The very real and sizable costs of using monetary policy to deal with risks to financial stability—along with the uncertain benefits of doing so—argues for finding alternative tools with more favorable tradeoffs. Policymakers should study ways to design policy frameworks that support financial stability, with only a modest cost to macroeconomic goals and anchoring inflation expectations. The following is adapted from a presentation by the president and CEO of the Federal Reserve Bank of San Francisco at the conference “Housing Markets and the Macroeconomy: Challenges for Monetary Policy and Financial Stability” in Eltville am Rhein, Germany, on June 5, 2014.

Of late, central bankers can’t seem to get enough talk about financial stability and its connections to monetary policy. At the Federal Reserve, policymakers often point to financial stability concerns as relevant to their monetary policy decisions, especially in the context of the current extraordinarily accommodative stance of policy. At the Bank of England, the Monetary Policy Committee’s statement included an explicit financial stability escape clause for their bank rate forward guidance (Bank of England 2013). The Norges Bank explicitly incorporates financial stability in its monetary policy discussions and decisions. And the Riksbank’s very public policy deliberations have centered on the tradeoffs between, and the appropriate balancing of, macroeconomic and financial stability goals.

In my remarks today, therefore, I will discuss what I view as the key issues regarding the appropriate role of monetary policy in supporting financial stability. I’ll also highlight some specific directions in which further progress is badly needed.

Before I proceed, I should make clear what I mean by financial stability. Given that I’m in Germany, I’ll quote the European Central Bank’s definition from its website: “as a condition in which the financial system—comprising of financial intermediaries, markets, and market infrastructures—is capable of withstanding shocks, thereby reducing the likelihood of disruptions in the financial intermediation process which are severe enough to significantly impair the allocation of savings to profitable investment opportunities.” In retrospect, the global financial system clearly did not meet this definition of financial stability when confronted by the Lehman shock and subsequent events of late 2008.

The heightened attention to the connections between monetary policy and financial stability represents a sea change from the consensus that was reached in the years preceding the global financial crisis. Back then, central bankers were nearly unanimous in their undying faith and fealty to a variant of inflation targeting, whereby monetary policy should be single-mindedly focused on price stability (and, usually more quietly, macroeconomic stabilization). Financial stability was generally viewed as a potentially dangerous distraction, risking the central bank’s attention to, and credibility in, achieving its price stability mandate. Indeed, this approach was codified in numerous central bank charters, which in some cases dictated consequences if the inflation goal was not met. Even at the Federal Reserve, where inflation targeting was never formally adopted, financial stability was rarely discussed at monetary policy meetings during the run-up to the financial crisis (Fligstein et al. 2014).

Instead, policymakers and the segment of the economics profession interested in central banking focused on the task of attaining and preserving price and economic stability. An enormous effort went into theoretical and empirical research on best practice monetary policy strategies within this general framework. This research was completely abstracted from any concerns related to financial stability.

The elevation of financial stability concerns at central banks and other regulatory agencies is a natural reaction to the events of the global financial crisis, when the near meltdown of the financial systems in many countries almost toppled the global economy. Even with the dramatic—and in many cases, unprecedented—actions of governments and central banks, the fallout from the financial crisis has been greater and longer-lasting than had been experienced in generations. Indeed, this renewed concern for financial stability represents more a return to the roots of central banking than new-age thinking. After all, the Federal Reserve was created from the ashes of the panics and resulting depressions that tormented the U.S. economy in the late 19th and early 20th centuries.

The renewed recognition of the importance of preserving financial stability is entirely appropriate and perhaps long overdue. However, the current discussion of the relationship between financial stability and monetary policy has mostly lacked rigorous theoretical and empirical analysis. Unlike the extensive literature on monetary policy rules and optimal monetary policy, our understanding of the interactions and tradeoffs between monetary policy and risks to financial stability remains limited and, to put it bluntly, unsatisfactory, given what’s at stake. We all talk about the need to account for financial stability in thinking about monetary policy, but, to borrow a phrase from American TV lore: “Where’s the beef?”

I see three key issues around the role of monetary policy in financial stability. The first is: What are the costs of using monetary policy actions to address perceived or potential risks to financial stability? The second is: How do monetary policy actions affect financial stability risks? And, third: Can monetary policy be designed to improve these tradeoffs?

Tradeoffs between macroeconomic and financial stability goals

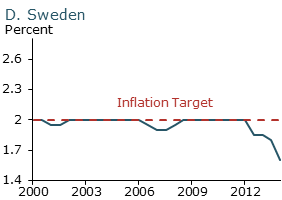

I’ll start with the question of the costs of using monetary policy to address financial stability risks. Perhaps this issue is best illustrated by the ongoing debates at the Riksbank regarding the appropriate course for monetary policy. In using this example, I am in no way judging the decisions that have been made; rather, I am using it as a timely real-world illustration of this issue. As background, Sweden’s economy has experienced inflation persistently below target, accompanied by extremely high and growing household debt. In a nutshell, the Sveriges Riksbank has undertaken a somewhat tighter stance of monetary policy than it would were it based purely on macroeconomic conditions. This has resulted in a more gradual return to inflation and unemployment goals, in order to reduce potential risks to financial stability stemming from Sweden’s very high level of household debt (Sveriges Riksbank 2014, p. 17).

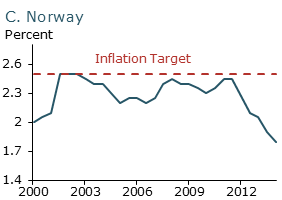

This situation is not unique: Financial stability considerations have played out in Norway as well. In its latest Monetary Policy Report, the Norges Bank frames its policy decision as follows: “Both the objective of keeping consumer price inflation close to 2.5% and the objective of sustaining capacity utilization in the years ahead could in isolation imply a somewhat lower key policy rate forecast.… On the other hand, a lower key policy rate may increase the risk of a further buildup of financial imbalances” (Norges Bank 2014, p. 16).

These decisions have clear and important costs in terms of achieving unemployment and inflation goals. For example, Lars Svensson (2013, and references therein) uses model simulations to show that the monetary policy actions of the Riksbank, based on a concern for financial stability, have induced a significantly higher rate of unemployment and a sustained shortfall of inflation relative to its target. He goes on to argue that the policy, by reducing income, has actually increased the already high household debt-to-income ratio, potentially exacerbating financial stability risks.

Preserving the nominal anchor

Turning to the risks: The costs of modifying the stance of monetary policy in deference to financial stability considerations may be even greater than those implied by cyclical deviations of inflation and economic activity from desired levels. If the central bank actions aimed at addressing financial stability risks are large and persistent, the inflation rate will likely deviate from target for many years. The protracted failure to deliver on the inflation objective could undermine the credibility of the central bank’s commitment to its inflation target and unmoor inflation expectations (Levin 2014).

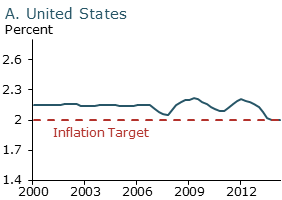

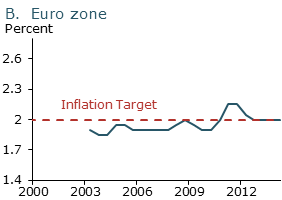

Figure 1

Long-run inflation expectations in four countries

Notes: Each panel depicts the central bank’s inflation target with a

dashed red line and the evolution of inflation expectations with a solid

blue line. Inflation expectations for non-U.S. countries is defined as the

average of the last two semiannual Consensus Forecast surveys of CPI

inflation projections 6 to 10 years ahead. Inflation expectations for the

United States for 2007 and after is the four-quarter average of the 10-

year PCEPI inflation forecast from the quarterly Survey of Professional

Forecasters (SPF) and an adjusted 10-year CPI inflation forecast from the

SPF prior to 2007. Based on charts in Levin (2014).

Particularly worrisome are the incipient signs that inflation expectations are slipping in countries that have emphasized financial stability in monetary policy deliberations. Figure 1 shows survey data on longer-run measures of inflation expectations for the United States, the euro area, Norway, and Sweden. Longer-run inflation expectations have remained very stable in the United States and euro area, despite the tumult of the global financial and euro crises and the subsequent aggressive monetary policy undertaken by the Federal Reserve and the European Central Bank. In contrast, Norway and Sweden have seen some slippage in long-run inflation expectations below target levels over the past year or so, based on this survey (Norges Bank 2014 and Sveriges Riksbank 2014). This follows a long period of realized inflation averaging below target levels and central bank communication that financial stability concerns have been affecting policy decisions.

Although this evidence is far from dispositive, it is an apt reminder of the potential long-run costs of losing sight of the price stability mandate. The steadfastness of the nominal anchor in most advanced economies was a key factor in central banks’ ability to keep inflation low and stable during and after the global financial crisis. It was forged over many years of consistent commitment to price stability and successfully fighting the inflation dragon. If the anchor were to slip, it would wreak lasting damage to a central bank’s control over both inflation and economic activity, at considerable cost to the economy. This applies equally to deviations above and below the target.

Although the costs of using monetary policy to address financial stability risks are clear and potentially sizable, the benefits are much harder to pin down. In part this is due to the challenge inherent in analyzing and measuring tail risks. But, importantly, it also reflects the shortcomings of standard macroeconomic models that entirely abstract from risks to financial stability and are therefore silent on how monetary policy may affect these risks.

Most standard macro models, such as dynamic stochastic general equilibrium models, generally used for monetary policy analysis simply lack the channels by which interest rates could potentially create risks to the financial system and thereby ultimately to the economy. The consensus framework is built on a foundation of optimizing agents, rational expectations, and frictionless financial markets. This approach assumes that asset markets clear through arbitrage-free relationships. Deviations from fundamentals are either assumed away or buried in exogenous risk premia. Such a framework severely limits one’s ability to think deeply about how monetary policy actions could affect risks to financial stability.

I recognize that this situation is changing, with new theories and approaches being developed as I speak, and I find this encouraging. Indeed, the papers at this conference represent important strides in developing theories that can help illuminate the interactions of monetary policy and financial stability. But much, much more needs to be done.

Behavioral economics and asset prices

Let me highlight one issue that I see as particularly important in thinking about how monetary policy may affect risks to financial stability: the modeling of asset prices. Standard asset price theory tells us that an increase in asset prices must reflect either an increase in expected future dividends or a reduction in the expected return on the asset. But the evidence is at odds with this prediction. Elevated levels of equity and house prices are not typically associated with higher future dividend growth rates or lower expected returns, based on surveys (see Williams 2013 and references therein). Something else is going on.

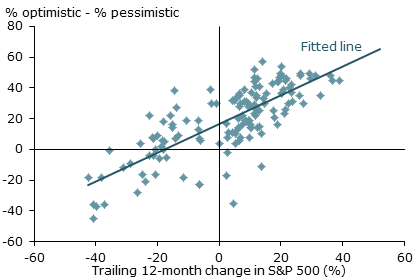

Figure 2

Extrapolative expectations in the stock market

Sources: Greenwood and Shleifer (2013), Wells Fargo/Gallup, and S&P

500 data from Shiller (2005, updated). Data from 1996 to 2013

One way to decipher this breakdown in the standard model is to relax the assumption of rational expectations and allow people’s decisions to be driven by their perceptions of what the future may hold, whether grounded in reality or not. In particular, the empirical evidence indicates that people tend to extrapolate future stock price movements from recent stock price performance (Greenwood and Shleifer 2013, Williams 2013). Figure 2 plots the degree of investor optimism about future stock market gains from a Gallup survey against the trailing 12-month change in the Standard & Poor’s 500 stock price index. The correlation is highly positive. In fact, the worst reading for the investor optimism index for the period shown in the figure occurred in early 2009, just as the stock market plunged to its recession low and was on the verge of a remarkable rebound. The highest reading of investor optimism occurred in early 2000 following the dot-com boom, on the cusp of the crash.

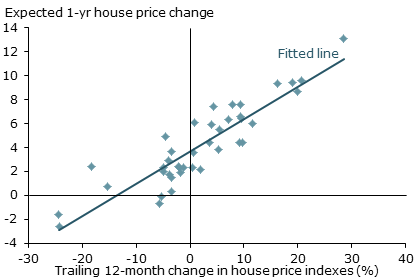

Figure 3

Extrapolative expectations in the housing market

Sources: S&P/Case-Shiller, FHFA, and Case, Shiller, and Thompson

(2012). Cities included are San Francisco/Alameda County, Boston, Los

Angeles/Orange County, and Milwaukee. Data from 2003 to 2012.

The same type of extrapolative expectations plays out in housing markets in the United States and abroad. When house prices go up, people expect them to continue to rise. And when they fall, people turn much more pessimistic about future appreciation. Figure 3 plots surveys of expected house price appreciation over the next year against the percentage change in prices observed during the prior year for four major U.S. cities over the past decade. Similar patterns for house price expectations are seen in Norway and Sweden, two other countries that have gone through huge house price booms (Jurgilas and Lansing 2013).

One way to make sense of these patterns in asset prices is to abandon the assumption of full information assumed in the standard asset price model with rational expectations. Instead, investors make do with the limited information at hand when judging likely future discounted dividend payments and the future price of the asset. A growing body of evidence in behavioral economics and finance shows that people’s expectations of future asset returns depend on their past experiences (Vissing-Jorgensen 2003 and Malmendier and Nagel 2011). In fact, a simple model of extrapolative expectations of future asset price movements does a very good job of explaining the big swings in the U.S. stock price-to-dividend ratio over time (Adam, Beutel, and Marcet 2013).

Why does this pattern of behavior matter for thinking about monetary policy and financial stability? The recognition that people behave in this way can move us a long way closer to understanding how asset price booms and busts can emerge and how policy actions could influence that process. Let me give a concrete example. Low interest rates boost fundamental valuation of assets. In a world of rational expectations, asset prices adjust and that’s it. But, if one allows for limited information, the resulting bull market may cause investors to get “carried away” over time and confuse what is a one-time, perhaps transitory, shift in fundamentals for a new paradigm of rising asset prices. This is the type of dynamic Robert Shiller (2005) found common to numerous booms throughout history. Such a process can also help us understand why households and financial institutions take on greater risks during asset booms, as they too fall into the trap of excessively optimistic expectations about the future (Williams 2011). More generally, it provides an opening to understand how risks to the financial system can grow, even when economic agents act optimally given the information they have.

Monetary policy frameworks in support of financial stability

The discussion of the very real and sizable costs of using monetary policy to deal with risks to financial stability—along with the uncertain benefits of doing so—argues for finding alternative tools that engender more favorable tradeoffs. It has become a mantra in central banking to declare that robust micro- and macro-prudential regulatory and supervisory policies should provide the first and second lines of defense for financial stability. And that monetary policy actions should only be a last resort. I agree with this conclusion.

However, this framing of the question is overly limited when it comes to thinking about how monetary policy can support financial stability. It is too steeped in the mechanism of response to asset bubbles or looming risks. One of monetary policy’s most important lessons—borne out in both theory and practice—is that the framework for policy is more important than the details of the execution. In terms of price and economic stability, anchoring inflation expectations and responding in a systematic way to economic developments are by far the most important elements of good monetary policy.

Instead of thinking about how monetary policy should respond to risks to financial stability, we should focus on studying ways to design policy frameworks that support financial stability with only a modest cost to macroeconomic goals and anchoring inflation expectations. Two recent proposals illustrate this type of thinking. The first is moving from inflation targeting to nominal income targeting. The second is conducting monetary policy in a way that reduces the creation of private-sector money-like assets. I am not personally advocating either of these proposals, but I do view them as creative ways to think of how to bend the curve in terms of macroeconomic and financial stability tradeoffs.

The idea that nominal income targeting could be supportive of financial stability is relatively straightforward (Koenig 2013, Sheedy 2014). Debt contracts are typically written in nominal terms, so the ability to repay depends on one’s nominal income. If the central bank acts to keep nominal income on a steady growth path, then—at least on the aggregate—people will be able to continue to repay their loans and the deadweight losses and disruptive effects associated with foreclosure and bankruptcy can be avoided. Moreover, the nominal income targeting framework has favorable characteristics in the presence of the zero lower bound. That said, nominal income targeting does allow for persistent deviations of inflation from target, which may undermine the anchoring of expectations. These are the types of tradeoffs that require further study and analysis.

The second proposal that has gained attention is the idea that a central bank with the ability to pay interest on bank reserves can independently use the quantity of bank reserves to affect the stability of the financial system (Stein 2012, Kashyap and Stein 2012, and Cochrane 2014). Note that this does not cause a tradeoff in terms of price and economic stabilization goals because the central bank retains the ability to set the short-term interest rate. The basic idea is that, in today’s economy, the concept of money extends beyond traditional definitions and includes short-term fixed-income securities. In these models, a central bank’s provision of interest-bearing short-term accounts to a broad set of intermediaries extending beyond depository institutions reduces the incentive of the private sector to create excessive short-term debt that contributes to financial instability. Again, this is an intriguing idea that calls for further study of its benefits and possible unintended consequences.

To sum up, we are all aware of the importance of having a robust, resilient financial system. Recent events have made that all too clear. The challenge for economists and policymakers is to better understand the sources of these risks and the tools that can be devised to reduce them, without undermining the hard-fought achievement of price stability and well-anchored inflation expectations.

John C. Williams is president and chief executive officer of the Federal Reserve Bank of San Francisco.

References

Adam, Klaus, Johannes Beutel, and Albert Marcet. 2013. “Stock Price Booms and Expected Capital Gains.” Unpublished manuscript, University of Mannheim.

Bank of England. 2013. “Forward Guidance,” statement, August 7.

Case, Karl E., Robert J. Shiller, and Anne Thompson. 2012. “What Have They Been Thinking? Home Buyer Behavior in Hot and Cold Markets.” NBER Working Paper 18400.

Cochrane, John H. 2014. “Monetary Policy with Interest on Reserves.” Presented at the Hoover Institution conference on Frameworks for Central Banking in the Next Century, May 29–30.

Fligstein, Neil, Jonah Stuart Brundage, and Michael Schultz. 2014. “Why the Federal Reserve Failed to See the Financial Crisis of 2008: The Role of ‘Macroeconomics’ as a Sensemaking and Cultural Frame.” University of California, February.

Greenwood, Robin, and Andrei Shleifer. 2013. “Expectations of Returns and Expected Returns.” NBER Working Paper 18686.

Jurgilas, Marius, and Kevin J. Lansing. 2013. “Housing Bubbles and Expected Returns to Homeownership: Lessons and Policy Implications.” In Property Prices and Real Estate Financing in a Turbulent World, eds. M. Balling and J. Berg, SUERF studies 2013/14. Brussels/Verona: Société Universitaire Européenne de Recherches Financières (SUERF), pp. 101–128.

Kashyap, Anil K., and Jeremy C. Stein 2012. “The Optimal Conduct of Monetary Policy with Interest on Reserves.” American Economic Journal: Macroeconomics 2012, 4(1), pp. 266–282.

Koenig, Evan F. 2013. “Like a Good Neighbor: Monetary Policy, Financial Stability, and the Distribution of Risk.” International Journal of Central Banking 9(2, June), pp. 57–82.

Levin, Andrew T. 2014. “The Design and Communication of Systematic Monetary Policy Strategies.” Presented at the Hoover Institution conference on “Frameworks for Central Banking in the Next Century,” May 29–30.

Malmendier, Ulrike, and Stefan Nagel. 2011. “Depression Babies: Do Macroeconomic Experiences Affect Risk-Taking?” Quarterly Journal of Economics 126(1), pp. 373–416.

Norges Bank. 2014. Monetary Policy Report with Financial Stability Assessment, March.

Sheedy, Kevin D. 2014. “Debt and Incomplete Financial Markets: A Case for Nominal GDP Targeting.” Presented at Brookings Panel on Economic Activity, March 20–21.

Shiller, Robert J. 2005. Irrational Exuberance. 2nd edition. Princeton, NJ: Princeton University Press.

Stein, Jeremy C. 2012. “Monetary Policy as Financial Stability Regulation.” The Quarterly Journal of Economics, 127, 57–95.

Svensson, Lars. E.O. 2013. “Some Lessons from Six Years of Practical Inflation Targeting,” Sveriges Riksbank Economic Review, 2013:3, 29-80.

Sveriges Riksbank. 2014. Monetary Policy Report. February.

Vissing-Jorgensen, Annette. 2003. “Perspectives on Behavioral Finance: Does ‘Irrationality’ Disappear with Wealth? Evidence from Expectations and Actions.” Chapter in NBER Macroeconomics Annual 2003, Volume 18, eds. Mark Gertler and Kenneth Rogoff. Cambridge, MA: MIT Press, pp. 139–208.

Williams, John C. 2011. “Monetary Policy and Housing Booms.” International Journal of Central Banking 7(1, March), pp. 345–354.

Williams, John C. 2013. “Bubbles Tomorrow, Yesterday, but Never Today?” FRBSF Economic Letter 2013-27, September 23.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org