Michael Bauer, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of January 18, 2024.

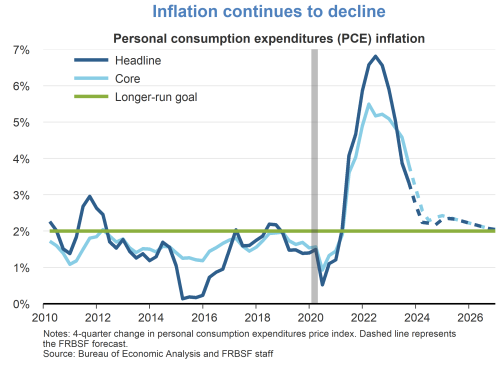

- Recent data show a continued trend of declining inflation, with headline personal consumption expenditures (PCE) inflation now below core PCE inflation due to lower energy and commodity prices. The 12-month change in the headline PCE price index for November 2023 was 2.6%, while the corresponding change for the core PCE, which removes food and energy prices, was 3.2%. The headline consumer price index (CPI) rose 3.4% over the 12 months ending in December 2023, while the core CPI index rose 3.9%.

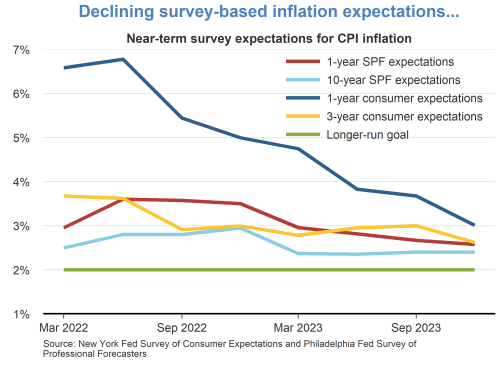

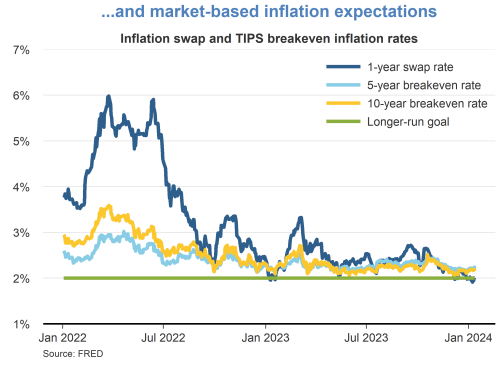

- Measures of expected inflation from surveys and financial market data have declined in recent months. For example, expected inflation over the next year in the New York Fed’s December Survey of Consumer Expectations declined to its lowest level in several years. Other survey- and market-based measures of expected inflation also suggest that inflation is expected to continue its steady decline.

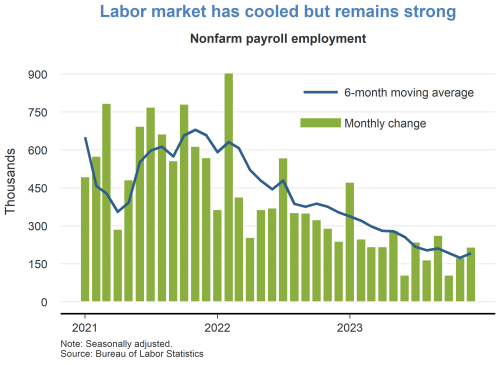

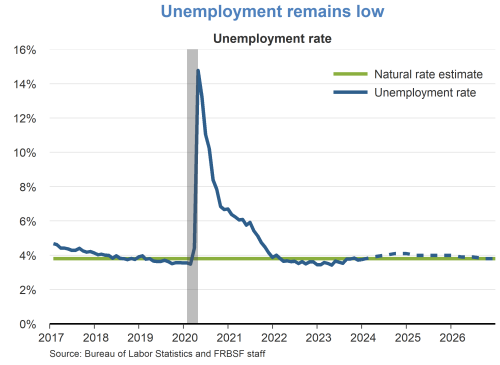

- The labor market remains strong. Nonfarm payroll employment increased by 216,000 jobs in December 2023, exceeding expectations. The unemployment rate held steady at 3.7%, just above the low of 3.4% last reached in early 2023. On the one hand, the continued strength in the labor market and, in particular, persistently strong wage growth pose an upside risk to the inflation outlook. On the other hand, a sudden cooling of the labor market could sharply raise unemployment and further push down inflation.

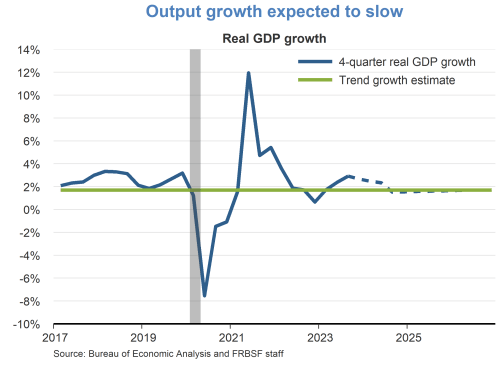

- Output growth was unusually strong in the third quarter of 2023, when real gross domestic product (GDP) grew at a robust 4.9% annualized rate. Recent data indicate that real GDP growth likely slowed in the fourth quarter of 2023. Going forward, real GDP is expected to grow slightly below trend.

- The current stance of monetary policy is restrictive and therefore expected to support a gradual decline in inflation towards the Federal Reserve’s 2% longer-run goal. The target range for the federal funds rate, between 5.25 and 5.50%, has remained constant since July 2023. As inflation declines, the implied real, or inflation-adjusted, federal funds rate has been rising, thus increasing the degree of monetary policy restraint. In addition, the lagged effects of prior policy tightening could turn out to be stronger than expected. Unexpectedly strong monetary restraint poses another downside risk for inflation.

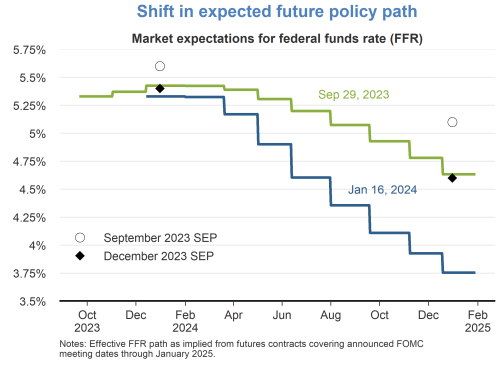

- Due in part to lower recent inflation data, expectations for the future path of the federal funds rate have shifted down markedly in recent months. The median forecast in the Fed’s Summary of Economic Projections (SEP) now anticipates a decline of 0.75 percentage points in the funds rate by the end of 2024. Market pricing from federal funds futures contracts suggests that investors expect a decline of more than a full percentage point over this period.

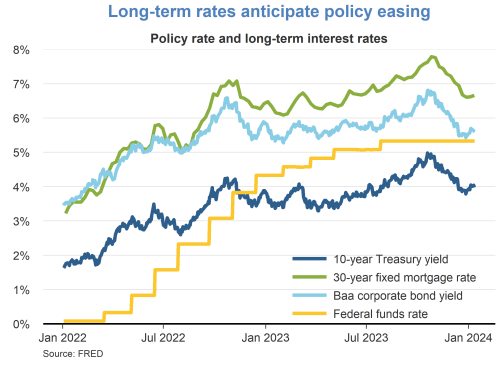

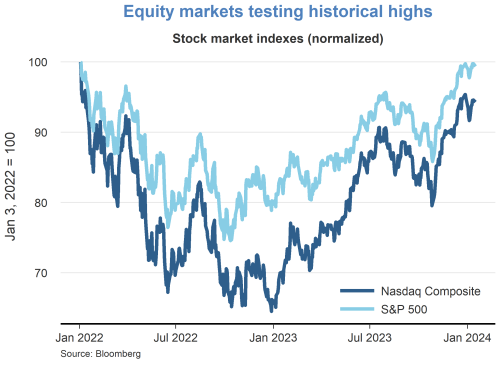

- In line with the shifting expectations about future monetary policy, long-term interest rates have declined notably. The 10-year Treasury yield peaked above 5% in mid-October 2023 but has since fallen to below 4%. This decline has been largely mirrored in other long-term interest rates, such as corporate bond yields and mortgage rates. At the same time, risk appetite in financial markets has increased, as evident in stock prices, which have tested historical highs in recent weeks.

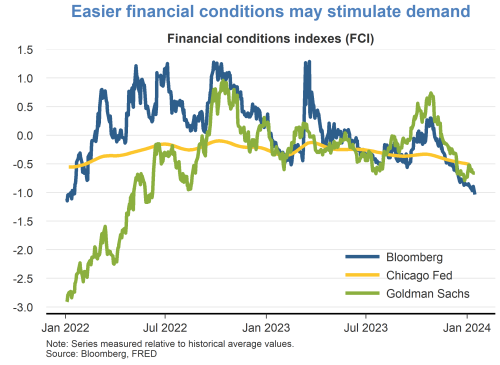

- Financial markets are a crucial link in the transmission of monetary policy to the economy. After all, it is not the federal funds rate—an overnight interest rate in the market for interbank loans—that directly affects consumption and investment. Rather, what matter more for aggregate demand and economic activity are the interest rates on consumer loans and corporate bonds, the values of financial assets such as stocks and houses, and the foreign exchange value of the dollar, among other indicators.

- Financial conditions indexes (FCIs) provide a way to summarize many financial indicators into a single number to measure how much support or restraint financial markets are providing to economic activity. Since late 2022, financial conditions have, on net, become more accommodative, according to a variety of FCIs. Since October 2023 in particular, long-term interest rates and the dollar declined, while stock prices rose. This easing gained additional momentum after the Federal Open Market Committee meeting held in December 2023, which shifted the market’s outlook for the federal funds rate path in 2024. Easing of financial conditions mitigates concerns about overly restrictive monetary policy and could even pose some upside risk to output growth and the inflation outlook if it continues.

- Overall, recent economic and financial developments are consistent with a gradual return of inflation to the Fed’s longer-run goal of 2%. While there are both downside and upside risks to this outlook, a “soft landing” for the economy, that is, a policy-induced disinflation without a recession, appears to be within reach.

Charts were produced by Zoë Arnaut.

About the Author

Michael Bauer is a senior research advisor and Director of the Center for Monetary Research in the Economic Research Department of the Federal Reserve Bank of San Francisco and research fellow at CEPR. Learn more about Michael Bauer

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.