The July jobs report once again brought great news on employment gains and less than exciting news on wage growth. Data through the second quarter of 2018 show that median weekly earnings of full time workers rose just 2% on an annual basis, well below what might be expected in such a robust labor market.

So what is going on? As we wrote about last year, updated work by Daly and Hobijn (2016) and Daly, Hobijn, and Pyle (2016) suggests that the news on wage growth is better than the headline numbers indicate. The reason is that aggregate wage growth continues to be held down by the entry of new and returning workers to full-time employment, who generally earn less than workers who are leaving full-time employment.

This is not as negative as it might sound. The drag on wage growth due to these flows into and out of full-time work reflects changes in workforce composition associated with demographics and a strong labor market.

- Simply stated, new entrants to full-time work, whether they are entering for the first time, re-entering from periods of involuntary or voluntary non-employment, or moving from part-time to full-time work, are more likely to make below-average wages.

- Counterintuitively, this means that strong job growth can pull average wages in the economy down and slow the pace of wage growth.

- This is exactly what we have been seeing in recent years. As the labor market has continued to strengthen, many workers have moved from the sidelines of the labor force or part-time positions into full-time employment. The vast majority of these new workers earn less than the typical full-time employee, so their entry brings down the average wage.

- This effect is even more pronounced than usual because of the large-scale exit of higher-paid baby boomers from the labor force. With so many of this generation still approaching retirement, the so-called Silver Tsunami will continue to be a drag on aggregate wage growth for some time.

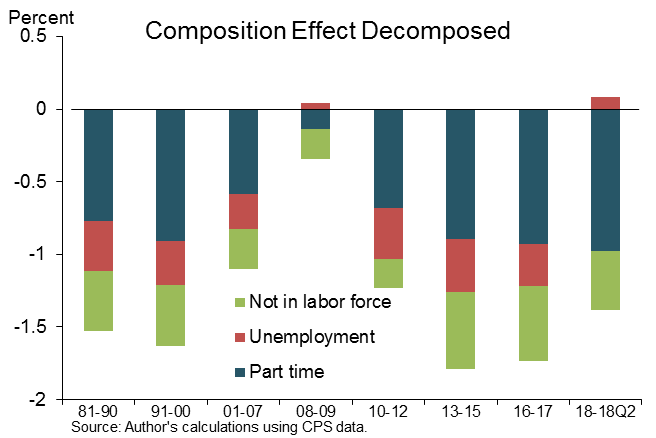

Overall, these factors have combined to hold down growth in median weekly earnings by 1.5-2 percentage points (see the figure) for much of this expansion. Although compositional changes in the labor force are imposing a larger drag than during the previous expansion, the impact is not outsized relative to other periods of history.

The bottom line is that adjusting for compositional changes matters, especially when considering whether weak wage growth is providing a signal about labor market slack. For example, taking account of the impact of entry and exit into full-time employment on annual growth in median weekly earnings, puts second quarter wage growth at 3.5 percent, a far brighter number than the unadjusted headline number of 2%.

The real question going forward is what should wage growth be in an economy that is sustainably running at full employment. We will address this issue in an upcoming blog on wage growth.

Figure 1

Contributions to drag on median earnings growth from entry to and exit from full-time employment

Mary C. Daly is executive vice president and Director of Research at the Federal Reserve Bank of San Francisco.

Joseph H. Pedtke is a Ph.D. student at the University of Minnesota.

References

Daly, Mary C., Bart Hobijn, and Benjamin Pyle. 2016. “What’s Up with Wage Growth?” FRBSF Economic Letter 2016-07.

Daly, Mary C., and Bart Hobijn. 2016. “The Intensive and Extensive Margins of Real Wage Adjustment.” Federal Reserve Bank of San Francisco Working Paper 2016-04.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.