For information on subprime mortgages, as well as mortgages in general, look to data published by the Mortgage Bankers Association (MBA)—a trade association that sells market research and data on its web site. The MBA data are often used to estimate subprime loans’ share of total mortgages. You can also visit the Press Center section of the MBA Web site and look for the latest free National Delinquency Survey (NDS) results.

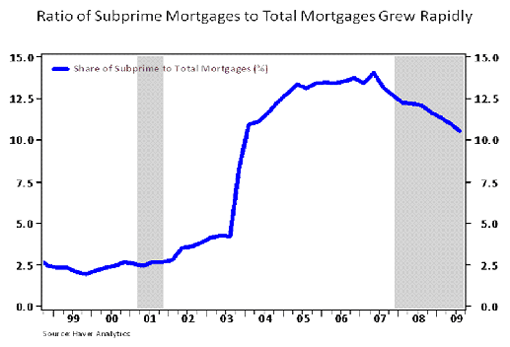

Share of Subprime Mortgages to Total Mortgages

Subprime mortgages are residential real estate loans that are generally considered to be higher risk. These loans are not guaranteed by the Federal Housing Administration (FHA). The MBA publishes quarterly data on loans outstanding and loan performance for subprime and other types of loans in its NDS. According to the MBA, the NDS is

“…based on a sample of more than 44 million mortgage loans serviced by mortgage companies, commercial banks, thrifts, credit unions and others, NDS provides quarterly delinquency and foreclosure statistics at the national, regional and state levels. Delinquency and foreclosure measures are broken out into loan type (prime, subprime, VA and FHA) and fixed and adjustable rate products. At each geographic classification, there are 7 measures: total delinquencies, delinquency by past due category (30-59 days, 60-89 days and 90 days and over), new foreclosures, foreclosure inventory and seriously delinquent. The total number of loans serviced each quarter, as compiled through the survey, is also included in the data.” 1

From these data we are able to derive the share of subprime loans by dividing the number of subprime loans being serviced by the total number of loans being serviced. Note that the very sharp rise in the subprime share in 2003, shown in Chart 1, in part reflects an increase in coverage by the MBA survey. Nevertheless, other evidence indicates that the share of subprime borrowers rose substantially in the latter stages of the recent housing boom that extended into 2005. Based on the MBA data, subprime loans as a share of total residential mortgage loans reached a high of about 14 percent in the second quarter of 2007. Since mid-2007, the number of subprime loans has dropped substantially, owing to their high default rate. Based on third quarter 2009 data from the MBA, 17.4 percent of subprime loans were “seriously delinquent”: 90 days or more past due or in foreclosure.

Also note that since mid-2007 originations of new subprime loans have all but dried up. You can view this at the FRBSF website, The Economy: Crisis & Response listed below. In late 2009 the main channel of mortgage credit for higher risk borrowers was through the FHA guarantee program. Information regarding FHA mortgages is available on the HUD web site.

Additional Resources

For more on subprime mortgages and the mortgage markets see:

Avery, Robert, Bevoort, Kenneth and Canner, Glenn. “The 2007 HMDA Data.” The Board of Governors of the Federal Reserve System, The Federal Reserve Bulletin. (Dec 2008). Pages 107A-146A.

Furlong, Frederick and Krainer, John. 2007 “The subprime mortgage market: national and Twelfth District developments”. FRBSF. Annual Report. p. 6-17.

Doms, Mark, Furlong, Frederick and Krainer, John. “House prices and subprime mortgage delinquencies”. FRBSF. FRBSF Economic Letter. 2007-14. (Jun 8, 2007).

Doms, Mark and Krainer, John. “Innovations in Mortgage Markets and Increased Spending on Housing.” FRBSF. Working paper. 2007-05.

Krainer, John. “Mortgage Choice and the Pricing of Fixed-Rate and Adjustable-Rate Mortgages.” FRBSF. FRBSF Economic Letter. 2010-03 (Feb. 1).

Krainer, John. “Recent Developments in Mortgage Finance.” FRBSF. FRBSF Economic Letter. 2009-33. (Oct. 26, 2009).

The Economy: Crisis & Response, Web site, Federal Reserve Bank of San Francisco.

End Notes

1. http://www.mbaa.org/ResearchandForecasts/ProductsandSurveys/NationalDelinquencySurvey.htm