Introduction

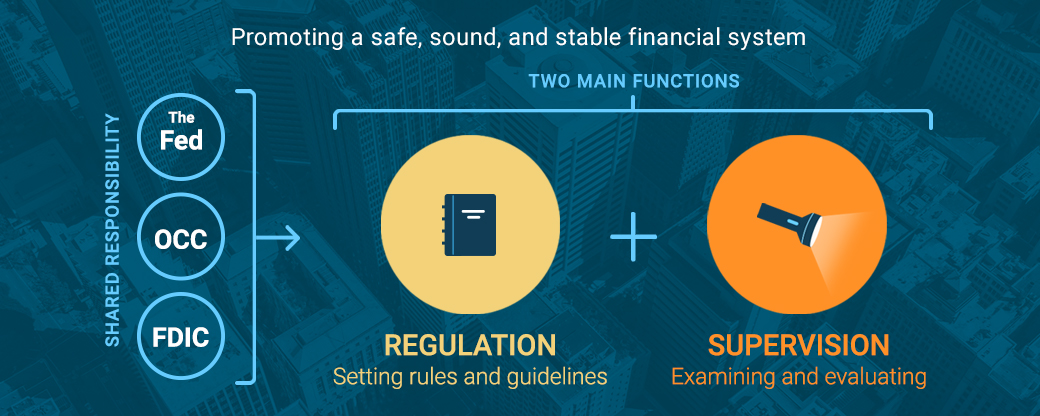

The Fed has supervisory and regulatory authority over many banking institutions. In this role the Fed 1) promotes the safety and soundness of the banking system; 2) fosters stability in financial markets; and 3) ensures compliance with laws and regulations under its jurisdiction. Supervision involves examining the financial condition of individual banks and evaluating their compliance with laws and regulations. Bank regulation involves setting rules and guidelines for the banking system.

Supervision

Supervisory Agencies

The objective of supervision is to evaluate the financial condition of banking organizations and their compliance with laws and regulations.

The Fed supervises several kinds of institutions. It supervises bank and financial holding companies (the companies that own banks and other financial operating units), including savings and loan holding companies (the companies that own thrifts or savings banks). The Fed also supervises state-chartered banks that are members of the Federal Reserve System and various foreign banking organizations. Finally, the Fed supervises the nonbank financial institutions whose safety and soundness are important to the overall financial system.

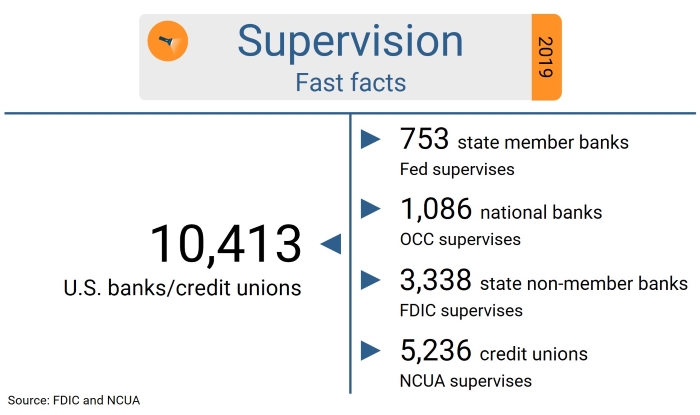

Several other financial regulatory agencies also supervise banking institutions. By law, nationally chartered banks must be members of the Federal Reserve System. However, they are supervised by the Office of the Comptroller of the Currency (OCC), part of the U.S. Treasury Department. The Federal Deposit Insurance Corporation (FDIC) supervises state-chartered banks that are not members of the Federal Reserve System. In addition, state-chartered banks are also supervised by their respective state banking agencies. And credit unions are supervised by the National Credit Union Administration (NCUA).

As outlined in the graphic below, of the 10,413 banks and credit unions in the U.S. that take deposits, the Fed supervises its 753 state member banks; the OCC supervises 1,086 national banks; the FDIC picks up the 3,338 remaining state banks that aren’t Fed members; and the NCUA supervises 5,236 credit unions.

The Supervisory Process

Bank supervisors examine banking organizations to make sure that they are operating in a safe and sound manner and following laws and regulations. Supervisors at each of the 12 Reserve Banks and at the Board of Governors perform on-site and off-site examinations and off-site monitoring.

The 2007–2008 financial crisis put the financial system and the whole economy under a lot of stress. In response, the Fed and other bank regulatory agencies issued new rules, regulations, and guidelines to strengthen the supervision and resiliency of large banking organizations. The goal was to better ensure that these organizations could withstand most forms of financial and economic stress. For example, banks are required to have enough capital to absorb large losses and withstand wide fluctuations in values that could affect their balance sheets, revenues, and costs. Regulators assess large banks’ capital projections and estimations under current and stress conditions to make sure that they’re sufficient. Large banking organizations also undergo reviews to ensure that they have adequate liquidity to meet current and stress conditions.

The largest banking organizations also are required to submit resolution plans or ‘living wills’ to the Fed and the FDIC. Each plan must describe the organization’s strategy for rapid and orderly resolution in the event of material financial distress or failure.

During the 2020 COVID-19 pandemic, Fed supervisors increased monitoring and outreach to banks to help them understand the challenges and risks of the situation. In addition, the Fed allowed banks additional time to address non-critical supervisory issues.

Regulation

The Fed’s regulations often are adopted in response to specific legislation passed by Congress.

As one of the nation’s bank regulatory agencies, the Fed, through the Board of Governors, sets standards of operation for banks through regulations, rules, policy guidelines, and interpretations of relevant laws. Sometimes regulations are restrictive, meaning they limit a bank’s activities. Other times they are permissive, which means they allow banks to conduct a given activity. And sometimes regulations prescribe action. For example, the Community Reinvestment Act places an obligation on banks to serve lower-income communities in their areas.

Regulations and interpretations are scaled to the size and complexity of the bank or holding company. Smaller banks would face an undue burden if they had some of the regulations that larger banks do, and any financial weaknesses of smaller banks would not shake the whole economy. So, regulators have more basic expectations for smaller, less complex banks. For example, although capital requirements for institutions of all sizes have strengthened since the 2007–2008 financial crisis, some requirements do not apply to smaller banks.

A More Systemic Approach

The Dodd-Frank Act called for a more systemic approach to supervision.

The Dodd-Frank Act of 2010 expanded the Fed’s supervisory and regulatory responsibilities. It also called for a more systemic approach to supervision in order to safeguard the financial system. For example, the legislation created a new interagency Financial Stability Oversight Council to monitor risks to the financial system as a whole. To this end, the Fed and other federal financial regulatory agencies expanded research and data collection in order to enhance financial system monitoring and analysis. In addition, the Fed makes its most consequential supervisory decisions on a System-wide level through the Large Institution Supervision Coordinating Committee, consisting of representatives from various professional disciplines and several Reserve Banks, as well as the Board of Governors.

The Dodd-Frank Act also directed the Fed to apply stronger supervisory standards to nonbank financial institutions that have the potential to affect the whole financial system. This group includes all bank and savings and loan holding companies with over $250 billion in assets. The legislation also gave the Fed authority to assign individual smaller holding companies and financial market intermediaries to this group. These stronger supervisory standards helped to make the entire financial system healthier, more stable, and more resilient to financial shocks and stresses.

Sources:

About Financial Institution Supervision and Credit, Federal Reserve Bank of San Francisco.

The Federal Reserve System Purposes & Functions, Federal Reserve Board of Governors, Tenth Edition, October 2016.

Financial Innovation and Consumer Protection, speech by Ben S. Bernanke, Chairman, Federal Reserve Board of Governors, at the Federal Reserve System’s Sixth Biennial Community Affairs Research Conference, Washington, D.C., April 17, 2009.

Housing, Mortgage Markets, and Foreclosures, speech by Ben S. Bernanke, Chairman, Federal Reserve Board of Governors, at the Federal Reserve System Conference on Housing and Mortgage Markets, Washington, D.C., December 4, 2008.

How is Banking Safer Following the Financial Crisis?, Federal Reserve Bank of San Francisco, Financial Institution Supervision and Credit.

Implementation of the Economic Growth, Regulatory Relief, and Consumer Protection Act, testimony by Randal Quarles, Vice Chairman for Supervision, Federal Reserve Board of Governors, before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C., October 2, 2018.

No, Dodd-Frank was neither repealed nor gutted. Here’s what really happened, by Aaron Klein, Brookings Center on Regulation and Markets, May 25, 2018.

Quarterly Banking Profile: Fourth Quarter 2019, Federal Deposit Insurance Corporation.

Quarterly Credit Union Data Summary: 2019 Q4, National Credit Union Administration.

Remarks on “The Squam Lake Report: Fixing the Financial System,” speech by Ben S. Bernanke, Chairman, Federal Reserve Board of Governors, at the Squam Lake Conference, New York, NY, June 16, 2010.

Supervision and Regulation Report, Federal Reserve Board of Governors, May 2019.