Adam Shapiro, vice president at the Federal Reserve Bank of San Francisco, shared views on the current economy and the outlook from the Economic Research Department as of April 24, 2025.

Recent trade policy announcements have raised economic uncertainty, pushed up market volatility, and tightened financial conditions. Equity prices have declined, the dollar has depreciated, and consumer sentiment has fallen sharply over the last month. Despite downside risks to growth, the labor market remains solid. Inflation is moderately above the Fed’s 2% goal but is anticipated to rise considerably over the next year as new tariffs raise the price of imported goods. Still, longer-term inflation expectations remain well anchored.

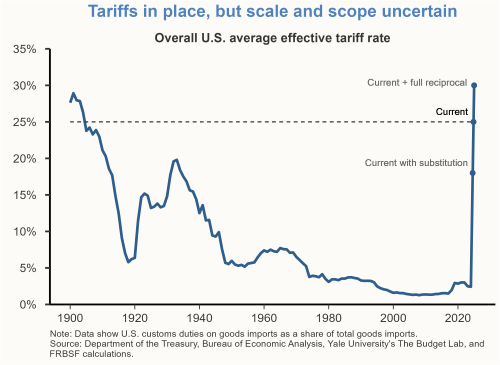

Tariffs are in place, but uncertainty remains high

Recent trade policy changes have introduced extensive tariffs on imports, significantly affecting the economic outlook. While some of the announced tariffs have already taken effect, the final scope, scale, and duration of various measures remain uncertain. Current trade policy implies an effective tariff rate of approximately 25%, placing it among the highest levels in U.S. history. While substitution toward lower-tariffed or domestically produced goods may ultimately reduce the effective tariff rate, risks remain due to the possibility of additional tariffs, including the full set of reciprocal tariffs currently on a 90-day pause.

Measures of economic and financial market uncertainty, such as the Economic Policy Uncertainty Index and the Chicago Board Options Exchange Volatility Index, or VIX, have reached levels not seen since the onset of the pandemic in early 2020. Heightened uncertainty can lead businesses to delay hiring and capital investment. It can also increase risk premiums and borrowing costs as well as reduce lending, all of which can put downward pressure on economic activity. More broadly, increased uncertainty tends to reduce aggregate demand for goods and services in the economy.

Financial markets and consumers are reflecting concerns about future growth

Financial conditions have tightened significantly since the start of the year, evidenced by sharp declines in equity prices and a notable rise in longer-term bond yields. The U.S. dollar has depreciated against many major currencies since the beginning of the year, suggesting that market participants are concerned about the growth outlook and foreign demand for U.S. goods and services. A depreciation of the U.S. dollar typically acts to make foreign imports relatively more expensive, which could exacerbate cost increases to U.S. businesses and consumers.

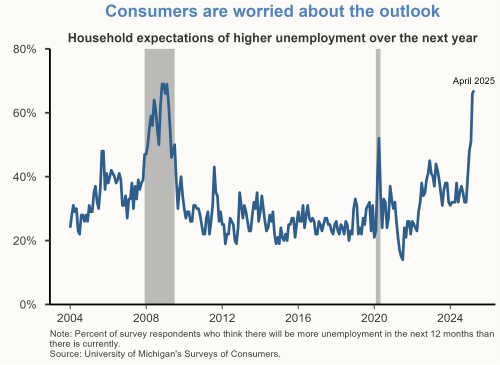

According to the University of Michigan’s Surveys of Consumers, the share of U.S. consumers who anticipate higher unemployment over the next year has risen of late, and overall sentiment levels have declined. Household expectations of a worsening economy or higher probability of losing employment can lead to higher levels of precautionary savings and a dampening of consumer spending.

The labor market has cooled but remains solid

Although downside risks to the outlook have increased, current labor market conditions have remained solid. Having moderated from the historically tight conditions observed in 2022 and 2023, the labor market now appears well balanced. The unemployment rate in March was 4.2%, well above the low of 3.4% reached in April 2023 but close to the median longer-run projection from the Federal Open Market Committee’s (FOMC’s) March 2025 Summary of Economic Projections (SEP). Furthermore, the U.S. economy has added 152,000 new jobs per month since the start of the year—enough to keep pace with the growth of the labor force. While the hiring rate has slowed from elevated levels in 2022, the layoff rate has remained stable at historically low levels.

Inflation has fallen from its peak but is expected to rise this year

Inflation, as measured by the 12-month change in the personal consumption expenditures (PCE) price index, was 2.5% in February 2025, while core PCE, which removes volatile food and energy prices, came in at 2.8%. These measures have declined considerably from their peaks in mid-2022 but are still above the Fed’s 2% inflation goal. Inflation for the services category remains particularly elevated. A key component for this includes housing, which historically has experienced persistent inflation. While goods inflation is low, it has increased over the past few months, shifting from a net negative to a net positive contribution to core PCE inflation. In addition, recent spending data and business reports suggest that consumers have been front-loading purchases of goods, such as autos and electronics, in anticipation of tariffs. We expect a notable increase in inflation in 2025, though the outlook remains highly uncertain and will depend on the final scope, scale, and duration of trade policy adjustments.

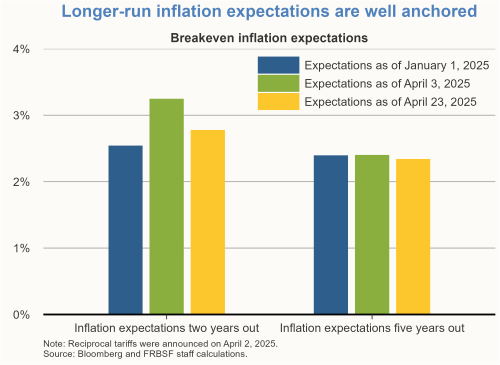

Longer-run inflation expectations remain well anchored

The longer-run inflation outlook depends critically on inflation expectations, which have proved to be a reliable indicator of longer-run future inflation. Market-based measures of expected inflation are particularly informative, as investors’ financial exposure provides a credible gauge of where they believe inflation is headed. Inflation expectations in the short- and medium-run have ticked up in recent months, likely reflecting market participants’ assessment of recent trade policy announcements. However, expectations of inflation over the next five years have remained unchanged, suggesting that market participants continue to view longer-run inflation as well anchored around 2%.

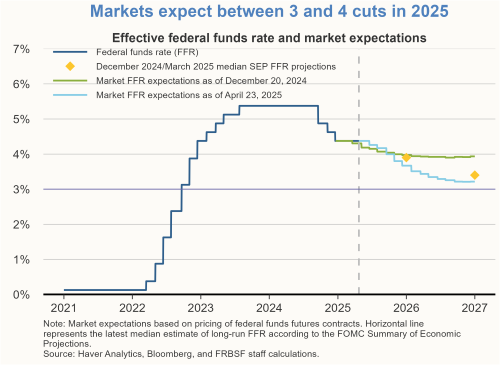

The policy outlook continues to shift

The current federal funds rate stands at 4.25 to 4.5%, moderately above the FOMC’s median longer-run projection in the March SEP of 3%. Market participants have recently lowered their projected path of the federal funds rate. A lower projected policy path, despite higher short-term inflation expectations, suggests that market participants expect slower growth of economic activity over the next year that would justify an easing in the stance of monetary policy. The latest projections from future markets are for four rate cuts in 2025, with the first one priced in for June. The Federal Reserve is well positioned to respond to incoming data to best achieve its dual mandate of full employment and price stability.

Charts were produced by Rami Najjar.

The views expressed are those of the author with input from the Federal Reserve Bank of San Francisco forecasting staff. They are not intended to represent the views of others within the Bank or the Federal Reserve System. This publication is edited by Kevin J. Lansing, Karen Barnes, and Hamza Abdelrahman. SF FedViews appears eight times a year. Please send editorial comments to Research Library.