Zheng Liu, vice president and director of the Center for Pacific Basin Studies at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of October 19, 2023.

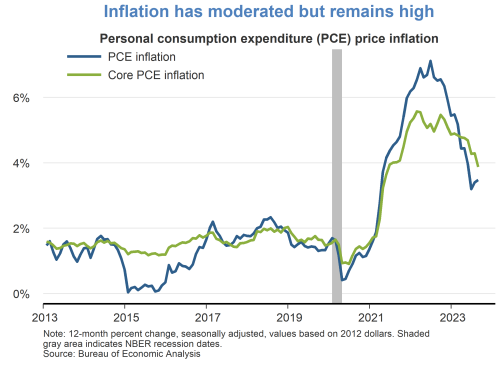

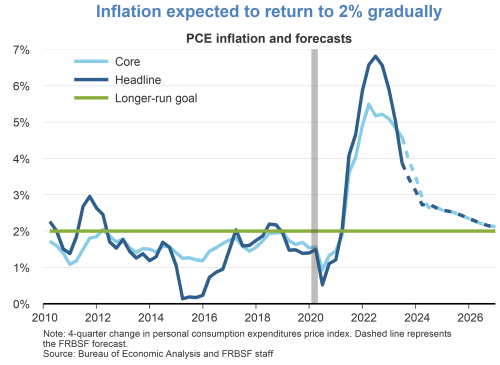

- Inflation has moderated substantially over the past year. The 12-month headline personal consumption expenditures (PCE) inflation rate was 3.5% in August 2023, down from a peak of 7.1% in June 2022. The 12-month core PCE inflation rate, which excludes volatile food and energy components, also declined during this period, but at a slower pace. The September 2023 readings for 12-month headline and core consumer price index (CPI) inflation display a similar pattern. Despite this progress, inflation remains well above the Federal Reserve’s 2% longer-run goal.

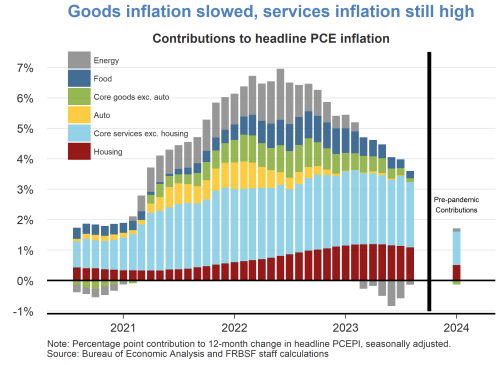

- The goods component of PCE inflation has slowed significantly, reflecting the easing of global supply chain bottlenecks over the past year. However, services inflation remains stubbornly high, with the 12-month change in the core PCE price index for services coming in at about 4.9% in August 2023. The 12-month change in the price index for core services excluding housing, often called supercore inflation, has remained above 4.4% over the past year.

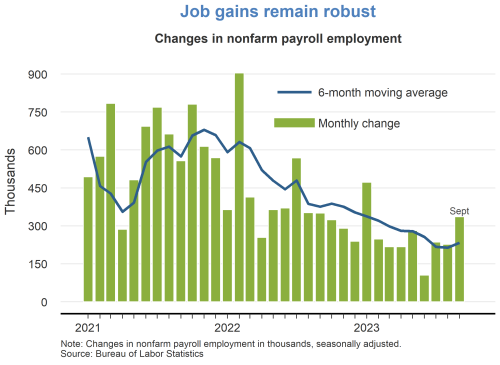

- Persistently high services inflation reflects the robust pace of consumer spending, supported by a strong labor market. Businesses added a whopping 336,000 jobs in September, increasing sharply from an upwardly revised gain of 227,000 jobs in August. Before the September jobs report, the 6-month moving average of monthly job gains had been declining steadily. These monthly job gains have greatly exceeded the amount needed to keep pace with the growth of the labor force. The September unemployment rate remained low at 3.8%, while the labor force participation rate held steady at 62.8%.

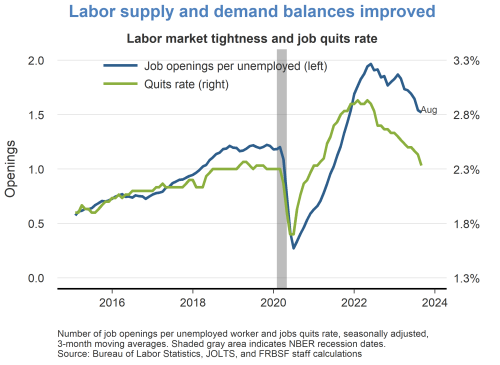

- The labor market remains tight, but the imbalance between supply and demand has moderated over the past year. One indicator of labor demand, the number of job openings per unemployed worker, fell to about 1.5 in July 2023, down from a peak of about 2 openings per unemployed worker in March 2022. Over the same period, the number of employee resignations as a share of total employment, that is, the job quits rate, has declined steadily toward the pre-pandemic level.

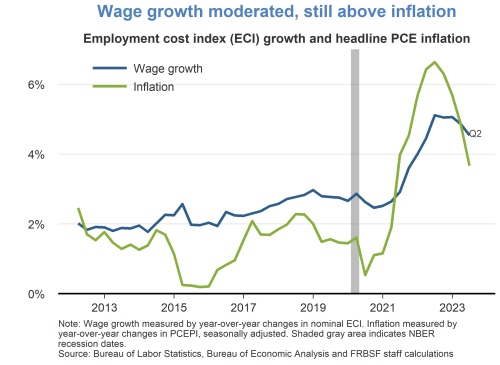

- Wage growth remains high relative to inflation. The 4-quarter change in the employment cost index, which is a broad measure of labor costs that includes nominal wages, salaries, and employer-provided benefits, has slowed modestly to 4.5% in the second quarter of this year, down from a peak of 5.1% in the second quarter of 2022. But the latest reading is still higher than the most recent 4-quarter PCE inflation rate of 3.9%.

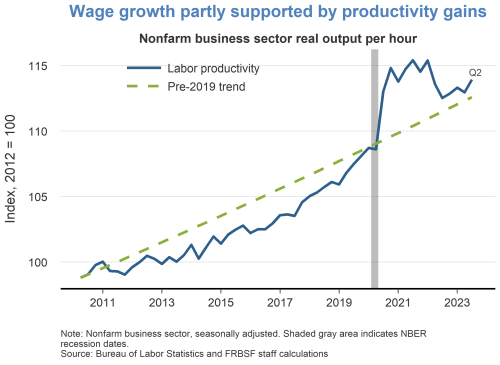

- Solid wage growth is partly supported by labor productivity gains following the onset of the pandemic. The growth rate of real output per hour of all workers in the nonfarm business sector accelerated in 2020 and 2021, reflecting a rapid increase in capital investment, particularly of equipment needed to facilitate remote work. More recently, productivity growth has slowed towards its pre-pandemic trend.

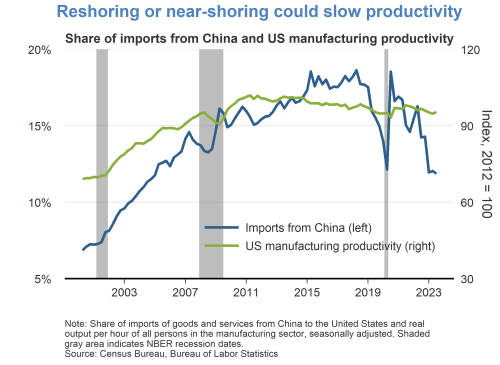

- In the longer term, labor productivity growth may be influenced by two opposing forces: the reshoring of production from abroad to the United States or North America and the growing use of automation for production processes. Reshoring has been boosted by trade tensions and concerns about the fragility of global supply chains. The reallocation costs stemming from reshoring activities could reduce productivity growth during the transition process.

- Trade tensions have contributed to a decline in the share of U.S. imports of goods and services coming from China. This share dropped to under 12% in the second quarter of 2023, down from about 18.5% in the second quarter of 2020. The declining import share represents a sharp reversal of the rapidly rising share of imports from China during the 2000s, after China joined the World Trade Organization. The rising import share from China was correlated with a rise in U.S. manufacturing productivity, as measured by real output per hour of all workers in the manufacturing sector. This pattern suggests that reshoring of manufacturing activity away from China could slow U.S. productivity growth.

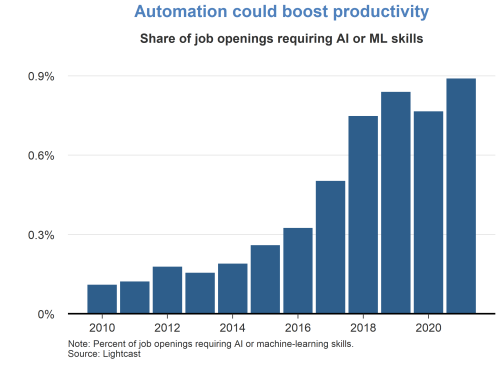

- Continued advances in automation may boost productivity growth over the longer term, helping to support wage gains. In recent years, businesses have increased the share of job postings that require skills in artificial intelligence (AI) or machine learning. Although the market share for AI-related jobs is still small, it has been rising steadily.

- Taking into account well-anchored inflation expectations, receding supply and demand imbalances, and the stance of monetary policy, we expect the PCE inflation rates—both headline and core— to decline gradually towards 2% by the end of 2026.

Charts were produced by Cindy Zhao.

About the Author

Zheng Liu is a vice president and director of the Center for Pacific Basin Studies in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Zheng Liu

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.