The Paycheck Protection Program (PPP) and the PPP Liquidity Facility were launched early in the pandemic to help many small businesses survive. These programs encouraged banks to lend more extensively to small businesses over the first half of 2020. Since then, however, banks have reduced their exposure to these loans, leaving no significant changes in small business lending associated with participation in these programs over the three-year period from 2020 through 2022. This raises some doubt that emergency lending programs encourage long-term relationships that outlast the programs.

The U.S. Treasury launched the Paycheck Protection Program (PPP) in March 2020 to help small businesses survive and continue paying their employees during pandemic-associated lockdowns (see Beauregard, Lopez, and Spiegel 2020 for details). The PPP was administered by the Small Business Administration (SBA), which guaranteed nearly $800 billion in loans originated by commercial banks to qualified small businesses and farms. The launch of the Paycheck Protection Program Liquidity Facility (PPPLF), established soon after by the Federal Reserve and the Treasury, provided liquidity to participating financial institutions by accepting PPP loans as collateral at face value.

Most research to date suggests that the programs encouraged additional small business lending. In a recent paper, Lopez and Spiegel (2023) demonstrated that both the PPP and the PPPLF increased small business lending growth during the most severe lockdown portion of the pandemic period, the first half of 2020. Moreover, Karakaplan (2021) identifies a complementary relationship between bank PPP activity and conventional small business lending and postulates that lending through the programs may have encouraged the formation of lasting relationships between banks and their small business borrowers.

In this Economic Letter, we examine the impact of these programs on bank small business lending over the past two to three years. Given that the programs encouraged more bank lending to small businesses early in the pandemic, lending patterns after the programs ended were likely influenced by the relationships forged under the programs. If small business lending relationships had been left unchanged by these programs, banks likely would have lowered their expanded small business exposure back toward pre-pandemic levels after the PPP ended. Alternatively, if the relationships were strengthened, the expanded share of small business loans on bank balance sheets would likely prove durable.

Our results show that bank small business lending growth between mid-2020 and the end of 2022 was declining in PPP and PPPLF participation at the start of the period. This is true both for overall lending growth and for the subset of small business lending that was not connected to the PPP. We therefore conclude that once these programs were phased out and loan guarantees were no longer available, banks reduced their small business exposure to shares comparable to their levels at the start of the pandemic, implying limited durability for the relationships established.

Measuring the intensity and impact of PPP and PPPLF participation

We examine the impact of PPP and PPPLF participation on growth in bank lending to small businesses using bank-level Call Report data at a quarterly frequency. Commercial banks are required to file quarterly reports of their income and balance sheet positions. Because most PPP loans were extended during the first half of 2020, we compare lending growth from the start of the second half of 2020 through the end of 2022—the most recent Call Report data available—as well as over the entire period from the start of 2020 through the end of 2022. We follow regulatory reporting conventions that define small business loans as being $1 million or less for standard commercial loans secured by nonfarm nonresidential properties or $500,000 or less for small agricultural loans.

We characterize the intensity of PPP participation by an individual bank as the share of PPP loans in total small business lending during the first half of 2020. Similarly, we characterize the intensity of PPPLF participation in terms of the share of PPP loans that banks used as collateral to obtain cash from the Federal Reserve. Take-up in the PPPLF was particularly large among smaller institutions for whom liquidity concerns from additional small bank lending through PPP participation were more prevalent.

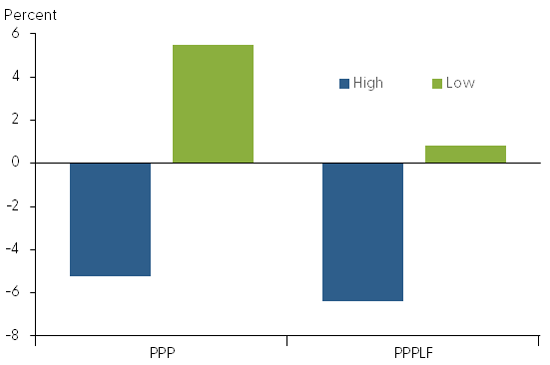

Using this definition, it appears that extensive participation in the PPP during early 2020 is associated with reduced subsequent lending to small businesses, measured from the middle of 2020 through the end of 2022. Figure 1 divides our sample of 4,641 banks in half, based on the intensity of PPP participation in the first half of 2020. The blue bar represents average growth rates in small business lending for banks with below-median levels of PPP participation during early 2020, and the green bar reflects the same for banks with above-median levels of PPP participation.

Figure 1

Small business lending growth and PPP participation

Source: Bank Call Reports and authors’ calculations.

Note: Mean annualized percentage point growth between 2020:Q2 and 2022:Q4 in small business and farm lending. Banks are grouped into either high or low participation, based on being above or below median participation in PPP and PPPLF programs in the first half of 2020, respectively.

Lending growth to small businesses moved in opposite directions on average for these two groups. Banks with below-median PPP participation increased their lending to small businesses over this time by an average of 5.5 percentage points per year. In contrast, banks with above-median PPP participation reduced their small business lending by an average of 5.2 percentage points per year.

Results were similar for PPPLF participation. Banks with below-median PPPLF participation increased their lending to small businesses by an average of 0.8 percentage points per year, while those with above-median PPPLF participation were 6.4 percentage points lower per year.

After accounting for participation in these programs, our results indicate that banks would have increased their small business lending over this period on average. However, for the group of banks with above-median PPP or PPPLF participation, the drop in bank lending on average demonstrates a move to rebalance small business lending back towards pre-pandemic shares.

Statistical evidence

Two potential pitfalls argue against drawing strong conclusions from the simple relationships displayed in Figure 1. First, banks could differ in ways other than their PPP participation intensity, including ways that affect both their program participation and their small business lending decisions. Second, program participation itself could be determined by unmeasured bank characteristics that influenced subsequent bank small business lending decisions.

To address both issues, we turn to additional statistical analysis. First, to account for other potentially important differences across banks, we include other Call Report variables, including proxies for the share of assets with high liquidity, the share of funding coming from deposits, the ratio of capital to equity, and the level of outstanding loan commitments. Second, to address the possible joint determination of program participation, we follow Anbil, Carlson, and Styczynski (2021) and Lopez and Spiegel (2023) in isolating the causal effects of PPP and PPPLF participation on bank small business lending through a statistical approach known as instrumental variables.

This approach allows us to identify the direct impact of these programs through differences in participation that are unrelated to prevailing conditions during the pandemic and hence unlikely to be directly linked to small business lending activity as well. We first estimate the regression relationship between participation in these programs and interactions with both the SBA and the Federal Reserve discount window before the pandemic. The discount window data used in this study is proprietary and not available to the general public. We assume that the intensity of previous interactions with the SBA and Federal Reserve facilitated participation in these programs, particularly because the funds were limited. As a result, banks with more intense pre-pandemic interaction with these institutions would likely have greater program participation.

The variations in program participation identified through this method can then be considered predetermined and not subject to any shocks associated with the onset of the pandemic. These fitted measures of PPP and PPPLF participation, combined with the conditioning variables mentioned earlier, should then yield accurate measures of the impact of PPP and PPPLF on small business lending via estimation of an additional regression equation.

In addition to growth in overall small business lending, we also consider growth in non-PPP lending, measured by subtracting PPP balances held at the beginning and end of our estimated time period. This ensures that any movements in small business lending we identify are not directly explained by loans extended or paid under the PPP.

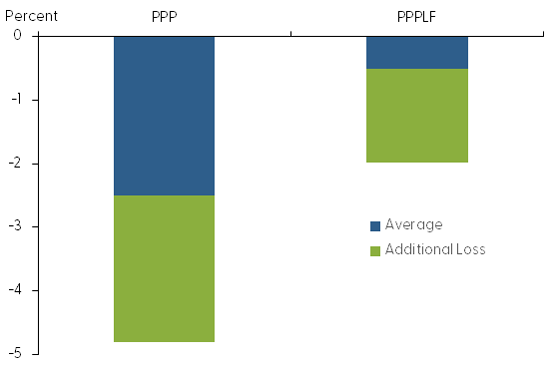

Our estimation results strongly confirm the implications of the averages reported earlier. First, we examine growth in non-PPP and overall small business lending from mid-2020 through the end of 2022. This period begins immediately after the bulk of PPP funds were distributed and ends with the most recent Call Report data available. We find that small business lending growth was decreasing in both PPP and PPPLF participation intensity for both measures at statistically significant levels. For example, our point estimates indicate that a one-standard-deviation increase in PPP participation intensity (0.26 in our sample) would reduce non-PPP small business lending an additional 2.30 percentage points on average per year over this period. Similarly, a one-standard-deviation increase in PPPLF participation intensity (0.25 in our sample) would reduce overall small business lending an additional 1.48 percentage points on average. These additional declines in non-PPP small business lending are shown by the green portions of the bars in Figure 2; our full regression results are available in an online appendix.

Figure 2

Declines in non-PPP lending for high-participation banks

Source: Bank Call Reports and authors’ calculations.

Note: Mean annualized percentage point growth between 2020:Q2 and 2022:Q4 in small business and farm lending. Sum of green and blue rectangles show predicted changes in non-PPP lending for high-participation banks, defined as those with one standard deviation above-median PPP and PPPLF participation, respectively. Blue rectangles alone depict population averages.

To assess the full impact of the PPP on small business lending over the medium term, we extend the sample to the full 2020–2022 period, including the PPP implementation period. If banks reduced their extra small business loan exposure after the programs ended, the overall impact of program participation is unlikely to be as positive for small business lending as we found for the early period.

Indeed, that is exactly what we find. Consistent with our findings of a negative association between program participation and small business lending growth for the latter portion of our sample, the net impact of PPP and PPPLF participation for small business lending growth over 2020–2022 is not significantly different from zero. We therefore conclude that, following the pandemic period, banks on average moved to undo the additional small business lending exposure they were encouraged to acquire during the pandemic.

Conclusion

Now that 2½ years have passed since the bulk of PPP loans were extended during the pandemic, it’s a good time to revisit the expansionary effects of the PPP and PPP Liquidity Facility. In this Economic Letter, we examined growth in small business lending over this period, both with and without PPP loans. Our results indicate that there was no significant medium-term effect of participation in either the PPP or PPPLF on small business lending growth over the entire three-year period from program implementation through the most recent data. Our interpretation is that, after the sunsetting of the pandemic-era programs, banks readjusted their expanded small business lending portfolios back towards pre-pandemic levels.

We should stress that our results do not identify whether these programs were “successful.” Earlier research has demonstrated that the programs encouraged banks to acquire more small business exposure during the early lockdown period of the pandemic, which is what they were designed to achieve. However, our results for the medium term raise doubts that the expanded small business lending resulting from these programs built durable lending relationships. Instead, it appears that, after these programs ended, banks on average moved to return their exposure towards pre-pandemic levels.

Jack Mueller

Research Associate, Economic Research Department, Federal Reserve Bank of San Francisco

Mark M. Spiegel

Senior Policy Advisor, Economic Research Department, Federal Reserve Bank of San Francisco

References

Anbil, Sriya, Mark Carlson, and Mary-Frances Styczynski. 2021. “The Effect of the PPPLF on PPP Lending by Commercial Banks.” Finance and Economics Discussion Series (FEDS) 2021-30, Federal Reserve Board of Governors.

Beauregard, Remy, Jose A. Lopez, and Mark M. Spiegel. 2020. “Small Business Lending during COVID-19.” FRBSF Economic Letter 2020-35 (November 23).

Karakaplan, Mustafa U. 2021. “This Time Is Really Different: The Multiplier Effect of the Paycheck Protection Program (PPP) on Small Business Bank Loans.” Journal of Banking and Finance 133(106223).

Lopez, Jose A., and Mark M. Spiegel. 2023. “Small Business Lending under the PPP and PPPLF Programs.” Journal of Financial Intermediation 53(101017), pp. 1–10.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org