The natural rate of interest, also known as r-star, is a key variable for analyzing fiscal and monetary policy. A novel method of measuring this rate for the euro area uses a yield curve model estimated directly on the prices of bonds that are indexed to euro-area inflation. Estimates suggest that the euro-area natural interest rate declined persistently in the two decades before the pandemic but has risen notably in recent years. Projections using this methodology suggest that the rate is likely to increase further, albeit more gradually.

The natural real rate of interest, widely known to researchers as r-star, is the inflation-adjusted short-term interest rate that should prevail when the economy is operating at its full potential and inflation is at its target. Estimates of this rate serve as a neutral benchmark to calibrate the stance of monetary policy: Monetary policy is likely to be expansionary if the real short-term interest rate lies below r-star and contractionary if it lies above. An estimate of r-star is also essential in standard policy rules such as the Taylor rule. For fiscal policy, the natural rate of interest is instrumental in assessing the future sustainability of public finances.

In the decades before the pandemic, policymakers debated whether a lower new normal for interest rates was responsible for modest responses of bond yields to monetary policy tightening, global saving gluts, and stagnant economic growth. More recently, monetary tightening to fight inflation has raised debates about whether interest rates will hold steady at the new higher levels or revert back towards pre-pandemic lows. These debates rely on assessments of r-star. However, the natural rate of interest is not directly observable and must be inferred from economic data, leading to much uncertainty about its level and even its definition.

In this Economic Letter, we follow Holston, Laubach, and Williams (2017) and define r-star as the average real short-term interest rate expected to prevail 5–10 years in the future, under an assumption that transitory shocks are likely to have dissipated and the economy will be growing at its trend rate. We develop a novel r-star measure for the euro area based on a yield curve model estimated directly on the prices of bonds with cash flows indexed to euro-area inflation, adjusted for bond-specific risk and real term premia as described in Christensen and Mouabbi (2024). Our results show that, after persistently declining in the two decades before the pandemic, r-star in the euro area has risen notably in recent years. Our model-based projections suggest that r-star in the euro area is likely to gradually increase further in coming years, and euro-area interest rates appear unlikely to return to the low levels seen before the pandemic.

Real yields in the euro area

For evidence of real yields in the euro area, we focus on so-called OAT€i bonds, which are issued and guaranteed by the French government and have cash flows indexed to the euro-area harmonized index of consumer prices (HICP) excluding tobacco. Because the European Central Bank targets HICP inflation in setting monetary policy and because these bonds are denominated in euros, we interpret their yields as representing real euro-area yields. The first OAT€i was issued in October 2001, and 13 such bonds were available to trade at the end of March 2025, representing a little over 7% of all marketable debt issued by the French government.

Figure 1 shows the monthly yield to maturity for the entire universe of OAT€i’s, with each bond represented by a separate line. To highlight the time series pattern in the sample yields, the dark blue line shows the second bond, which was issued in October 2002 and extends through the end of our sample in March 2025. Note the general and persistent decline in these yields between 2002 and 2021 and their sharp reversal since then.

Figure 1

Yield to maturity of individual OAT€i bonds

Real bond yields are often used to assess financial market participants’ real interest rate expectations. They also reflect two other elements that we need to adjust for in our model. They include the real term premium, which represents the additional return that investors’ demand to assume the risk that real bond rate outcomes may differ from the expected path of real rates. They also may embed other risk premiums that vary with the liquidity of inflation-indexed securities and with the relative demand for indexed bonds.

A yield curve model of real yields

To estimate these liquidity risk premiums in the OAT€i prices, we augment a standard yield curve model with a bond-specific risk factor. Depending on the time since issuance and the remaining time to maturity, different bonds respond differently to changes in the bond-specific risk factor, which helps identify this factor. Accounting for the effect of age dependence reflects the view that the extra premium investors demand for assuming the liquidity risk of a bond depends on how much of the original bond issuance remains available for trading. This amount tends to decline as a bond ages and more of its outstanding notional amount gets locked up in buy-and-hold investors’ portfolios.

Over time, these market dynamics raise the bond’s sensitivity to variation in the market-wide systemic component of the bond-specific premium captured by this risk factor. By observing OAT€i prices over time, we can identify the market-wide bond-specific risk factor and distinguish it from the conventional fundamental risk factors in the model, which represent general patterns in the level, slope, and curvature of the yield curve. These represent the dynamics that would prevail in a world without any obstacles to trading and constitute the key input to the calculation of our estimate of r-star. Specifically, we assume that the model-implied expected frictionless real short-term interest rates reflect investors’ views about the steady state of the euro-area economy, including its natural rate of interest, defined as the average expected frictionless real short-term rate over a five-year period starting five years ahead.

Our approach contrasts with approaches like Holston et al. (2017), that combine historical macroeconomic data with statistical techniques to distinguish between transitory fluctuations and persistent long-term trend changes in the data. Although such estimates may map more directly to the economic definition of the natural rate of interest, they are inherently backward-looking and require an accurate joint specification of the nominal and real sides of the economy, which is particularly challenging during the pandemic and post-pandemic period. Moreover, some of the macroeconomic series they use are subject to statistical revisions and are typically reported with a lag.

In comparison and to underscore the strength of our approach, we rely on forward-looking bond prices with maturities up to 30 years ahead. They are available in real time and are never subject to revisions. Moreover, they reflect the economic expectations of a large and diverse set of investors and financial market participants.

Results

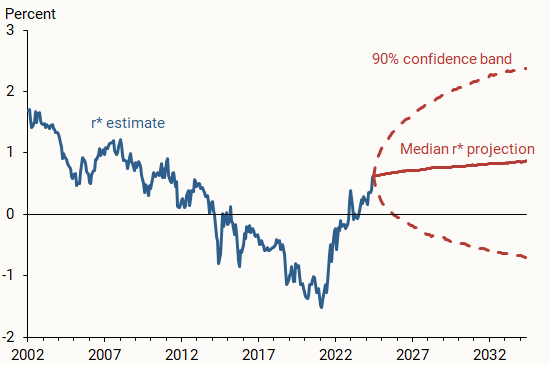

Figure 2 depicts our estimate of r-star in the euro area. It fell persistently from above 1.5% in 2002 to below –1.5% by the end of 2021, before its recent rise retraced about half of that decline. Hence, our results suggest that more than three-fourths of the 4-percentage-point decline for long-term real yields in the euro area from 2002 to 2021 reflected a reduction in r-star. Our estimate also indicates that about three-fourths of the real yield increases since then can be explained by increases in r-star.

Figure 2

Market-based estimate of r-star and 10-year projections

This raises the question of whether r-star in the euro area is likely to rise further going forward. To assess this risk, we simulate 10,000 paths over a 10-year horizon using our estimated factors and dynamics as of March 2025. That is, the simulations are conditioned on the shape of the real yield curve and investors’ embedded forward-looking expectations as of March 2025. We then convert these simulations into forecasts of r-star. Figure 2 shows the median projection (solid red line) and the surrounding 90% confidence area (dashed red lines) for the simulated r-star over a 10-year horizon.

Our projections indicate that r-star in the euro area is likely to experience a further modest increase in the years ahead. Although our projections are highly uncertain, as indicated by the wide confidence band, they still imply that r-star is unlikely to return to its low level from the pre-pandemic years. Consequently, short-term interest rates in the euro area are also unlikely to return to their pre-pandemic low levels once the economy moves past the recent period of high inflation.

Comparison with other estimates of r-star

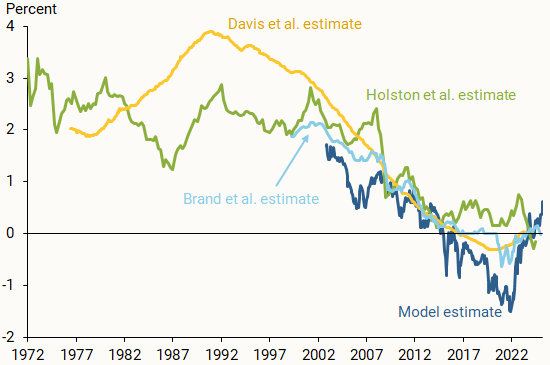

To validate our market-based r-star estimate for the euro area, we compare it with other macro- and finance-based estimates from the literature, depicted in Figure 3. The green line is the macro-based estimate of r-star from Holston et al. (2017), which is generated by adapting the Laubach and Williams (2003) model to euro-area data. The gold line is a hybrid macro-finance r-star estimate from Davis et al. (2024), who use two trend factors to estimate r-star for 10 advanced economies, including Germany, France, and Spain. We average their estimates for these three countries into a single representative estimate for the euro area. The light blue line is the median of various r-star estimates from Brand, Lisack, and Mazelis (2024), based on macro-, finance-, and survey-based estimates for the euro area.

Figure 3

Comparing alternative estimates of r-star

Despite some differences in their levels, the estimates in Figure 3 generally show a persistent decline in r-star during the first two decades of the current century. Moreover, except for the Holston et al. estimate, they all point to a rise in r-star since the pandemic, although they are somewhat more tempered than our r-star estimate thanks to their lower frequency and smoother pattern. Overall, our market-based r-star estimate appears consistent with other estimates of the persistent trends in the natural rate of interest in the euro area.

For perspective, Carvalho et. al (2025) examine the role of population aging, global factors, total factor productivity, and fiscal spending for U.S. short-term real rates. They report an increase in U.S. real rates over the last couple of years that is broadly similar to our findings for the euro area. According to their analysis, elevated fiscal spending explains most of the U.S. increase. The source of the recent rise in the euro area r-star is an important area for additional research.

Conclusion

In this Letter, we present a novel measure of r-star in the euro area that uses prices for French government bonds with cash flows indexed to the euro-area inflation. The results suggest that, after persistently declining in the decades before the pandemic, r-star in the euro area has risen notably in recent years and is projected to increase further, albeit more gradually, over the next decade. Hence, interest rates in the euro area appear unlikely to return to the low levels observed before the pandemic, which may have implications for both monetary and fiscal policy.

References

Brand, Claus, Nöemie Lisack, and Falk Mazelis. 2024. “Estimates of the Natural Interest Rate for the Euro Area: An Update.” European Central Bank Economic Bulletin, Issue 1.

Carvalho, Carlos, Andrea Ferrero, Felipe Mazin, and Fernanda Nechio. 2025. “Underlying Trends in the U.S. Neutral Interest Rate.” FRBSF Economic Letter 2025-10 (April 21).

Christensen, Jens H.E. and Sarah Mouabbi. 2024. “The Natural Rate of Interest in the Euro Area: Evidence from Inflation-Indexed Bonds.” FRB San Francisco Working Paper 2024-08.

Davis, Josh, Cristian Feunzalida, Leon Huetsch, Benjamin Mills, and Alan M. Taylor. 2024, “Global Natural Rates in the Long Run: Postwar Macro Trends and the Market-Implied r* in 10 Advanced Economies.” Journal of International Economics 149(103919).

Holston, Kathryn, Thomas Laubach, and John C. Williams. 2017. “Measuring the Natural Rate of Interest: International Trends and Determinants.” Journal of International Economics 108, pp. S59–S75.

Laubach, Thomas, and John C. Williams. 2003. “Measuring the Natural Rate of Interest.” Review of Economics and Statistics 85(4, November), pp. 1,063–1,070.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org