Legend goes that when notorious bank robber Willie Sutton was asked why he

robbed banks, he said, because that’s where the money is. When asked why we

should be concerned with the middle neighborhoods of our legacy cities, one practitioner

said, “because that’s where the people are.”

Legacy cities represent a unique subset of American cities because they struggled to

manage a severe loss of manufacturing jobs and experienced significant population loss.1

Legacy cities like Detroit and St. Louis have declined in population by nearly 62 percent

since their peak in the 1950s. Others like Pittsburgh, Baltimore, and Philadelphia lost 55

percent, 34 percent, and 26 percent of their 1950 populations, respectively.

Across legacy cities, middle neighborhoods generally are home to a large share of the

people and households that remain. Although for city leaders, protecting the population

that remains in legacy cities is a strategic priority, they typically have not focused on middle

neighborhoods. Instead, with some exceptions, they are now more focused on high-profile

downtowns that they believe will build the local tax base and create jobs. Middle neighborhoods

generally do not get the attention of nonprofits and community development corporations

(CDCs) either. Such organizations usually focus on the most distressed areas, and

because middle neighborhoods are not the most blighted or highest poverty areas, they typically

do not receive the benefit of federal community development funds. Notwithstanding

the customary lack of attention, middle neighborhoods represent a significant part of the tax

base that supports critical municipal functions.

The decline of federal resources to support community and economic development has

motivated policymakers to use evidence when allocating their increasingly scarce housing

and community development resources. In an environment of limited resources, community

development leaders are challenged to rediscover the value and the importance of middle

neighborhoods.

Our core argument here is that middle neighborhoods in legacy cities are vital because

they are home to a substantial segment of a city’s population and therefore provide the tax

base on which so many city services rely. Further, despite the population decline and job

losses in legacy cities, middle neighborhoods have relatively stable populations. These areas are generally racially mixed, and residents are reasonably well educated, employed, and in

households with modest (or higher) incomes. Moreover, middle neighborhoods tend to be

relatively affordable and, therefore, are generally opportune places for an important segment

of a city’s population. Attention to these places is critical because, we believe, residents of

middle neighborhoods possess the economic wherewithal to have choices, and should the

value proposition for their communities begin to fail, they could exercise those choices and

leave. Underscoring the importance of this notion, Philadelphia’s former mayor John Street

called these neighborhoods the “key battlegrounds”—lose them and you lose the city.2

To explore our argument, this chapter offers a data-based description of the middle neighborhoods

of several legacy cities: Baltimore, Detroit, Milwaukee, Philadelphia, Pittsburgh,

and St. Louis. These are not a random selection of legacy cities; they are cities for which

Reinvestment Fund has completed its Market Value Analyses (MVAs), described below,

within the last five years.3

It is through brief case studies of each of these cities that we

can systematically understand what the middle neighborhoods look like demographically,

socially, and economically. Further, through insights gained from interviews with practitioners

in each of these cities, we explore the strengths, challenges and opportunities for middle

neighborhoods.

A Changing Funding Environment in Legacy Cities

An obvious place to begin a brief review of the historical funding context of these markets

is with the federal Community Development Block Grant (CDBG) program. The CDBG

program has historically been a, if not the, critical source of funds for communities across the

United States to address housing, community and economic development, infrastructure,

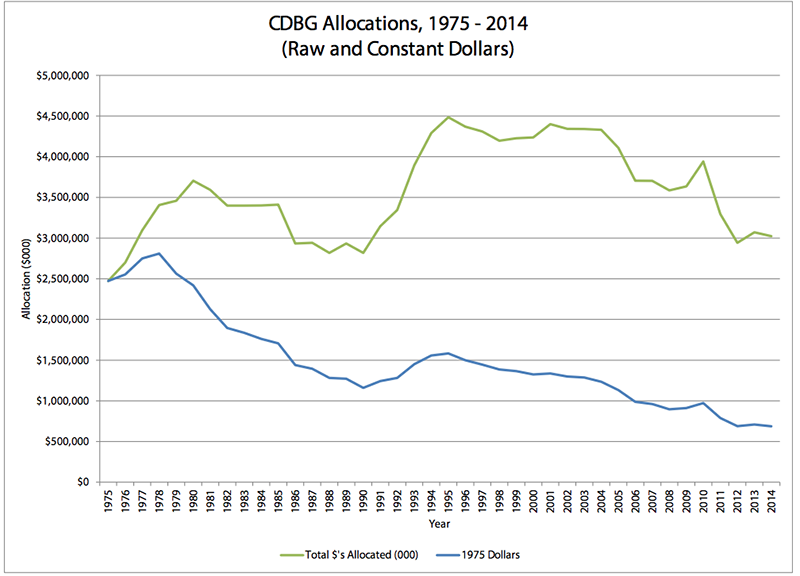

and related needs. As Figure 1 shows, between 1975 and 2014, annual federal allocations

have fluctuated substantially, but overall are down 72 percent in inflation-adjusted terms.

Although other sources of funds now support affordable housing (e.g., the Low Income

Housing Tax Credit, which began in 1986), the loss of CDBG is crucial because of the flexibility

in its potential uses.

Figure 1

Annual CDBG Allocations (Raw and Inflation-Adjusted), 1975-2014

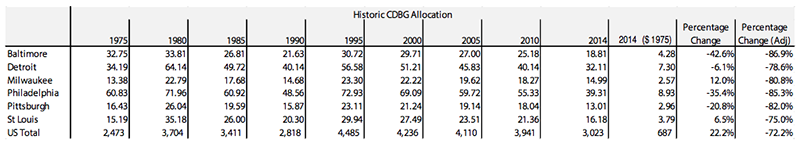

Table 1 presents data on the annual CDBG allocation in the six legacy cities we focus on

here. Between 1975 and 2014, every city except for St. Louis and Milwaukee experienced a

nominal loss in its CDBG allocation. In real terms, although the national average CDBG allocation

declined by 72 percent, the allocations in these selected legacy cities declined from 75

percent in St. Louis to 86.9 percent in Baltimore (in real dollars).4

The implication for cities is

manifest: less federal funding to address critical community and economic development needs.

These cuts may not have had as direct an impact on middle neighborhoods, because, as

more than one interviewee noted, the CDBG regulations and guidance historically made it

difficult to direct CDBG funds to these areas. At the same time, however, the loss of CDBG

funds has meant that more areas are competing for the same shrinking pool of resources.

The relative scarcity of public funds in today’s world of public investment and development

has served to further emphasize the importance of middle neighborhoods when considering

strategic deployment and return on investment of public dollars.

Table 1

CDBG Allocations (million $) 1975-2014

Economic and Demographic Changes in Legacy Cities

In addition to changes in the funding environment, the population and the economy

also changed in legacy cities.5

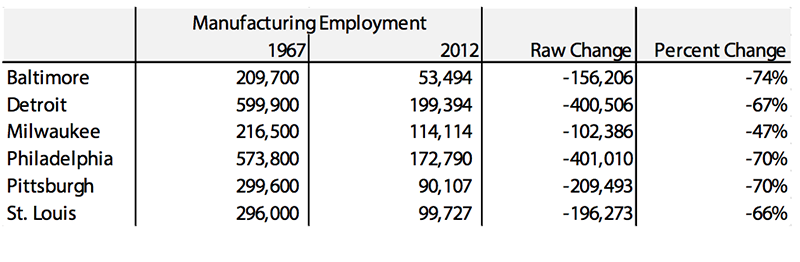

Others have chronicled the national decline in manufacturing,

and the experience of legacy cities is generally more severe because legacy cities had historically

relied more heavily on manufacturing as the bedrock of their local economies. As Table

2 shows, with the exception of Milwaukee, the magnitude of the decline in manufacturing in

legacy cities between 1967 and 2012 is more than double the national average (31 percent).

Table 2

Change in Manufacturing Employment, 1967-20126

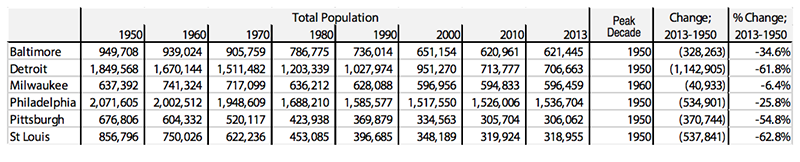

The loss of population in these legacy cities was also severe. When city residents move,

they frequently move from the urban core to the suburban counties in the region, and the

movers are typically those who earn higher incomes and have higher educational attainment.

Table 3 presents population data for the six legacy cities from 1950 to 2013. All except

Milwaukee have lost population from their peaks in 1950 (Milwaukee peaked in 1960). Far

and away, Detroit saw the most severe population loss at more than 1.1 million people,

representing 62.3 percent of the 1950 population. St. Louis lost 538,000 people, or 62.8 percent of the 1950 population. Philadelphia experienced a comparable raw population loss

(524,000), which represented 25.8 percent of its 1950 population.

Table 3

Population of Selected Legacy Cities, 1950-2013

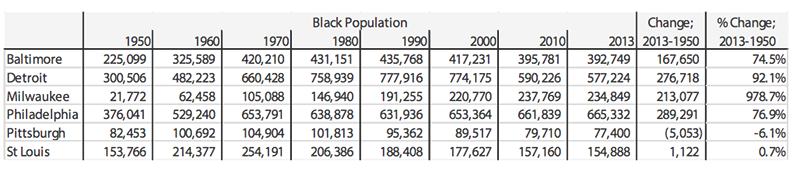

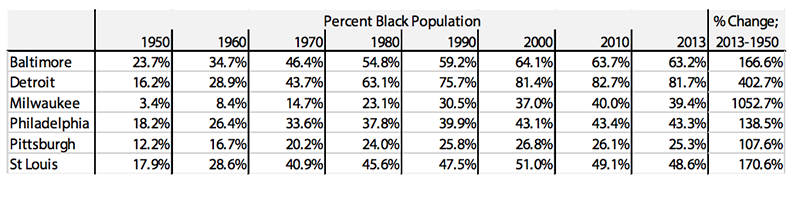

Except for Pittsburgh, each of the legacy cities experienced substantial growth in the

number and percentage of minority (especially African American) residents (Table 4 and 5).

The African American population in Pittsburgh declined, but as a percentage of the total

population, it increased.7

Table 4

Black Population of Legacy Cities, 1950-2013

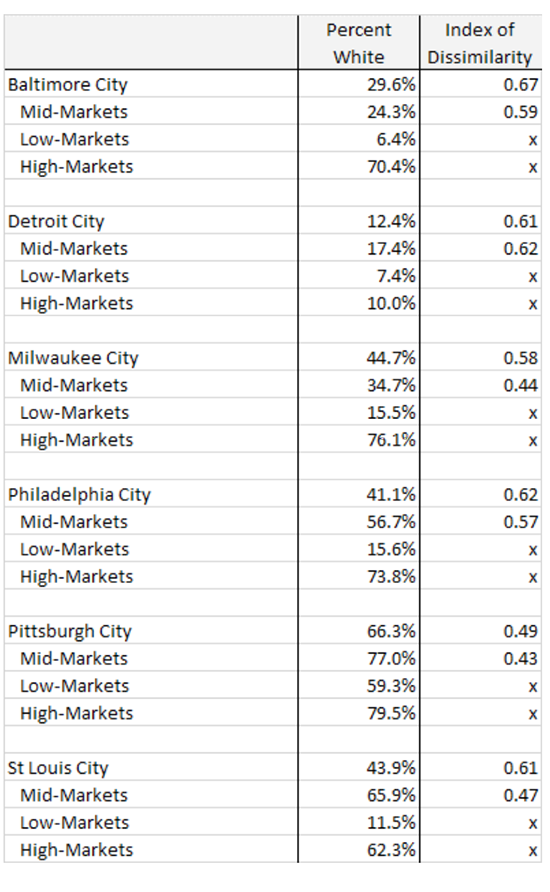

Table 6 shows that middle neighborhoods are generally more representative of the citywide

racial composition than either stronger or weaker MVA market areas. Moreover, these

areas are generally equally or more racially integrated than the city as a whole.8

Table 5

Percentage Black in Legacy Cities, 1950 – 2013

Table 6

Racial Composition and Segregation in Legacy Cities. Lower scores on

the Index of Dissimilarity mean greater integration. See footnote 8.

Using the Market Value Analysis to Identify Middle Neighborhoods and

Target Investment

Although this chapter focuses on middle neighborhoods, it is important to point out that

there is no bright-line definition of a middle neighborhood. One tool cities have used to

identify their middle neighborhoods is Reinvestment Fund’s Market Value Analysis.

Reinvestment Fund first created the MVA in 2001 in support of former Philadelphia

Mayor John Street’s Neighborhood Transformation Initiative.9

The MVA summarizes a set

of market indicators to measure the strength or weakness of the real estate market in individual

areas of a city, ordinarily at a jurisdiction’s census block groups.

Typically, the MVA relies on a set of indicators obtained from the local jurisdictions (i.e.,

administrative data). Usual indicators include median residential sale prices; foreclosures as

a percentage of housing units (or residential sales); variation in sale prices; percentage of all

housing units that are vacant; percent of all parcels that are vacant; percent of (occupied)

housing units occupied by the owner; percent of properties with building permits representing

new construction or substantial rehabilitation; and mixture of land uses. Although

this group of indicators may vary to a degree from city to city, the MVA uses a common set

of indicators that reflect the market conditions that an investor or developer might observe

when evaluating areas for investment or intervention.

Most of these indicators are acquired at an individual address level and then aggregated

to the census block group. Based on experience, the census block group is large enough to

ensure that the data are reasonably stable yet small enough to ensure that the natural mosaic

of a community is revealed.

Although the MVA is not designed to identify middle neighborhoods per se, the results

make clear which areas of a city are strongest, which are most distressed, and which fall in the

middle. We identified MVA markets that, across the spectrum of all local markets, generally

reflect the typical levels of each MVA component indicator.10 Next, we conferred with local

experts in each legacy city to test the appropriateness of our designation of market types as

middle neighborhoods. Although not every expert defined middle market areas exactly as

we did, we achieved a reasonable consensus in most cities. From both of those processes,

we identified the typically three or four MVA market categories that we designated middle

markets, which then we will describe as middle neighborhoods.11

Each of the other market types were then categorized as low if they were in MVA categories

that represented more market stress, and high if they were in categories with less stress. We caution that because of the subjectivity in the designation of middle markets, small

differences between middle markets and the other categories should not be emphasized.

Each of the MVAs presented in this chapter was created within the last five years.12

Data and Methods

The data sources for this chapter are many. As part of the MVA process in each city, we

gathered data from the respective housing or planning department, redevelopment authority,

property assessor, and/or Sheriff. Occasionally, we obtain data from propriety data sources

(e.g., Valassis Lists, First American Real Estate Solutions) when administrative data do not

exist. We also occasionally use census and American Community Survey (ACS) data, but for

a variety of reasons, these are not favored as market indicators for use in the MVA.13

Prior to data aggregation for each MVA indicator, the data components are cleaned and

validated with local subject-matter experts and then through fieldwork, where researchers

review the data by systematically driving through the streets of the MVA city. Often the

researchers are accompanied by local practitioners who have specific knowledge of an issue

(e.g., abandonment and vacant land) or a neighborhood(s).

Finally, researchers use a statistical cluster analysis to combine cases (i.e., block groups),

based on all of the measured indicators, into categories so that each group shares a common

pattern of characteristics. The groupings are designed to maximize the similarity of areas

within groups and maximize the differences between groups. The cluster analysis results are

mapped and validated using a similar field validation process. Additional social, economic,

and demographic characteristics in this chapter are gathered from the decennial censuses of

2000 and 2010 as well as the ACS, 2009-2013 five-year sample estimates.

Middle Neighborhoods14

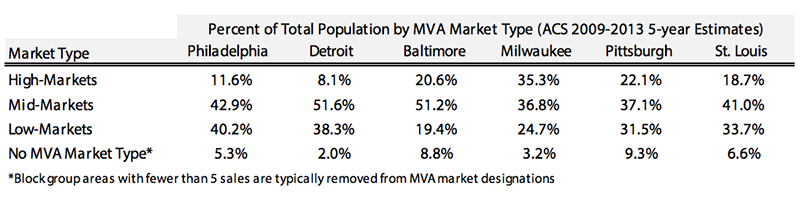

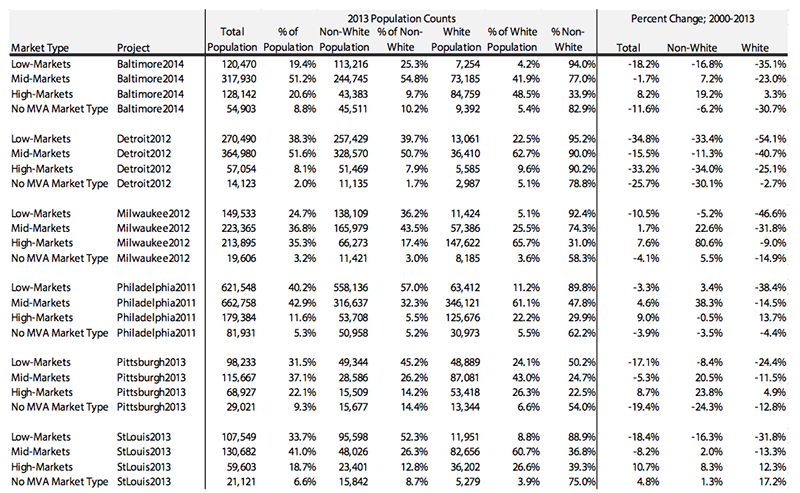

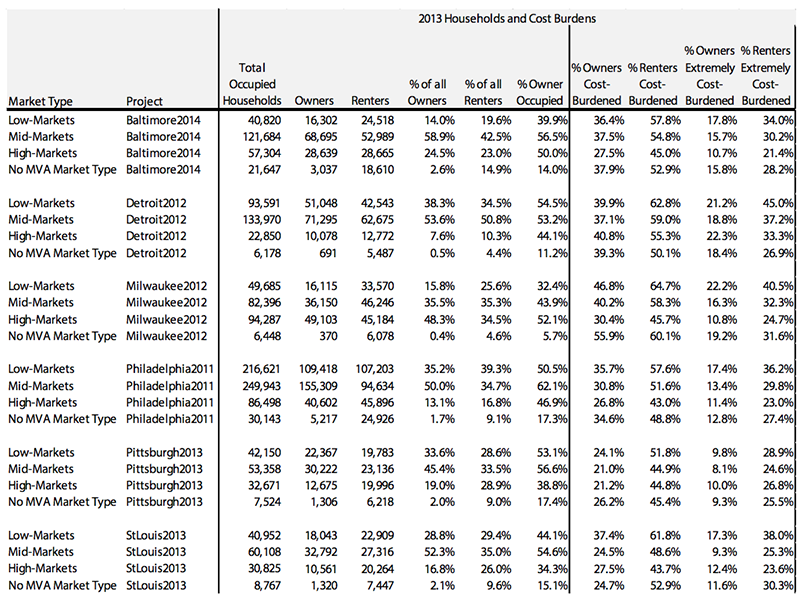

Across each of the studied cities, the middle neighborhoods are home to the largest

segment of the population. In Detroit and Baltimore, more than one-half of the population

resides in the MVA middle neighborhoods as defined by the MVA; Philadelphia’s and St.

Louis’ middle neighborhoods are home to more than 40 percent, while Milwaukee and Pittsburgh

house approximately 37 percent (Table 7).

Table 7

Population Distribution by Market Type

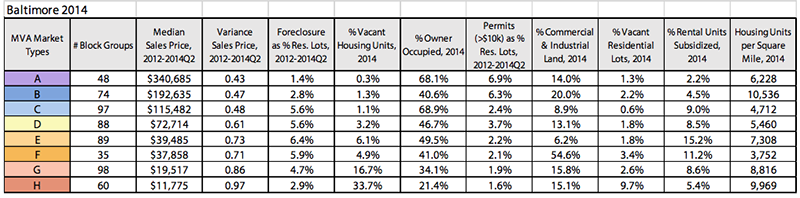

Baltimore: Reinvestment Fund created multiple MVAs dating to 2005 in Baltimore. The

most current MVA (Table 8) presents a similar but not identical portrayal of Baltimore’s

housing market than previous MVAs. Aside from pockets of market stabilization and

improvement (e.g., the Fells Point and Canton sections on the Patapsco River or Patterson

Park to the north of Canton) and entrenched distress (e.g., Sandtown/Winchester and Park

Heights) much of Baltimore shows modest strength or modest decline.

Baltimore’s middle neighborhoods are home to 318,000 residents, equal to 51.2 percent

of Baltimore’s total population. Seventy-seven percent of residents are nonwhite in middle

neighborhoods. Notwithstanding the relatively reasonable price of housing in Baltimore and

modest income levels, owner, and especially renter, cost burdens are elevated. In fact, costburden

levels for Baltimore’s middle neighborhoods look more like their distressed counterparts

than they do the stronger areas where incomes are substantially higher and the level of

poverty is well below the citywide average. Residents of Baltimore’s middle neighborhoods

tend to be reasonably well educated, certainly when compared with residents of the more

distressed market areas.

Sales prices in Baltimore’s middle neighborhoods range between $40,000 and $115,000—a

wide range but still affordable to households earning a modest annual income. These middle

neighborhoods face significant pressure from foreclosures and are not undergoing significant

maintenance or upgrading as evidenced by low levels of permitting. Middle neighborhoods

in Baltimore are where renters with subsidies are finding homes, although they tend to be

in the lower-priced areas of the markets. We note also that these areas run the full range of

owner occupancy.

Driving through Baltimore’s middle neighborhoods, one sees a full array of Baltimore’s

housing style, quality, level of maintenance, tenure, price points, and general curb appeal.

But mostly, they represent places where modest-income families can find a home to meet

their basic needs. At the same time, it is clear that maintenance is deferred in some of

the market areas, conditions that most certainly undermine housing values and community

stability.

Table 8

Characteristics of Baltimore’s Markets

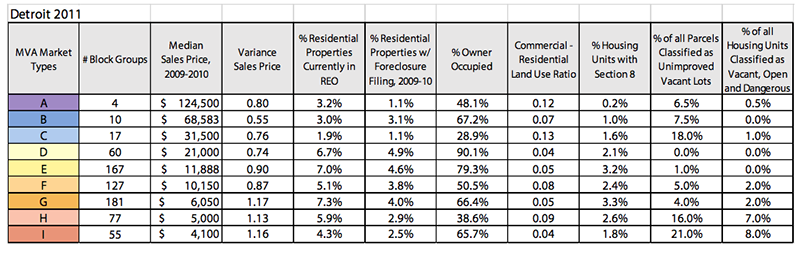

Detroit: Detroit’s MVA (Table 9) was completed at a time when a state takeover and the

potential bankruptcy of Detroit was becoming increasingly likely. Home prices in Detroit

are substantially lower than in any of the other legacy cities. Even at the strongest end of the

market, homes were selling for prices averaging under $125,000. Homes in Detroit’s most

distressed areas averaged under $5,000.

Like Baltimore, Detroit’s middle neighborhoods are home to more than 50 percent of

its population. There is no substantial difference in racial composition across the Detroit

market categories. Although Detroit lost a significant percentage of its population, the

losses in middle neighborhoods were substantially less severe, even compared to its strongest

markets. Middle neighborhoods have a higher proportion of owner-occupied housing

than even Detroit’s strongest markets. This is a function of the relatively recent conversion

and rehabilitation of housing stock in the downtown and midtown areas, much of which is

now renter-occupied. Owner cost-burdens (including the extremely cost burdened) for those

residing in the middle neighborhoods of Detroit is relatively low compared with other parts

of the city. Adult residents of Detroit’s middle neighborhoods have reasonably similar levels

of education as their counterparts in the stronger market areas. Although Detroit’s poverty

rate is generally higher than other legacy cities, the city’s poverty rate in middle neighborhoods

is relatively low.

The high level of real estate owned (REO) homes (those held in the inventory of investors

after foreclosure), homes pending mortgage foreclosure actions, as well as the amount

of vacant land (created through demolition) are an obvious drag on the value and desirability

of Detroit’s middle neighborhoods. But, consistent with other legacy cities, several of

the middle areas are highly owner-occupied. Further, middle neighborhoods have a higher

proportion of the rental stock occupied by renters with a subsidy. Subsidized renters who

live in middle neighborhoods are fortunate because these areas are some of the most stable

places in Detroit.

Compared with other legacy cities for which we have completed MVAs, Detroit is unique

in that the physical distance between areas of market strength and distress is extremely small,

sometimes the width of a single street. It is clear that the city’s middle neighborhoods (e.g.,

East English Village, Grandmont, Rosedale, Sherwood Forest) are places where families dedicate significant effort to maintain their communities, despite everything going on around

them. A home in pristine condition with a perfectly manicured lawn next to a burned-out

structure is a common sight. It is here that signs frequently notify passers-by that a town

watch is active. Many of the communities also appear to have worked to maintain their

historic identity. However, more than in the other legacy cities, vacancy and abandonment

(and apparent vacancy caused by fire or demolition) and properties warehoused in a lender

or investor’s REO portfolio are manifest.

Table 9

Characteristics of Detroit’s Markets

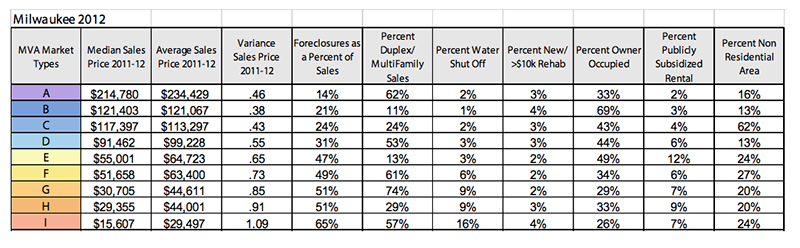

Milwaukee: Milwaukee’s middle neighborhoods are home to approximately 37 percent of

the city’s population, generally lower than other legacy cities. However, a substantially larger

share of the Milwaukee population resides in stronger markets and a smaller population is in

distressed market areas. Milwaukee’s middle neighborhoods are places with modest levels of

owner occupancy and a substantial percentage of sales of duplexes and other small multifamily

units (Table 10). Middle neighborhoods are still being affected by foreclosures although, unlike

other legacy cities, Milwaukee’s more distressed markets are now being hit harder.

Milwaukee’s population was stable between 2000 and 2013, with the middle neighborhoods

growing by 1.7 percent. The largest proportionate loss was found in the more

distressed market areas of Milwaukee. Milwaukee is similar to the other legacy cities in that a

substantial share of the city’s non-white population lives in middle neighborhoods. Though

sales prices are relatively low, Milwaukee’s middle neighborhoods are not particularly affordable

for owners or renters. A relatively high percentage of residents are cost burdened.

Milwaukee’s middle neighborhoods are split: markets with homes prices ranging from

$90,000 to $120,000 and those, albeit often similar in appearance, with home prices from

$50,000 to $70,000. Some of this bifurcation may be related to Milwaukee’s legacy of racial

segregation. However, some of the price difference can also be accounted for by the much

higher levels of foreclosure activity in the less expensive neighborhoods. History tells us

though that segregation and foreclosures are not unrelated phenomena.

Table 10

Characteristics of Milwaukee’s Markets

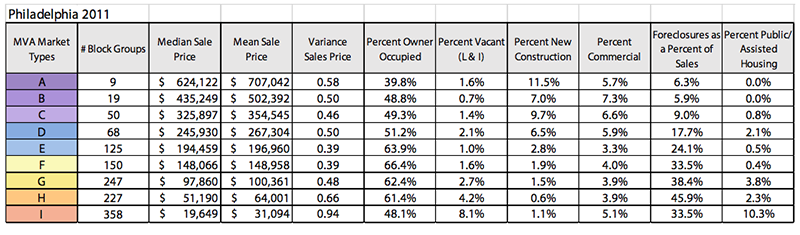

Philadelphia: Overall, 42.9 percent of Philadelphia’s residents (663,000) live in the

middle neighborhoods, a 4.6 percent rise over the decade. The nonwhite population of Philadelphia

is over-represented in the more challenged market areas of Philadelphia. Although

47.8 percent of the residents in middle neighborhoods are nonwhite, disproportionately

fewer (32.3 percent) of nonwhites live in middle neighborhoods.

Philadelphia stands out among the group of legacy cities in a number of ways. First, it has

the largest population. Second, a considerable share of Philadelphia’s residential population

resides in the strong market areas in the downtown. Third, Philadelphia’s residential downtown,

along with a few communities, particularly in the northwest section, have sale prices

well over $600,000 (price points not frequently observed in the other cities). The middle

neighborhoods, however, are relatively affordable and are unmistakably Philadelphia’s

owner-occupied communities (Table 11). New construction is rare in these areas; however,

that which is new will be found largely in the northwest and the far northeast sections of

the city. Mortgage foreclosures continue to affect these areas; a second wave related to the

recession came on the heels of a significant number of foreclosures in the early 2000s due to

to subprime mortgages and abusive lending practices. Unlike some of the other legacy cities,

middle neighborhoods in Philadelphia are largely absent renters with subsidies. Those renters

are generally clustered in the most distressed markets.

Philadelphia’s middle neighborhoods are home to 50 percent of all owners, and these

areas have the highest typical owner occupancy rate at 62.1 percent. Notwithstanding the

prices in Philadelphia’s strongest markets, Philadelphia’s middle neighborhoods are relatively

affordable compared with the other legacy cities as evidenced by the relatively low levels of

owner and renter cost burdens (among the cities examined, only Pittsburgh and St. Louis

have lower levels of cost burdens). It is interesting to note just how different residents of

Philadelphia’s middle neighborhoods are from their stronger market counterparts. Of adults

in middle areas, 23.2 percent have a college degree compared with 62.2 percent of those in

the stronger markets. Such a stark difference is found only in Baltimore.

Philadelphia’s middle neighborhoods are staunchly middle-class communities. Many of

the residents earn a modest income. The most recent wave of foreclosures has visibly affected many of these communities and can be seen in the presence of REOs, especially in the more

challenged parts of the middle areas. The poor quality of Philadelphia’s schools hits these

communities particularly hard. Unlike residents of the stronger markets, residents of middle

neighborhoods generally cannot afford private schools, and public charter schools generally

admit through lottery, not residence. The tenuousness of these communities is manifest,

especially in the lower end of the middle areas.

Table 11

Characteristics of Philadelphia’s Markets

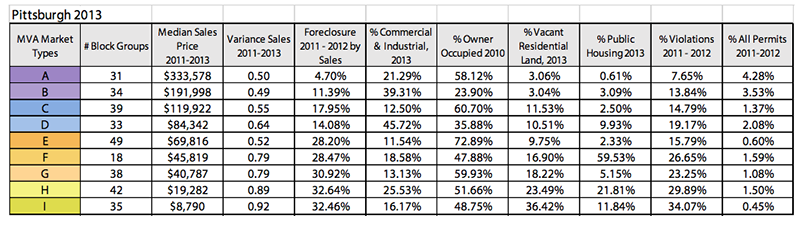

Pittsburgh: Of all legacy cities, Pittsburgh’s middle neighborhoods are home to the

lowest percentage of the city’s population (37.1 percent). In some ways, this is a manifestation

of the even distribution of the city’s populations across all markets. Although Pittsburgh’s

population declined by almost 10 percent between 2000 and 2013, the middle neighborhoods

fared reasonably well, losing only 5.3 percent of their population. We find a disproportionately

large percent of Pittsburgh’s white population in these areas (43 percent) and a

disproportionately smaller percentage of its nonwhite population in middle neighborhoods

(26.2 percent).

Pittsburgh’s middle neighborhoods have home sale prices that are affordable even for

those of fairly modest means (Table 12). In general, the city’s middle neighborhoods have

the highest levels of owner occupancy, higher even than the stronger market areas. One MVA

middle market type is home to a significant group of subsidized rental properties. Foreclosures

in Pittsburgh are elevated in the middle neighborhoods, and like some of the other

legacy cities, the REO inventory is readily visible to the casual observer.

Owing to the very low home sale prices, the cost-burden in Pittsburgh’s middle areas is

relatively low compared to the other legacy cities. Cost-burdens are also relatively low among

renters living in middle neighborhoods.

The educational profile of Pittsburgh’s adult population residing in middle neighborhoods

is the most advantageous among these legacy cities. Approximately one-third of

middle area residents have bachelor’s degrees and fewer than 9 percent lack a high school

diploma. The poverty rate for residents of middle neighborhoods is notably lower than the

other legacy cities.

In validating Pittsburgh’s MVA, we were struck by how stable and advantageous the

city’s middle areas were, and how few residents have fully exploited the many extraordinary

physical elevations and view sheds the city has to offer. Homes on a hill with an unobstructed

view of the rivers that in other cities might be million dollar tear-downs sell for

under $35,000, for example. Several of the communities along the Allegheny River have

market momentum, and the East Liberty section is showing substantial market strength. Like

some of the other legacy cities, the impact of the universities and medical centers is readily

apparent in the surrounding real estate markets.

Table 12

Characteristics of Pittsburgh’s Markets

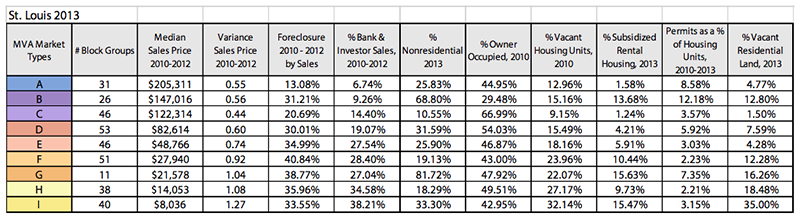

St. Louis: St. Louis’s middle neighborhoods are home to 41 percent of its population.

These areas lost 8.2 percent of their population during the last decade while the stronger

market areas gained 10.7 percent. However, the city’s most distressed markets—home to onethird

of the population—lost 18.4 percent. The racial segregation in St. Louis is manifest in

these markets. For example, although 60.7 percent of the white population lives in middle

neighborhoods, only 36.8 percent of the nonwhite population lives in these areas.

The middle neighborhoods of St. Louis are largely in the southern part of the city, south

of Dr. Martin Luther King Blvd. Like the other legacy cities, St. Louis’s middle areas have

comparatively low sale prices, making them reasonably affordable to both owners and

renters. These are markets with high levels of foreclosures and a substantial level of investor

activity (Table 13). As observed in other legacy cities, owner occupancy is generally highest

in the middle neighborhoods. Like Detroit, vacant housing and land are common and have

an obvious impact on community life. Subsidized rental housing, like other legacy cities, is

more common in some of the middle neighborhoods, although there is a significant concentration

in the city’s most challenged market areas.

The adult population is relatively well educated in these middle neighborhoods compared

with other legacy cities. One-third have bachelor’s degrees, second only to Pittsburgh.

Further, fewer than 15 percent failed to graduate from high school, again second only to

Pittsburgh. St. Louis’s middle areas have a poverty rate of 15 percent, a rate slightly above

the city’s stronger markets (13.5 percent).

Rehabilitation and redevelopment are consistent with the historic character of the city.

Moreover, the quality of public facilities (i.e., parks and libraries) is amazingly high and

consistent across the city, regardless of the challenges or strengths of the real estate markets.

Although some of the most expensive real estate in St. Louis is adjacent to the city’s Forest

Park, there are several middle neighborhoods ringing the southern border of that same park.

Even on the north side where the residential market is weaker, middle neighborhoods are

adjacent to several of the city’s parks. At the same time, like the other legacy cities, many of

the middle areas are hanging on, apparently challenged by the elevated levels of investor-owned

property.

Table 13

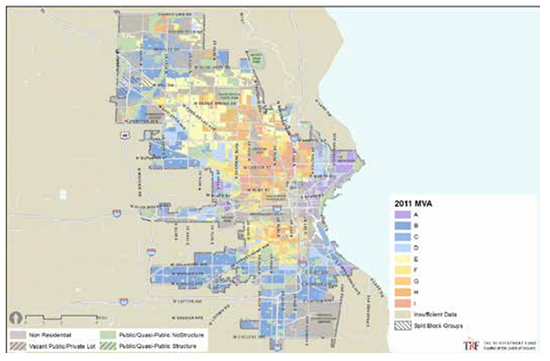

Characteristics of St. Louis’s Markets

Table 14

Demographic Characteristics of MVA Market Types

Table 15

Housing Characteristics of MVA Market Types

Table 16

Education, Income and Poverty of MVA Market Types

Discussion

Economist Charles Tiebout is credited

with popularizing the concept of the

value proposition.15 For policymakers

and elected officials in legacy cities, it is a

vital proposition for the middle neighborhoods.

To reverse the loss of population,

legacy cities must nurture the conditions

and amenities that attract and retain residents.

VALUE PROPOSITION.

Attracting new residents

and retaining those who currently

live in the city requires an effective “value

proposition.” For Detroit, this proposition

is firmly based on offering a high quality

of life that is well within each resident’s

grasp. This is arguably a proposition

the city has not been able to effectively

make. People make decisions about cities

based on what their neighborhoods offer,

including access to employment opportunities,

quality schools, efficient and

effective public services, housing options,

safety and security, and affordability.

Detroit must deliver on these to make

itself truly regionally competitive—where

area residents, city residents, and those

coming to the region for the first time can

truly see themselves, and in many cases

their families, living in Detroit.

Detroit Future City, 2012 Detroit Strategic

Framework Plan (2nd printing). (Detroit: Inland

Press, 2013), p. 478.

In many ways, middle neighborhoods

have the strongest value proposition for

residents, at least for now. Middle neighborhoods

contain an attractive housing

stock and their homes are reasonably

affordable to middle- and modest-income

families.

Middle neighborhoods in each of

the legacy cities manifest both market

strengths and challenges. In many of the

legacy cities, the middle neighborhoods

are where racial-ethnic diversity is strong

and modest-income families can live in a

relatively opportune area. But, residents of

middle neighborhoods also have relatively

advantageous levels of education and

income, which means they may have other options of where to live.

Accordingly, middle neighborhoods are also, in many ways, in the most precarious position.

Local experts and practitioners pointed out that middle neighborhoods are the areas

with the most to lose, and the farthest to fall when confronted with continued strain on

residential markets.

One of the complications of working in middle neighborhoods is that cities are forced to

simultaneously play offense and defense. A public official in one city noted the dual role that

middle neighborhoods play as both nodes of strength for their surrounding neighborhoods

and as fragile areas on the verge of decline. “If your neighborhood is close to strength, then

you’re really hoping to have positive bleed over. Where your neighborhood is surrounded by

weaker areas, I could see folks thinking, ‘now might be the time to get out.’”

Middle neighborhoods are areas where, in the words of one interviewee, “One or two

boarded up houses on a block” can be the difference between a neighborhood on the rise

or one falling into distress. This means that for cities with limited resources, investing in the

middle neighborhoods can often produce the largest returns. In the words of a community

development expert, “If you ignore these places, then you’ll continue to see declines.”

Stated differently, middle neighborhoods are where the real estate market continues to

operate within market expectations while also providing homes within reach for low- and

middle-income families. In contrast, distressed market areas have experienced market fallout

and collapse, signaled by very few home sales or residential property turnover.

“Areas with relatively strong market

activity should be targeted for investment,

with the goal of increasing

demand, strengthening property values,

and rebuilding confidence in the

community. Focusing resources on these

places, which may include residential

neighborhoods, commercial districts,

and/or downtowns, can motivate

existing property owners to reinvest in

their properties, and encourage people

to buy in the area.”

A. Mallach, Rebuilding America’s Legacy

Cities: Report of the 110th American

Assembly (New York: The American

Assembly, Columbia University, 2012), p. 329

One of Reinvestment Fund’s operating

assumptions, developed over the 15-year

history of the MVA, is that, owing in part

to the scarcity of available housing subsidies,

what subsidy does exist cannot alone

create a market. Rather, subsidies should

be used strategically to leverage private

market forces, clearing barriers to private

actors, and thereby multiplying the impact

of public dollars in a given neighborhood.

One interviewee noted, “These are places

where your neighborhood is not so far

gone that it takes decades or millions of

dollars to see something change.” Middle

neighborhoods provide an opportunity to

make targeted and focused investments,

the result of which will be readily apparent.

As another interviewee noted, focusing

on middle neighborhoods is the nexus of

bringing private-sector discipline to publicsector

practice: “Of course these [middle markets] are the places that you want to invest.”

For Legacy Cities, the health of middle neighborhoods is more important than ever.

In his address to the 2013 Federal Reserve Bank of Richmond Community Development

Conference, Jeremy Nowak pointed to the dangers middle neighborhoods face. “Demographics,

economics potentially, and cultural factors have given some advantages to cities,”

he said, “including cities that are relatively distressed and have been quite distressed for 40

or 50 years.” Residents, he said, “are now willing to pay more if they have access to certain

things.” Nowak warned, “if the relationship between quality and cost does not work, then they will opt out.”16

In describing the condition in

Youngstown, OH, Mallach and Brachman

write:

“Youngstown Neighborhood Development

Corporation focused its resources

on neighborhoods that, although

troubled, were still vital and potentially

capable of regeneration … There are

strong arguments to prioritize such areas

over attempts to pursue the large-scale

reconfiguration of mostly abandoned

areas. Legacy cities like Youngstown are

now seeing extensive and often rapid

destabilization of traditional neighborhoods

like Idora; absent concerted efforts

to reverse this trend, some cities may

be left with few viable neighborhoods

outside their downtown and near-downtown

cores. This is a matter of far more

urgency for the future viability of legacy

cities than repurposing land in largely

vacant areas…”

A. Mallach and L. Brachman, Regenerating

America’s Legacy Cities (Cambridge, MA:

Lincoln Institute of Land Policy, 2013), p.52.

These words speak to the importance of

supporting middle neighborhoods in our

legacy cities, and are echoed by a recent

Pew Research study of millennials in Philadelphia.17

Pew’s research suggests that this

younger generation was more likely than

older generations to leave Philadelphia

because of quality of life and opportunity

issues (i.e., public safety, career opportunity,

public education). At some point in

the future, as millennials age, get married,

and have children, the importance of safe

streets and good schools will increase and

these “consumer-voters” (in Tiebout’s

parlance) will leave. For middle neighborhoods,

the failure to address these core

issues may leave residents with few reasons

to stay. For legacy cities, losing the battle

in these places will have systemic and longlasting

effects.18

We return to the initial premise. Federal

funds for neighborhood improvement

have declined significantly during the past

40 years, and many of our public institutions

and systems (e.g., public safety, public

education, local government service, and

infrastructure) are not where they need to

be. Our officials are overly focused on the downtowns, and they are competing vigorously for high-profile, but spatially compact, revitalization

opportunities for distressed neighborhoods (e.g., CHOICE Neighborhoods and

Promise Zones). Middle neighborhoods are not a priority. The fundamentals that support

stability, opportunity, and quality of life are important to all city residents. But they are

uniquely important to residents of middle neighborhoods.

Lastly, middle neighborhoods in these legacy cities are most representative of citywide

racial composition and generally more integrated than the city itself or the other market

types. Although we have argued that it is good public policy to use public funds to invest

in middle neighborhoods from a community development or neighborhood improvement

perspective, middle neighborhoods may also be important targets for public investment

because they are places where opportunity is high and racial integration greatest.

Without a clear space in the public policy and investment conversations, the future of

middle neighborhoods as areas of opportunity is in doubt. If Tiebout is correct, cities ignore

their middle neighborhoods at their own peril. Unless policymakers recognize and act to

maintain the quality of life and stability of these areas, residents may well leave because their

economic wherewithal allows them to find those qualities elsewhere.

About Reinvestment Fund

Reinvestment Fund is a national leader in rebuilding America’s distressed towns and

cities through the innovative use of capital and information. A CDFI, Reinvestment Fund

has made more than $1.7 billion in community investments since 1985 and is supported by

nationally trusted research and policy analysis.

The authors of this chapter would like to thank the JP Morgan Chase Foundation for its support.

1. See, for example, http://www.legacycities.org/

2. City of Philadelphia, “Neighborhood Transformation: A Strategy for Investment and Growth” (2001).

3. Alan Mallach and Lavea Brachman rank legacy cities from 1 to 18 based on a variety of demographic, social,

and economic characteristics (with 1 being the strongest rank). Using their scale, the cities in this chapter

represent the wide range of conditions among legacy cities. Philadelphia is ranked 1, Pittsburgh, 2, Baltimore,

3, Milwaukee, 5. St. Louis, 8 and Detroit, 17. See A. Mallach and L. Brachman, Regenerating America’s

Legacy Cities (Cambridge, MA: Lincoln Institute of Land Policy, 2013).

4. When the federal government consolidated existing categorical grants into the CDBG program, cities were

held harmless against a loss of funding. The expiration of the hold harmless program and the introduction

of new census data in 1980 led to a number of large funding fluctuations apparent in the 1975 and 1980

allocations. Personal communication with Todd M. Richardson, associate deputy assistant secretary, Office of

Policy Development and Research, U.S. Department of Housing and Urban Development, 2015.

5. See, for example, http://www.legacycities.org/

6. See American Fact Finder, “Manufacturing: Geographic Area Series: Industry Statistics for the States,

Metropolitan and Micropolitan Statistical Areas, Counties, and Places: 2012 & 2012 Economic Census of the

United States.” (Washington, DC: U.S. Census), at http://factfinder.census.gov/faces/tableservices/jsf/pages/

productview.xhtml?pid=ECN_2012_US_31A1&prodType=table. See also: ftp://ftp2.census.gov/econ1977/

Graphic_Summary_of_the_1977_Economic_Censuses.pdf

7. Thomas notes that this is not an uncommon pattern observed in legacy cities. She argues that understanding

this trend is critical to developing proactive strategies in these cities that are attentive to fundamental social

justice issues. J.M. Thomas, “Addressing the Racial, Ethnic, and Class Implications of Legacy Cities.” In

Rebuilding America’s Legacy Cities: New Directions for the Industrial Heartland, edited by Alan Mallach (New York:

American Assembly, Columbia University, 2012).

8. The Index of Dissimilarity (“D”) measures how evenly two groups are distributed across a geographic area,

with lower values representing higher levels of integration. D values literally translate into the percent of a

population (e.g., African American) that would need to move to achieve a uniform (i.e., integrated) area. In

every city but Detroit, the index is lower in middle market areas than a city’s total score. See: O. Duncan and

B. Duncan. “A Methodological Analysis of Segregation Indices.” American Sociological Review 1955 Vol. 20

Pg.210-17.

9. For a more thorough description of the MVA’s history and applications, see I. Goldstein, “Making Sense

of Markets: Using Data to Guide Reinvestment Strategies.” In What Counts: Harnessing Data for America’s

Communities (San Francisco: Federal Reserve Bank of San Francisco and the Urban Institute, 2014).

10. The general approach for designating middle markets for this analysis was to include markets that had

characteristics that, taken together, were within about 50 percent to 200 percent of the citywide average.

11. In our experience, established neighborhood boundaries are typically comprised of more than one MVA

market type.

12. Data were most recently collected in the following years: Baltimore (2012-14), Detroit (2010-11), Milwaukee

(2011-12), Philadelphia (2010-11), Pittsburgh (2011-13), and St. Louis (2010-12). It is frequently not possible

to obtain each MVA data element entirely coincident in time. Moreover, for several indicators (e.g.,

residential sales or mortgage foreclosures) we will oftentimes aggregate across multiple years in an effort

to obtain a sufficiency of activity upon which a stable estimate can be made. The years noted for each city

therefore are presented as an indicator of the period for which the MVA is most representative.

13. ACS data are generally not preferred for MVAs because the margins are error are often quite large and the

5-year aggregation makes the data less contemporary than other critical indicators.

14. Tables 14, 15 and 16 contain the demographic data for all cities.

15. C.M. Tiebout, “A Pure Theory of Local Expenditures,” Journal of Political Economy, 64(5)(1956): 416-424.

16. Jeremy Nowak, “Redefining ‘Rust Belt’: An Exchange of Strategies by the Cities of Baltimore, Cleveland,

Detroit and Philadelphia,” presentation at the Federal Reserve Bank of Richmond, Community Development

Conference, June 2013, Baltimore, MD. Available at http://jnowakassociates.com/publications/.

17. Pew Research, “Millennials in Philadelphia: A promising but fragile boom” (Washington, DC: Pew Research,

2014), at www.pewtrusts.org/en/research-and-analysis/reports/2014/01/21/millennials-in-philadelphia-apromising-but-fragile-boom.

18. Brophy’s analysis of Baltimore’s neighborhoods concludes with a set of recommendations that both prioritize

the city’s middle markets and offer a promising programmatic approach to working in these areas. Specifically,

the multifaceted Baltimore’s Healthy Neighborhoods initiative exemplifies a demonstrably impactful and

“cost-effective approach to strengthening middle neighborhoods.” Paul Brophy, Great Neighborhoods Great

City: Strategies for the 2010s (2012 update). (Baltimore, MD: Goldseker Foundation, 2012), p. 24, at www.

goldsekerfoundation.org/uploaded_files/0000/0023/great_cities_2012.pdf.

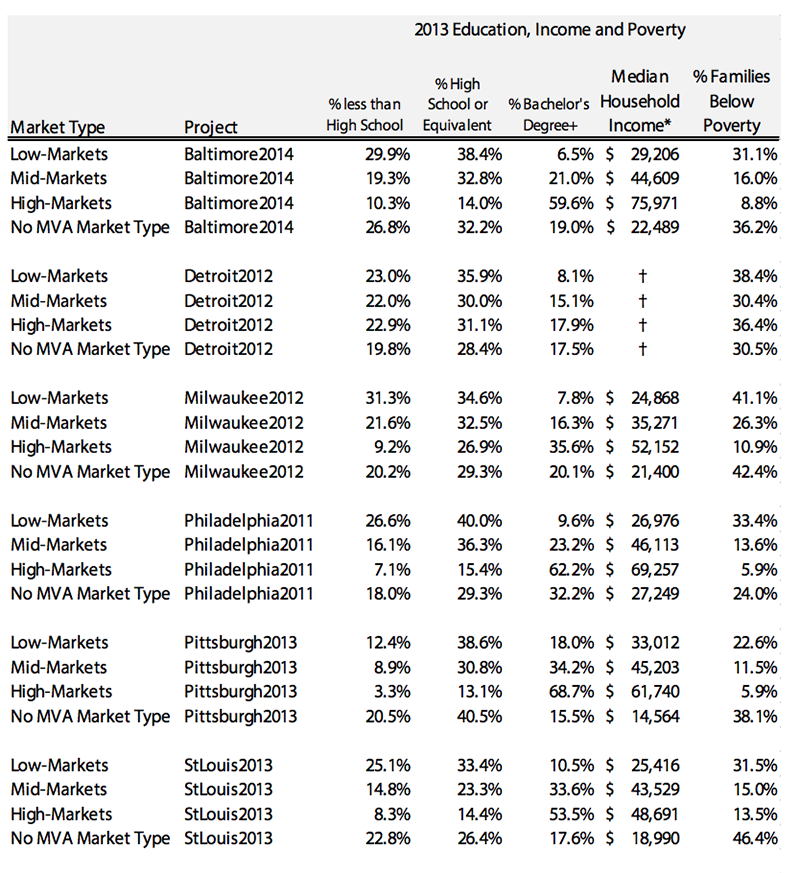

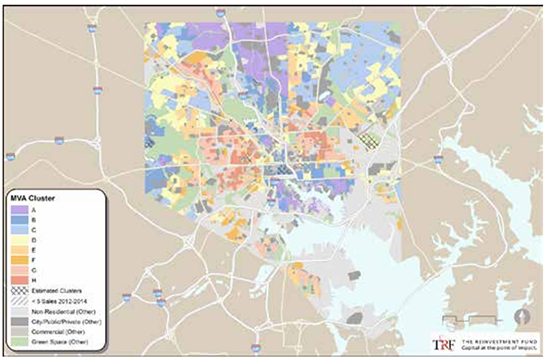

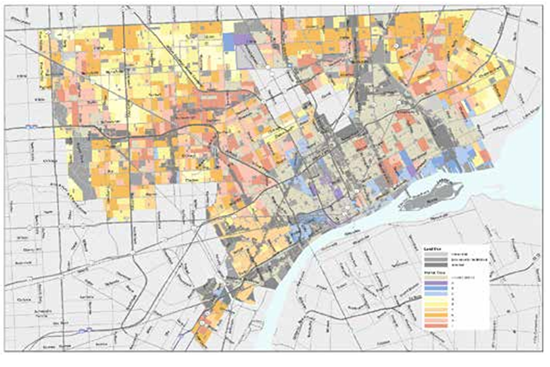

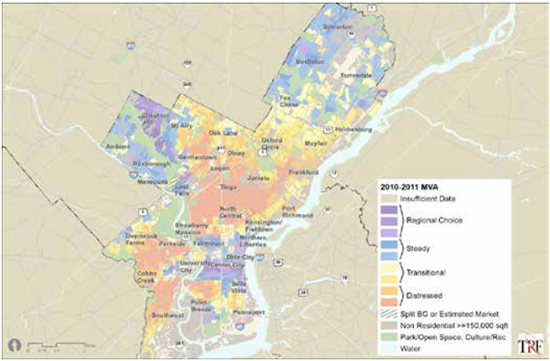

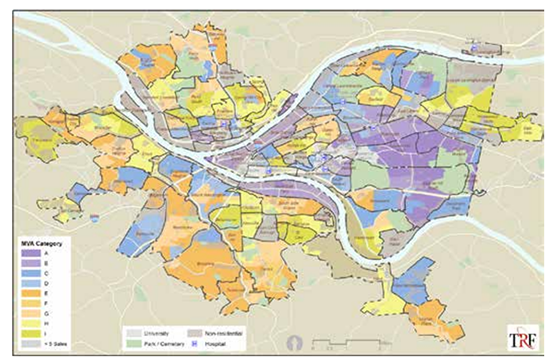

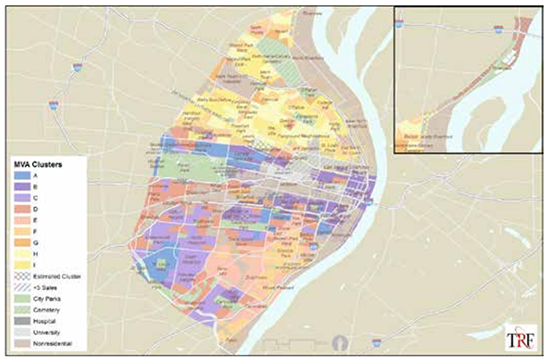

Appendix 1: MVA Maps

Appendix 1, Figure 1

Baltimore MVA

Appendix 1, Figure 2

Detroit MVA

Appendix 1, Figure 3

Milwaukee MVA

Appendix 1, Figure 4

Philadelphia MVA

Appendix 1, Figure 5

Pittsburgh MVA

Appendix 1, Figure 6

St. Louis MVA

Appendix 2: Chapter Interviewees

Brian Abernathy – First Deputy Managing Director at City of Philadelphia. Formerly served as Executive Director

of the Philadelphia Redevelopment Authority.

Martha Brown – Deputy Commissioner, Milwaukee Department of City Development.

Kathryn Dunn – Vice President, Community Investment at the Greater Milwaukee Foundation.

Jeff Hebert – Chief Resilience Officer and Executive Director of the New Orleans Redevelopment Authority.

Karla Henderson – Director of Strategic Plannng and Facility Management at Wayne County Michigan and former

Group Executive of Planning & Facilities for the City of Detroit.

Steve Janes – Assistant Commissioner of Research and Compliance for the City of Baltimore Housing Department.

Don Roe – Director of the Planning and Urban Design Agency, the City of St. Louis.

RJ Stidham – A community development consultant, who has worked with a number of cities on their development

and implementation of the MVA, including Detroit and St. Louis.

Kyra Straussman – Director of Real Estate, The Urban Redevelopment Authority of Pittsburgh.

Ira Goldstein is the President of Policy Solutions at Reinvestment Fund. His research focuses on various

aspects of housing and economic development in America’s cities. Prior to joining Reinvestment

Fund, Goldstein was Mid-Atlantic Regional Director of Fair Housing and Equal Opportunity at the

US Department of Housing and Urban Development. For more than 25 years, Goldstein has been a

Lecturer at the University of Pennsylvania, teaching courses focused on housing policy and social science

research methods and statistics. Goldstein holds a PhD, MA and BA from Temple University.

Jacob L. Rosch is a Research Associate at Reinvestment Fund. His research focuses on residential

housing markets, intersections between health and housing, and education. Prior to joining Reinvestment

Fund, Mr. Rosch spent six years as a researcher and consultant advising educational institutions

in K-12 and higher education. He holds a BA with honors from the University of North Carolina at

Chapel Hill and an MPP from the University of Chicago’s Harris School of Public Policy.

William Schrecker has been a Research Analyst at Reinvestment Fund since 2013, with much of his

work focused on residential real estate analyses. His recent MVA projects include Baltimore, New

Orleans, and Wilmington, DE, with past research including Houston, Pittsburgh, and St. Louis.

Mr. Schrecker holds a Master’s of Business Administration from the Fox School of Business at Temple

University and a Master’s of Social Work from the University of Pennsylvania.