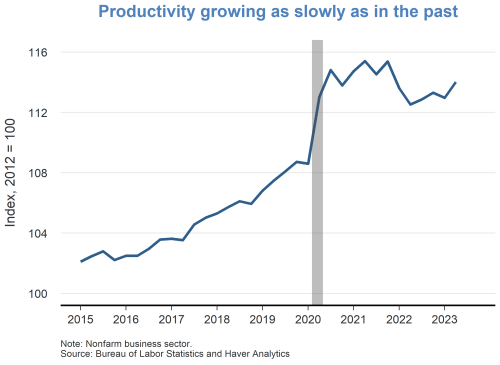

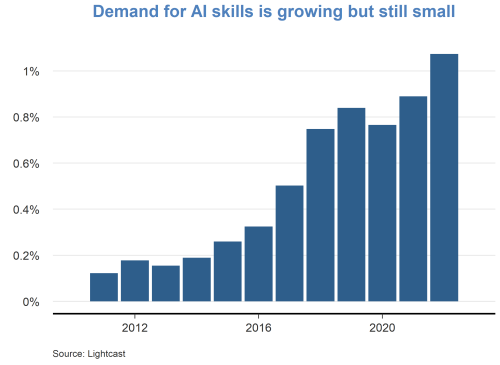

- Wage growth should moderate over the next two years as inflation recedes and labor productivity grows slowly as it did before the pandemic. It is possible that recent rapid advances in artificial intelligence (AI) could boost productivity growth and support higher nominal wage growth. But so far, the share of job openings requiring AI or machine learning skills remains extremely small.

- All told, we expect the road back to 2% inflation to take time. We see headline PCE inflation declining to 2.8% in 2024 and then moving down further to 2.3% in 2025, slightly above the Fed’s goal. We anticipate similar movements in core PCE inflation. One important risk is that services inflation could prove stickier than expected and delay the return to price stability, absent further policy tightening. However, this risk must be balanced against the possibility that previous interest rate hikes are still working their way through the economy and that banking lending may slow more than anticipated in coming months.

Charts produced by Schuyler J. Louie.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.