Òscar Jordà, senior policy advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 18, 2024.

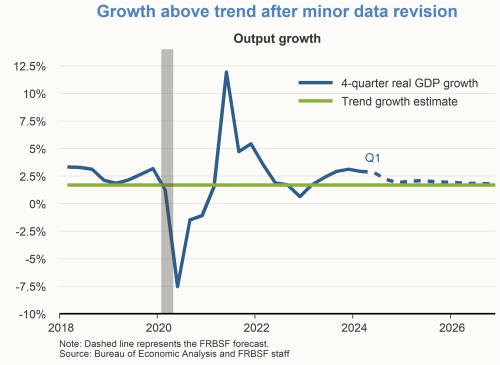

- Real gross domestic product (GDP) grew at an annualized rate of 1.4% in the first quarter of 2024, according to the U.S. Bureau of Economic Analysis. This figure was revised up slightly from the prior estimate and follows the reading of 3.4% growth in the fourth quarter of 2023. Real personal consumption expenditures, which represents the largest component of GDP, increased by 0.3% in May following April’s 0.1% decline. Going forward, we expect restrictive monetary policy to slow real GDP growth over the forecast horizon towards our 1.7% estimate of trend growth.

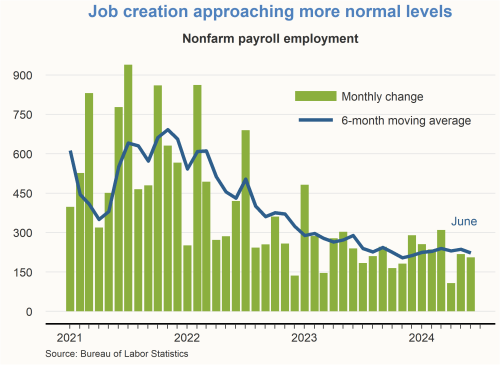

- The labor market remains strong, but overall employment conditions appear to be cooling. Nonfarm payroll employment grew by a robust 206,000 jobs in June. However, data for April and May were revised down by a cumulative 110,000 jobs. Over the past six months, the economy has created an average of 222,000 jobs per month. The unemployment rate edged up to 4.1% in June from 4.0% in May.

- One way to assess the state of the labor market is to compare labor demand (the number of available jobs) to labor supply (the number of available workers). Employed workers plus job openings (labor demand) are now nearly equal to the size of the labor force plus marginally attached workers (labor supply), implying that the labor market is close to balanced.

- Average hourly earnings grew by 3.9% over the 12 months ending in June, which continues a declining trend. Wage inflation remains above pre-pandemic levels and will likely need to decline a bit further to be compatible with a return of inflation to the Fed’s 2% longer-run goal.

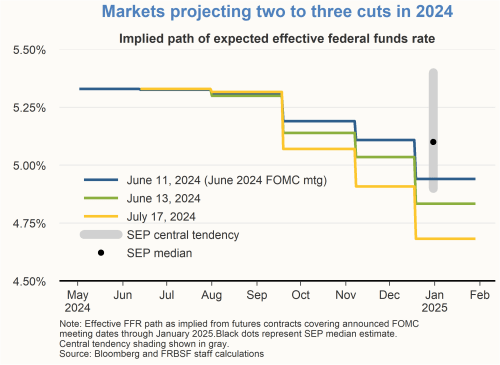

- Following the conclusion of its latest meeting on June 12, 2024, the Federal Open Market Committee announced its decision to maintain the federal funds rate target range between 5-1/4 and 5-1/2%. The Committee noted that it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.” Just after the meeting, financial markets were projecting approximately one to two 25 basis point cuts in the federal funds rate by the end of 2024. The June reading for consumer price index (CPI) inflation that was released on July 11 has shifted the financial market projection closer to three 25 basis point rate cuts by the end of 2024.

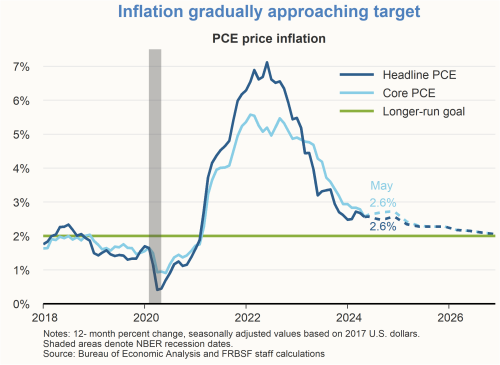

- The 12-month change in the headline consumer price index (CPI) for June 2024 was 3.0%, while the corresponding change for the core CPI, which excludes food and energy prices, was 3.3%. Both figures are down from readings in May. The 12-month change in the headline PCE price index for May 2024 was 2.6%, while the corresponding change for the core PCE price index was also 2.6%.

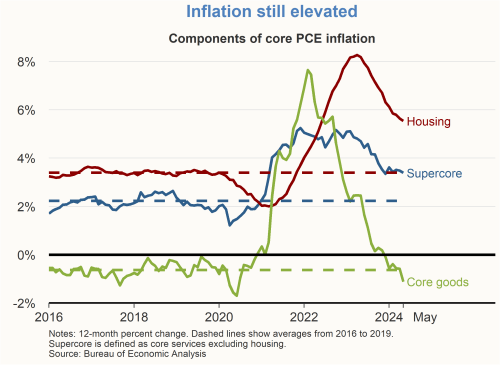

- With the Fed’s continued monetary policy restraint and a cooling labor market, we expect PCE inflation to decline gradually to 2%. The core goods component of 12-month PCE inflation is in negative territory, consistent with pre-pandemic levels. The “supercore” component of PCE inflation, defined as core services excluding housing, remains about 1.2 percentage points above the pre-pandemic average. The housing services component of PCE inflation remains 2.1 percentage points above the pre-pandemic average.

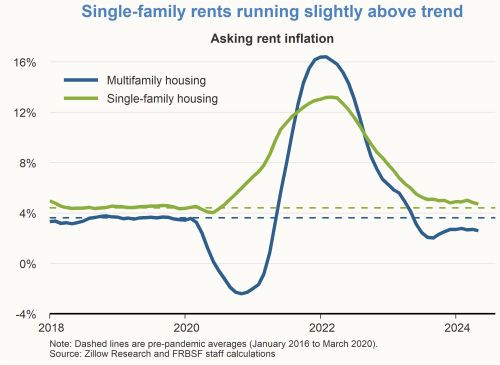

- According to the Zillow observed rent index, which measures the asking rents that landlords are currently seeking for new leases of rental units, 12-month rent inflation for multi-family units in May 2024 is running below the pre-pandemic average, while the corresponding reading for single-family units remains slightly above the pre-pandemic average.

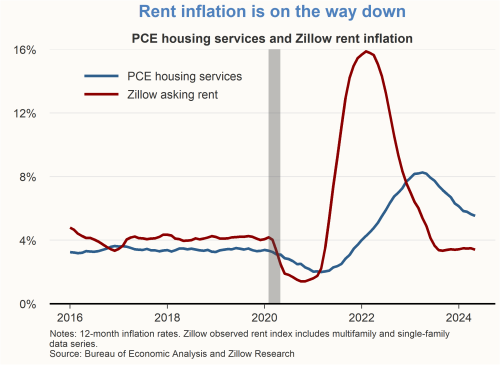

- Asking rent inflation as measured by the Zillow observed rent index that combines both multifamily and single-family series is now well below the housing services component of 12-month PCE inflation. Movements in asking rent inflation tend to lead movements in housing services inflation by about one year. Given that asking rent inflation is now close to the pre-pandemic average, we would expect to see continued declines in housing services inflation over the next year or so.

Charts were produced by Aren Yalcin.

About the Author

Òscar Jordà is a senior policy advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Òscar Jordà

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. This publication is edited by Kevin J. Lansing and Karen Barnes. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.