Monetary policy is often regarded as having only temporary effects on the economy, moderating the expansions and contractions that make up the business cycle. However, it is possible for monetary policy to affect an economy’s long-run trajectory. Analyzing cross-country data for a set of large national economies since 1900 suggests that tight monetary policy can reduce potential output even after a decade. By contrast, loose monetary policy does not appear to raise long-run potential. Such effects may be important for assessing the preferred stance of monetary policy.

Monetary policy has traditionally been regarded as being “neutral” in the long run. This means that the path of an economy over time is determined by factors other than what the central bank does, including the availability of workers and capital and how productively they can be combined. Monetary policy has generally been viewed as having a moderating influence on cyclical economic fluctuations. Its long-run effects are believed to be limited to nominal variables, such as prices and nominal interest rates.

In this Economic Letter, we examine the long-run implications of monetary policy for the productive capacity of the economy. Using cross-country data for a set of large national economies over the past century, we assess situations when an economy’s productive potential is different than it would otherwise be due to previous monetary interventions. We find that these long-run effects develop primarily through investment decisions that ultimately result in lower productivity and lower capital stock than would be available without policy intervention. These productivity effects persist for at least 12 years following a period of monetary policy tightening.

Policy effects in the short and long run

Traditional theories of how national economies work typically assume that monetary policy is neutral in the long run (for example, Lucas 1996; see Cerra, Fatás, and Saxena 2023 for a more recent literature review). That is, central bank actions such as lowering policy interest rates cannot be used to stimulate the economy indefinitely. Similarly, conventional wisdom implies that tightening policy by raising interest rates might only have temporary consequences for keeping economies running at a healthy pace. In this view, when inflation rises above a central bank’s target, policymakers may be less concerned about the risk of overtightening policy since the costs of doing so are temporary.

Our recent research in Jordà, Singh, and Taylor (2023) casts doubt on this traditional belief. To understand the situations in which monetary policy could have long-term effects, our work described in this Letter delves into historical data to describe how economies grow.

Broadly speaking, three factors determine an economy’s productive potential (see Basu and Fernald 2002). The first two are how much capital is available in an economy and how much labor there is to operate that capital. The more workers and the more machines are available, the more the potential output. The third factor is total factor productivity (TFP), which can be thought of as how cleverly existing stocks of capital and labor can be combined to obtain more output. The more TFP improves, the more the economy can produce, even if no new workers and no new machines are added. TFP growth is therefore a critical driver of economic growth.

How might interest rates affect an economy’s productive potential? Consider two examples. First, think of research and development (R&D) investment. In most cases, interest rates determine how much a business is willing to invest in increasing its capital and how much to invest in R&D, which is a good way to improve TFP. Higher interest rates slow down economic activity and tighten credit conditions; in turn, businesses tend to cut investments in all categories, including R&D (Moran and Queralto 2018). So, a potential mechanism for high interest rates to reduce the economy’s potential is through a reduction of R&D investment. A second example is known as labor scarring. When workers are laid off, their human capital depreciates the longer they remain unemployed. Thus, a slowdown in economic activity due to higher interest rates could generate a loss of the total skill level in the economy. These two simple examples illustrate a different view of how the economy’s potential can be hampered by monetary policy.

Measuring the effects of monetary policy

A key challenge for analyzing data on the macroeconomy is isolating the relationships between economic variables that represent causation rather than correlation. If interest rates are raised when the economy is buoyant and inflation is rising, a simple correlation analysis could mistakenly suggest that high interest rates cause high inflation. In reality, interest rates are typically high because the central bank is trying to bring inflation down. Accounting for such reverse causality in macroeconomic data is crucial for understanding business cycle dynamics and the influence of monetary policy.

The approach we use to separate causation from correlation is based on a simple idea from international economics. Over the past century or more, smaller economies have sometimes pegged their exchange rate to the currency of a bigger economy, usually referred to as the base. In that scenario, the returns on assets with similar risk characteristics will move at a similar pace between the pegging and the base economies. Otherwise, if money is free to flow across borders, investors will borrow where interest rates are low and invest where interest rates are high, eventually equalizing rates in both economies. This is called an arbitrage opportunity, and the mechanism we just described is usually called the trilemma of international finance.

Thus, when the base economy changes interest rates in response to domestic economic conditions, interest rates in the pegging economy will move in tandem, even if that economy’s domestic conditions do not require such an adjustment to interest rates. We use these externally driven interest rate movements as a source of random variation in monetary policy for the pegging economy. Because the change in financial conditions is independent of economic conditions in the pegging country, the resulting impacts are more likely to reflect causation rather than correlation.

We rely on this observation between base and pegging interest rates for our empirical analysis. Using annual data for 17 advanced economies over the period 1900 to 2015 excluding the two World Wars, we estimate how output and its components—labor, capital, and TFP—respond to movements in interest rates generated outside the pegging economy’s borders. We specifically assess the effects of an unexpected increase in interest rates by 1%. We then trace the responses of output, labor, capital, and TFP over the next 12 years. Output is measured as real GDP. Labor is measured as total hours worked, capital stock is constructed from investment in machines and buildings, and TFP is a residual from an aggregate production function using capital and labor as inputs.

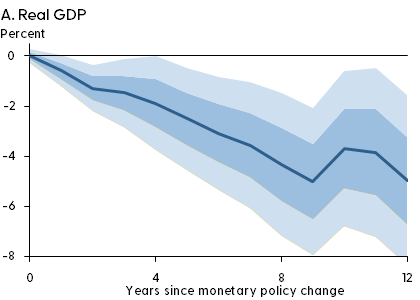

Figure 1 show that unexpected changes in monetary policy, known as shocks, can slow the pace of economic activity much more persistently than is commonly believed, all other economic factors being equal. For example, panel A shows that, in response to a 1% increase in interest rates, output would be about 5% lower after 12 years than it would otherwise be. To provide some context for these numbers, consider some data for the United States. A 5% decline in the output trend caused by the monetary intervention relative to the pre-intervention trend would reduce an individual’s income by $3,000 in today’s dollars on average.

Figure 1

Average responses to 1% unexpected increase in policy interest rate: 1900-2015

Note: Responses to a 1% unexpected change in domestic short-term interest rate. Full sample: 1900–2015, World Wars excluded. In panel A, darker shading indicates one-standard-error and lighter shading indicates two-standard-error confidence bands around average. See Jordà, Singh, and Taylor (2023) for estimation details.

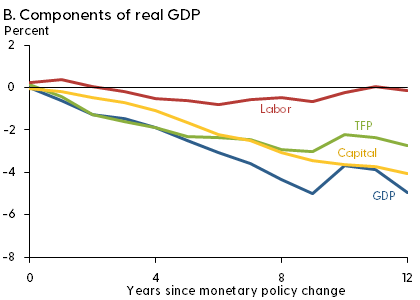

Panel B of Figure 1 breaks down the response of output into subcomponents of an aggregate production function. In response to a similar 1% increase in interest rates, after 12 years TFP would be about 3% lower and capital would be about 4% lower. However, labor would be about the same as the pre-shock trend. One plausible way to explain this is by considering a model of endogenous growth where investment in R&D determines TFP growth but labor demand is stable over the long run (Fornaro and Wolf 2023). In response to a monetary tightening, investment in productive ideas would fall, slowing TFP growth temporarily. This temporary growth slowdown accumulates to a lower trend level of TFP after the shock abates. Labor, on the other hand, returns to the pre-shock trend because labor usage in the long run is unaffected by the trend level of TFP.

No free lunch

If raising interest rates can have such costs in terms of the longer-run capacity of the economy, what about lowering rates: can a central bank boost the economy’s long-run potential with more accommodative monetary policy through lower interest rates?

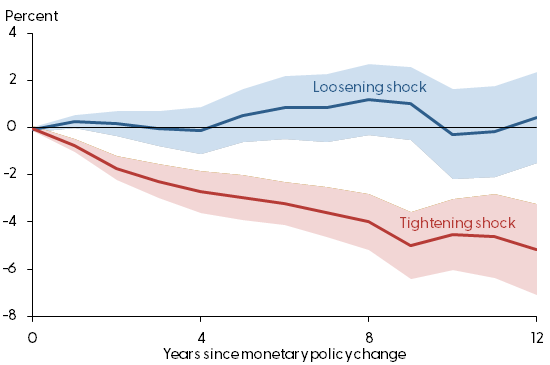

Figure 2 shows that this is not the case. When we separate our interest rate experiments into those that resulted in rate hikes versus those that resulted in lower interest rates, we see that there is no free lunch. That is, a central bank might not be able to undo the long-run effects on the economy’s potential by running the economy hot. The blue line shows that lower interest rates have mostly temporary effects that vanish after a few years, as traditional theories predict. However, the red line reinforces the results from Figure 1 that show an increase in interest rates casts a long shadow on the economy.

Figure 2

Real GDP response to unexpected policy rate changes

Note: Responses to a 1% unexpected change in domestic short-term interest rate. Full sample: 1900–2015, World Wars excluded. Shading indicates one-standard-error confidence bands around each average. See Jordà, Singh, and Taylor (2023) for estimation details.

Among the usual caveats to any empirical analysis, we should emphasize that, in our sample, the United States is usually a base economy that other countries peg their currencies to. Therefore, our findings mostly reflect the experiences of pegging economies, not that of the United States. However, in Jordà, Singh, and Taylor (2023) we find evidence using additional data sets, experiments, and methods that suggests similar long-lasting effects for the United States as the ones we report here.

Conclusion

What lessons should we take away from our analysis in this Letter? In line with traditional thought, monetary policy aims at having the economy grow to its potential while keeping inflation low and stable. Our results suggest that a challenge for monetary policy is that, in addition to the effects on current economic activity, variations in policy rates can have unintended lingering effects on potential growth, which may ultimately complicate the calibration of policy.

Òscar Jordà

Senior Policy Advisor, Economic Research Department, Federal Reserve Bank of San Francisco

Sanjay R. Singh

Senior Economist, Economic Research Department, Federal Reserve Bank of San Francisco

Alan M. Taylor

Professor, University of California, Davis, and Visiting Scholar, Federal Reserve Bank of San Francisco

References

Basu, Susanto, and John G. Fernald. 2002. “Aggregate Productivity and Aggregate Technology.” European Economic Review 46(6), pp. 963–991.

Cerra, Valerie, Antonio Fatás, and Sweta C. Saxena. 2023. “Hysteresis and Business Cycles.” Journal of Economic Literature 61(1), pp. 181–225

Fornaro, Luca, and Martin Wolf. 2023. “The Scars of Supply Shocks: Implications for Monetary Policy.” Journal of Monetary Economics, forthcoming.

Jordà, Òscar, Sanjay R Singh, and Alan M Taylor. 2023. “The Long-Run Effects of Monetary Policy.” FRB San Francisco Working Paper 2020-01.

Lucas, Robert E., Jr. 1996. “Nobel Lecture: Monetary Neutrality.” Journal of Political Economy 104(4), pp. 661–682.

Moran, Patrick, and Albert Queralto. 2018. “Innovation, Productivity, and Monetary Policy.” Journal of Monetary Economics 93, pp. 24–41.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org