Download PDF (pdf, 480 kb)

Download Chart Data (Excel document, 128 kb)

Summary

The Diary of Consumer Payment Choice (Diary) is an ongoing annual research effort conducted by the Federal Reserve to better understand payment habits of the U.S. population. This paper highlights findings from the sixth Diary study in 2019, and the fourth conducted annually in the month of October since 20161. A demographically-representative sample of 3,016 individuals from the Understanding America survey panel were asked to participate. Each individual was instructed to report all of their payments and transactions over an assigned, consecutive three-day period. The high-level findings are:

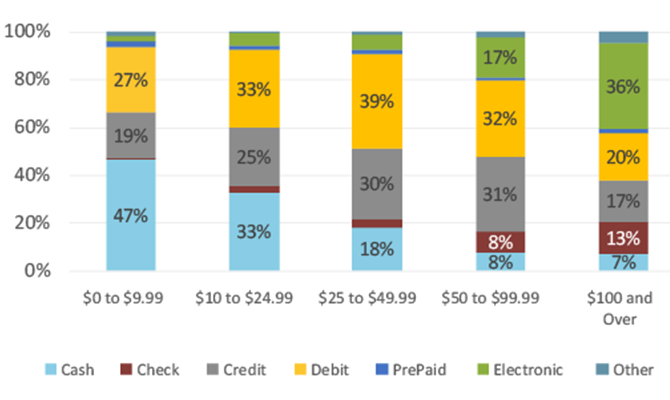

- Consumers used cash for 26 percent of all payments, consistent with the finding from 2018

- Cash is used heavily for small-value payments, about 47 percent of payments under $10

- Debit cards were the most used instrument, accounting for 30 percent of payments

- The share of cash use across all age cohorts was generally unchanged

- 87 percent of non-bill payments were made in-person, and cash was used for 35 percent of those payments

The share of cash use remained unchanged from last year, though the average number of cash payments made declined from 11 payments in 2018 to 10 in 2019. The one payment decline is equivalent to last year’s change (12 payments in 2017 to 11 in 2018). The decline in cash payments is accompanied by a decline in the total number of payments amongst Diary participants; these two factors explain the consistent share of cash use from one year to the next.

In 2019, cash was used for 47 percent of payments under $10 and for 40 percent of payments between $10 and $25. While participants reported fewer cash payments in the under $10 range than in 2018, they also reported fewer payments overall in this range, suggesting that the drop in cash payments for small valued transactions is not necessarily the result of payment substitution from cash to cards.

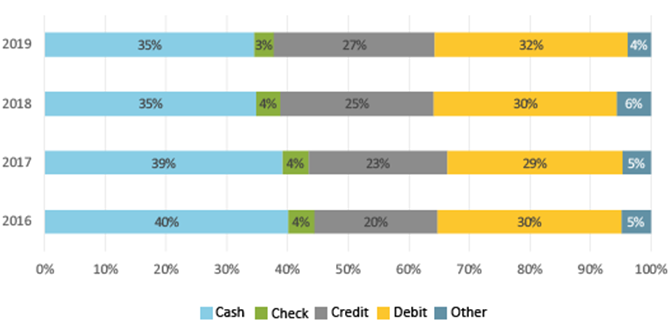

As with findings in 2018, cash use accounted for 35 percent of in-person payments. Shares of in-person credit card and debit card payments increased, while in-person payments made with checks continued to decline.

Just as with payment shares, individuals’ stated payment preferences remained consistent with the 2018 Diary, and stated preferences continue to align with payment usage. Debit cards were the most used and the most preferred instrument. Approximately 42 percent of participants prefer to pay with debit cards, followed by credit cards at 29 percent, and cash at 23 percent. In general, participants’ preferences align with their payment usage. Although participants prefer credit cards over cash, cash is used more often than credit cards because debit and credit-preferring individuals use cash for approximately 20 percent of their payments.

The body of this paper is structured into four sections, with each section exploring various aspects of cash usage. Section 1 details trends in cash usage; Section 2 discusses how payment preferences influence the use of cash; Section 3 explores cash holdings by demographic cohort; and Section 4 outlines payment use by transaction characteristic and merchant type. Appendix A provides an overview of methodology. Additional information about the 2020 Diary is available through the Federal Reserve Bank of Atlanta.2

Note Regarding COVID-19

This year’s Diary study was conducted in October 2019, before the spread of COVID-19 in the United States. The authors acknowledge that payment behavior may likely change as a result of this pandemic and the ensuing stay-at-home or shelter-in-place orders. While current Diary data does not represent consumers’ payment behavior during this national emergency, data from the Diary studies has been vital for analysis conducted by the Cash Product Office, the 12 Reserve Banks, and the Board of Governors to ensure that the Federal Reserve can effectively meet its mission of providing ready access to FedCash® Services. Payment details from the Diary, such as payment instrument usage, value of purchases, and merchant type, were utilized to better understand how consumers might use cash at open businesses once CARES Act Economic Impact Payments were issued. How the current crisis will affect cash usage and general payment behavior going forward is unknown. However, future Diary studies may provide insights about whether and how consumer payments have changed in a post COVID-19 era.3

Acknowledgements

This paper would not have been possible without the support and contributions of the following individuals. From the Atlanta Fed: Kevin Foster, Claire Greene, Marcin Hitczenko, Brian Prescott, and Oz Shy. From the Boston Fed: Joanna Stavins and Liang Zhang. From the San Francisco Fed: Justin Wray and Tom Flannigan. From the Cash Product Office: Alexander Bau, Amy Burr, Ben Gold, Kelly McGuire, Margaret Riley, Louise Willard, Kathleen Young, and Roger Replogle.

Section 1. Trends in Cash Usage

Share of cash usage remains consistent with previous year

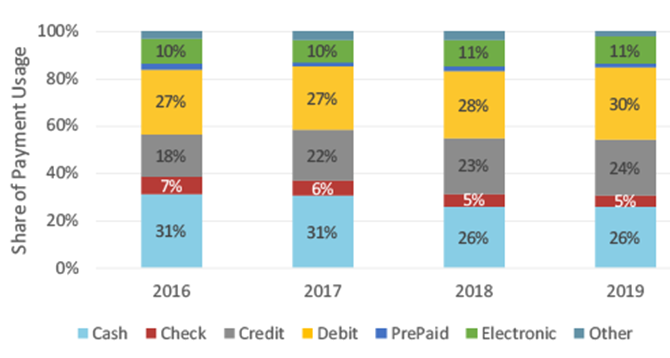

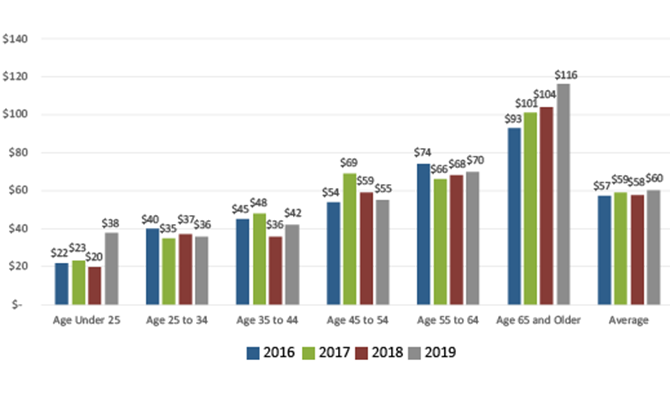

Diary participants reported making an average of 38 payments per month in October 2019, down from 43 payments reported in 2018. Despite the decline in total transactions, the share of cash use remains consistent at 26 percent, though cash usage decreased by one payment per month. Debit cards were once again the most frequently used payment instrument, accounting for 30 percent of payments, a 2 percentage point increase from 2018 (Figure 1)4. Consumers’ use of credit cards has continued to increase steadily since 2016, though the year to year change in 2019 was not statistically significant. In general, the share of payment instrument usage between 2018 and 2019 was mostly unchanged.

Figure 1

Share of Payment Instrument Usage by Year

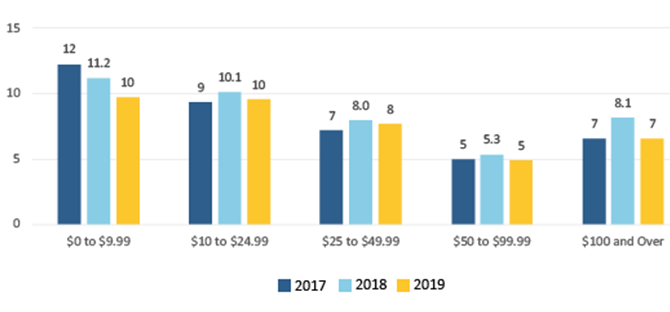

The decline in the total number of cash payments was largely the result of a decrease in the number of small value cash payments under $10. In addition to this decline in small value cash payments, the total number of small value payments also decreased to 10 payments in 2019, down from 11 in 2018 (Figure 2). The decrease in number and share of small value cash payments over the last four years has led to an increase in the share of card payments. However, the number of small value debit card payments has remained unchanged since 2017. This suggests the increasing share of small value debit card payments is not due to an increase in card usage, but to a decrease in the reported number of small value cash payments.

Figure 2

Total Distribution of Purchases

In contrast to the trends for small value payments, the number of larger value purchases has been consistent since 2017 (Figure 3). From 2017 to 2019, cash has been used between five and six times per month for payments above $10. This consistency in the number of payments applies not only to cash payments, but also to the share and usage of credit cards, debit cards, and electronic payments.

Figure 3

Payment Instrument Usage by Purchase Amount – 2019

Section 2. Who is using cash?

Payment preferences remain consistent

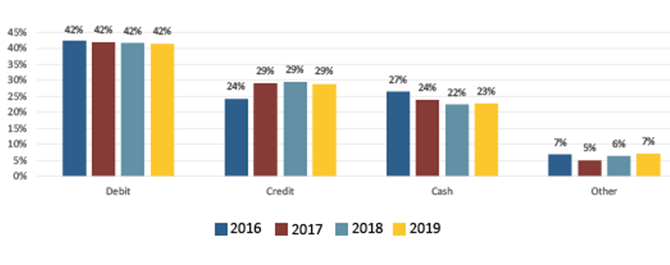

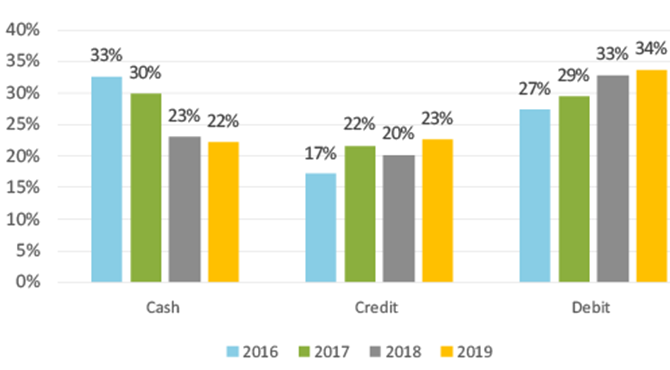

The changing payments landscape does not seem to be significantly influencing consumers’ long-held preference for cash, credit cards, and debit cards yet. These three instruments combined have accounted for at least 93 percent of stated preferences since 2016, though there have been preference shifts between these instruments as Figure 4 shows. Participants’ 2019 payment preferences remained similar to those of the last three years, with 42 percent preferring to pay with debit cards, 29 percent preferring to pay with credit cards, and 23 percent preferring cash. Analogous to preferences, debit card’s payment share has remained consistent, credit’s share has increased, and cash’s share has decreased.

Figure 4

Payment Preference from 2016 – 2019

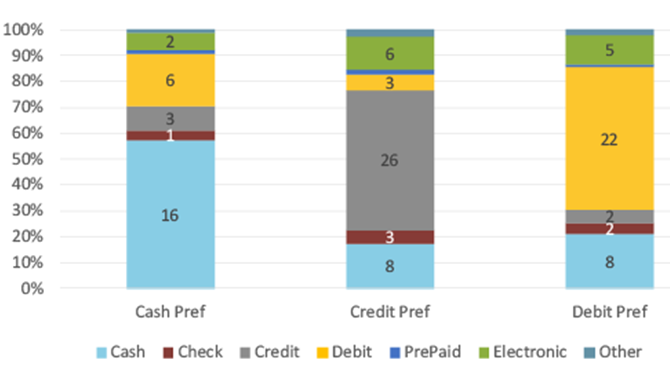

Consumers’ stated payment preferences continue to align with their actual payment habits, where participants report making the majority of their payments with their preferred instrument. However, the use of other instruments varied depending on one’s initial preference. Cash-preferring consumers tended to use debit cards as a backup payment at nearly double the rate as credit cards (Figure 5). Conversely, consumers who preferred credit or debit cards were more likely to use cash as a secondary payment instrument instead of using another card payment. This secondary cash use by those preferring cards aligns with what diarists indicated when asked about their backup payment preferences. It also explains why the share of cash use is relatively high compared to stated preferences. Those who prefer cards, on average, use cash approximately eight times per month, which accounts for nearly 19 percent of their total payments.

Figure 5

Payment Instrument Use by Preference – 2019

Cash remains popular among younger and older age groups

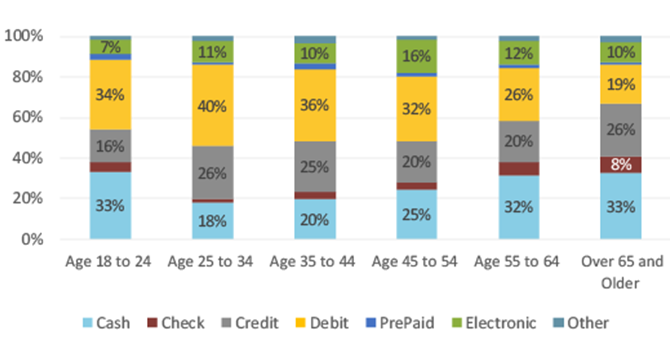

The overall pattern of cash use by age cohort remains consistent. While cash use is prevalent among people of all ages, the share of cash use is highest among individuals aged 18 to 24 and those 55 and older (Figure 6). Conversely, individuals age 25 to 44 use cash less often than any other age cohort and use both debit and credit cards more frequently than cash.

Figure 6

2019 Percent Payment Instrument Usage by Age

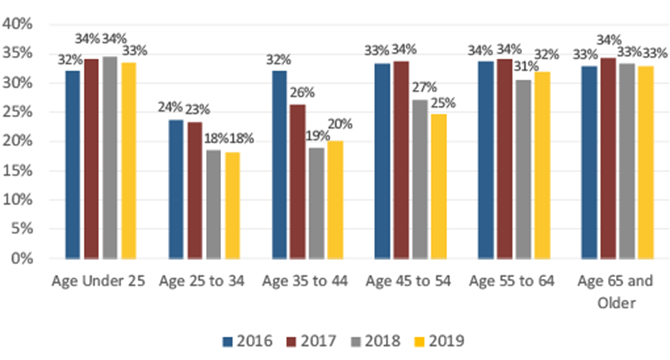

The share of cash use across all age groups did not change dramatically from 2018 to 2019, with the largest change being a 2 percentage point drop for those age 45 to 555. This is a shift from the prior Diary, which had decreases ranging from five to seven percentage points for those aged 25 to 54 (Figure 7). The data also shows that the change in cash use by individuals between the ages of 25 and 54 caused the aggregate 5 percentage point decline in cash use between 2017 and 2018. In contrast, those in the 18 to 24 and 55 and older age groups have been largely consistent with their share of cash use over the last four years.

Figure 7

Cash Use by Age Group and Year

Additionally, those age 35 to 54 have reported the largest percentage point decrease of cash use, 11 percentage points, of any cohort since 2016 (Figure 8). The decrease of cash purchases for those 35 to 54 has been offset by increases in debit card and credit card usage with the shares increasing by six and seven percentage points, respectively, since 2016.

Figure 8

Select Yearly Payment Share for those Age 35 – 54

Section 3. Who is holding cash?

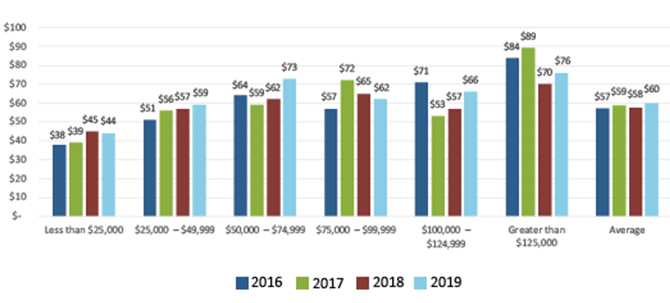

Older individuals and high-income households continue to hold more cash

As part of the Diary, individuals are asked to report the amount of cash held in their pocket, purse, or wallet at the end of each day. In general, the average daily value of cash held by individuals has remained consistent between 2016 and 2019, with participants holding approximately $60 each day (Figure 9). As has been the case in previous years, average cash holdings vary depending on one’s age and household income. Individuals over the age of 65 increased their average holdings to $116, continuing the upward trend started in 2016. No other age group shows such a consistent upward trend over the same time period. Each age cohort’s cash holdings has been fairly consistent across the past four years, with increased holdings in some years and decreased holdings in others. One interesting change from 2018 was the increase in cash holdings for 18 to 24 year olds, who nearly doubled their average amount held. This increase was simply driven by some individuals holding more cash. For example, approximately half of these individuals held about the same amount as last year with the median value of cash holdings being $4 in 2018 and $6 in 2019. However, the increase in cash holdings was not the result of a few outliers. Individuals in the top 25 percent of cash holdings increased the average held from $30 in 2018 to $52 in 2019, and for the top 10 percent of cash holders the increase went from $60 to $110 over the same time period.

Figure 9

Average Daily Holdings by Age & Year

Cash holdings vary within income groups each year, but individuals from higher income households generally hold a greater amount of cash throughout the day than those from lower income households (Figure 10). However, the correlation between holdings and household income is not as strong as the correlation between holdings and age. Additionally, there may be a convergence of holdings across household income. Individuals living in households earning more than $125,000 hold the largest value of cash ($76); however, the 2019 data shows the difference in daily holdings between this highest-income group and those in households making $50,000 to $74,999 is only $3. This difference is much smaller than the $20 difference in holdings reported in 2016 for the same two groups, and a similar pattern is present for all other household income groups as well.

Figure 10

Average Daily Holdings by Household Income and Year

Section 4. Where is cash being used?

While online shopping increases, cash is the most used in-person payment instrument

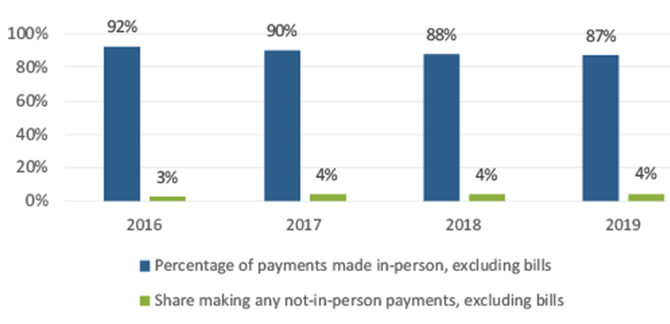

Participants continue to report an increasing share of online or “not-in-person” payments, specifically non-bill payments. Figure 11 shows both the share of non-bill payments that took place in-person as well as the share of individuals who made at least one not-in-person payment.

Figure 11

Share of In-Person Payments and the Share Making at Least One Not-In-Person Payment, by Year

While the decrease of in-person payments from 2018 to 2019 was not statistically significant, the trend over the last four years is consistent and statistically significant between 2016 and 2019. Additionally, the 4 percent of individuals who report making any online payments, excluding bills, shows the growth of individuals making online payments is increasing rather slowly over time. While there has not been significant growth of individuals making online payments, those who are shopping online look to be shifting habits slowly towards online purchases. These slow but consistent changes suggest the share of online payments will likely continue to increase over time.

Given the year to year change for in-person payments has ranged from a one to two percentage point decline, it is important to understand the effects this changing landscape could have on cash. While cash’s share of all payments declined four percentage points since 2017, cash has been the most used in-person payment instrument in each Diary study. Cash accounted for 35 percent of in-person payments in 2019, unchanged from 2018 (Figure 12). As shopping continues to move to online platforms, the decline of in-person payments is important to understand because cash transactions, unlike cards, cannot be conducted online.

Figure 12

Percent Share of In-Person Payment Use

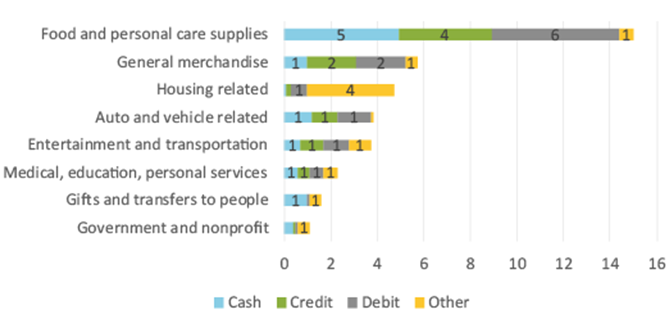

One factor affecting the likelihood of cash payments is that cash is not used uniformly across all merchant types. Cash is most often used at merchants that offer food and personal care supplies, where it was used for approximately five payments per month in 2019 (Figure 13), down from seven payments in 2017. The average number of cash payments at other merchant types, excluding housing related and government/nonprofit, is about one payment per month. Given the relatively large number of cash purchases for food and personal care supplies, there is a greater likelihood of a decline in total cash payments if consumers shift their in-person purchases of these items to an online shopping platform.

Figure 13

Total Transactions by Merchant Type in 2019

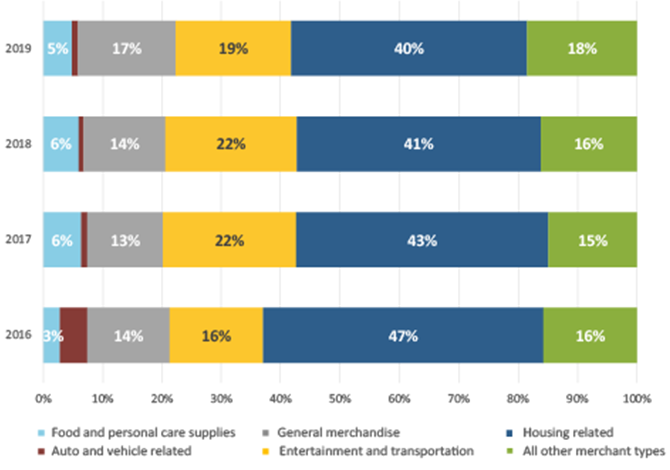

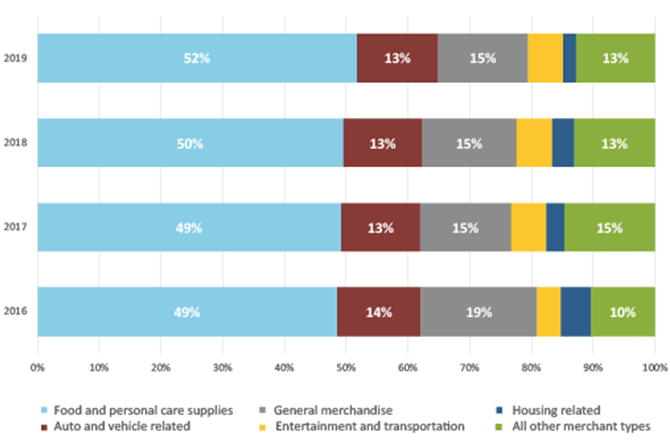

However, this shift to not-in-person payments for food and personal care supplies does not appear to have taken place. The percentage shares of payments at each merchant type for both in-person and not-in-person payments are shown in Figure 14 and Figure 15. Smaller merchant types are consolidated and only the more frequented merchant types are shown6. The payment shares by merchant type for both in-person and not-in-person transactions have changed slowly over time, though these yearly changes are not statistically significant7. It is important to note that the payment shares for not-in-person, food and personal care supplies have remained consistent since 2017. While there has been a decline in payments at this merchant type, specifically cash payments, the number and share of online food and personal care supplies payments has not increased. This suggests that changes in cash use for food and personal care supplies are likely attributed to consumers using cards for a higher share of in-person purchases, rather than consumers shifting their purchases to online platforms.

Figure 14

Share of Not-in-Person Payments by Year and Merchant Type

Figure 15

Share of In-Person Payments by Year and Merchant Type

Conclusion

The 2020 Diary findings were consistent with the prior year as the share of cash usage was consistent and the changes for debit and credit cards were not statistically significant. Such stability in the share of cash use suggests that consumers continue to value cash even as payment instrument choices continue to expand. While we observe consistencies in payment patterns, we see a simultaneous decrease in the use of cash and consistent usage of both debit and credit cards.

Although consumers are using cash less often, specifically for payments under $10, the amount of cash they hold on a regular basis has remained consistent at around $60 since 2016. Individuals age 18 to 24 and 55 and older continue to use cash for approximately one-third of payments, while those age 35 to 54 use cash approximately 20 percent of the time, a 10 percentage point decline from 2016. Cash continues to be the most used payment instrument for transactions that take place in-person, which is where almost three-quarters of all payments take place and where about 87 percent of non-bill payments are conducted.

The results of the 2020 Diary continue to highlight that many consumers value and prefer to use cash for everyday payments, while others use cash as a backup payment instrument, or for the convenience of small value payments even while preferring debit and credit cards. The wide range of use for cash continues to show its importance to consumers despite the number of competing payment technologies available in the economy today.

Appendix

Diary of Consumer Payment Choice

The Federal Reserve’s national Cash Product Office (CPO) uses data from the Diary of Consumer Payment Choice (Diary) to understand consumer cash use and anticipate its ongoing role in the payments landscape. Developed by the Federal Reserve Bank of Boston’s Consumer Payment Research Center (CPRC) and currently managed by the Retail Payments Risk Forum at the Federal Reserve Bank of Atlanta, the Diary includes a unique, nationally representative survey of consumer shopping and payment decisions administered by the University of Southern California (USC) Dornsife Center for Economic and Social Research. USC’s Understanding America Study panel comprises approximately 6,000 individuals from across the United States, of which 3,016 panelists completed the 2019 Diary.

By tracking consumer payment transactions and preferences during the month of October every year, the CPO compares cash with other payment instruments, such as debit and credit cards, checks, and electronic options. Diary participants also report the amount of cash on-hand after each survey day, as well as any cash deposits or withdrawals conducted throughout the day. The CPO analyzes the Diary data, including the impact of age and income on an individual’s payment behavior and preferences. This detail of the stock and flow of cash at an individual level provides insight into how consumers use cash.

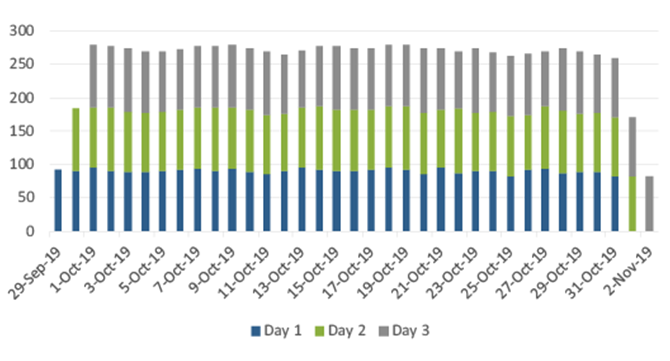

To ensure a nationally representative sample, responses are weighted to match national population estimates based on the Census Bureau’s Current Population Survey. The Diary is administered throughout the month of October, which was selected as a “typical month” to minimize seasonality effects in consumer spending patterns. Participants were each assigned a three day period within the month, with some individuals assigned a starting date in late September and others assigned to finish in early November. As Figure A1 shows, this ensures a near uniform distribution of participants for each October day. For a more detailed description of the Diary of Consumer Payment Choice, see Angrisani, Foster, and Hitczenko (2017b); Angrisani, Foster, and Hitczenko (2018); Greene, Schuh, and Stavins (2018); Greene and Schuh (2017); Greene, O’Brien, and Schuh (2017); and Schuh (2017).

Figure A1

Diary Participation by Diary Day and Date

About the Cash Product Office

As the nation’s central bank, the Federal Reserve ensures that cash is available when and where it is needed, including in times of crisis and business disruption, by providing FedCash® Services to depository institutions and, through them, to the general public. In fulfilling this role, the Fed’s primary responsibility is to maintain public confidence in the integrity and availability of U.S. currency.

The Federal Reserve System’s Cash Product Office (CPO) provides strategic leadership for this key function by formulating and implementing service level policies, operational guidance, and technology strategies for U.S. currency and coin services provided by Federal Reserve Banks nationally and internationally. In addition to guiding policies and procedures, the CPO establishes budget guidance for FedCash® Services, provides support for Federal Reserve currency and coin inventory management, and supports business continuity planning at the supply chain level. It also conducts market research and works directly with financial institutions and retailers to analyze trends in cash usage.

References

Angrisani, Marco, Kevin Foster, and Marcin Hitczenko. 2017b. “The 2012 Diary of Consumer Payment Choice: Technical Appendix.” Federal Reserve Bank of Boston Research Data Reports No. 17-5.

Angrisani, Marco, Kevin Foster, and Marcin Hitczenko. 2018. “The 2015 and 2016 Diaries of Consumer Payment Choice: Technical Appendix” Federal Reserve Bank of Boston Research Data Reports No. 18-2.

Greene, Claire, and Scott D. Schuh. 2017. “The 2016 Diary of Consumer Payment Choice.” Federal Reserve Bank of Boston Research Data Reports No. 17-7.

Greene, Claire, Shaun O’Brien, and Scott Schuh. 2017. “U.S. Consumer Cash Use, 2012–2015: An Introduction to the Diary of Consumer Payment Choice.” Federal Reserve Bank of Boston Research Data Reports No. 17-6.

Greene, Claire, Scott D. Schuh, and Joanna Stavins. 2018. “The 2012 Diary of Consumer Payment Choice: Summary Results.” Federal Reserve Bank of Boston Research Data Reports No. 18-1.

Schuh, Scott. 2017. “Measuring Consumer Expenditures with Payment Diaries.” Federal Reserve Bank of Boston Research Department Working Papers No. 17-2.

Footnotes

1. Previous Diary studies were conducted in 2012 and 2015. The 2012 study used RAND’s American Life Panel, and the 2015 study took place from October 16 through December 15.

2. FRB Atlanta publication (forthcoming)

3. A supplemental Diary paper published in July 2020 on “Consumer Payments & the COVID-19 Pandemic” is available.

4. “Electronic” payments include bank account number payments, online banking bill pay, and payment services like PayPal. “Other” payments include money orders, traveler’s checks, transfers, and direct deposit.

5. The difference in share is not statistically significant, but the difference in actual cash usage is statistically different as cash transactions declined to 9.7 payments from 13.0 payments. In addition, the difference in share was not statistically significant due to 45 to 54 year olds reporting fewer overall payments.

6. The other category includes payments to “Medical, education, personal services,” “Financial, professional, miscellaneous services,” “Government and nonprofit,” and “Gifts and transfers to people.”

7. Differences between 2016 data and the other years are likely due to a change in how merchants were defined. In 2017 the number of merchant types was reduced and, as a result, merchant type comparisons with 2016 are not equivalent.