The persistent run-up of U.S. stock prices over the past year and the recent sell-off both raise the question: Is the stock market due for a correction?

In an earlier Economic Letter (Liu and Spiegel 2011), we argued that the upcoming waves of retirement of the baby boom generation born between 1946 and 1964 could push down U.S. equity markets. As boomers reach retirement age, they are likely to shift from buying stocks to selling them to finance retirement, and this massive sell-off could depress equity values. We based our argument on a strong historical relationship between the age distribution of the U.S. population and stock market performance that has prevailed since the mid-1950s.

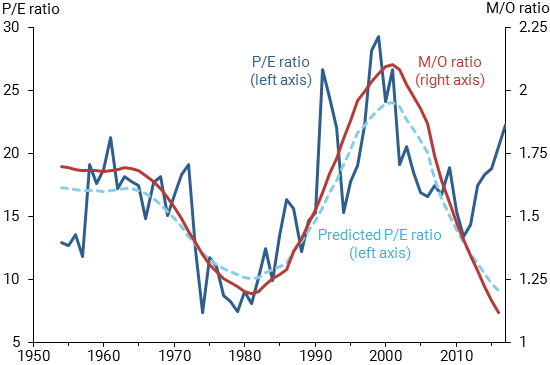

Since that Letter was published, however, there appears to have been a breakup in the relationship. Figure 1 shows the Standard & Poor’s 500 Index price-to-earnings (P/E) ratio (solid blue line) and the ratio of middle-age to old-age population or M/O ratio (red line) from 1954 to 2016. The M/O ratio shown here is the ratio of the U.S. population between ages 40 and 49 to those between ages 60 and 69.

Figure 1

P/E ratio and M/O ratio

The figure shows that the P/E ratio and the M/O ratio tracked each other well through 2010. In the two decades between 1981 and 2000, as the baby boomers reached their peak working and saving years, the M/O ratio rose steadily from about 1.2 to 2.1. During the same period, the P/E ratio tripled from about 8 to 24. Since 2001, the baby-boom generation has been gradually moving from working to retirement, and the next much smaller “baby bust” generation has entered its peak working and saving years. These demographic changes have resulted in steady declines in the M/O ratio, which matched the declines in the P/E ratio over the first decade of this century.

Since 2011, however, the close correlation between demographic patterns and equity values has disappeared. The M/O ratio has continued to fall, but the P/E ratio has been steadily climbing. Formal statistical analysis confirms this apparent change in the historical relationship. We used the estimated relationship between the P/E ratio and the M/O ratio from our earlier work, extrapolating from the 1954 to 2010 data to estimate what our model would have predicted for the path of the P/E ratio up to 2016 given realized movements in the M/O ratio.

Figure 1 shows that the actual P/E ratio (solid blue line) tracked our predicted P/E ratio (dashed blue line) closely from the mid-1950s to 2011, but diverged from the predicted path after 2011. While the actual P/E ratio of 13.4 stayed very close to the model-based forecast of 13.0 in 2011, the actual P/E ratio rose to about 20.6 by the end of 2016, more than twice the forecast value of 9.1. The recent sell-off moved the P/E ratio only marginally closer to our model’s forecast.

This breakdown between demographic trends and equity values raises the question: Should we expect a large correction in stock markets, similar to what we observed in the early 1990s? In that decade, the P/E ratio departed significantly from the demographic-based forecasts, then fell back sharply to the forecast path.

The answer is uncertain. As we argued in our earlier Letter, the empirical relation between demographic trends and equity valuation that we identified in the historical data through 2010 could be spurious. Demographic trends are predictable, so current stock prices should already reflect investor expectations of the impact of recent and upcoming demographic changes (see Poterba 2014 for a similar argument). Furthermore, retirees may continue to hold stocks to leave to their heirs and as a source of wealth in case they live longer than expected (Poterba 2001). Going forward, foreign demand could also reduce the sensitivity of U.S. equities to domestic U.S. demand. However, most other affluent countries in the world are aging as well (Liu, Spiegel, and Wang 2014).

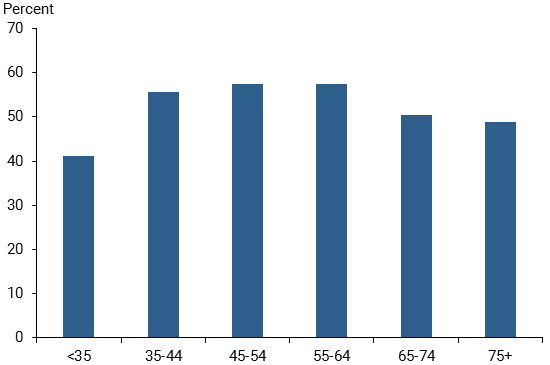

Nonetheless, there are valid arguments for a role for demographic trends in stock valuation. According to the Survey of Consumer Finances, stock market participation varies over the life cycle, first rising with age to a peak around ages 55-64, then declining significantly at older ages (Figure 2). Given these life cycle changes, the aging of the baby boomers and the broader shift of the age distribution in the population could adversely affect equity markets (Abel 2001, 2003; Brooks 2002).

Figure 2

Stock market participation over the life cycle

Ultimately, even if a “boomer effect” on equity markets does exist, historical patterns suggest that the timing and magnitude of any correction could be highly uncertain.

Zheng Liu is a senior research advisor and Mark M. Spiegel is a vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco.

References

Abel, Andrew B. 2001. “Will Bequests Attenuate the Predicted Meltdown in Stock Prices When Baby Boomers Retire?” Review of Economics and Statistics 83(4), pp. 589–595.

Abel, Andrew B. 2003. “The Effects of a Baby Boom on Stock Prices and Capital Accumulation in the Presence of Social Security.” Econometrica 71(2), pp. 551–578.

Brooks, Robin. 2002. “Asset-Market Effects of the Baby Boom and Social-Security Reform.” American Economic Review Papers and Proceedings 92(2), pp. 402–406.

Liu, Zheng and Mark M. Spiegel. 2011. “Boomer Retirement: Headwinds for U.S. Equity Markets?” FRBSF Economic Letter 2011-26, August 22.

Liu, Zheng, Mark M. Spiegel, and Bing Wang. 2014. “Global Aging: More Headwinds for U.S. Stocks?” FRBSF Economic Letter 2014-38, December 22.

Poterba, James M. 2001. “Demographic Structure and Asset Returns.” Review of Economics and Statistics 83(4), pp. 565–584.

Poterba, James M. 2014. “Retirement Security in an Aging Population.” American Economic Review 104(5), pp. 1-30.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.