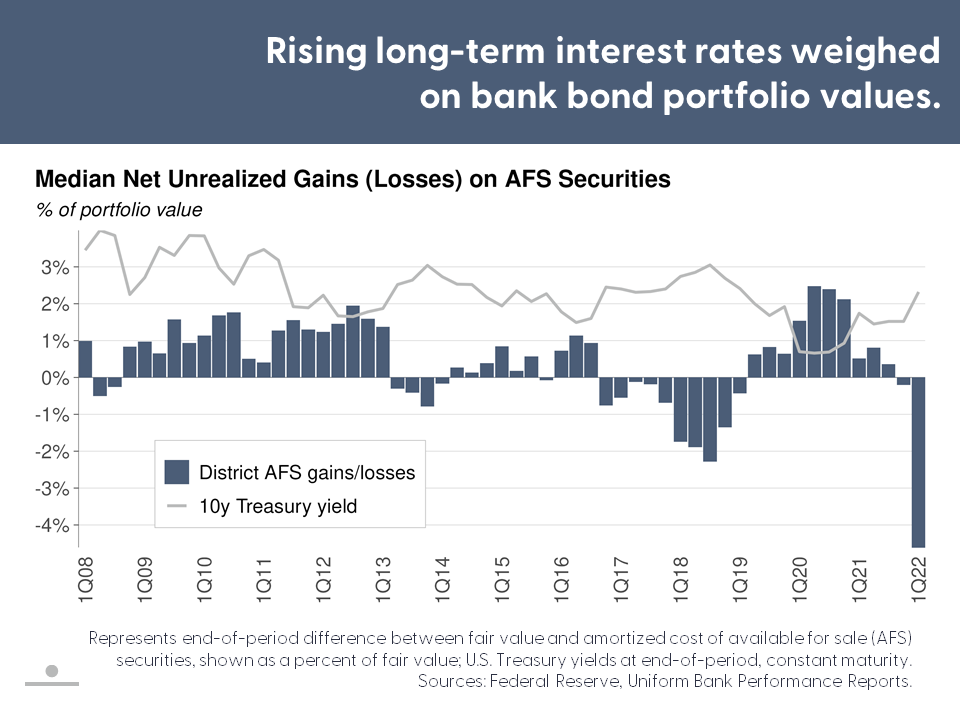

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. During 1Q22, District bank median loan growth – excluding Paycheck Protection Program (PPP) loans — topped 13% year-over-year, the fastest pace among twelve Federal Reserve districts. Median quarterly profit ratios also compared favorably but slipped from 4Q21, due partly to waning PPP fees. Loan performance remained strong. Still, receding fiscal stimulus, rising inflation and interest rates, and persistent supply chain and staffing challenges may pressure borrowers prospectively. On-balance sheet liquidity remained high but eased slightly, and rising interest rates hurt bond values. In addition, the shift in banks’ asset mix away from liquid instruments and PPP loans crimped risk-based capital ratios.

Unemployment in the District also continued to ease through Q1. In aggregate, home-price growth reaccelerated as buyers pulled forward demand amid tight inventories and rising mortgage rates. Meanwhile, housing permit volumes increased but completions fell, hampered by supply chain, staffing, and input cost challenges. Commercial real estate (CRE) price growth slowed in most sectors. District CRE fundamentals remained stronger among industrial and apartment properties than office and retail. Headwinds from inflation and geopolitical tensions may become greater drags in the next quarter.