An August 2018 update is available at Revisiting Wage Growth.

The July jobs report from the U.S. Bureau of Labor Statistics brought welcome news on wage growth: Median weekly earnings rose 4.2% on an annual basis, the fastest pace seen since 2007. The underlying story about wage growth may be even better than the headline number suggests, according to updated work by Daly, Hobijn, and Pyle (2016).

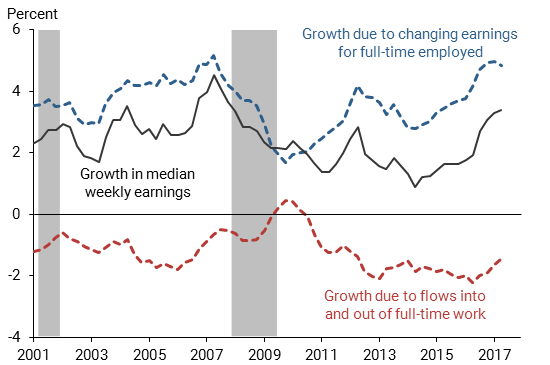

Figure 1 shows why. It separates wage growth for workers who are in stable full-time jobs from those who are moving into and out of full-time employment.

- Wage growth for continuously full-time employed workers (blue dashed line) has been rising and is currently in line with rates seen at the previous economic peak in 2007.

- That said, aggregate wage growth (black line) continues to be held down by the entry of new and returning workers to full-time employment, who generally earn less than workers who are leaving full-time employment (red dashed line).

Figure 1

Median weekly earnings growth, overall and by full-time status

However, this is not as negative as it might sound. The drag on wage growth due to these flows into and out of full-time work reflects changes in workforce composition associated with demographics and a strong labor market.

- Simply stated, new entrants to full-time work, whether they are entering for the first time, re-entering from periods of involuntary or voluntary non-employment, or moving from part-time to full-time work, are more likely to make below-average wages.

- Counterintuitively, this means that strong job growth can pull average wages in the economy down and slow the pace of wage growth.

- This is exactly what we have been seeing in recent years. As the labor market has continued to strengthen, many workers have moved from the sidelines of the labor force or part-time positions into full-time employment. The vast majority of these new workers earn less than the typical full-time employee, so their entry brings down the average wage.

- This effect is even more pronounced than usual because of the large-scale exit of higher-paid baby boomers from the labor force. With so many of this generation still approaching retirement, the so-called Silver Tsunami will continue to be a drag on aggregate wage growth for some time.

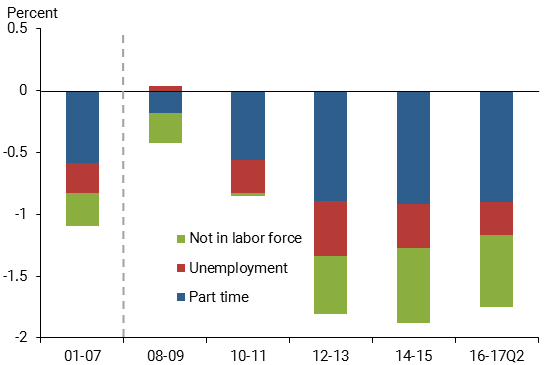

Overall, these factors have combined to hold down growth in the median weekly earnings measure by a little under 2 percentage points (Figure 2), a sizable effect relative to the normal expected gains.

Most recently, the effect from flows into and out of full-time work has started to tick upward and might be a sign of stronger growth ahead.

Figure 2

Contributions to drag on median earnings growth from entry to and exit from full-time employment

Mary C. Daly is executive vice president and Director of Research at the Federal Reserve Bank of San Francisco.

Bart Hobijn is a professor at Arizona State University.

Joseph Pedtke is a research associate at the Federal Reserve Bank of San Francisco.

References

Daly, Mary C., Bart Hobijn, and Benjamin Pyle. 2016. “What’s Up with Wage Growth?” FRBSF Economic Letter 2016-07.

Daly, Mary C., and Bart Hobijn. 2016. “The Intensive and Extensive Margins of Real Wage Adjustment.” Federal Reserve Bank of San Francisco Working Paper 2016-04.

Daly, Mary C., and Bart Hobijn. 2017. “Composition and Aggregate Real Wage Growth.” American Economic Review 107(5), pp. 349–352.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.