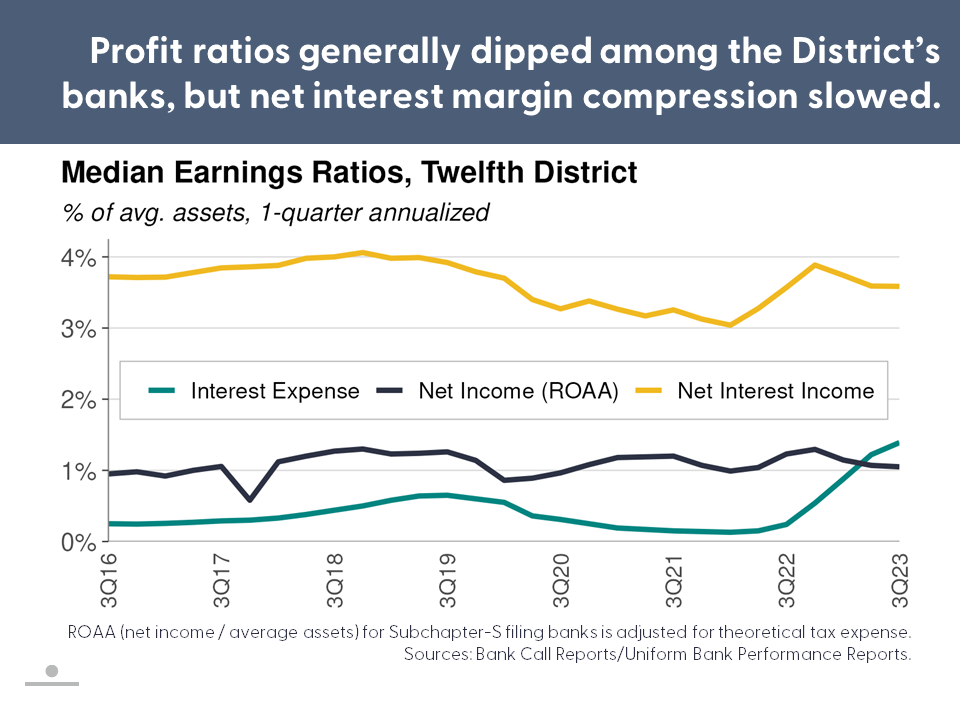

First Glance 12L provides a quarterly look at banking and economic conditions within the Federal Reserve System’s Twelfth District. Quarterly return on average asset and net interest margin ratios among the District’s banks eased slightly on a median basis. Funding costs increased at a slower pace and were offset mostly by higher asset yields. Loan loss provision activity ticked higher amid lingering economic concerns and slight increases in problem loan levels. Loan growth tended to slow on net, partly influenced by weaker demand and seasonal factors. Meanwhile, increases in costlier time deposits and noncore funding sources usually decelerated as nonmaturity deposit runoff abated. Bond portfolio values continued to weaken given rising intermediate-term interest rates, placing persistent pressure on banks’ liquidity options and “book” equity. Regulatory capital ratios generally improved, with performance continuing to vary by bank size.

Overall, District job growth slowed quarter-over-quarter, and unemployment rates edged higher within a growing number of District states. Although still down from prior year peaks, home price indices increased in most markets during the quarter. Commercial real estate (CRE) continued to be an area of concern. Economic uncertainty, property price pressures, subdued transaction volumes, and tighter credit conditions both reflected and influenced investor and lender sentiment.