States that were hit hard by the housing bust performed worse economically during the recession of 2007-09. However, the close relationship between the fall in home prices and state economic activity has largely disappeared during the recovery. High unemployment, restrained demand, and idle production capacity are national in scope. These are just the sorts of problems monetary policy can address. The following is adapted from a speech by the president and CEO of the Federal Reserve Bank of San Francisco at the University of San Diego on April 3, 2012.

It’s a particular pleasure to be with you this morning. The subject of my talk today is the outlook for the economy and Federal Reserve policy. I’ll start with a look at the national economy, focusing on why the recent recession was so severe and why the recovery has been relatively anemic. I’ll then talk about prospects for growth, employment, and inflation. Finally, I’ll discuss what the Federal Reserve is doing to bolster the recovery.

Let me begin by saying that I’m encouraged by recent signs of a stronger, self-sustaining recovery. I’m especially glad to see that the economy is adding jobs at a pretty decent clip. Still, we have a long way to go. The Fed’s mandate from Congress is to promote maximum employment and stable prices (Williams 2012b). Inflation generally has been subdued over the past few years. But, more than four years after the recession began, the unemployment rate is still 8.3%, leaving us far short of our employment goal. The Fed has acted vigorously to boost the economy. It’s critical that we keep doing so in order to achieve our statutory mandate.

The role of housing in the financial crisis

I’d like to start with a little bit of history. We are in the aftermath of the worst financial crisis and economic downturn since the Great Depression. The downturn came in the wake of an unprecedented run-up in housing prices, followed by a traumatic collapse. Although the recession started with this burst housing bubble, the economy’s problems over the past few years have extended well beyond housing. In the broad sense, what we’ve seen has been a sharp fall in household and business demand for goods and services. That has caused the economy to perform well below its potential.

Let’s look at this in more detail. The housing boom was a classic financial bubble, fueled by speculative excess. Buyers kept bidding up prices, convinced they could sell for more than they paid. Lenders enabled this behavior by offering excessively easy terms. The growth in house prices outstripped anything that could be supported by market fundamentals, such as household incomes or rental rates on comparable properties.

The inevitable crash landed with a resounding thud. Beginning in 2006, home prices plummeted. Eventually they fell by about a third nationally. About a quarter of borrowers found themselves under water, owing more than their homes were worth. Large chunks of the wealth of tens of millions of Americans vanished. Overall, the destruction of net worth from housing equaled more than 40% of the value of annual U.S. production.

When wealth is destroyed on such a vast scale, the economic effects are severe. During the boom, higher house prices helped fuel consumption as people tapped home equity to buy cars, boats, vacations, and the like. When house prices did a U-turn, households hunkered down. They cut spending and salted away more savings to rebuild lost wealth. And that wasn’t the housing bust’s only depressing effect. By early 2009, home construction had plunged by over 75% from its 2006 high. It’s remained near historical lows since. That’s put a lid on demand for construction materials and home furnishings. And it’s kept millions of carpenters, plumbers, and others in construction and real estate out of work.

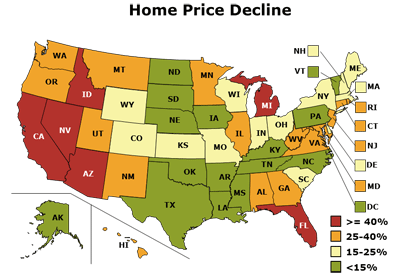

Figure 1

Distribution of observed nominal wage changes

Note: Percentage decline in CoreLogic home price index from pre-recession peak to post-recession trough or latest month (identified separately for each state).

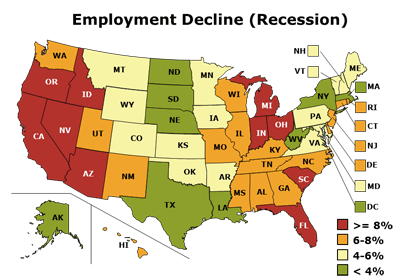

Figure 2

Job losses mirrored home price decline

Note: Percentage decline in BLS nonfarm payroll employment from pre-recession peak to post-recession trough (identified separately for each state).

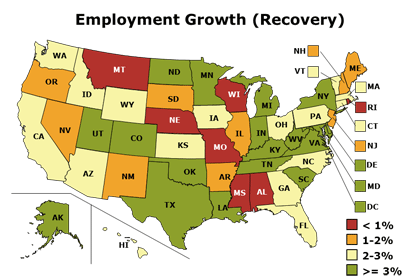

Figure 3

Job growth in recovery unrelated to housing bust

Note: Percentage growth in BLS nonfarm payroll employment from post-recession trough to February 2012 (identified separately for each state).

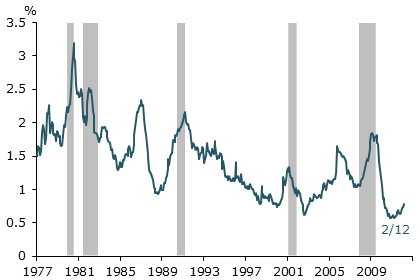

Figure 4

Total job changes have evened out across states

Notes: Standard deviations of BLS payroll employment growth (12-month percent change) across states (including DC), weighted by state shares of national employment. Grey bars denote NBER recession dates.

It’s impossible to understand the economy of the past few years without taking into account these housing effects (see, for example, Mian and Sufi 2011, Mian, Rao, and Sufi 2011, and Feroli et al. 2012). Consider the difference in economic performance between states hit hard by the housing bust and states that got off relatively lightly. Figure 1 shows price declines by state. The hardest hit states, including Nevada, Arizona, California, and Florida, are shown in red. Prices in these states plunged by 40% or more from their peaks. By contrast, the states shown in green posted price declines of less than 15%. In one green state, North Dakota, prices actually increased.

Figure 2 shows the drop in employment during the downturn by state, using the same color coding as Figure 1. For example, in the hard-hit states, shown in red here, employment fell by 8% or more. The overlap with the pattern of house price declines is striking. The states where home prices fell most were generally among those that suffered the worst job losses during the recession. In states where prices fell less, employment declined less (Williams 2012a).

To be sure, this overlap was not perfect. Employment fell in all but North Dakota and Alaska, with sharp declines registered even in some states where the housing bust wasn’t harsh. Examples include Indiana, Ohio, and South Carolina. One reason this happened is the tight web that binds economic activity in far-flung places in the modern world (Mian and Sufi 2011). When under water homeowners in the Central Valley put off buying new cars, auto workers in Indiana may lose their jobs.

But, what is fascinating, and perhaps surprising, is this: The close relationship between the fall in home prices and state economic activity has largely disappeared during the recovery (Williams 2012a). Figure 3 shows state employment gains during the rebound. There’s almost no systematic relationship between employment growth and home price declines.

Figure 4 reinforces this. The blue line measures the gap in employment growth rates between states where the job market has been relatively stronger and states where it has been weaker. This gap grew sharply during the recession, reflecting in part the uneven effects of the housing bust. But, during the recovery, the gap has been smaller than at any time since the mid-1970s. In other words, across the country, state-level employment growth has become quite balanced.

These comparisons indicate that the economy faces obstacles that are national in scope. The slow pace of expansion has affected all regions of the country. During the recovery, states where house price declines have been relatively mild have not done noticeably better than states where housing got hammered.

Three forces behind pattern of slow growth

Powerful forces have kept us stuck in a slow-growth pattern. Some of those forces reflect the direct effects of the housing collapse on household finances. The connection with housing is less direct for other forces holding back the economy. I’ll highlight three of those forces: tight credit, uncertainty, and government contraction.

Tight credit was clearly a product of the housing bust. But it took on a life of its own when fallout from housing almost brought down the global financial system in 2008. The repercussions of those dramatic events still affect markets today. Let me explain how this played out.

When home prices crashed, mortgage delinquencies and foreclosures surged. Exposure to risky U.S. subprime mortgages was spread globally through investments held by financial institutions. Those mortgages had been repackaged to create financial instruments of mind-bending complexity. When the music stopped, it was hard to tell who was left with all those toxic assets. Financial institutions became afraid to lend money to anybody, including other financial institutions. The result was a massive credit crunch that choked off the flow of funds financial institutions and nonfinancial businesses depend on for their day-to-day operations. Many financial institutions that had placed big bets on housing posted massive losses. Some of them failed.

Thankfully, central banks and governments around the world stepped in to provide emergency loans and other support. Those interventions prevented complete financial collapse. In the United States, the financial system has healed to a very considerable extent. The Fed recently conducted a series of tests on the largest U.S. banks. We found that most of them would have adequate capital even if the economy went through another extreme downturn.

As financial institutions have regained their footing, access to credit has improved. Nevertheless, we haven’t returned to normal. Many small businesses and consumers still struggle to get loans. For example, to get a mortgage, a borrower must have a top-notch credit rating and the cash to make a substantial down payment.

Uncertainty is a second factor holding back the recovery. Businesses, investors, and households remain skittish, even in the face of better economic news. Many of my business contacts say they remain cautious about expanding because they’re unsure about future conditions. Ordinary Americans worry about job prospects and future income. Everybody is unsettled by the highly charged political environment.

Financial turmoil in Europe has added another dimension to the unease here. The imminent threat of European financial meltdown has diminished. But the underlying problem of countries with unsustainable debt has not been resolved. Over the next few years, the total debt load among countries that use the euro will grow larger. I’ve heard Europe’s policy described as kicking the can down the road. But the risk is that Europe might be rolling an ever-growing snowball down a hill.

Government cutbacks are a third obstacle to growth. Typically, government spending rises when the economy turns down. That’s because the cost of safety net programs, such as unemployment insurance, go up. And sometimes governments deliberately boost spending to stimulate the economy. But the federal government’s long-term budget problems loom large. And state and local government finances are reeling from the economic downturn. As a result, government stimulus has been unusually limited.

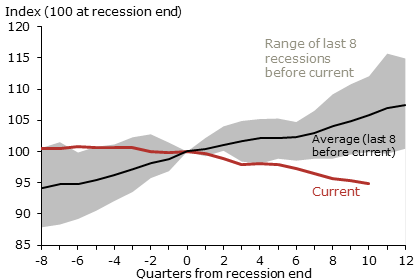

Figure 5

State and local governments cut spending

Note: Series are real (inflation adjusted) state and local government consumption and gross investment spending. 32

Sources: U.S. Bureau of Economic Analysis and Haver Analytics.

Figure 5 compares recent inflation-adjusted spending by state and local governments with past periods. The red line represents the most recent recession and recovery. The shaded region portrays the range of outcomes over the eight previous recessions and recoveries, with the average displayed in black. During the current period, the housing bust has cut into the revenue of state and local governments, forcing them to slash spending (Feroli et al. 2012). That contrasts with comparable periods in the past, when such spending typically increased.

I don’t see government spending turning around soon. Indeed, spending at the federal level is set to contract sharply at the end of this year as several temporary programs end. Some of those programs may be extended. But, overall, we can expect federal spending trends to weigh on near-term economic growth.

However, things are getting better as far as tight credit and uncertainty are concerned. Improvements in credit, and rises in business and consumer confidence, have helped the economy gain real traction. We can see the improvement in the data. Consumer spending hasn’t been growing fast, but it’s been growing steadily. Car sales have surged and nearly reached pre-recession levels in February. The rebound in car sales and strong exports of other goods have helped U.S. manufacturers create jobs at the fastest pace since the mid-1990s.

Real gross domestic product measures the nation’s total output of goods and services adjusted for inflation. During the first half of 2011, real GDP expanded at just under a 1% annual rate. Then, in the second half, it shifted into higher gear, rising at nearly a 2½% pace. My forecast calls for GDP growth to pick up further to about 2½% this year and 2¾% in 2013. That’s not overdrive, but it does represent improvement.

Outlook for unemployment

As I said earlier, the news from the labor market has been heartening. The jobless rate has fallen about three-quarters of a percentage point since August and is now at its lowest level in three years. Unfortunately, the kind of moderate economic growth I expect won’t sustain such rapid progress. The February unemployment rate held steady at 8.3%. I expect unemployment rates to remain around 8% through year-end. And we’re still likely to be around 7% at the end of 2014. We haven’t had such a long period of high unemployment in the United States since the Great Depression. And this phenomenon is widespread. Compared with December 2007, when the recession began, the unemployment rate is up in all 50 states. That’s true even in North Dakota and Alaska, the two states where total employment grew during the recession.

Economists have been debating why unemployment has been so high during this recovery. Broadly speaking, they fall into two camps. One group argues that changes in the structure of the economy are pushing up the unemployment rate. The other group maintains that high unemployment is the result of a severe downturn, which significantly cut demand for goods and services.

Those who favor a structural explanation point out that many job seekers lack the skills employers need. For example, computer industry employers are having a hard time finding qualified workers. But they’re not likely to find such employees in the ranks of jobless construction workers. If such labor market mismatches are widespread, they could be boosting the unemployment rate.

To put this in perspective, I’m going to introduce the concept of the natural rate of unemployment. The natural rate is basically an equilibrium jobless rate that pushes inflation neither up, nor down. Before the recession, most economists thought this rate was around 5%. Today though, economists in the structural camp argue that the natural rate has risen substantially, largely because of the labor market mismatches I described. The idea is that a lot of people are unemployed not because jobs are lacking, but because those jobs require skills unemployed workers don’t have. If this were correct, then our 8.3% unemployment rate might not be that far above the natural unemployment rate. In other words, we might not really be so far from the Fed’s goal of maximum sustainable employment.

I’m not convinced. Research at the San Francisco and New York Feds suggests that job mismatches are limited in scope. The difficulty some Silicon Valley companies find hiring software engineers is not enough to fundamentally transform the labor market. Now, other factors besides skill mismatches may also have helped push up the natural unemployment rate. Over the longer term, mismatches and other labor market inefficiencies may have raised the natural unemployment rate from about 5% to around 6 to 6½% (see, for example, Daly et al. 2012 and Weidner and Williams 2011). So, in my view, the nation remains far from the Fed’s goal of maximum sustainable employment.

Outlook for inflation

The Fed’s other goal is to keep prices stable. I would say that we’ve succeeded pretty well on that score. Inflation overall has been well-contained. Taking a long view, over the past 15 years, the overall inflation rate has averaged almost exactly 2%, which is the Fed’s target rate of inflation. The same is true of the past five years, a tumultuous period of crisis, recession, and recovery.

Now, it’s true that inflation picked up to 2½% last year as the prices of oil and other commodities surged in the face of strong global demand. Oil prices have run up again recently in response to geopolitical concerns. But other commodity prices have not generally followed suit. I expect inflation to be near our 2% target this year and edge down a bit to about 1½% in 2013.

Let me summarize where the Fed stands in terms of achieving its congressionally mandated goals. We are far below maximum employment and are likely to remain there for some time. The housing bust and financial crisis set in motion an extraordinarily harsh recession, which has held down consumer, businesses, and government spending. By contrast, inflation is contained and may even fall next year below our 2% target.

Under these circumstances, it’s essential that we keep strong monetary stimulus in place. The recovery has been sluggish nationwide, not just in states hit hard by the housing bust. High unemployment, restrained demand, and idle production capacity are national in scope. These are just the sorts of problems monetary policy can address. And we don’t need to worry that our stimulative monetary policy could fuel regional imbalances.

Monetary policy’s role in the recovery

Monetary policy works by raising and lowering interest rates. The Fed’s policymaking body is the Federal Open Market Committee, or FOMC. In December 2008, when the recession’s full force hit, the FOMC slashed its benchmark interest rate close to zero. It’s been there since. Standard monetary policy guidelines tell us this rate should have gone deep into negative territory. But that’s not possible (see Rudebusch 2009 and Chung et al. 2012 for discussion of the effects of the zero bound on interest rate policy in the recession and Swanson and Williams 2012 for estimates of the effects of constrained monetary policy).

So the Fed has had to find other ways to stimulate the economy. One measure we’ve adopted has been to buy large quantities of longer-term securities issued by the U.S. government and mortgage agencies. Our purchases have raised demand for these securities, lowering their yields. And that has put downward pressure on other longer-term interest rates, making it cheaper for households, businesses, and governments to borrow.

These policy actions have been effective. For example, recent gains in automobile sales have a lot to do with cheap financing. And our securities purchases have helped drive longer-term interest rates near to post-World War II lows. In particular, our purchases of mortgage-related securities appear to have lowered home loan rates significantly. (Hancock and Passmore 2011 and Krishnamurthy and Vissing-Jorgensen 2011 find significant effects of mortgage-backed securities purchases. Stroebel and Taylor 2009, by contrast, do not.) Low mortgage rates have been crucial in stabilizing home sales and construction.

I should emphasize that our unusually stimulative monetary policy won’t last forever. Eventually, as recovery picks up, we will trim our securities holdings and raise our interest rate target. We’ve planned in detail for this, and we’re confident we can do it in a timely and effective fashion (see, for example, the discussion of exit strategy in the minutes for the June 2011 FOMC meeting in Board of Governors 2011). But, that time is still well off in the future.

We’ve passed through extraordinary economic times that have required extraordinary responses from the Fed. We’re not miracle workers. Lower interest rates alone can’t instantly put the economy right. But things would be much worse if we hadn’t acted so forcefully. We were vigilant in 2008 and 2009 when the economy was in dire straits. We remain vigilant now, when the economy is showing real signs of improvement, sharply focused on our goals of maximum sustainable employment and price stability.

References

Board of Governors of the Federal Reserve System. 2011. “Minutes of the Federal Open Market Committee.” June 21–22.

Chung, Hess, Jean-Philippe Laforte, David Reifschneider, and John C. Williams. 2012. “Have We Underestimated the Likelihood and Severity of Zero Lower Bound Events?” Journal of Money, Credit, and Banking 44(s1, February), pp. 47–82.

Daly, Mary, Bart Hobijn, Ayşegül Şahin, and Robert G. Valletta. 2012. “A Rising Natural Rate of Unemployment: Transitory or Permanent?” Journal of Economic Perspectives, forthcoming.

Feroli, Mike, Ethan Harris, Amir Sufi, and Ken West. 2012. “Housing, Monetary Policy, and the Recovery.” Presentation to the 2012 U.S. Monetary Policy Forum, New York, February 24.

Hancock, Diana, and Wayne Passmore. 2011. “Did the Federal Reserve’s MBS Purchase Program Lower Mortgage Rates?” Federal Reserve Board Finance and Economics Discussion Series 2011-01.

Krishnamurthy, Arvind, and Annette Vissing-Jorgensen. 2011. “The Effects of Quantitative Easing on Interest Rates.” Brookings Papers on Economic Activity, forthcoming.

Mian, Atif R., Kamalesh Rao, and Amir Sufi. 2011. “Household Balance Sheets, Consumption, and the Economic Slump.” Working paper.

Mian, Atif R., and Amir Sufi. 2011. “What Explains High Unemployment? The Aggregate Demand Channel.” Working paper.

Rudebusch, Glenn D. 2009. “The Fed’s Monetary Policy Response to the Current Crisis.” FRBSF Economic Letter 2009-17 (May 22).

Stroebel, Johannes C., and John B. Taylor. 2009. “Estimated Impact of the Fed’s Mortgage-Backed Securities Purchase Program.” NBER Working Paper 15626.

Swanson, Eric, and John C. Williams. 2012. “Measuring the Effect of the Zero Lower Bound on Medium- and Longer-Term Interest Rates.” FRBSF Working Paper 2012-02.

Weidner, Justin, and John C. Williams. 2011. “What Is the New Normal Unemployment Rate?” FRBSF Economic Letter 2011-05 (February 14).

Williams, John C. 2012a. Discussion of “Housing, Monetary Policy, and the Economy.” Presentation to the Monetary Policy Forum, New York, February 24.

Williams, John C. 2012b. “The Federal Reserve’s Mandate and Best Practice Monetary Policy.” Presentation to the Marian Miner Cook Athenaeum, Claremont McKenna College, Claremont, California, February 13.

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to research.library@sf.frb.org