In the years since the bursting of the housing bubble, the personal saving rate has trended up from around 1% to around 6%, while the ratio of household debt to disposable income has dropped from 130% to 118%. Changes over time in the availability of credit to households can explain 90% of the variance of the saving rate since the mid-1960s, including the recent uptrend, according to a simple empirical model.

Following a 20-year decline, the U.S. personal saving rate bottomed out at around 1% in the third quarter of 2005. Since then, the rate has been trending upward, reaching around 6% in the third quarter of 2010. The era of declining saving rates coincided with a period of expanding credit availability for households that contributed to a dramatic increase in leverage as measured by the ratio of household debt to personal disposable income. During the boom years of the mid-2000s, the combination of declining saving rates and rapidly rising household debt allowed consumer spending to grow much faster than disposable income, providing a significant boost to the economy. Recently however, the rebound in the saving rate has coincided with a reduction in household debt—a deleveraging—that has acted as a drag on consumer spending and the economy.

In this Economic Letter, we show that movements in the availability of credit are very important for explaining movements in the saving rate. Over the past half century, greater credit availability for households has been associated with lower saving rates and a resulting higher leverage. Standard economic models seek to explain movements in the saving rate primarily in terms of movements in household net worth, as measured by the value of assets minus debt. Taking credit availability into account significantly improves the explanatory power of saving rate models.

Models of consumption and saving

The standard life-cycle model of saving behavior holds that, over their lifetimes, consumers strive to achieve a target ratio of net worth to income that will allow them to maintain their desired consumption patterns through retirement (see Skinner 2007). If unexpected events, such as drops in the prices of stocks or houses, cause net worth to decline, then the life-cycle model predicts an increase in saving behavior to help return the net worth–income ratio to target. Additional saving could be used to purchase assets or pay down debt, thereby increasing net worth.

With this theory as background, most empirical studies seek to explain movements in the saving rate using movements in the ratio of household net worth to personal disposable income. However, some studies have shown that the behavior of consumption, and by extension saving, is also strongly associated with changes in credit growth. Bacchetta and Gerlach (1997) and Ludvigson (1999) find that credit growth has a significant positive impact on consumption growth in the United States and other countries. In these studies, changes in credit growth can be interpreted as capturing changes in lending practices or other factors that affect consumer access to borrowed money. For example, a period of rapid credit growth may reflect lending industry changes that reduce down-payment requirements for homebuyers, or allow applicants with modest incomes or impaired credit histories to obtain loans. This line of thought suggests that some measure of credit availability may be helpful in explaining movements in the saving rate through a channel separate from that of net worth.

Household net worth, credit, and the saving rate

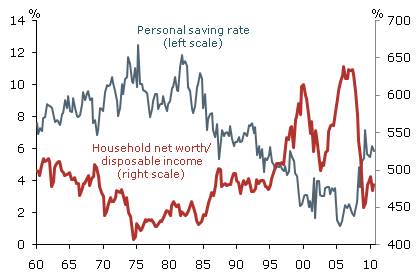

Figure 1

Household net worth and personal saving rate

Figure 1 plots the personal saving rate versus the ratio of household net worth to disposable income. Household net worth is defined as the value of financial and real estate assets minus mortgage debt and other liabilities. The two series are negatively correlated.

As described by Lansing (2005), the secular decline in the saving rate that bottomed out in 2005 can be viewed as a behavioral response to long-lived bull markets in stocks and housing that increased the value of household assets and, as a result, net worth. Consistent with the life-cycle model, consumers seem to view asset appreciation as a substitute for the practice of saving money each month from their paychecks. Not surprisingly, the saving rate has trended up in recent years as stocks and housing have experienced bear markets. Of course, other factors besides net worth may also affect saving behavior. For example, the saving rate spiked in the second quarters of 2008 and 2009 as a result of tax rebate programs enacted by Congress. However, one drawback of using net worth is that it obscures the potentially separate and complex manner in which assets and debt may affect the saving rate.

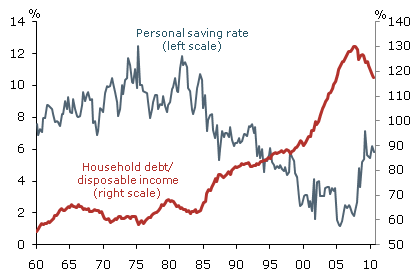

Figure 2

Household debt and personal saving rate

Figure 2 shows that the household debt ratio is negatively correlated with the saving rate for most of the sample period, with the saving rate declining and the household debt ratio rising between 1975 and 2005. This pattern is consistent with the studies cited above that find a positive link between consumption behavior and credit growth. The rising debt ratio can be interpreted as reflecting changes in both credit supply and credit demand. Supply-side changes include the greater availability of credit cards and home equity loans, the growth of subprime lending, the spread of exotic mortgage products, and other changes that over time served to relax consumer borrowing constraints and thereby reduced the need for precautionary saving. Demand-side changes include the secular decline in interest rates starting in the mid-1980s that lowered the cost of borrowing for consumers. At the tail end of the sample period, beginning around 2007, we observe a declining debt ratio coinciding with a rising saving rate. This pattern reflects consumer deleveraging in the face of the tighter lending standards, excessive debt burdens, and uncertainty about future income that prevailed during and after the financial crisis (see Glick and Lansing, 2009). The main takeaway from Figure 2 is that the relationship between saving and debt is complex and likely depends on factors that govern credit availability.

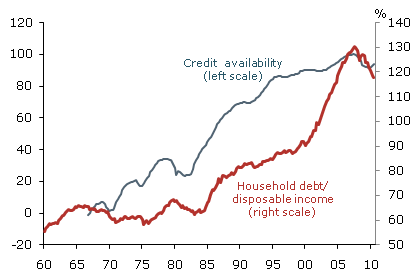

Figure 3

Household debt and credit availability

To explore this relationship further, Figure 3 plots a measure of credit availability constructed from the Federal Reserve Board Senior Loan Officer Opinion Survey. Following Muellbauer (2007), we examine the quarterly changes since 1966 in the net percentage of reporting institutions indicating a greater willingness to make consumer installment loans. The quarterly changes are cumulated over time and the resulting series is scaled to have a value of 100 at the peak, which occurred in the first quarter of 2007. The figure shows a long-term uptrend in the availability of credit to U.S. households that tracks reasonably well with the uptrend in household leverage, as measured by the ratio of household debt to disposable income. The correlation of the two series suggests that the dramatic run-up in household debt relative to income was largely driven by an increase in the supply of credit over time.

Empirical models of the saving rate

To explain movements in the saving rate over time, we construct a simple empirical model that uses data from the first quarter of 1966 through the third quarter of 2010. We perform a regression, a statistical exercise in which we look at the relationship between the personal saving rate and two contemporaneous explanatory variables: the ratio of household net worth to disposable income, shown in Figure 1, and our constructed measure of credit availability, shown in Figure 3. The first variable is based on the standard life-cycle model of net worth and saving. The second variable is intended to capture shifts in credit available to U.S. households that affect saving behavior outside the standard net worth channel.

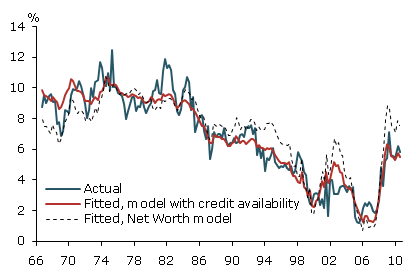

Figure 4

Actual and fitted saving rates

Figure 4 plots the actual saving rate versus the corresponding value fitted to the data from our empirical model incorporating credit availability. The model explains 90% of the variance of the saving rate since 1966. Both explanatory variables are statistically significant in helping explain movements in the saving

rate. Rising net worth and easier credit availability both correlate with lower saving rates, which is consistent with the broad patterns shown in Figures 1 and 3. Similar results are obtained when we omit the credit availability variable but account for the separate influence of the household asset and debt ratios on the saving rate, rather than subtracting the two ratios to form a single net worth variable. This result reinforces the notion that changes in the household debt ratio tend to reflect changes in credit availability.

For comparison, Figure 4 also plots the fitted value from a standard empirical model that employs the net worth ratio as the only explanatory variable. The standard model explains only 73% of the variance of the saving rate, considerably less than our empirical model that includes the credit availability variable. Moreover, the model incorporating credit availability does a much better job of reproducing movements in the saving rate that have occurred over the past 10 years, when lending industry changes have been particularly dramatic.

Conclusion

In the years leading up to the financial crisis of 2008–2009, a combination of factors including low interest rates, lax lending standards, the proliferation of exotic mortgage products, and the growth of a global market for securitized loans promoted increased household borrowing. Homebuyers with access to easy credit helped bid up U.S. house prices to unprecedented levels relative to rents and disposable income. The rapid rise in household net worth encouraged lenders to ease credit even further based on the assumption that house price appreciation would continue indefinitely. U.S. household leverage, as measured by the ratio of debt to disposable income, reached an all-time high of 130% in 2007.

The U.S. experience was by no means unique. Household leverage in many industrialized countries increased dramatically in the years prior to 2007. Countries exhibiting the largest increases in household leverage tended to experience the fastest rises in house prices over the same period (see Glick and Lansing 2010). House prices in the United States have dropped on average by about 30% from their peak in 2006. In the years since the bursting of the bubble, the personal saving rate trended up from around 1% to about 6% in the third quarter of 2010, while the ratio of household debt to disposable income dropped from 130% to 118%.

A simple empirical model of the saving rate that accounts for changes in the availability of credit to households over time can explain 90% of the variance of the saving rate and tracks the recent uptrend well. Going forward, households may keep trying to reduce excessive debt loads by increasing their saving. On the one hand, higher saving rates imply correspondingly lower rates of domestic household consumption growth so that a larger share of GDP growth would need to come from business investment, net exports, or government spending. On the other hand, an increase in domestic saving would help rebuild household nest eggs in preparation for retirement and also help correct the large imbalance that now exists in the U.S. current account.

Reuven Glick is a group vice president in Economic Research at the Federal Reserve Bank of San Francisco.

Kevin J. Lansing is a senior economist in Economic Research at the Federal Reserve Bank of San Francisco.

References

Bacchetta, Philippe, and Stefan Gerlach. 1997. “Consumption and Credit Constraints: International Evidence.” Journal of Monetary Economics 40, pp. 207–238.

Glick, Reuven, and Kevin J. Lansing. 2009. “U.S. Household Deleveraging and Future Consumption Growth.” FRBSF Economic Letter 2009-16 (May 15).

Glick, Reuven, and Kevin J. Lansing. 2010. “Global Household Leverage, House Prices and Consumption.” FRBSF Economic Letter 2010-01 (January 11).

Lansing, Kevin J. 2005. “Spendthrift Nation.” FRBSF Economic Letter 2005-30 (November 10).

Ludvigson, Sydney. 1999. “Consumption and Credit: A Model of Time-Varying Liquidity Constraints.” Review of Economics and Statistics 81(3), pp. 434–447.

Muellbauer, John. 2007. “Housing, Credit, and Consumer Expenditure.” In Housing, Housing Finance, and Monetary Policy, a symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming.

Skinner, Jonathan. 2007. “Are You Sure You’re Saving Enough for Retirement?” Journal of Economic Perspectives 21(3), pp. 59–80.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org