The natural rate of interest, or r-star, is used to evaluate whether monetary policy is restrictive or supportive of economic activity. However, this benchmark rate can only be estimated, and policymakers’ misperceptions of the level of the natural rate can carry substantial economic costs in terms of unemployment and inflation. A scenario using mistaken perceptions shows that the costs of overestimating the natural rate are greater than the cost of underestimating it if policy space is limited by the effective lower bound on the nominal federal funds rate.

A key concept that guides the Federal Reserve’s monetary policy is the natural rate of interest, also known as r-star. This refers to the real, or inflation-adjusted, interest rate that is consistent with an economy at full employment with inflation stabilized at a desired target. If the real interest rate that prevails as a result of the Federal Reserve’s monetary policy decisions is above r-star, then monetary conditions are tight and are likely to lead to higher unemployment and lower inflation. Conversely, if the real interest rate is below r-star, then monetary conditions are loose and likely to lead to lower unemployment and higher inflation.

Unfortunately, the natural rate of interest is not directly observable and can only be estimated (Laubach and Williams 2003). Furthermore, these estimates are imprecise and often revised with new data (Cúrdia 2015), which means that policymakers could perceive r-star to be either higher or lower than its actual value.

In this Economic Letter we use an empirical model of the U.S. economy to quantitatively examine the costs of misperceiving r-star. We look back at the period from 2016 through 2019, when the Federal Reserve slowly raised the federal funds rate (FFR) above its effective lower bound (ELB) of near zero, where it had been since the end of the Great Recession. To illustrate the potential costs of misperceptions, we consider a scenario in which the true r-star fell 2 percentage points relative to its estimate at the time decisions were made. Missing this change and assuming a higher r-star would lead to monetary policy being too tight, raising unemployment 1.7 percentage points. By contrast, mistakenly believing r-star had fallen by twice its true decline could lead to policy being too accommodative, lowering unemployment 1.2 percentage points.

Our findings suggest that, when the FFR is close to the ELB, the costs are higher if policymakers mistakenly assume that r-star is greater than its true value. This happens because the ELB limits the ability of policymakers to counter a weaker economic outlook and correct course when they realize that monetary policy is not as accommodative as was previously thought. Therefore, when the policy rate is close to the lower bound, policymakers may prefer to act under the assumption of a lower r-star.

Modeling natural rate misperceptions

To measure the effects of policymakers’ perceptions regarding the natural rate, we use the empirical model described in Ajello et al. (2020) to construct possible scenarios. This is based on a standard workhorse macroeconomic model typically used to analyze monetary policy.

We measure economic slack as the unemployment gap, which is the difference between current unemployment and full employment, a hypothetical level that would prevail in the model if all prices adjusted freely in response to economic shocks to allow labor resources to be fully utilized. In the model, the unemployment gap increases with the interest rate. Ultimately, economic slack increases with the current and expected future interest rate gaps, measured as the difference between the real FFR and the real natural rate of interest. The intuition is that a positive interest rate gap means that financial conditions are tighter, leading households and firms to save more and delay consumption and investment. This lowers demand and increases unemployment. Inflationary pressures fall with economic slack but rise with expected future inflation.

In the model, monetary policy sets the FFR level to keep inflation and unemployment as close as possible to desired or target levels and avoids large changes to the FFR. Furthermore, monetary policy avoids large interest rate gaps, consistent with the evidence that the FFR responded to r-star from 1987 through 2008 (Cúrdia et al. 2015).

Measuring the costs of natural rate misperception

We use data from 1987 through the second quarter of 2019 for core personal consumption expenditures price inflation; real GDP growth; the unemployment rate; the effective FFR; the long-run unemployment rate from the Congressional Budget Office and the Fed’s Summary of Economic Projections; and FFR expectations derived from financial data based on Christensen and Rudebusch (2012).

To measure the costs of natural rate misperceptions, we use the framework to estimate the factors determining the evolution of the U.S. economy from 2016 through 2019, including an estimate of r-star. In the first quarter of 2016 our estimate of r-star was –0.8%. We then consider an alternative scenario in which underlying conditions change, lowering the level of r-star at the beginning of 2016 by 2 percentage points. We look at potential policy responses, one in which the central bank correctly perceives the drop in r-star as well as two possible misperceptions, in which policymakers either miss the drop, believing the rate is higher than it is, or overstate the drop to be twice as large, believing the rate is lower than it actually is.

This alternative scenario is meant to showcase what would happen if economic conditions were to take a turn for the worse during the early stages of the so-called liftoff, when the federal funds rate began to rise above its effective lower bound. By comparison, our estimate of r-star fell nearly 6 percentage points during the financial crisis of 2008. From 2008 to 2016, our model estimates are within a 90% confidence range as wide as 4 percentage points around the central estimate. Our scenario thus lies well within historical standards.

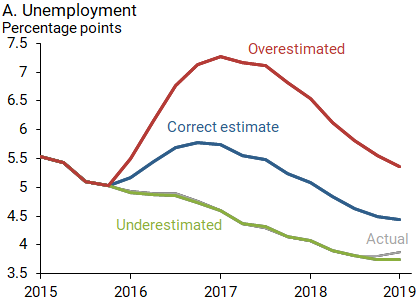

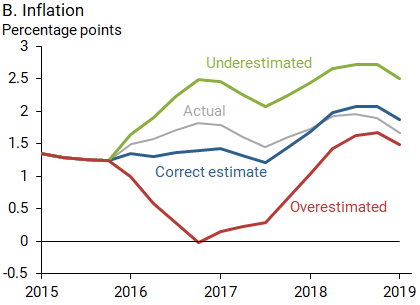

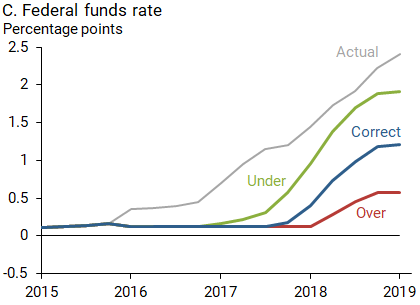

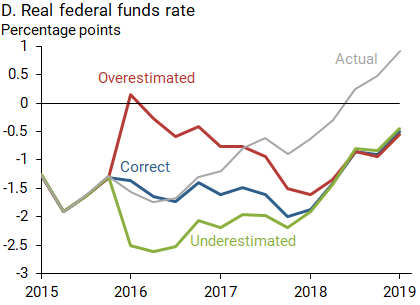

Figure 1 shows the simulated paths of unemployment, inflation, and both the nominal and real FFR for this alternative scenario. It compares the case in which policymakers correctly perceive the drop (blue lines) against the two cases in which policymakers either overestimate r-star (red lines) or underestimate r-star (green lines). The figure also shows the actual data (gray lines).

Figure 1

Estimates following correct and incorrect policy assumptions about the natural rate of interest

The blue lines show that, even if policymakers correctly perceive the level of r-star, the ELB substantially limits the ability of monetary policy to contain the economic impact of the fall in r-star. If the lower bound were not a constraint, the FFR would have reached –0.6%, and unemployment would have peaked at 5.2% rather than 5.8%.

If policymakers miss the drop and overestimate the natural rate (red lines), they set policy too tight, leading to higher unemployment and lower inflation. In particular, panel A shows that unemployment is as much as 1.7 percentage points higher than with the correct estimate. Despite tight policy, the FFR is actually lower, because economic conditions deteriorate and policy has to correct for that. The proper measure of policy tightness is the real FFR, which is 1.5 percentage points higher than in the case with correct assumptions. In other words, the misperception pushes up the FFR, but the immediate deterioration in economic conditions implies a larger downward pull, forcing policymakers to keep the FFR at the lower bound for a longer time. Unemployment is considerably higher because of the ELB constraint. If the lower bound were not a constraint, the FFR would fall to –1.2%, and unemployment would peak at 5.6% rather than 7.3%.

Conversely, if policymakers underestimate the true value of the natural rate by assuming a larger drop (green lines), policy is too accommodative, with a lower real FFR leading to lower unemployment and higher inflation. In this case, unemployment is 1.2 percentage points lower than if r-star is correctly perceived. Due to higher inflation and lower unemployment, the FFR rises faster in this case.

Unemployment thus reacts to different degrees depending on policymakers’ misperceptions of r-star. The response of inflation is also asymmetric: inflation falls 1.4 percentage points lower in the case that the r-star drop is missed, but rises 1.1 percentage points higher in the case that the r-star drop is perceived to be twice as large. The inflation response to misperceptions is less asymmetric than for unemployment because of the lower sensitivity of inflation to economic slack in recent years, also known as the flat Phillips curve, discussed in Jordà et al. (2019).

Summary

In this Letter, we find that the effective lower bound on the nominal federal funds rate produces an asymmetry in the economic costs of policymakers’ errors in estimating the natural rate of interest. In particular, assuming that the natural rate is greater than its true value has a higher economic cost than assuming it to be lower than the true value. This asymmetry arises because the effective lower bound on the nominal federal funds rate limits the policy space available to correct for overestimations of r-star. This finding might lead policymakers to err on the side of choosing a lower estimate of r-star or, equivalently, setting monetary policy as if they have embraced a lower r-star; this is likely to imply a gradual normalization of the federal funds rate when the time comes to lift off from the effective lower bound.

The updated Federal Open Market Committee statement on longer-run goals and monetary policy strategy describes the new strategy of average inflation targeting (Board of Governors 2020). This is one way to mitigate the constraint imposed by the effective lower bound and reduce the asymmetry of economic outcomes due to r-star misperceptions.

Andrea Ajello is chief of the Macro Financial Analysis section of the Federal Reserve Board of Governors.

Isabel Cairó is a senior economist in the Macroeconomic and Quantitative Studies section of the Federal Reserve Board of Governors.

Vasco Cúrdia is a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco.

Albert Queralto is a principal economist in the Global Modeling Studies section of the Federal Reserve Board of Governors.

References

Ajello, Andrea, Isabel Cairó, Vasco Cúrdia, Thomas A. Lubik, and Albert Queralto. 2020. “Monetary Policy Tradeoffs and the Federal Reserve’s Dual Mandate.” Finance and Economics Discussion Series 2020-66.

Board of Governors of the Federal Reserve System. 2020. “Statement on Longer-Run Goals and Monetary Policy Strategy.” August 27.

Christensen, Jens H.E., and Glenn D. Rudebusch. 2012. “The Response of Interest Rates to U.S. and U.K. Quantitative Easing.” The Economic Journal 122, pp. F385–F414.

Cúrdia, Vasco, Andrea Ferrero, Ging Cee Ng, and Andrea Tambalotti. 2015. “Has U.S. Monetary Policy Tracked the Efficient Interest Rate?” Journal of Monetary Economics 70(C), pp. 72–83.

Cúrdia, Vasco. 2015. “Why So Slow? A Gradual Return for Interest Rates.” FRBSF Economic Letter 2015-32 (October 12).

Jordà, Òscar, Chitra Marti, Fernanda Nechio, and Eric Tallman. 2019. “Inflation: Stress-Testing the Phillips Curve.” FRBSF Economic Letter 2019-05 (February 11).

Laubach, Thomas, and John C. Williams. 2003. “Measuring the Natural Rate of Interest.” The Review of Economics and Statistics 85(4), pp. 1,063–1,070.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org