Mark Spiegel, senior policy advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of May 28, 2020.

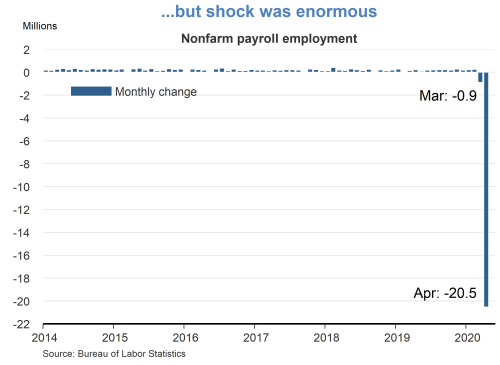

- The economic effects of the COVID-19 pandemic have been massive. First quarter GDP contracted at a –5.0% annualized growth rate. April’s plummeting numbers for retail sales, industrial production, and housing starts suggest a much larger drop in GDP in the second quarter.

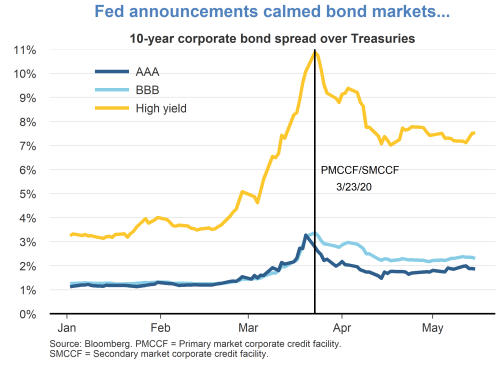

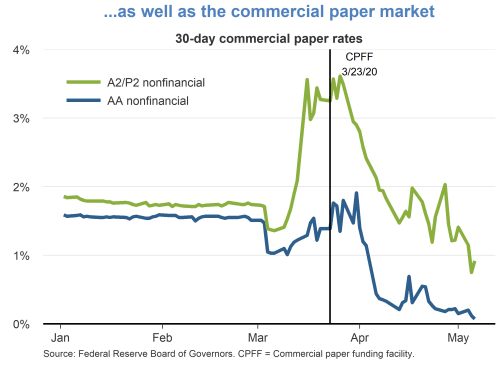

- The onset of the pandemic disrupted financial markets in late February and March, both in the United States and abroad. Investors moved away from risky and illiquid assets, resulting in strains in many markets, including high-yield bonds, commercial paper, and investment-grade corporate bonds. Financing difficulties also affected the market for Treasury bonds, and interest rates fell dramatically in medium- and long-term Treasury markets. The reduction in demand for assets perceived to be risky was accompanied by a sharply increased demand for cash and other assets regarded as safe and liquid. Yields on overnight securities actually fell below zero on several occasions.

- The Federal Reserve responded quickly and aggressively to these disruptions. Since early March, the Federal Open Market Committee (FOMC) has lowered the federal funds rate 150 basis points to its current level of between 0 and 0.25 percentage points. The Committee also gave guidance in its April 29 statement that it “expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” In addition, the FOMC statement announced that the Committee would continue to purchase Treasury securities and mortgage-backed securities “in the amounts needed to support smooth market functioning.”

- In cooperation with the Treasury, beginning in March, the Federal Reserve also launched a number of facilities to address strains in financial markets. To stem disruptions in short-term debt markets, it launched the Commercial Paper Funding Facility and the Money Market Mutual Fund Liquidity Facility under section 13(3) of the Federal Reserve Act. The Federal Reserve also launched the Primary Dealer Credit Facility to provide loans against good collateral to primary dealers, a set of major financial institutions that are trading counterparties for the implementation of monetary policy, to support their critical role in maintaining the smooth functioning of credit markets. These efforts complement the existing and pending aid packages passed by Congress to provide aid to relief efforts, households, and businesses.

- Other facilities were launched to maintain the functioning of markets for longer-term funding needs. The onset of the crisis saw large increases in borrowing costs for issuers of corporate and municipal bonds, as well as asset-backed securities. Also in concert with the Treasury, the Federal Reserve launched the Term Asset-Backed Loan Facility to purchase asset-backed securities, the Primary Corporate Credit and the Secondary Market Corporate Credit facilities to purchase investment-grade bonds as well as recently downgraded securities, and the Municipal Liquidity Facility to purchase short-term debt from U.S. states, counties, and cities. The Fed also established the Paycheck Protection Program Liquidity Facility, designed to aid small businesses by extending credit to participants in the Small Business Administration’s Paycheck Protection Program.

- Fed announcements to launch many of these facilities served to calm financial markets. For example, between March 23, when the Fed announced its expanded programs, and May 20, spreads on Treasuries on ten-year AAA bonds have fallen from 2.8% to 1.9%, while other spreads for the same maturity have fallen from 3.4% to 2.3% for BBB bonds and from 10.9% to 7.5% for high yield bonds. Strains also eased in other markets, such as the commercial paper market; since March 23, yields have fallen from 3.25% to 0.92% on 30-day A2/P2 and from 1.39% to 0.07% on AA nonfinancial commercial paper. However, market-based measures of volatility remain elevated relative to historical norms.

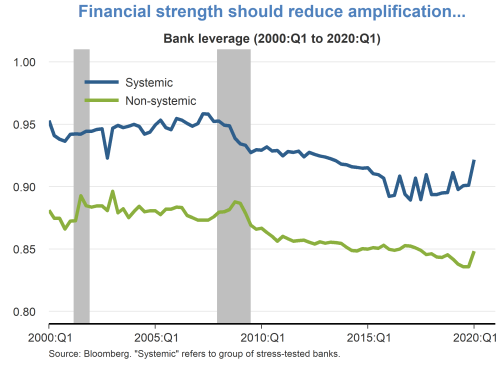

- The relatively strong position of the U.S. banking system at the onset of the coronavirus pandemic should provide a source of strength to help weather the economic costs. Although the capital ratios of both systemic banks and the rest of the banking system as a group deteriorated somewhat during the first quarter of 2020, their positions were stronger than at the onset of the global financial crisis in the fourth quarter of 2008. This is partly attributable to regulatory measures introduced after the crisis. Their relatively stronger positions going into the crisis should mitigate the amplification of the pandemic shock through the financial sector, as compared to the financial distress during the global financial crisis.

- The labor market has suffered a huge hit from business closures. Nonfarm payroll employment lost about 9 million jobs in March, and another 20 million in April. The unemployment rate has also increased, from 3.5% in February to 14.7% in April. Moreover, labor force participation fell from 63.4% in February to 60.2% in April, suggesting an increase in the number of workers who are effectively unemployed because they have become discouraged and stopped searching for employment.

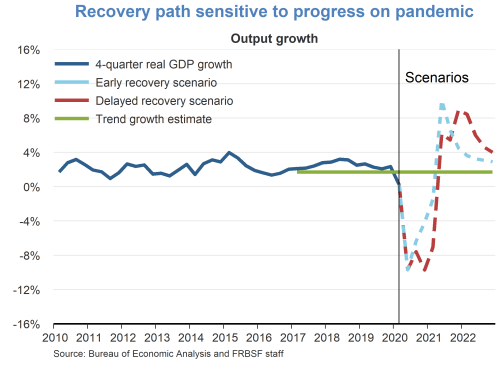

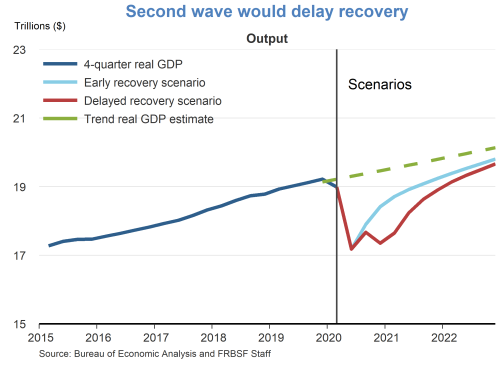

- Going forward, the pace of economic recovery will depend on the progression of the pandemic and, in particular, on the severity of a possible second wave of COVID-19. Given the substantive uncertainty concerning how the situation will develop, we offer two scenarios for the path of recovery.

- The early recovery scenario assumes that most social distancing measures are phased out by the end of the year. The delayed recovery scenario assumes these measures will initially be phased out at the same speed as in the first scenario, but presumes that a second wave in infections will lead to the reinstatement of shelter-in-place restrictions later in the year. Both scenarios presume that a vaccine against the virus will become available by mid-2021.

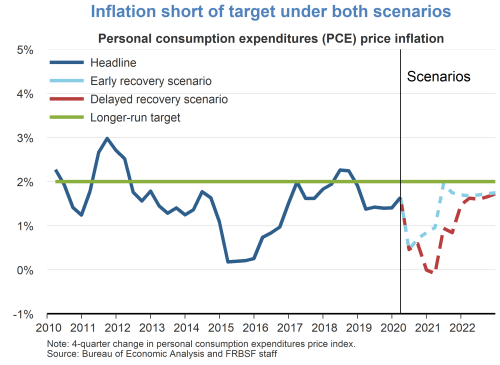

- Under the early recovery scenario, we expect the economy to rebound beginning in the third quarter of this year. Under the delayed recovery scenario, we expect positive, but lower, growth in the third quarter and negative output growth in the fourth quarter. As a result, U.S. output is much lower under the delayed recovery scenario in 2021, and the return of GDP output levels to trend is projected to take longer. Overall, we consider the economic risks associated with a second wave of the pandemic as tilted to the downside. We project the level of inflation to fall below the FOMC’s symmetric 2% policy target over the medium term in both scenarios.

Figures reflect data as of May 20, 2020

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.