We are the Federal Reserve Bank of San Francisco, public servants with a mission to advance the nation’s monetary, financial, and payment systems to build a stronger economy for all Americans.

The Federal Reserve System regulates and supervises financial institutions to ensure they operate safely. Examiners do not run or manage financial institutions . Rather, they work to understand and evaluate financial institutions’ operations, major risks, how well they manage those risks and whether they have sufficient financial and managerial resources, and comply with laws and regulations. When a financial institution does not manage its risks well or have sufficient financial or other resources, examiners require the financial institution to take corrective action.

Banking supervision at the federal level is carried out by three agencies: the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC). State banking agencies also supervise certain banks. Each agency supervises banks and other financial institutions subject to their authority.

Learn more about understanding Federal Reserve Supervision

How Federal Reserve Supervisors Do Their Jobs

The primary way supervisors, also known as examiners, do their job is through financial institution examinations and inspections. An examination is a review and evaluation of a bank’s activities, risk management, financial condition, and other aspects of their operations, such as compliance with consumer regulations. Bank examinations result in assessments that are reported to the bank in writing. Examiners decide what to examine at banks, mostly based on the bank’s known and potential risks. Some financial institutions may also be subjected to continuous monitoring, depending upon their size and/or complexity.

Learn more about bank examinations

Discount Window

Federal Reserve lending to depository institutions (the “discount window”) plays an important role in supporting the liquidity and stability of the banking system and the effective implementation of monetary policy. By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers, such as withdrawing credit during times of market stress. Thus, the discount window supports the smooth flow of credit to households and businesses. Providing liquidity in this way is one of the original purposes of the Federal Reserve System and other central banks around the world.

Learn more about the discount window

Press Releases and Regulations

Board of Governors Press Releases

The Board of Governors webpage for banking and consumer regulatory policy, orders on banking applications, enforcement actions, and other announcements.

Board of Governors Proposed Regulations and Requests for Comment

Information concerning proposed Federal Reserve regulation changes, including relevant background information on the proposed regulation and how to submit a comment to the Board.

Board of Governors Regulatory Developments

The Board of Governors webpage for banking information and regulation.

Board of Governors Regulations

Bank regulation entails issuing specific regulations and guidelines governing the operations, activities, and acquisitions of banking organizations.

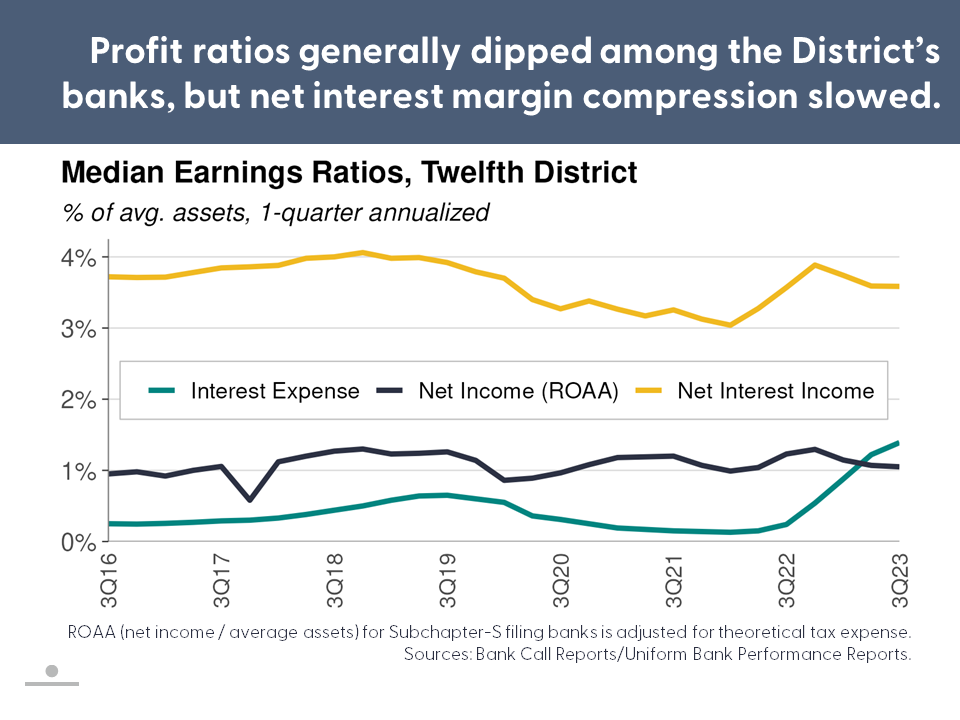

First Glance 12L