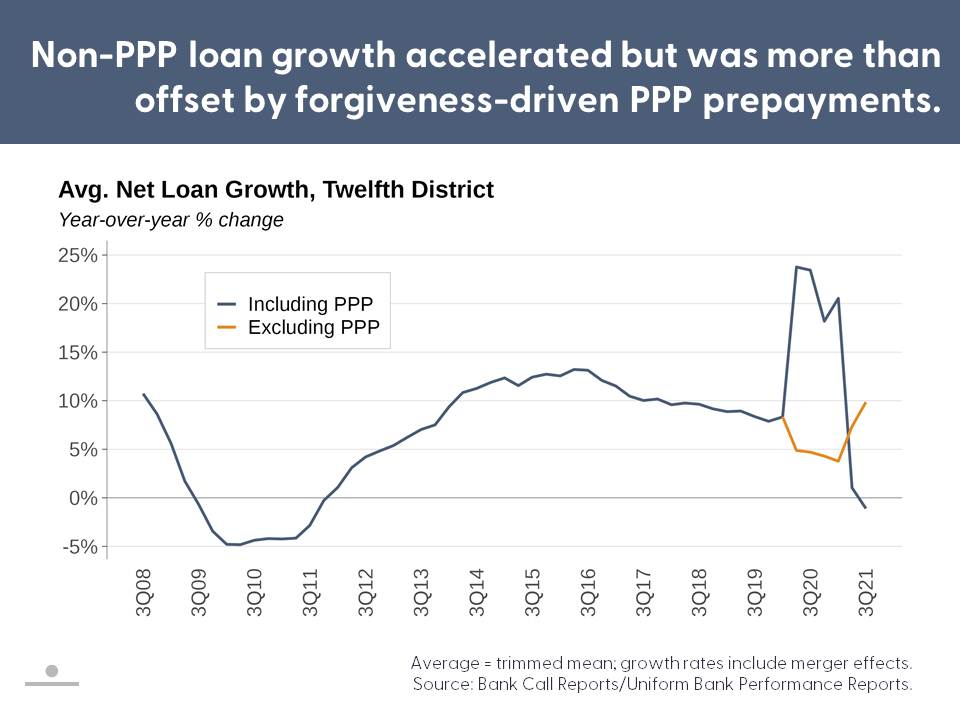

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. Among District banks, Paycheck Protection Program (PPP) forgiveness continued to offset accelerating loan growth in other categories. Consequently, net new lending was negative on average and continued to trail deposit growth. On-balance sheet liquidity accumulated further as a result. PPP forgiveness also triggered earlier PPP fee recognition to the benefit of earnings but shifted the mix of assets to the detriment of risk-based capital ratios. Loan delinquencies and losses remained low in the wake of monetary and fiscal stimulus and economic recovery.

Meanwhile, aggregate District payrolls improved to more than 96% of pre-pandemic (February 2020) levels in October, from a trough of 86% in April 2020. Nevertheless, business concerns about hiring difficulties, supply chains, and inflation intensified. Home price appreciation eased slightly from summer highs in some District states but remained very strong relative to pre-pandemic trends. Among commercial properties, downtown office performance continued to lag while suburban offices joined other sectors in a recovery. Notwithstanding signs of improvement, the ongoing threat of a seasonal- or variant-led surge in COVID-19 cases continued to cloud the outlook.