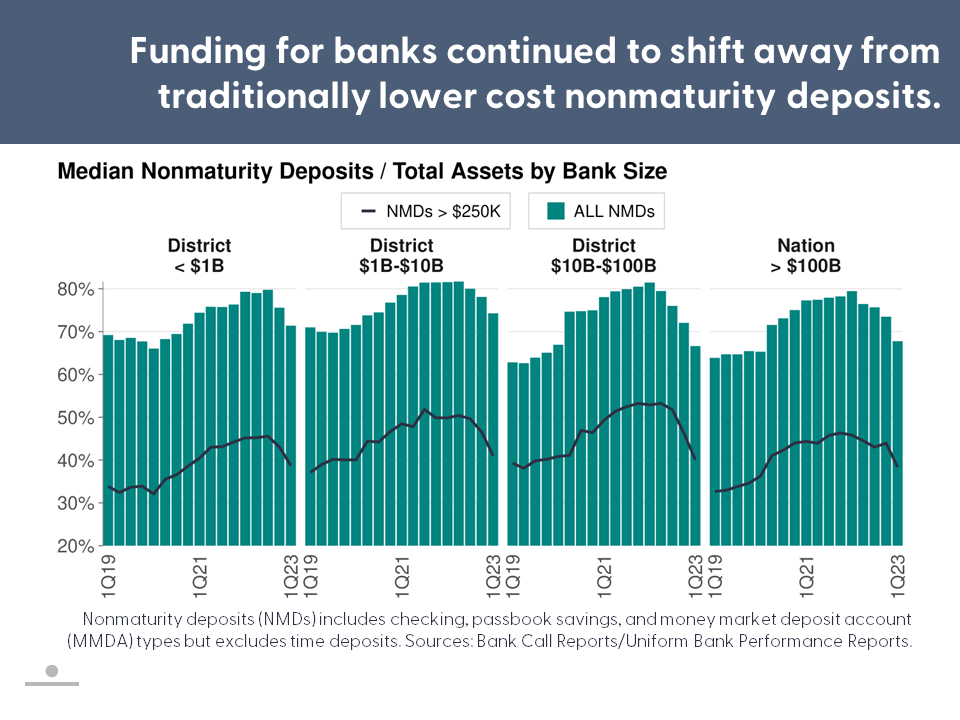

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. Banks encountered a challenging funding environment during the quarter. Nonmaturity deposit runoff continued, especially in March following the failure of two large depositories. Banks leaned increasingly on time deposits (including brokered funds) and borrowing lines and strengthened cash buffers in response. Institutions remained solidly profitable, but the combination of rising short-term interest rates, competitive pricing pressures, and shifts in funding mix compressed banks’ net interest margins. Meanwhile, although net unrealized losses among bond portfolios moderated, they influenced depositor and investor behavior and constrained banks’ liquidity options.

District job growth improved slightly during 1Q23, and state level unemployment rates were generally stable-to-lower. Home prices, permit activity, and homebuilder sentiment responded favorably to an early-2023 dip in mortgage interest rates and low inventories of existing homes for sale but remained below prior year levels in most District states. Meanwhile, commercial real estate (CRE) markets remained under pressure, particularly in the office sector. Generally, CRE owners faced flat or declining property prices, weakening demand, higher debt service and operating costs, and tightening credit conditions.