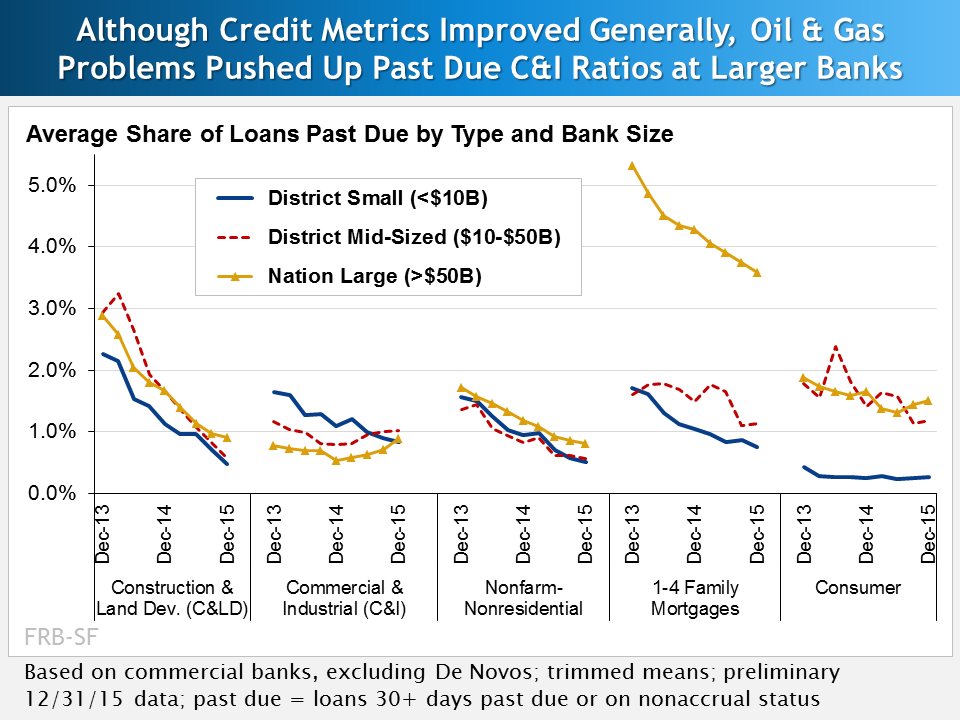

The First Glance 12L provides a first look at economic and banking performance within the 12th Federal Reserve District. According to the fourth quarter report, titled “Will 2015 be the High Point for District Bank Credit Quality?,” a strong dollar and slowing abroad dampened export activity but did not affect the District’s overall credit conditions or job growth materially through year-end. Although energy sector stress hampered commercial and industrial (C&I) loan quality at larger banks and contributed to some tightening of C&I loan standards, most community banks were unaffected. Of note, lenders also are beginning to show caution about commercial real estate (CRE) underwriting, according to Federal Reserve surveys. In 2015, bank earnings benefitted from improving credit conditions and historically low provision expenses. This, along with tight cost controls, helped offset continued narrow net interest margins and led to small gains in returns on average assets. Going forward, seasoning within rapidly-growing loan portfolios may cause delinquency and charge-off ratios to lift from cyclical lows and force more significant growth in loan loss reserves. Although banks face headwinds, supervisory examination upgrades outpaced downgrades through year-end 2015, and the share of institutions with less-than-satisfactory safety and soundness ratings edged down.