This speech was posted on December 7, 2018.

Good afternoon. I appreciate the opportunity to speak with you today. Most of my interactions with auto dealers are under more stressful circumstances. It’s a genuine pleasure to be meeting with you without any high-pressure talk about sticker prices and dealer costs, and no papers to sign.

In my comments, I’ll begin by discussing the current U.S. economic outlook, which by most reckonings is very good. And since I work for the organization that sets U.S. monetary policy, the Federal Reserve, or “the Fed” as it’s affectionately known, I’ll talk about that as well. As you know, interest rates have been going up, and that’s expected to continue. What may surprise you is just how little they’re expected to increase. This is guided by the intent of keeping the economic expansion going as long as possible. I’ll also talk about some longer-term economic challenges, specifically how technology has been changing the labor market, that monetary policy can only affect indirectly. I’ll be using a few slides and charts as guideposts, but not too many!

Before I proceed, I want to emphasize an important disclaimer: the views I express today are wholly my own and do not necessarily reflect those of other individuals or institutions in the Federal Reserve System.

Economic outlook

I’ll start with the economic outlook. As I just mentioned, the U.S. economy is looking very good at the moment. The expansion is entering its 10th year. If it extends past June of next year, as widely expected, it will become the longest U.S. expansion in historical records dating back to the 1850s.1 The Great Recession from a decade ago is starting to fade from memory. Household and business balance sheets have been repaired, and there’s plenty of optimism fueling continued spending growth all around.

We typically assess the economy’s performance using a measure of overall activity, called gross domestic product, or GDP. It’s grown at a strong pace this year, and even though some slowing is expected, growth should remain quite healthy over the next few years.

GDP is a good overall indicator, but it’s a bit opaque to the average person. Probably the clearest signs of the strong economy are in the labor market. Lots of new jobs are being created every month, and the unemployment rate has been running below 4 percent. This is the lowest it’s been since the 1960s. In other words, jobs are plentiful, and unemployed individuals to place in those jobs are becoming scarce. That can create challenges for employers, but from a broad economic perspective, it’s a situation that most people want to see continue.

Sustaining the expansion: An environment of rising interest rates

That’s where the Federal Reserve comes in. The goal of sustaining the expansion forms the backdrop for current and projected monetary policy.

The Fed has two main goals, as mandated by longstanding federal laws—this is the so-called dual mandate.

The first goal is maximum or full employment. That doesn’t mean everyone is working. Instead, it means a thriving labor market, with unemployment low enough that it largely reflects routine worker and job turnover. The low numbers I just mentioned strongly suggest that the labor market has not only reached but actually moved past full employment.

The Fed’s other goal is stable prices. In practice, this means a modest rate of inflation, specifically 2 percent.2 Inflation had been running below that target for much of the time since the Great Recession ended in 2009, but recently it has come back up and is basically on target.

These are not easy goals to achieve, especially when the Fed has only one main tool at its disposal: moving interest rates up and down. Low rates rev up the economy by stimulating borrowing, spending, and investment. High rates do the opposite, putting some brake pressure on the expansion. The Fed’s key policy rate is set by our monetary policy arm, the Federal Open Market Committee, or FOMC, which meets eight times per year. As I’m sure you know, the FOMC left rates at very low levels for a long time during and after the recession. This helped support the economic recovery.

Now, with the targets largely met, and the economy able to stand on its own two feet, the Fed is well on the way to normalizing monetary policy. This means rising interest rates. The goal of this normalization process is to maintain the expansion and ensure that the Fed does not backslide on its dual mandate. If rates are left low, the economy could start running too hot, spurring an uptick in inflation. Recall that I mentioned the 1960s, another time when unemployment was very low. What was the aftermath? The 1970s, when, as I know from personal experience, rock music and fashion took a decided turn for the worse, and more importantly, inflation shot up to double digits.3

The problem with rapid increases in inflation is that they may require an aggressive monetary policy response, which can stifle the expansion. To minimize this risk and more generally keep the economy on an even keel, the FOMC has been raising interest rates over the past few years.

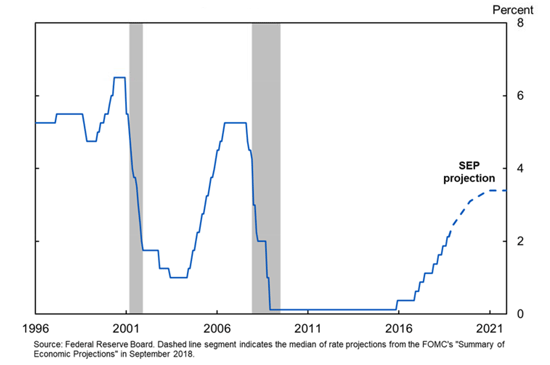

But here’s the really interesting part of the story. This process of raising rates has been occurring much more gradually than it did during recent economic expansions (see the first figure). For example, during the mid-2000s, the Fed’s policy rates rose by about 2 percentage points per year. By contrast, they’ve been rising half that pace or less during the current normalization cycle.

Interest rates: Gradual, limited increase

Federal funds rate (set by FOMC; with projections)

The economy already is seeing some impact from rising rates. This is mainly evident in the housing sector, where construction and sales have been easing this year. Of course, auto sales also depend heavily on borrowing, and they have slipped a bit over the past couple of years as well. Importantly, however, despite the restraining effects of higher rates for some sectors, the overall economic expansion has actually accelerated this year compared with 2017.

It’s also important to keep in mind that rates are not expected to rise anywhere near their past highs. This may be a pleasant surprise for you. The dashed line in the chart shows a likely path for the federal funds rate, based on the median projection in the FOMC’s most recent Summary of Economic Projections from late September.4 To be clear, these are only projections, not set plans. The FOMC has indicated that it will respond to changes in economic conditions accordingly. But if conditions evolve as expected, the funds rate is likely to top out at just under 3½ percent over the next few years, about 2 to 3 percentage points below its past highs. The reasons for these lower rates are complicated and would make for a separate talk in themselves.5 The key takeaway is that rates are likely to rise further but not by a lot.

Long-term challenges: Technology and the labor market

I’ve described a strong economy, in which the Fed’s main goals have largely been achieved. That’s the short of it. But all this happy talk often raises a question: if the economy is so good, why are some people feeling so bad? It’s a fair question. Many families, and in some cases entire communities, are struggling to make ends meet, and they are understandably baffled when people like me tell them that the economy is doing great.

The key longer-term challenges generally are coming from shifts in the labor market. And a key culprit is changing technology—by that, I mean the way work is organized, and the interactions between people and machinery that produce goods and services. Technology raises our standard of living in general, but it can be a major disrupter to the traditional economic order. With the expansion of computers and related technology, lots of jobs that used to be stable and well-paid are getting replaced by automation. This is well-known in manufacturing. But we also see this in a wide variety of services, from call centers to online retail and self-serve checkout at grocery stores. Auto dealers have been affected as well, although probably not as much—as far as I know, virtual reality test drives aren’t yet an adequate substitute for the real thing.

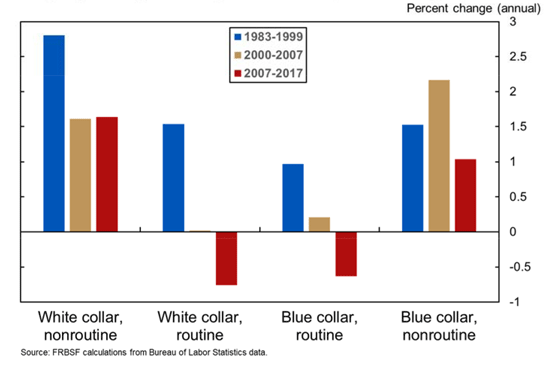

Economists refer to these shifts as job market polarization.6 This is the process by which changing technology and rising automation have been eroding the status of traditional middle-class jobs (depicted in the second figure). These so-called routine jobs are readily replaced by automation. Broadly speaking, this includes many white-collar sales and office jobs, as well as blue-collar factory jobs and related positions. These types of jobs have been disappearing over the past few decades, as shown by the gold and red bars in the chart. By contrast, the highly skilled professional positions have been doing well, as have lower-paying service positions that involve direct personal contact and hence are not routine—baristas and home health-care aides are basic examples, but there are lots of others.

Disappearance of middle-class jobs

Employment growth by broad occupation category

Polarization has had a profound impact on the job market. Wages have grown rapidly at the top, where workers tend to take advantage of the new technologies rather than being replaced by them. But those in the middle and below, who are competing for the same shrinking pool of jobs, generally have seen much slower gains.7

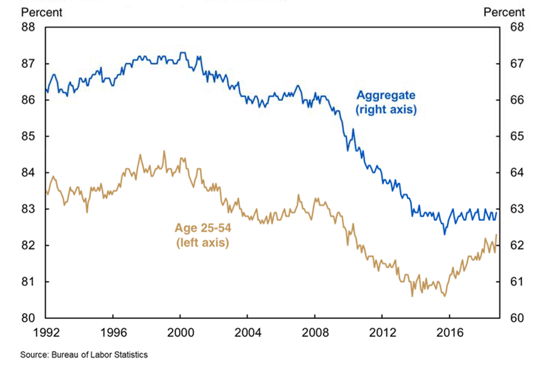

Recent research conducted by myself and others suggests that polarization likely has contributed to lower labor force participation as well.8 This refers to the fraction of the working-age population that is either employed or actively looking for a job (in the third figure). You can see that the overall participation rate has declined during the past two decades. This occurred in part because the baby boom generation started heading off for retirement. But participation by individuals in their prime working years, between the ages of 25 and 54, also has declined. It has recovered somewhat but generally is expected to remain well below past highs.9 The disappearance of good middle-class jobs, without obvious and natural replacement jobs being created, has left large numbers of potential workers on the sidelines.

Labor force participation has fallen

Labor force participation rates

And technology has affected the types of jobs available in other ways. Even with the labor market fully recovered from the Great Recession, there are still lots of workers who want to work full-time hours but are stuck in part-time jobs. My own research on this topic suggests that changing technology, reflected in job shifts toward industries that rely more heavily on unpredictable part-time schedules, has played a key role.10

Similarly, the growth of the gig economy reflects new technologies that have enabled ride-sharing services like Lyft and Uber to flourish. This is a great example of how new technologies can be a mixed bag. Gig jobs allow flexibility in work schedules and greater ability to supplement income, but they also lack traditional benefits and job security.

All this means that finding and staying in a well-paid job is not the same as it used to be. This makes for a challenging economic environment for workers and families buffeted by these changes, even when overall economic conditions are strong.

Where do the Fed and monetary policy come in? As I’ve argued, these challenges are largely created by changing technology and workplace practices, which monetary policy does not directly affect. But by keeping the expansion going, enabling job creation to continue and perhaps wages and job quality to improve, well-designed monetary policy can offset some of the negative impacts of these trends. Such challenges are easier to address when the economy is growing and the nation’s financial health is good, whether the solution is educational investments by households, training decisions by businesses, or spending decisions by government at all levels.

Conclusion

To conclude, the United States economy is strong. The goal of monetary policy is to keep it strong by avoiding recessions without sparking unwanted inflation or other potential problems. This also helps create the best environment for addressing the challenges of a changing labor market. Thank you.

End notes

1. https://www.nber.org/cycles.html

2. Board of Governors (2012).

3. See Orphanides and Williams (2013) for a history of monetary policy during these decades.

4. Board of Governors (2018).

5. Williams (2017).

6. Acemoglu and Autor (2011), Autor (2015).

7. Autor (2015), Gould (2018).

8. Valletta and Barlow (2018) and references therein.

9. CBO (2018), Hornstein, Kudlyak, and Schweinert (2018).

10. Valletta, Bengali, and van der List (2018). See also Valletta (2018) for a summary.

References

Acemoglu, Daron, and David Autor. 2011. “Skills, Tasks and Technologies: Implications for Employment and Earnings.” In Handbook of Labor Economics, Volume 4b, eds. Orley Ashenfelter and David Card. Amsterdam: Elsevier-North Holland, pp. 1,043–1,171.

Autor, David H. 2015. “Polanyi’s Paradox and the Shape of Employment Growth.” In Reevaluating Labor Market Dynamics, Federal Reserve Bank of St. Louis: Economic Policy Proceedings, pp. 129–177.

Board of Governors of the Federal Reserve System. 2012. “Federal Reserve issues FOMC statement of longer-run goals and policy strategy.” January 25.

Board of Governors of the Federal Reserve System. 2018. “FOMC Projections materials, accessible version.” March 21.

Congressional Budget Office. 2018. “The Budget and Economic Outlook: 2018 to 2028.” Report, April 9.

Gould, Elise. 2018. “The State of American Wages 2017.” Report, Economic Policy Institute. March 1.

Hornstein, Andreas, Marianna Kudlyak, and Annemarie Schweinert. 2018. “The Labor Force Participation Rate Trend and Its Projections.” FRBSF Economic Letter 2018-25 (November 19).

Orphanides, Athanasios, and John C. Williams. 2013. “Monetary Policy Mistakes and the Evolution of Inflation Expectations.” In The Great Inflation: The Rebirth of Modern Central Banking, eds. Michael D. Bordo and Athanasios Orphanides. Chicago: University of Chicago Press.

Valletta, Rob. 2018. “Involuntary Part-Time Work: Yes, It’s Here to Stay.” SF Fed Blog, April 11.

Valletta, Rob, and Nathaniel Barlow. 2018. “The Prime-Age Workforce and Labor Market Polarization.” FRBSF Economic Letter 2018-21 (September 10).

Valletta, Robert G., Leila Bengali, and Catherine van der List. 2018. “Cyclical and Market Determinants of Involuntary Part-Time Employment.” FRBSF Working Paper 2015-19. Updated March 2018. Forthcoming in The Journal of Labor Economics.

Williams, John C. 2017. “What’s the Future of Interest Rates? The Answer’s in the Stars.” Remarks at the Salt Lake Area Community Leaders Luncheon, October 11.