Nicolas Petrosky-Nadeau, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of April 8, 2021.

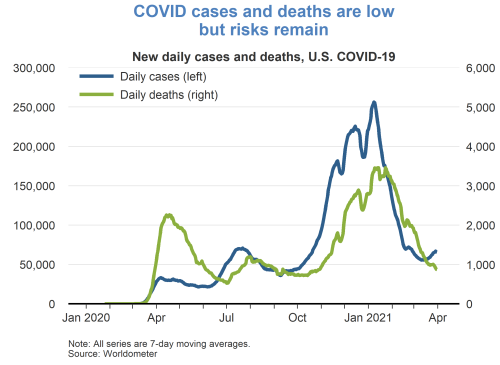

- Progress continues on containment of the COVID-19 pandemic. The number of new cases in the United States has declined rapidly since January peaks and remains low, recently averaging 68,000 people over 14 days. Rates for hospitalizations and deaths due to the virus have also declined. Coupled with an acceleration in the vaccine rollouts and number of administered doses averaging 3 million per day over the past seven days, prospects for immunizing the majority of the population by the end of the year have improved significantly.

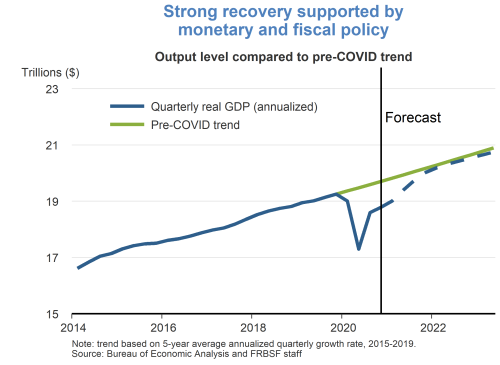

- Real GDP growth is off to a strong start in 2021 with continued support from accommodative fiscal and monetary policy. Consumer spending in particular, supported by the latest rounds of fiscal relief, is becoming more brisk. Overall, we expect a very strong second quarter of 2021, and for year-on-year GDP growth to reach 6.6% this year. We project real GDP to gradually return to its pre-pandemic trend over 2022 and 2023.

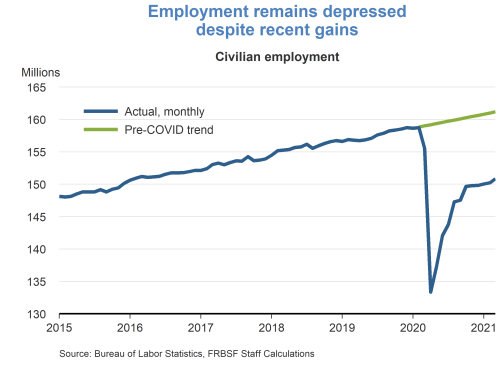

- The U.S. economy added a higher-than-anticipated 916,000 jobs in March, further supporting a positive outlook for the year. Job growth was widespread, led by 280,000 new workers in leisure and hospitality, as large parts of the United States somewhat relaxed virus-containment measures and limits on in-person business activities. The unemployment rate fell from 6.2% to 6% in March and is expected to continue declining gradually over the next few years.

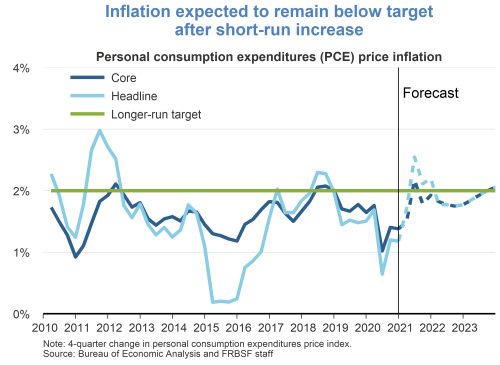

- Inflation has rebounded somewhat from the low reached in April 2020, but still remains below its pre-pandemic levels. Headline personal consumption expenditures (PCE) inflation rose in February, to 1.6% on a 12-month basis. By contrast, core PCE inflation fell slightly, registering 1.4% on a 12-month basis. We expect inflation to remain below the 2% goal into 2023 after a transitory rise in 2021 due to a roll-off of the pandemic shock’s initial downward effect on prices.

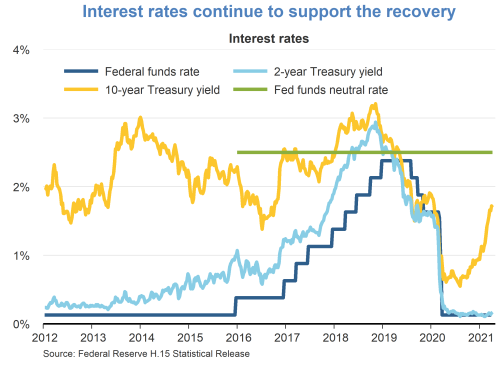

- Chair Powell, during public remarks following the March 2021 meeting of the Federal Open Market Committee, reiterated the stance of monetary policy would remain accommodative until conditions in the labor market are consistent with the committee’s views on full employment, and inflation has run above 2% for some time. And while yields on long term assets such as 10-year Treasuries have increased notably recently, the increases likely reflect optimism over the prospects for U.S. economic growth being further supported by accommodative fiscal and monetary policy.

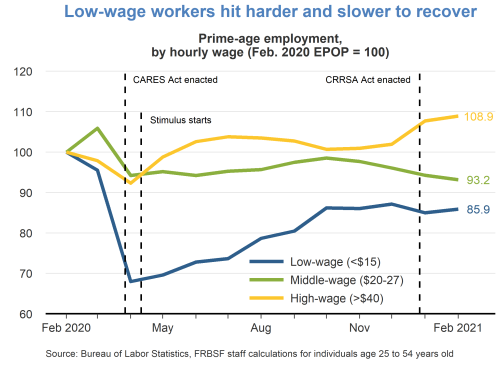

- Business closures and voluntary consumer behavioral changes made in response to the spread of the virus hit sectors and occupations employing lower-skilled workers and minorities the hardest. Employment in low-wage jobs, with earnings less than $15 an hour, remains 14% below pre-pandemic levels. This contrasts with high-wage jobs, with earnings more than $40 an hour, where employment has grown 9% over the course of the pandemic.

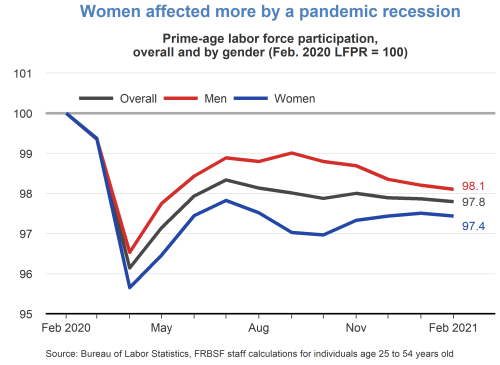

- The onset of the pandemic and massive disruption to economic activity affected women to a greater extent than men. Following sharp declines in April 2020, labor force participation rates for prime-age men and women (individuals between ages 25 and 54 ) had recovered half of their earlier declines by midsummer. Since then, their participation has failed to make further gains toward pre-recession rates, with women still faring worse than men.

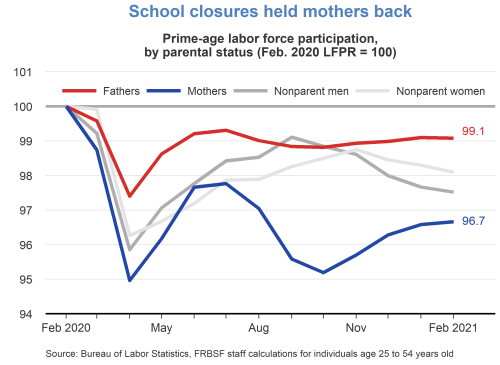

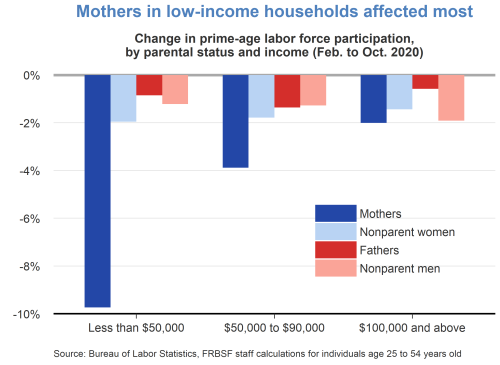

- These gender differences are driven by the differential impacts of the pandemic on parents. The initial impact of the pandemic was much more pronounced on mothers’ participation in the labor market than on that of fathers. And while mothers’ participation partially recovered during the summer, it reversed course with the start of the new school year, falling back to April 2020 lows. This contrasts with the participation patterns of women and men without children: nonparents experienced similar declines at the onset of the pandemic, and their participation was slightly below pre-pandemic rates in December, alongside fathers.

- The disparate gender and parental labor market impacts of the pandemic are amplified across the household income distribution. Mothers in the lowest income group, households with annual income below $50,000 per year, exited the labor force at a rate four times that of mothers in the highest household income group with incomes above $100,000 per year. Specifically, participation for mothers in low-income households declined nearly 9%, while mothers in high-income households fell a little under 2% below their pre-pandemic participation rate.

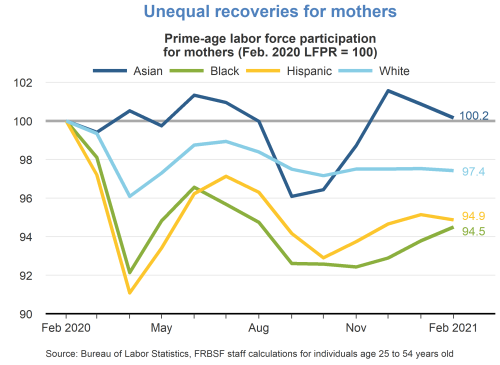

- Racial and ethnic minorities typically fare worse in more severe recessions and the pandemic recession is no exception. The initial sharp decline in participation was more pronounced among Black and Hispanic mothers: participation between February and April 2020 fell twice as much for Black and Hispanic mothers, relative to white mothers. In addition, a robust recovery for Black and Hispanic mothers during the summer months was all but undone with the start of the school year.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.