We introduce boundedly-rational expectations into a standard asset-pricing model of the exchange rate, where cross-country interest rate differentials are governed by Taylor-type rules. Agents augment a lagged-information random walk forecast with a term that captures news about Taylor-rule fundamentals. The coefficient on fundamental news is pinned down using the moments of observable data such that the resulting forecast errors are close to white noise. The model generates volatility and persistence that is remarkably similar to that observed in monthly exchange rate data for Canada, Japan, and the U.K. Regressions performed on model-generated data can deliver the well-documented forward premium anomaly.

About the Authors

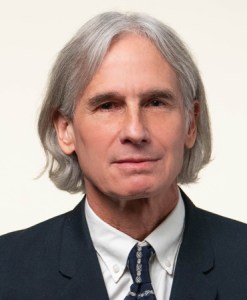

Kevin Lansing is a senior research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Kevin Lansing