Both actual inflation and inflation expectations increased recently in Japan after decades of being undesirably low. An estimate based on nominal and real Japanese bond yields adjusted for liquidity and other risk premiums confirms that investors’ long-term inflation expectations have also increased. However, projections indicate that further increases are less likely and that long-term expected inflation in Japan is likely to remain anchored below the Bank of Japan’s 2% inflation target.

Inflation in Japan was below desirable levels for decades, including episodes of actual deflation. In response, the Bank of Japan tried various policies to raise inflation, including the adoption of a formal 2% inflation target in 2013. However, none of those efforts succeeded in achieving a persistent rise in inflation (see Christensen and Spiegel 2019 for a review). Since spring 2022, though, there has been a notable and seemingly lasting increase in Japanese inflation. Moreover, there are tentative signs that inflation expectations in Japan may have moved up in response to the spike in inflation. For example, surveys indicate that professional forecasters have lifted both their short-term forecasts for inflation in 2024 and their long-term expectations for average inflation over the coming decade.

This upturn in inflation and measures of expected inflation coincides with a booming stock market—Japan’s Nikkei index recently surpassed its previous 1989 all-time high—suggesting investor optimism. At the same time, though, measures of economic growth over the last couple of quarters have been disappointing, which may reflect declining economic momentum.

Given Japan’s difficulty escaping its long history of undesirably low inflation, the sustainability of the recent upturn remains in question. In this Economic Letter, we turn to Japanese bond markets to produce market-based estimates of investors’ expectations for future inflation using a novel model of nominal and real Japanese government bond yields described in Christensen and Spiegel (2024). Our yield curve model is the first to account for liquidity risk in real yields while also adjusting for inflation and deflation risk premia. Our results indicate that long-term inflation expectations have increased over the past couple of years, above levels indicated by recent survey data. However, our model projections suggest that further increases are less likely and that long-term expectations for future inflation will remain anchored below Japan’s 2% inflation target.

Recent inflation developments in Japan

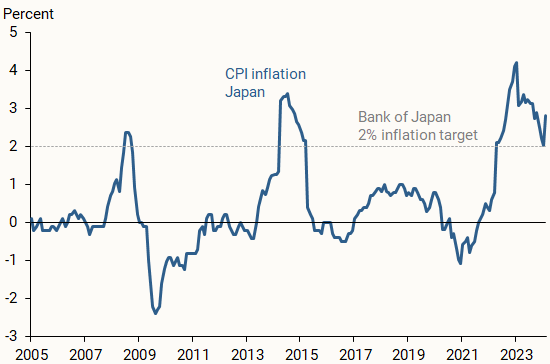

Consumer price index (CPI) inflation in Japan has been well below the 2% target adopted by the Bank of Japan in 2013 for much of this century. This has included several periods of declining prices, such as during the Global Financial Crisis and the COVID-19 pandemic (Figure 1).

Figure 1

Japanese CPI inflation

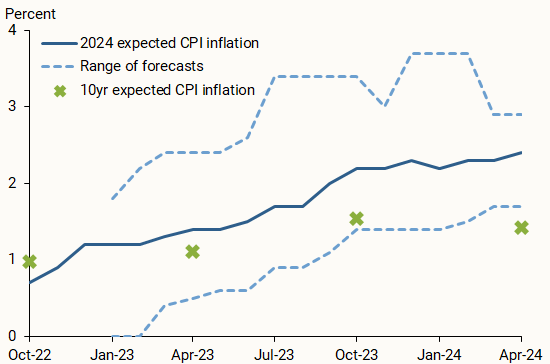

The increase in inflation since spring 2022 may have changed Japanese inflation dynamics in a lasting way. One noticeable change is that inflation has remained elevated for several months. Also, there are early signs that inflation expectations in Japan may have started to respond. Figure 2 shows that professional forecasters surveyed by Consensus Economics have progressively lifted their monthly responses for the short-term inflation outlook for 2024, reflected in the median projection (solid blue line) and range of forecasts (dashed blue lines). Perhaps more importantly, they also raised their long-term expectations for average inflation over the next 10 years. These are reported every six months and are shown as a green data point for the 10-year forecast as of each corresponding survey date.

Figure 2

Short-and long-term Japanese CPI inflation forecasts

Source: Consensus Economics

Given Japan’s history of unsuccessful attempts at raising inflation, it remains unclear whether recent increases in inflation are likely to be sustained. One risk is that long-term inflation expectations could return to their pre-pandemic lower levels, as has happened in the past. Maintaining long-term inflation expectations that are anchored near the Bank of Japan’s 2% inflation target is likely necessary for achieving and sustaining that target.

Using bond pricing to estimate inflation expectations

Following our work in Christensen and Spiegel (2024), we generate market-based estimates of expected long-term Japanese inflation. We examine yields for inflation-indexed bonds issued by the Japanese government from January 2005 to the end of March 2024. We also include a sample of Japanese nominal zero-coupon government bond yields from 1995 through the end of March 2024.

Japanese inflation-indexed bonds have always protected against inflation by adjusting interest payments, known as coupons, and principal payments to compensate holders for increases in the Japanese CPI from issuance to maturity. However, inflation-indexed bonds issued since 2013 also provide “deflation protection,” in that they pay off their nominal payment at maturity if deflation has occurred over the lifetime of the bond. Due to Japan’s very low inflation and occasional deflation over the past 20 years, this protection has turned out to be valuable—worth well over half a percentage point for extended periods.

The difference between nominal and inflation-adjusted yields on bonds of the same maturity, commonly known as the breakeven inflation (BEI) rate, is widely used to assess inflation expectations. However, there are three distinctions between the BEI rate implied by Japan’s inflation-indexed bonds and expected inflation. First, BEI rates contain an inflation risk premium, which is the additional positive or negative return required by investors to compensate for exposure to risk associated with future inflation. Second, BEI rates also reflect the value of deflation protection discussed earlier. This enhancement raises the value of inflation-indexed bonds and hence pushes down their real yields, which can distort upwards the measurement of inflation expectations through BEI rates. Finally, variation in the relative liquidity between the tiny inflation-indexed bond market, which represents only about 1% of government debt in Japan, and the huge nominal Japanese government bond market can add an additional layer of distortion.

Using the Christensen and Spiegel (2024) model, we adjust observed BEI rates for all three distortions, namely inflation risk premia, deflation protection, and liquidity. We also incorporate the semiannual 10-year forecasts of CPI inflation from the Consensus Economics survey of professional forecasters into our model estimation. As shown by Kim and Orphanides (2012), incorporating these external forecasts tends to improve the plausibility over long horizons. However, to ensure our results are driven by market data, we minimize the impact of the survey information by only including the survey forecasts once every two years. We use the April forecasts in uneven years since 2005.

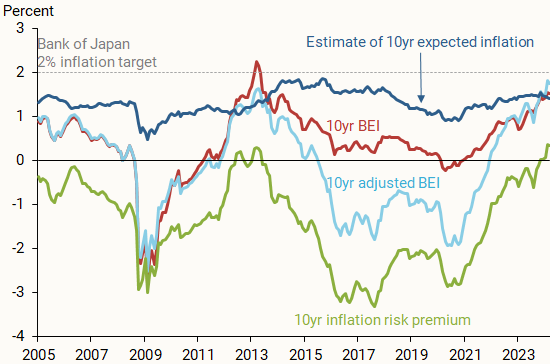

Result of BEI according to components

Figure 3 breaks out some components of the 10-year BEI rates produced by our model. The red line shows the observed 10-year BEI rate without any adjustment. Although it has trended up since 2020, it remained well below the Bank of Japan’s 2% inflation target. After adjustments for liquidity risk premiums and the value of deflation protection, we are left with the adjusted 10-year BEI rate (light blue line). The wedge between the two 10-year BEI rates is driven primarily by the value of the deflation protection. This wedge was small prior to 2013 because the indexed bonds trading at that time did not provide this protection. Importantly, after these adjustments, long-term BEI rates in Japan have been generally lower than unadjusted BEI rates would suggest.

Figure 3

Japan’s 10-year breakeven inflation components

Our model, combined with our assumption of no arbitrage in the deep and liquid Japanese bond market, can also be used to gauge investors’ expected inflation over the next 10 years, shown in the figure as a dark blue line. Finally, we calculate the residual 10-year inflation risk premium (green line) by deducting our estimated 10-year expected inflation from the 10-year adjusted BEI rate. Our estimate of expected inflation has been relatively stable and usually remains well above the observed 10-year BEI rate. In contrast, our estimate of the 10-year inflation risk premium has been volatile and almost always negative.

Most of the recent increase in unadjusted 10-year BEI rates reflects the increase in the inflation risk premium, which has turned positive as the risk of very low inflation has declined. This is a sign that the outlook for inflation in Japan is now more balanced than it has been over the past 10 years. In comparison, 10-year expected inflation has experienced a more modest but still notable uptick since 2020.

Outlook for long-term inflation expectations

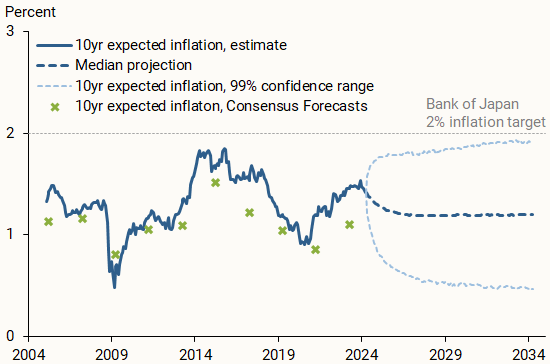

So where do Japan’s long-term inflation expectations go from here? To offer an answer, we follow the approach of Christensen, Lopez, and Rudebusch (2015) and simulate paths over a 10-year horizon, accounting for the shape of the nominal and real yield curves and investors’ embedded forward-looking expectations as of the end of our sample.

Figure 4 extends our estimate from Figure 3 to show the median projection for our 10-year expected inflation through 2034 (dashed dark blue line). The median projection suggests that 10-year expected inflation is predicted to drop to a level close to 1.20% within the next 24 months and stay there for the remainder of the projection period. However, the wide range of the 99% confidence bands around our median estimate (dashed light blue lines) reflects sizable uncertainty around this point prediction, particularly at long horizons.

Figure 4

Projections of 10-year expected inflation in Japan

For perspective, Figure 4 also shows that our estimates of 10-year expected inflation tended to be above the Consensus Economics survey results, shown by the biennial green data points used in our model estimation. This suggests that bond investors appear to have been more optimistic than professional forecasters about the long-term outlook for inflation in Japan since 2005. The mild upward bias leads us to conclude that further increases in expected long-term inflation in Japan are likely to be limited. Moreover, long-term expected inflation will most likely remain anchored at a level somewhat below the 2% target set by the Bank of Japan. Note, however, that our projections and confidence bands suggest that investors do not expect a return to Japanese deflation over the next 10 years and allows for long-term inflation expectations to remain anchored around current levels.

Conclusion

After several decades of very low and at times negative price changes, inflation in Japan recently surged above the 2% inflation target set by the Bank of Japan in 2013. At the same time, survey evidence suggests that inflation expectations in Japan have moved higher. However, mixed signals from Japanese economic activity and Japanese equity markets raise the question of whether this increase in Japanese inflation will be sustained.

In this Letter, we estimate long-term Japanese inflation expectations using a novel model of nominal and real Japanese government bond yields that adjusts for inflation risk, liquidity risk, and the deflation protection afforded by Japanese inflation-indexed bonds issued since 2013. Our estimates confirm that investors’ long-term expected inflation has trended up over the past couple of years. However, our projections suggest that long-term expected inflation is not likely to increase much further in the coming years, leaving inflation expectations in Japan anchored at a level below the Bank of Japan’s 2% inflation target.

References

Christensen, Jens H.E., Jose A. Lopez, and Glenn D. Rudebusch. 2015. “A Probability-Based Stress Test of Federal Reserve Assets and Income.” Journal of Monetary Economics 73, pp. 26–43.

Christensen, Jens H.E., and Mark M. Spiegel. 2019. “Negative Interest Rates and Inflation Expectations in Japan.” FRBSF Economic Letter 2019-22 (August 26).

Christensen, Jens H.E., and Mark M. Spiegel. 2022. “Monetary Reforms and Inflation Expectations in Japan: Evidence from Inflation-Indexed Bonds.” Journal of Econometrics 231(2), pp. 410–431.

Christensen, Jens H.E., and Mark M. Spiegel. 2024. “Inflation Expectations, Liquidity Premia and Global Spillovers in Japanese Bond Markets.” FRB San Francisco Working Paper 2024-12.

Kim, Don H., and Athanasios Orphanides. 2012. “Term Structure Estimation with Survey Data on Interest Rate Forecasts.” Journal of Financial and Quantitative Analysis 47(1), pp. 241–272.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org