An analysis shows that the Federal Reserve’s large-scale asset purchases have been effective at reducing the economic costs of the zero lower bound on interest rates. Model simulations indicate that, by 2012, the past and projected expansion of the Fed’s securities holdings since late 2008 will lower the unemployment rate by 1½ percentage points relative to what it would have been absent the purchases. The asset purchases also have probably prevented the U.S. economy from falling into deflation.

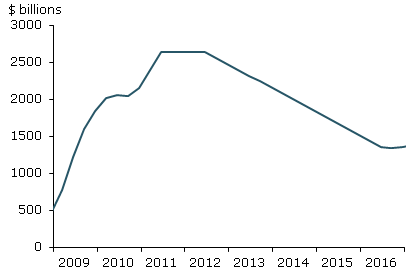

Figure 1

Projected path for Fed longer-term securities holdings

The zero lower bound on nominal interest rates limits the ability of central banks to reduce short-term interest rates. As a result, when nominal interest rates are near zero, central banks are unable to use further reductions in short-term interest rates to provide additional stimulus to the economy and check unwelcome disinflation. With the unemployment rate very high and measures of underlying inflation trending downward, the Federal Reserve’s main policy tool, the federal funds rate, has been at its effective lower bound for over two years now. Participants in futures markets currently expect the federal funds rate to remain near zero until late 2011. Owing to the constraint of the zero lower bound, several major central banks, including the Bank of England and the Bank of Japan, have adopted alternative monetary policy approaches of buying longer-term securities. Similarly, the Fed purchased $1.7 trillion in longer-term securities from late 2008 through March 2010 and in November 2010 announced its intention to expand the size of its securities holdings further by purchasing an additional $600 billion in longer-term Treasury securities by the middle of 2011. This Economic Letter summarizes recent research by Chung et al. (2011) on the economic effects of the Fed’s large-scale asset purchase program.

The effects of asset purchases: Three channels

The primary objective of the Fed’s large-scale asset purchases is to put additional downward pressure on longer-term yields at a time when short-term interest rates have already fallen to their effective lower bound. Such a reduction in longer-term yields should lead to more accommodative financial conditions overall, thereby helping to stimulate real economic activity and check undesirable disinflationary pressures. In many ways, the transmission mechanism is similar to the one involved in conventional monetary policy, which primarily influences long-term yields through changes to the current and expected future path of the federal funds rate.

How do the Fed’s asset purchases affect long-term interest rates? Three main channels have been identified. One is that such actions may signal to market participants the Fed’s desire to hold short-term interest rates low for a longer time. Such an expectation of lower future short-term interest rates will lower long-term rates. A second channel works through the beneficial market effects that such purchases can have in times of stress. For example, the spreads between mortgage rates and U.S. Treasury yields rose to very high levels during the height of the financial crisis in late 2008, but fell markedly after the Fed announced its intention of buying agency mortgage-backed securities (MBS) guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The third channel–and probably the most important–results from the way central bank asset purchases reduce the overall supply of longer-term securities available to investors, thereby pushing up securities prices and pushing down yields. Vayanos and Vila (2009) provide a theoretical framework for analyzing such effects by developing a no-arbitrage pricing model for securities of various maturities that takes account of investors, such as pension funds and insurance companies, that prefer to hold longer-term securities. Because of these “habitat” preferences, yields on securities of different maturities are linked in a manner that partly depends on their relative supplies. As a result, the model implies that a central bank should be able to lower longer-term interest rates if it can substantially reduce the stock of longer-term debt held by the private sector.

To accomplish such a reduction in longer-term interest rates, the Fed in 2009 and early 2010 purchased about $1.25 trillion in agency MBS, $170 billion in agency debt issued by housing-related government-sponsored enterprises, and $300 billion in longer-term Treasury securities. This was followed by the $600 billion program to buy additional longer-term Treasury securities, announced after the November 2010 meeting of the Federal Open Market Committee (FOMC). The FOMC also said it would continue to reinvest principal payments on its holdings of these longer-term assets, a policy announced in August 2010. Collectively, these actions, partially offset by earlier redemptions and MBS principal payments, are expected to boost securities holdings in the Federal Reserve’s System Open Market Account (SOMA) to $2.6 trillion by the middle of 2011, consisting essentially of assets with an original maturity of greater than one year. In mid-2007, prior to the crisis, Fed securities holdings were only $790 billion. These purchases have been accompanied by significant increases in bank reserve balances at the Federal Reserve.

Several recent studies have sought to estimate the effects of the Fed’s large-scale asset purchases on U.S. long-term interest rates (see Gagnon et al. 2010, D’Amico and King 2010, Doh 2010, and Hamilton and Wu 2010). Other researchers employing a variety of techniques have examined the quantitative effects of similar unconventional policy actions carried out abroad, such as the Bank of England’s quantitative-easing program (see Meier 2009 and Joyce et al. 2010). The consensus from this research is that central bank asset purchases have significantly reduced the general level of longer-term interest rates. These studies suggest that, on balance, the first round of asset purchases probably lowered yields on the 10-year Treasury note and high-grade corporate bonds by around half a percentage point. To put this in perspective, it would take roughly a 2 percentage point cut in the federal funds rate to achieve an equivalent half percentage point drop in the 10-year Treasury yield, based on patterns since 1987.

Modeling macroeconomic benefits

For a more complete assessment of the possible macroeconomic benefits of the Fed’s asset purchases, including the effects of the latest $600 billion expansion, we carried out simulations of the FRB/US model, a large-scale model of the U.S. economy used at the Federal Reserve Board for forecasting and policy analysis (see Brayton 1997 for a description of the FRB/US model). These exercises go beyond the initial impact of the original asset purchase program and specify how the evolution of Fed holdings of longer-term securities influences term premiums over time. For this purpose, we construct an illustrative path for the Fed’s balance sheet, shown in Figure 1. This path includes the various elements of the asset purchase program described above.

We then build a simple model of portfolio-balance effects, in which the size of the effect on long-term rates at any point in time is assumed to be proportional to the discounted present value of expected future Fed holdings of longer-term securities beyond what the Fed would normally hold relative to nominal GDP. This model implies that the magnitude of the effect on long-term interest rates depends not just on the amount of longer-term assets currently held by the Fed, but also on investor expectations regarding the evolution of these holdings in the future. The model is constructed so that the initial Fed purchase program implies a half percentage point reduction in long-term yields, consistent with what research suggests actually occurred. In addition, we incorporate reductions in the spread of the mortgage rate over the 10-year Treasury yield during 2009 and the first half of 2010 that reflect improvements in market functioning achieved through the purchases of agency MBS. For these simulations, we assume that the federal funds rate follows its baseline path through 2014, but then responds to deviations of output and inflation from baseline as prescribed by a simple monetary policy rule estimated using data from 1987 through 2007. Such an assumption is appropriate if the asset purchase program doesn’t affect the stance of or expectations regarding conventional monetary policy over the medium term–that is, if the public thought the asset purchase program was intended to provide additional monetary stimulus, rather than substituting for a lower level of the federal funds rate in the longer run.

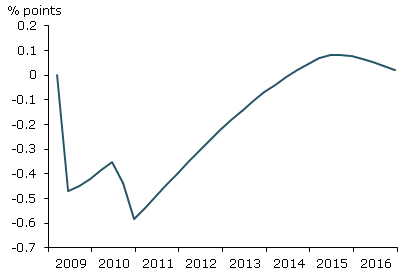

Figure 2

Effect of Fed’s asset purchases on 10-year Treasury yield

Figure 2 summarizes the model’s predictions of portfolio-balance effects from the Fed’s large-scale asset purchases. In this figure and those following, the lines plot the effects of the asset purchase program compared with a situation in which the Fed does not purchase assets. When the first phase of the program initially is announced, the 10-year Treasury yield drops by about half a percentage point (50 basis points). During the next few quarters, yields begin to move back towards baseline until pushed lower by the introduction of the next two phases of the program. The program’s effect on longer-term Treasury yields fades quickly after late 2010 primarily because the portfolio-balance effects wane as portfolio renormalization draws nearer. The notches in the curve reflect the introduction of changes in the asset purchase program, which we assume were unanticipated by market participants beforehand.

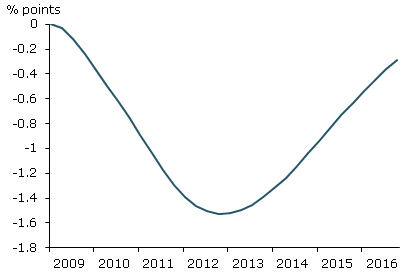

Figure 3

Effect of Fed’s asset purchases on unemployment rate

The model projects that lower long-term interest rates produce higher stock market valuations and a modestly lower foreign exchange value of the dollar. These changes in financial conditions provide considerable stimulus to real economic activity over time. The full program raises the level of real GDP almost 3% by the second half of 2012. In turn, this boost to real output makes labor market conditions noticeably better than they would have been without large-scale asset purchases, benefits that are predicted to grow further over time. By 2012, the full program’s incremental contribution is estimated to be 3 million jobs, with an additional 700,000 jobs generated just by the most recent phase of the program. Increased hiring lowers the unemployment rate by 1½ percentage points compared with what it would have been absent the Fed’s asset purchases, as shown in Figure 3. Based on other simulations, providing an equivalent amount of support to real economic activity through conventional monetary policy would have required cutting the federal funds rate approximately 3 percentage points relative to baseline from early 2009 through 2012, an obvious impossibility because of the zero lower bound.

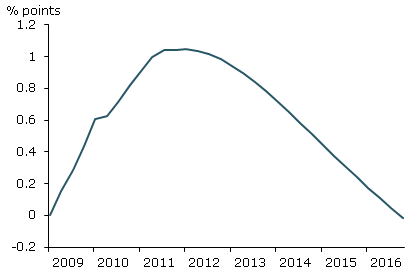

Figure 4

Effect of Fed’s asset purchases on core inflation

(four-quarter change)

Finally, the simulations suggest that the asset purchase program has contributed importantly to price stability. Figure 4 implies that inflation is currently a percentage point higher than it would have been if the FOMC had never initiated the program, meaning that the economy would now be close to deflation. The simulations also suggest that the longer-run inflationary consequences of the program are likely to be minimal, as portfolio-balance effects rapidly fall to zero and conventional monetary policy adjusts to bring conditions back to baseline. In part, this long-run neutrality reflects that agents in the model have confidence in the FOMC’s determination and ability to maintain price stability–a belief that policymakers ratify.

Conclusion

Overall, these results suggest that the Fed’s large-scale asset purchase program is providing significant support to real economic activity and the labor market. Moreover, the program may also be offsetting undesirable deflationary pressures appreciably, assuming that agents do not anticipate a tighter stance of conventional monetary policy over the medium term. While these estimates are subject to considerable uncertainty, it is likely that the Fed’s asset purchases have significantly reduced the severity of the zero lower bound’s effect during the current downturn.

References

Brayton, Flint, Eileen Mauskopf, David Reifschneider, Peter Tinsley, and John Williams. 1997. “The Role of Expectations in the FRB/US Macroeconomic Model.” Federal Reserve Bulletin (April), pp. 227-245. http://www.federalreserve.gov/pubs/bulletin/1997/199704lead.pdf

Chung, Hess, Jean-Philippe Laforte, David Reifschneider, and John C. Williams. 2011. “Have We Underestimated the Likelihood and Severity of Zero Lower Bound Events?” FRBSF Working Paper 2011-01, January. http://www.federalreservebanksf.org/economic-research/papers/2011/wp11-01bk.pdf

D’Amico, Stefania, and Thomas B. King. 2010. “Flow and Stock Effects of Large-Scale Treasury Purchases.” Finance and Economics Discussion Series 2010-52, Federal Reserve Board (September). http://www.federalreserve.gov/pubs/feds/2010/201052/201052abs.html

Doh, Taeyoung. 2010. “The Efficacy of Large-Scale Asset Purchases at the Zero Lower Bound.” FRB Kansas City Economic Review, Q2, pp. 5-34. http://www.kansascityfed.org/Publicat/Econrev/pdf/10q2Doh.pdf

Gagnon, Joseph, Matthew Raskin, Julie Remache, and Brian Sack. 2010. “Large-Scale Asset Purchases by the Federal Reserve: Did They Work?” FRB New York Staff Reports 441 (March). http://www.ny.frb.org/research/staff_reports/sr441.html

Hamilton, James D., and Jing (Cynthia) Wu. 2010. “The Effectiveness of Alternative Monetary Policy Tools in a Zero Lower Bound Environment.” Working paper, University of California at San Diego.

Joyce, Michael, Ana Lasaosa, Ibrahim Stevens and Matthew Tong. 2010. “The Financial Market Impact of Quantitative Easing.” Bank of England Working Paper 393. http://www.bankofengland.co.uk/publications/workingpapers/wp393.pdf

Meier, André. 2009. “Panacea, Curse, or Nonevent? Unconventional Monetary Policy in the United Kingdom.” IMF Working Paper 09/163 (August). http://imf.org/external/pubs/ft/wp/2009/wp09163.pdf

Vayanos, Dimitri and Jean-Luc Vila. 2009. “A Preferred-Habitat Model of the Term Structure of Interest Rates.” NBER Working Paper 15487 (November). http://www.nber.org/papers/w15487

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org