Robert G. Valletta, associate director of research and senior vice president at the Federal Reserve Bank of San Francisco, shared views on the current economy and the outlook from the Economic Research Department as of November 20, 2025.

Inflation has risen since early this year, largely driven by core goods prices. The increases likely relate to higher tariffs but have been smaller than projected earlier in the year, reinforcing our view that inflation will recede back toward 2% next year. Employment growth has slowed notably this year. The unemployment rate and new jobless claims are low but have drifted up, and elevated government and corporate layoff announcements this year highlight downside risks to the labor market. Economic growth has remained close to trend, supported by solid productivity gains. However, slower wage gains and rising financial distress may be weighing on consumer spending, especially for lower-income households.

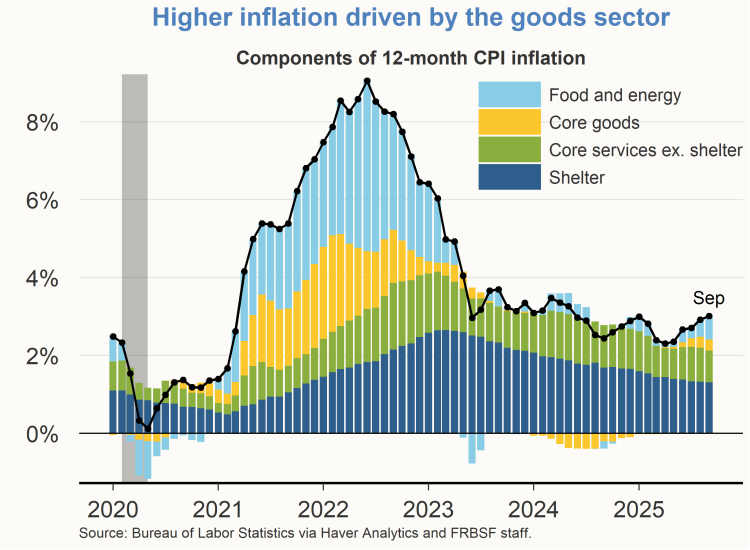

Higher inflation so far this year has been driven by core goods

Progress on inflation has been uneven, with declines late last year offset by increases in recent months. Focusing on the 12-month change in the consumer price index (CPI), for which we have official data through September, shows that headline inflation is up from 2.3% in April to 3.0%. Core CPI inflation, which excludes volatile food and energy components, is up only 0.2 percentage point over the same period. Core goods inflation switched from notably negative in mid-2024 to positive and growing in recent months, increasing its contribution to the headline number by about 0.7 percentage point. The inflation rate for food and energy products has also been rising in recent months.

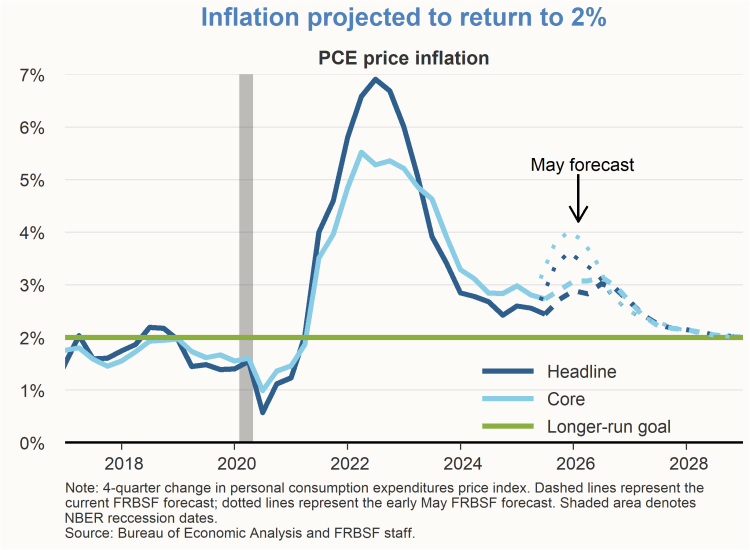

Our projection for inflation has declined notably since our initial assessment of the likely impact of the tariffs that were announced in April. In early May, we projected that core inflation, as measured by the four-quarter change in the personal consumption expenditures (PCE) price index, which excludes volatile food and energy prices, would increase to 4% this year. This assessment was based on April’s announced tariff rates and prior research on the pass-through of tariffs to domestic prices. These pass-through effects have been relatively contained thus far as U.S. companies have shifted their imports to countries and products that are less affected by the higher tariffs. The muted inflation impact of tariffs thus far reinforces our view that the tariffs’ effects will recede next year and put inflation back on track toward the Federal Reserve’s 2% goal. Substantial uncertainty surrounds this projection, however, with balanced upside and downside risks.

The labor market has slowed, with downside risks

Job gains slowed to nearly a standstill during the late spring and summer months. Due to the federal government shutdown, official labor data from the Bureau of Labor Statistics (BLS) have been delayed. Today’s release for September showed a pickup in job growth, but downward revisions for prior months confirm that growth has slowed. An alternative data series from the firm Automatic Data Processing, Inc. (ADP), which closely tracks the BLS series on average, shows minimal private-sector job gains through October.

Along with the downshift in job growth, the unemployment rate has increased somewhat this year. The reading from the most recent BLS data for September was 4.4%. This value is somewhat above common estimates of the sustainable natural rate of unemployment but still low on a historical basis. However, the unemployment rate is up 1 percentage point from its post-pandemic low of 3.4%, consistent with the view that the labor market has cooled over the past few years.

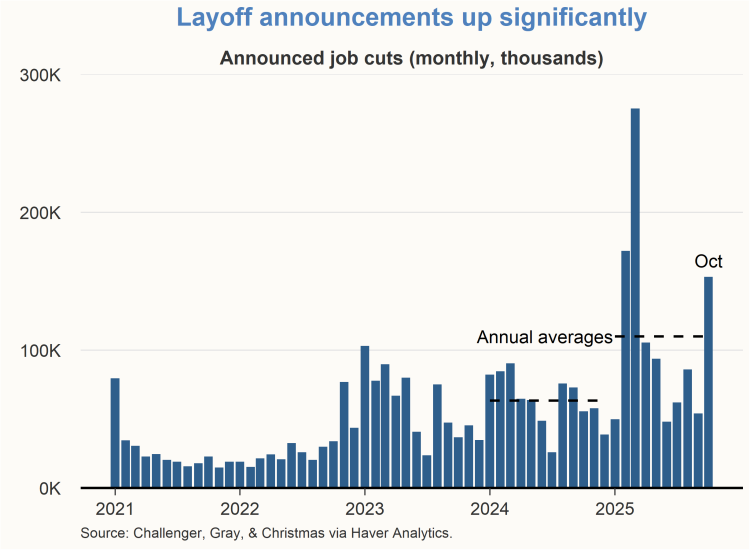

Job losses, as reflected in new claims for unemployment insurance (UI), also remain low on a historical basis. However, UI claims have drifted up on net since early 2023. Moreover, layoff announcements from private and government employers are up notably in 2025 relative to last year. The increase early this year was driven by layoffs at federal government agencies and contractors, but job cuts since then have spread more broadly. Layoff announcements in October were the highest for that month since 2003. The slowing of multiple labor market indicators highlights the risk of a more pronounced downturn in the labor market, which could occur rapidly in response to economic or financial shocks.

GDP growth remains solid, supported by productivity gains

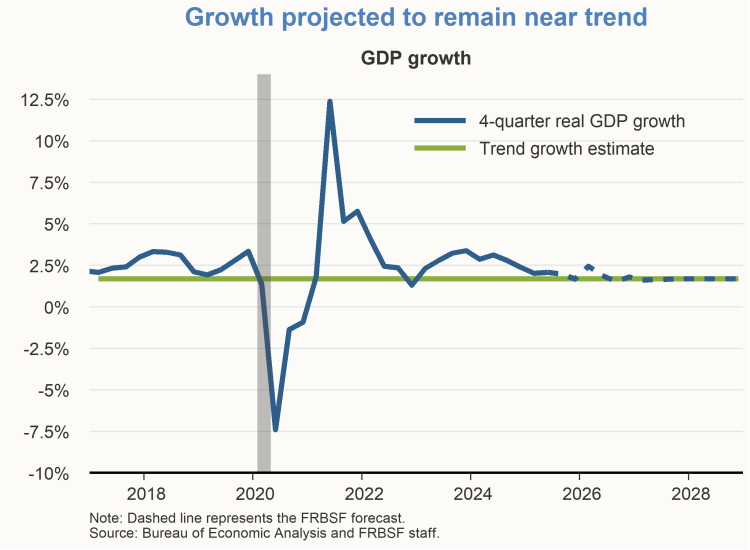

Four-quarter real GDP growth since 2022 has generally exceeded our estimated long-run trend growth rate of 1.7%. Growth has been supported by solid gains in consumer spending, along with a surge in business investment spending that partly reflects the rapidly rising demand for artificial intelligence (AI) applications and infrastructure.

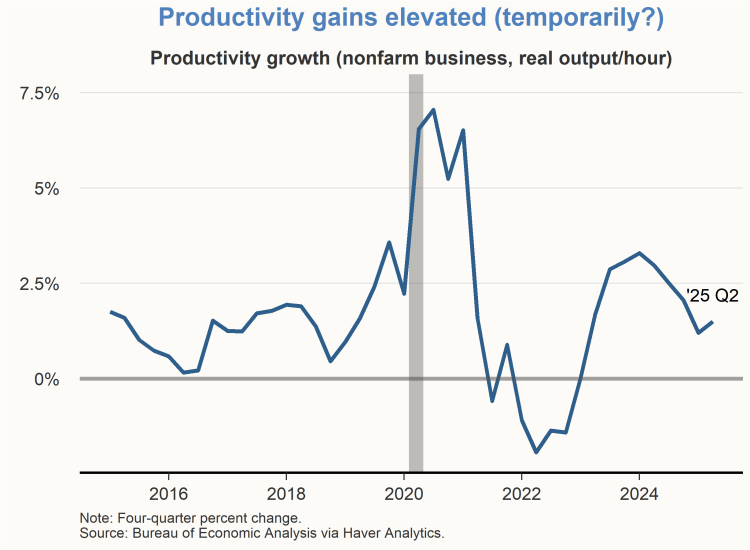

Real GDP growth appears to have remained on track this year despite modest job gains. Growth has been supported by solid productivity gains, which have been uneven since the end of the pandemic but on average well above the pre-pandemic trend of about 1 to 1-1/4%. Since the second half of 2023, four-quarter productivity growth has averaged nearly 2-1/2%. It is too early to know whether these gains reflect a new, higher productivity growth regime fostered by the rising use of AI and related technologies or a temporary surge related to reorganization and consolidation in the aftermath of the pandemic.

Income and spending growth slowing notably for lower-income groups

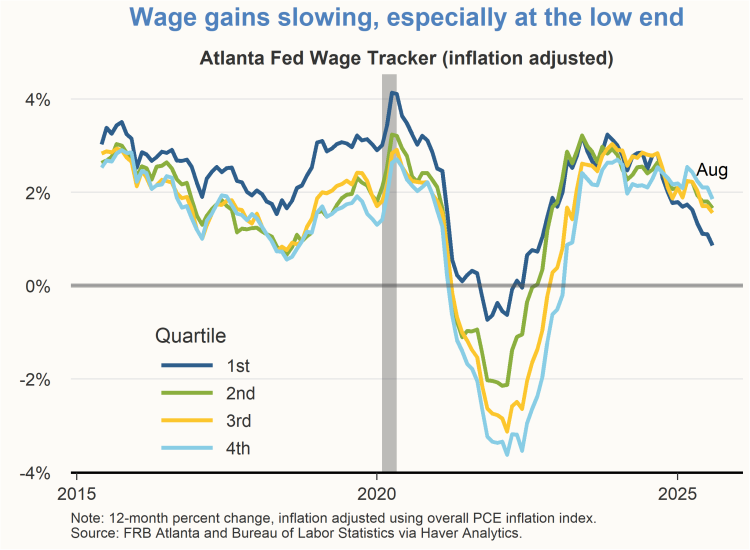

Consumer spending over the past few years has been supported by income growth and excess household savings from the pandemic period. These factors are now waning, raising the risk that consumer spending may slow. In addition to the exhaustion of their excess household savings, wage growth has slowed the most for workers in the bottom, or first, quartile of the wage scale. These same workers had previously seen the fastest wage gains during the pandemic and subsequent recovery.

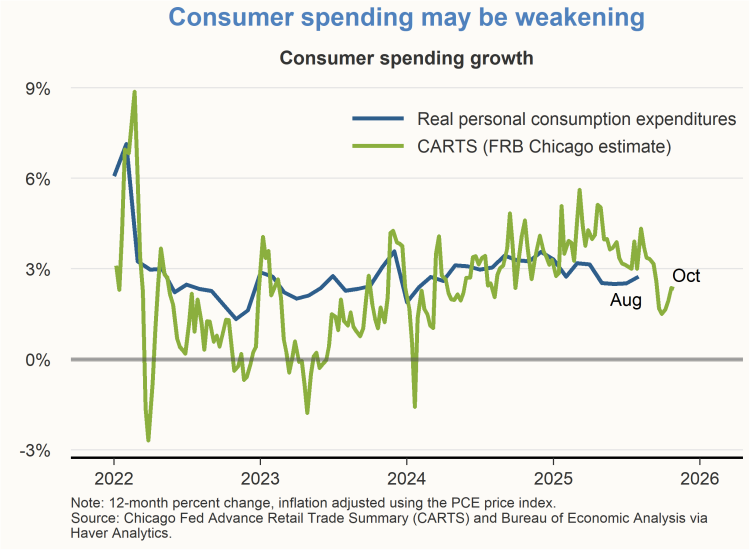

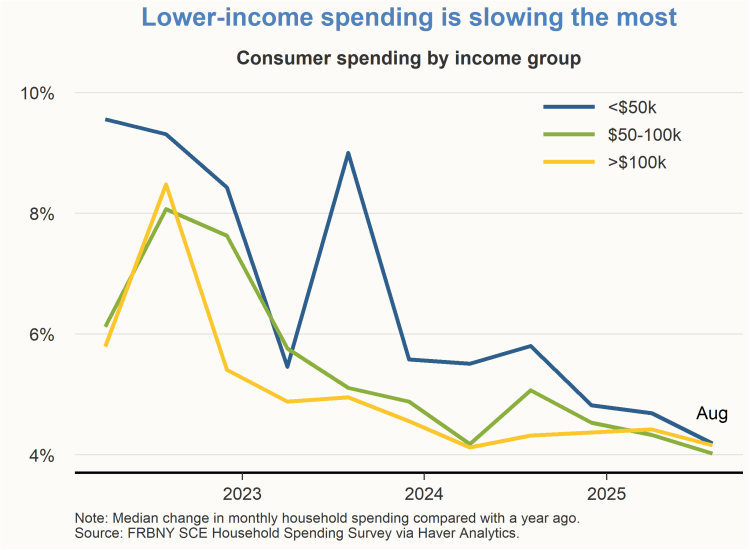

Available data on real personal consumption expenditures show signs of a slowdown in consumer spending in recent months. The official series from the U.S. Bureau of Economic Analysis, available through August, shows that the 12-month growth rate in consumer spending has dropped to slightly below 3%. The Chicago Fed provides retail spending estimates through October that are derived from a statistical model combining data from multiple sources. The estimated spending series, while noisy, shows a growth slowdown in recent months. Other data from a household survey conducted by the New York Fed show that spending growth has slowed the most for lower-income households, consistent with the exhaustion of their excess savings and slower wage growth.

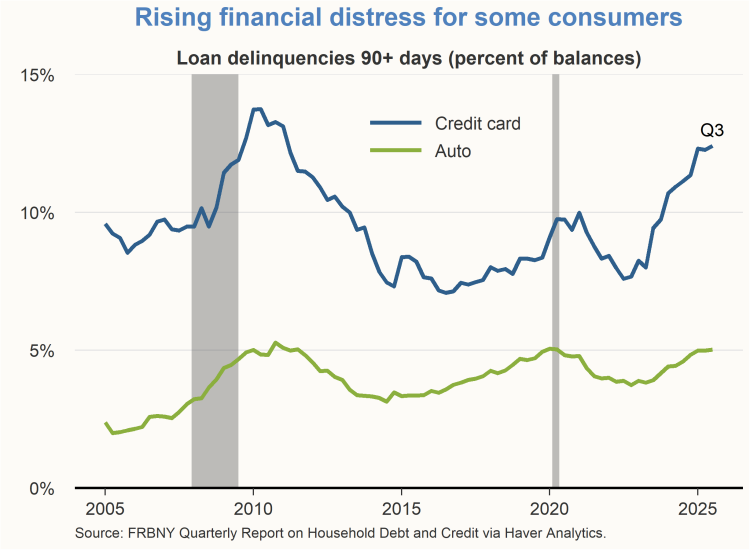

Rising financial challenges pose a downside risk to consumer spending growth. The New York Fed compiles credit bureau data on household debt and credit conditions. Serious delinquencies in their data, defined as payments that are at least 90 days overdue, have risen substantially for credit card balances and auto loan balances over the past two years. This financial distress is likely most severe for lower-income households, placing downward pressure on their spending.

Charts were produced by Ingrid Chen.

The views expressed are those of the author with input from the Federal Reserve Bank of San Francisco forecasting staff. They are not intended to represent the views of others within the Bank or the Federal Reserve System. This publication is edited by Kevin J. Lansing, Karen Barnes, and Hamza Abdelrahman. SF FedViews appears eight times a year. Please send editorial comments to Research Library.