Concerns emerged during the COVID-19 pandemic over banks continuing to lend to unproductive businesses that were close to default. Recent research shows that lenders have incentives to offer relatively better terms to less-productive and more-indebted firms to recover their prior investments. U.S. loan-level data confirm the empirical relevance of such lending behavior. A rich model of firms and banks further emphasizes that this type of lending can also depress overall productivity by sustaining firms that should otherwise exit the economy.

Standard economic intuition suggests that banks should restrict credit to unproductive firms that are close to default to avoid further losses. However, historical episodes suggest that banks may not always act according to such principles. Following the collapse of stock and real estate markets in the early 1990s, Japanese banks eased credit conditions to poorly performing firms (Peek and Rosengren 2005). Such practices contributed to less-productive firms remaining in business, leading to the creation of so-called zombie firms, which depressed productivity and economic growth (Caballero, Hoshi, and Kashyap 2008). Similar evidence has been documented for other countries that find themselves in a severe recession and have undercapitalized banks—such as periphery countries of the European Union during the euro-zone crisis (Acharya et al. 2022).

When the COVID-19 pandemic broke out in March 2020, U.S. businesses experienced a sharp drop in profits, pushing many to the brink of failure. At the time, concerns emerged that U.S. banks would also evergreen some loans—granting further credit to firms close to default to keep them alive. However, such worries were often dismissed because the U.S. economy was not thought to be in a severe depression and banks were assessed to be relatively well capitalized (Gagnon 2021).

Motivated by these developments, this Economic Letter describes our research (Faria-e-Castro, Paul, and Sánchez 2023) that considers whether evergreening can be a general feature of financial intermediation. Our study builds on an intuitive idea: to recover its past investment, a lender has incentives to offer more favorable lending terms to a firm close to default to keep the firm alive. In contrast to standard intuition, we find that evergreening allows a firm with worse fundamentals—less productive and with more debt—to borrow at relatively better terms. Based on detailed U.S. loan-level data for the years 2014-19, we provide empirical support for our theory at a time when the banks were relatively well capitalized and the economy was growing steadily. Using a dynamic model of the U.S. economy, we find that evergreening has material effects on the performance of the overall economy, resulting in lower borrowing rates, higher levels of debt, and depressed overall productivity.

A simple model of evergreening

We illustrate the basic decision making process with a simple model that revolves around the tradeoff faced by a bank that has to decide what interest rate to offer a firm with which it has an ongoing relationship—that is, a firm that already owes some debt to that lender. On the one hand, the bank would like to choose a high interest rate to maximize its profit from the lending relationship. On the other hand, the bank understands that a high interest rate may instead cause the firm to close its business, which would no longer be profitable, and default on its existing loan. Thus, the bank will try to balance these concerns when proposing lending terms. Additionally, we assume that the firm has the option to obtain credit from other potential lenders. The competition from other lenders further limits the maximum interest rate the lending bank could charge.

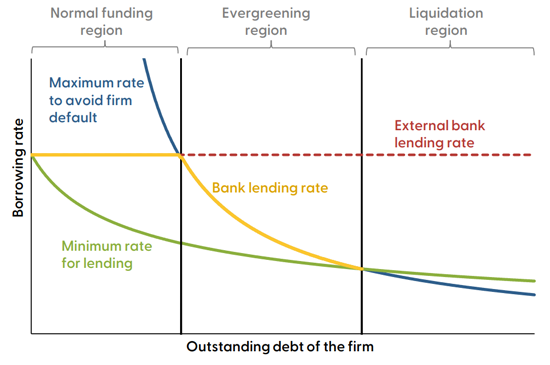

Our analysis shows that the optimal lending agreement depends on the level of existing debt the firm owes to the bank. This is illustrated using three different areas in Figure 1, where the amount of outstanding debt is shown on the horizontal axis and the borrowing rate is shown on the vertical axis. The interest rate offered by the lending bank is illustrated by the gold line. In the first region, when the amount of existing debt is relatively low and the firm is unlikely to default, the lender tries to gain as much profit as it can from the relationship by offering an interest rate that matches the interest rate offered by external lenders, shown as the red dashed line. We call this the normal funding region.

Figure 1

Decision analysis for evergreening loans

Default becomes more likely for firms with intermediate levels of outstanding debt, the middle region in Figure 1. The bank therefore chooses to offer a lower interest rate that is high enough to retain some profit but still avoid firm default (blue line). In turn, this allows the bank to recoup its past lending. We call this the evergreening region, where the more-indebted and less-productive firms can access relatively more borrowing at better lending terms. Finally, a third liquidation region exists for firms with high levels of outstanding debt. In this region, the amount of profit that the lender would lose by keeping the firm alive through lower interest rates exceeds the value of recovering the old debt. That is, the minimum rate that the bank is willing to lend (green line) lies above the maximum rate to avoid firm default. If that is the case, it is not profitable for the bank to continue lending, and the firm would therefore go out of business.

Empirical evidence on evergreening

To assess whether our theory accurately reflects how banks make lending decisions in practice, the empirical analysis in Faria-e-Castro, Paul, and Sánchez (2023) relies on the Federal Reserve’s Y-14 data set, which is typically used for stress-testing large U.S. banks. These data provide us with detailed loan-level information, including banks’ risk assessments for each borrower—in particular, the probability of default, which measures a firm’s degree of financial distress.

To use these data, we need to separate the changes in demand for credit—stemming from the business side—from changes in supply that originate from the bank side. Because our theory is concerned with supply-side changes, we need to hold credit demand from businesses constant. We achieve this by considering a sample of firms that borrow from multiple banks, which allows us to keep credit demand fixed under the assumption that firms have a common demand across their lenders (Khwaja and Mian 2008). Cross-sectional variation in bank exposures to distressed firms can then capture the supply-side changes.

We measure a bank’s exposure according to the share of a firm’s debt that it holds; we classify a firm as financially distressed if a bank assesses the firm’s probability of default as elevated. Consistent with our theory, we find that a bank that owns a larger debt share provides a distressed firm with relatively more credit at lower interest rates. We further show that these effects persist at the business level: a distressed firm that borrows from fewer lenders shows relatively more debt growth and invests relatively more.

We find these effects even outside of a recession: the U.S. economy was growing steadily over the period from 2014 to 2019 that we consider. In contrast to prior studies that focused on distressed European and Japanese institutions, U.S. banks were also relatively well capitalized over our sample.

Macroeconomic consequences of evergreening

The empirical evidence validates the key arguments in our simple model, but the framework otherwise provides few insights into the broader macroeconomic consequences of evergreening. To explore such implications, we use a dynamic model with different types of businesses that have varying levels of debt and default. The dynamic model accounts for businesses entering and exiting the economy and allows us to analyze overall changes to the economy by aggregating across the individual firms. We can also consider scenarios in which risky lending is either spread across a large number of dispersed banks or focused on a single bank that is more likely to internalize the possibility of default on past lending.

Applying the model to U.S. data, we find that evergreening affects business borrowing and bank investment decisions even when the economy is not in a recession. On the one hand, evergreening allows lenders to recover their investments more frequently, and those benefits are passed on to borrowers through lower interest rates. As a result, businesses that have a relationship with a single bank tend to increase their debt and capital between 1% and 3%, depending on the different model specifications. On the other hand, while those businesses invest more, they also tend to be less productive, which reduces economy-wide productivity around 0.25% relative to an economy with lending spread out among competitive lenders.

We also find that firms that benefit from subsidized lending tend to be more leveraged and less productive—features that the literature typically associates with zombie firms. However, subsidized firms are also more risky and pay higher interest rates than unsubsidized firms—though those interest rates are lower than in a scenario without evergreening. This means that using a measure that classifies firms as zombies depending on whether they pay interest rates lower than the benchmark safe rate may underestimate the extent of the problem.

Conclusion

Up to this point, the literature has largely associated zombie lending or evergreening with economies that find themselves in deep recessions and have severely undercapitalized banks. The main empirical contributions focus on cases that fit these descriptions—Japan in the 1990s and periphery countries during the euro-zone crisis more recently. In our research described in this Letter, we take a different perspective. We theoretically and empirically argue that evergreening is a general feature of financial intermediation—taking place even in times of economic growth and within economies that have well-capitalized banks.

We build on an intuitive idea. To recover its past investment, a lender has incentives to offer more favorable lending terms to a firm close to default to keep the firm alive. We find empirical support for our theory using data for large U.S. banks during the years 2014-19, a time when the banks were thought to be relatively well capitalized and the U.S. economy was growing steadily. Using a calibrated dynamic model, we find that evergreening has negative effects for overall productivity since less productive firms are kept alive that would otherwise default.

Miguel Faria-e-Castro

Economic Policy Advisor, Research Division, Federal Reserve Bank of St. Louis

Pascal Paul

Senior Economist, Economic Research Department, Federal Reserve Bank of San Francisco

Juan M. Sánchez

Senior Economic Policy Advisor, Research Division, Federal Reserve Bank of St. Louis

References

Acharya, Viral, Matteo Crosignani, Tim Eisert, and Sascha Steffen. 2022. “Zombie Lending: Theoretical, International, and Historical Perspectives.” NBER Working Paper 29904.

Caballero, Ricardo, Takeo Hoshi, and Anil Kashyap. 2008. “Zombie Lending and Depressed Restructuring in Japan.” American Economic Review 98(5), pp. 1,943–1,977.

Faria-e-Castro, Miguel, Pascal Paul, and Juan M. Sánchez. 2023. “Evergreening.” FRBSF Working Paper 2022-14, forthcoming in Journal of Financial Economics.

Gagnon, Joseph. 2021. “Zombies Are a Symptom of Economic Weakness, Not a Cause.” Op-ed, Peterson Institute for International Economics, May 17.

Khwaja, Asim Ijaz, and Atif Mian. 2008. “Tracing the Impact of Bank Liquidity Shocks: Evidence from an Emerging Market.” American Economic Review 98(4), pp. 1,413–1,442.

Peek, Joe, and Eric S. Rosengren. 2005. “Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan.” American Economic Review 95(4), pp. 1,144–1,166.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org