Community Development & District Engagement

-

Around the District: A Busy Day in Southern Nevada

SF Fed Regional Executive Qiana Charles describes her recent community engagement trip to Las Vegas with Mary Daly, SF Fed President and CEO.

-

Extreme Heat’s Disparate Impacts on a Local Economy: Phoenix, AZ

At the Federal Reserve Bank of San Francisco, we are examining the ways that the increasing incidence of extreme heat affects the economy and community resilience. We’re paying particular attention to this issue given the number of highly impacted places in the Federal Reserve’s 12th District, which includes the City of Phoenix in Maricopa County, Arizona.

-

Around the District: Central Valley, California

Here’s a snapshot of a recent outreach visit to California’s San Joaquin Valley from Stephen Delay, Regional Executive of the SF Fed’s San Francisco branch.

-

Around the District: Anchorage, Alaska

Here’s a snapshot of Christina Prkic’s recent trip to Anchorage, Alaska as the SF Fed’s new Vice President and Regional Executive of our Seattle Branch Office.

-

In Dialogue: Silvia Castro, President and CEO of the Suazo Business Center

Get to know Silvia Castro, a member of the SF Fed’s Community Advisory Council and President and CEO of the Suazo Business Center, which recently received a Community Development Financial Institution designation.

-

Around the District: Oregon

The SF Fed seeks out real-time information on economic conditions around the Twelfth District by engaging with and learning from businesses, community organizations, and local leaders. Here’s a snapshot of the Oregon Business and Industry’s 2023 Manufacturing Roadshow from Ian Galloway, Regional Executive of the SF Fed’s Portland branch.

-

How Are Small Businesses in the Western U.S. Faring?

When more business owners complete the Small Business Credit Survey, more in-depth analysis on business needs is possible. Take or share the survey today.

-

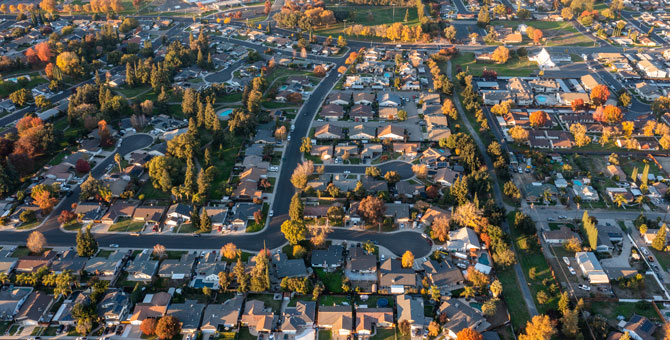

Post-Pandemic Poverty is Rising in America’s Suburbs

AVP of Community Development Research Elizabeth Kneebone and her co-author examine what the geography of poverty in America looks like 10 years after the publication of their book Confronting Suburban Poverty in America.

-

Building Resilience to Economic Impacts of Wildfire Smoke

To better understand how stakeholders across the Twelfth District are navigating the economic impacts of increasing wildfire smoke and their actions to build resilience to these impacts, the SF Fed hosted a webinar in August with industry, small business, and community leaders. Here are our top takeaways.

-

Visiting Scholar Q&A: Multi-Family Homeownership as a Strategy for Improving Regional Economic Participation in Low- and Moderate-Income Communities

Visiting Scholar Dr. Alex Schafran discusses multi-family homeownership and its connection to regional equity and labor market participation in a Q&A with one of our Community Development researchers.